The Ann Arbor Michigan Amendment to Living Trust is a legal document used to modify or update specific provisions within an existing living trust. In Ann Arbor, Michigan, individuals often use this amendment to ensure their living trust accurately reflects their current desires and circumstances. Whether it is to make minor changes or significant revisions to the trust, the amendment provides flexibility while avoiding the need to create an entirely new trust. There are several types of Ann Arbor Michigan Amendment to Living Trust, including: 1. Revocation and Replacement Amendment: This type of amendment allows individuals to revoke their existing living trust in its entirety and replace it with a new one. It is commonly used when substantial changes are desired, such as adding or removing beneficiaries, changing trustee designations, or incorporating updated estate planning strategies. 2. Partial Amendment: A partial amendment enables individuals to modify specific provisions within their living trust without completely revoking it. This type of amendment is typically used for relatively minor changes, like updating beneficiary designations, adjusting asset allocations, or clarifying instructions for the trustee. 3. Administrative Amendment: An administrative amendment focuses on administrative or procedural matters within the living trust rather than substantive changes. It may be used to address issues like changing the successor trustee, updating contact information, or refining the trust's administrative framework. 4. Amendment and Restatement: This type of amendment combines the revocation and replacement amendment with a comprehensive restatement of the living trust. It is suitable when significant changes are necessary, allowing individuals to start anew while retaining any unaltered provisions from the original trust. By utilizing the Ann Arbor Michigan Amendment to Living Trust, individuals can ensure their estate plans truly reflect their current wishes, account for changes in their financial circumstances, family dynamics, or changes in laws. Seeking legal advice from a qualified attorney knowledgeable in Michigan estate planning is crucial to ensure compliance with state requirements and the trust's original intent.

