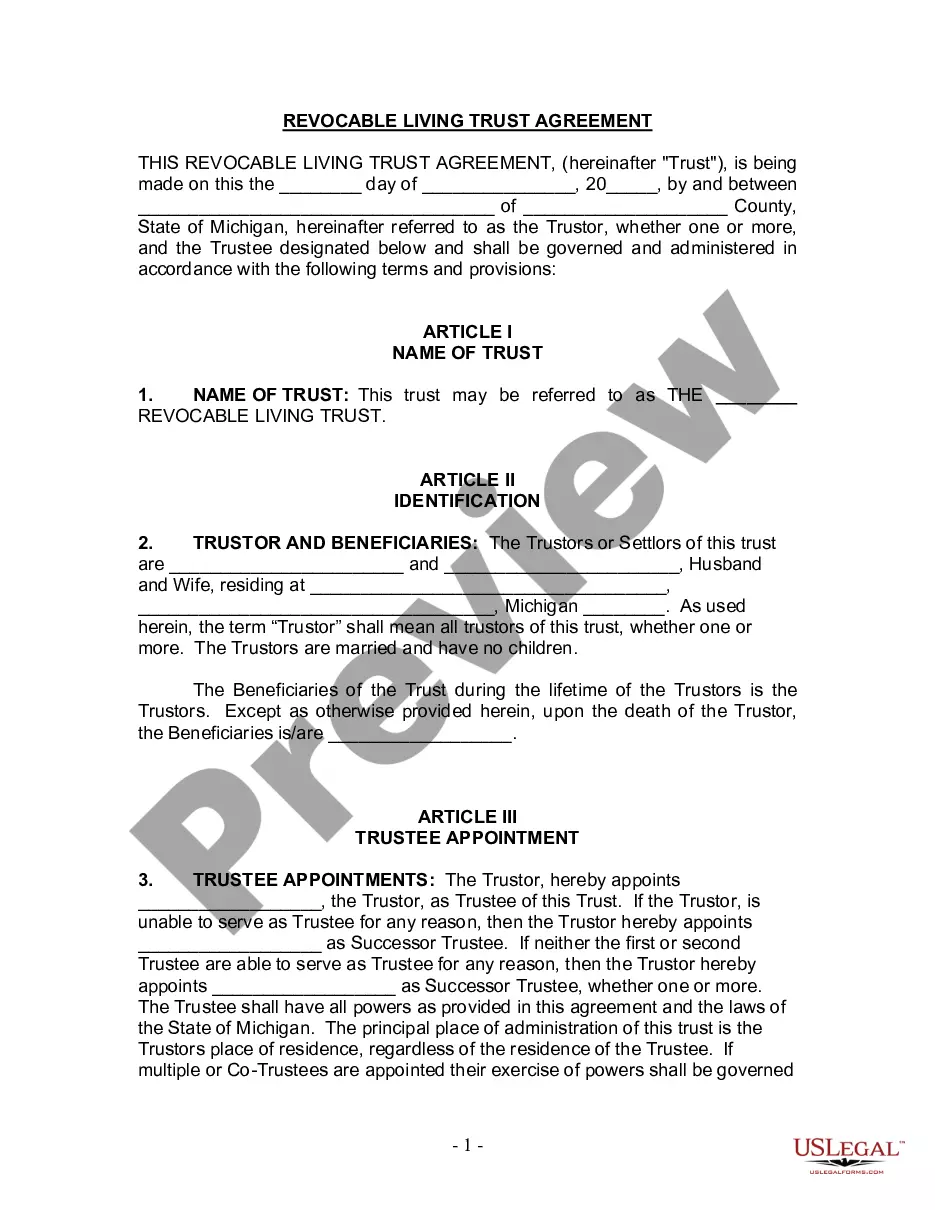

Detroit Michigan Living Trust for Husband and Wife with No Children

Description

How to fill out Michigan Living Trust For Husband And Wife With No Children?

Are you searching for a trustworthy and affordable supplier of legal documents to purchase the Detroit Michigan Living Trust for Husband and Wife without Children? US Legal Forms is your ideal choice.

Whether you need a basic plan to establish guidelines for living together with your partner or a collection of forms to move forward with your separation or divorce through the courts, we have you covered. Our site features over 85,000 current legal document templates for individual and business use. All templates we provide are not generic and are structured according to the needs of specific states and regions.

To download the document, you must Log In to your account, find the required template, and click the Download button next to it. Please note that you can access your previously purchased document templates at any time from the My documents tab.

Is this your first visit to our website? No need to worry. You can register an account with ease, but first, please ensure to do the following.

Now you can create your account. Next, select the subscription plan and move forward to payment. Once the payment is processed, download the Detroit Michigan Living Trust for Husband and Wife without Children in any format available. You can return to the website whenever you like and redownload the document at no additional cost.

Finding current legal forms has never been simpler. Give US Legal Forms a chance today, and stop wasting your precious time searching for legal documents online once and for all.

- Check if the Detroit Michigan Living Trust for Husband and Wife without Children complies with your state's and local area's regulations.

- Review the form’s description (if accessible) to determine who and what the document is meant for.

- Start your search anew if the template does not fit your legal situation.

Form popularity

FAQ

Spouses in Michigan Inheritance Law Unlike some states, spouses are not automatically entitled to your entire estate should you die intestate in Michigan. However, if you die with a spouse and no living parents or descendants, your spouse gets 100% of your estate.

The cost of forming a living trust in Michigan will depend on how you go about creating it. One option is to make it yourself using an online service. You could pay less than $100 or as much as $300 if you opt for this method. The other option is to draw up the trust document with the help an attorney.

There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

A Living Trust can help you avoid Probate in Michigan, but a Will cannot. A Living Trust is a private document which does not require any court intervention. Most Living Trust transfers take place in the privacy of your attorney's office shortly after a death.

Unlike some states, spouses are not automatically entitled to your entire estate should you die intestate in Michigan. However, if you die with a spouse and no living parents or descendants, your spouse gets 100% of your estate.

The law in Michigan provides a surviving spouse in a testate proceeding (one with a will of the deceased spouse admitted to probate by the Court) with the right to elect a share of the estate of his or her spouse even if the will says the spouse is not to receive anything.

Real Estate Probate ? If a property is valued below $22,000, a spouse or any surviving heirs can petition a probate court to have the estate probated. For estates valued above $22,000 there is a formal supervised probate process which requires the appointment of a personal representative to distribute the estate.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Living Trusts In Michigan, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Michigan Probate Laws require a decedent's assets go through Probate if the assets were held solely in their name. Assets usually don't need to go through Probate if the assets that are jointly owned, the assets have a beneficiary designation, or the assets are held in a Living Trust.