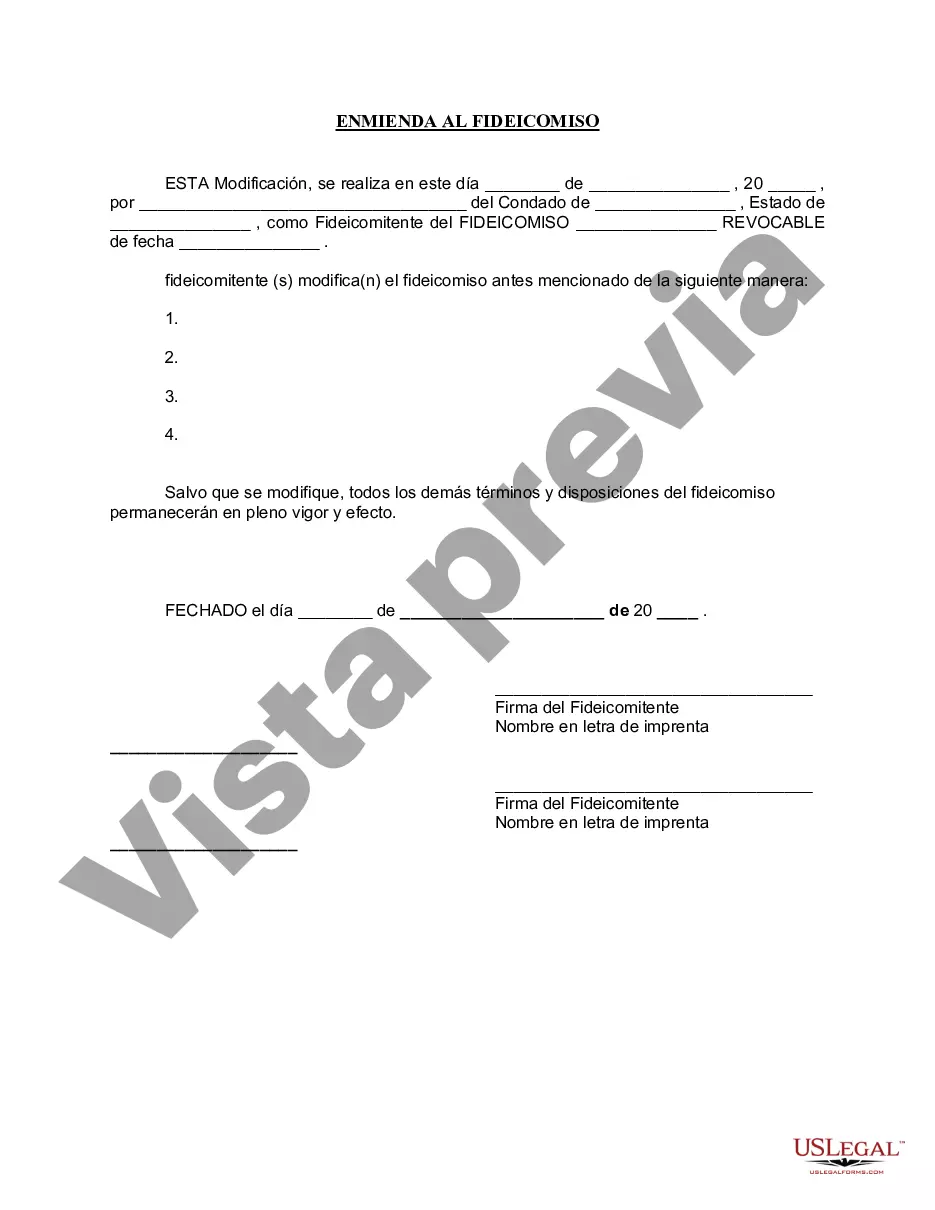

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ann Arbor Michigan Enmienda al fideicomiso en vida - Michigan Amendment to Living Trust

State:

Michigan

City:

Ann Arbor

Control #:

MI-E0178A

Format:

Word

Instant download

Description

Formulario para modificar un fideicomiso en vida.

The Ann Arbor Michigan Amendment to Living Trust is a legal document used to modify or update specific provisions within an existing living trust. In Ann Arbor, Michigan, individuals often use this amendment to ensure their living trust accurately reflects their current desires and circumstances. Whether it is to make minor changes or significant revisions to the trust, the amendment provides flexibility while avoiding the need to create an entirely new trust. There are several types of Ann Arbor Michigan Amendment to Living Trust, including: 1. Revocation and Replacement Amendment: This type of amendment allows individuals to revoke their existing living trust in its entirety and replace it with a new one. It is commonly used when substantial changes are desired, such as adding or removing beneficiaries, changing trustee designations, or incorporating updated estate planning strategies. 2. Partial Amendment: A partial amendment enables individuals to modify specific provisions within their living trust without completely revoking it. This type of amendment is typically used for relatively minor changes, like updating beneficiary designations, adjusting asset allocations, or clarifying instructions for the trustee. 3. Administrative Amendment: An administrative amendment focuses on administrative or procedural matters within the living trust rather than substantive changes. It may be used to address issues like changing the successor trustee, updating contact information, or refining the trust's administrative framework. 4. Amendment and Restatement: This type of amendment combines the revocation and replacement amendment with a comprehensive restatement of the living trust. It is suitable when significant changes are necessary, allowing individuals to start anew while retaining any unaltered provisions from the original trust. By utilizing the Ann Arbor Michigan Amendment to Living Trust, individuals can ensure their estate plans truly reflect their current wishes, account for changes in their financial circumstances, family dynamics, or changes in laws. Seeking legal advice from a qualified attorney knowledgeable in Michigan estate planning is crucial to ensure compliance with state requirements and the trust's original intent.

Free preview

How to fill out Ann Arbor Michigan Enmienda Al Fideicomiso En Vida?

If you’ve already utilized our service before, log in to your account and save the Ann Arbor Michigan Amendment to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Ann Arbor Michigan Amendment to Living Trust. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!