The Detroit Michigan Amendment to Living Trust refers to a legal document used to modify or update a living trust established in the city of Detroit, Michigan. A living trust is a common estate planning tool that allows individuals to place their assets and properties into a trust during their lifetime, ensuring they are managed and distributed according to their wishes after their passing. The amendment serves as a means to make changes or additions to the existing provisions of the original living trust within the jurisdiction of Detroit, Michigan. It enables the trust creator, also known as the granter or settler, to reflect their current intentions, protect against unforeseen circumstances, or adapt to changes in their personal or financial circumstances. By creating an amendment, the granter can maintain control over their trust while ensuring its effectiveness and relevance over time. There can be various types of Detroit Michigan Amendments to Living Trust, based on the nature of the modification being made. Some common types include: 1. Amendment of Beneficiary Distribution: This type of amendment allows the granter to change the beneficiaries of the trust or modify their share of the distribution. It may involve adding or removing beneficiaries, revising the distribution percentages, or redirecting assets to new recipients. 2. Amendment of Trustee Appointment: This type of amendment enables the granter to alter the individuals or entities named as trustees responsible for administering the trust. It may involve replacing the original trustee with a new one, adding co-trustees, or selecting successor trustees in case the original trustee becomes incapacitated or passes away. 3. Amendment of Trust Terms: This type of amendment is used to modify the terms and conditions stipulated in the original living trust document. It could involve changing provisions related to asset management, distribution, or even revoking certain terms altogether. 4. Amendment for Special Provisions: In certain cases, a granter may require more specific amendments, such as establishing new charitable provisions, creating special needs trusts, or providing instructions for the care of pets or other dependents after their passing. It is important to consult with an attorney specializing in estate planning or a legal professional familiar with the laws and regulations of Detroit, Michigan, to ensure the proper creation and execution of the Detroit Michigan Amendment to Living Trust. The amendment should be drafted in accordance with applicable state laws to avoid any legal complications and ensure the granter's intentions are accurately represented.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Detroit Michigan Enmienda al fideicomiso en vida - Michigan Amendment to Living Trust

State:

Michigan

City:

Detroit

Control #:

MI-E0178A

Format:

Word

Instant download

Description

Formulario para modificar un fideicomiso en vida.

The Detroit Michigan Amendment to Living Trust refers to a legal document used to modify or update a living trust established in the city of Detroit, Michigan. A living trust is a common estate planning tool that allows individuals to place their assets and properties into a trust during their lifetime, ensuring they are managed and distributed according to their wishes after their passing. The amendment serves as a means to make changes or additions to the existing provisions of the original living trust within the jurisdiction of Detroit, Michigan. It enables the trust creator, also known as the granter or settler, to reflect their current intentions, protect against unforeseen circumstances, or adapt to changes in their personal or financial circumstances. By creating an amendment, the granter can maintain control over their trust while ensuring its effectiveness and relevance over time. There can be various types of Detroit Michigan Amendments to Living Trust, based on the nature of the modification being made. Some common types include: 1. Amendment of Beneficiary Distribution: This type of amendment allows the granter to change the beneficiaries of the trust or modify their share of the distribution. It may involve adding or removing beneficiaries, revising the distribution percentages, or redirecting assets to new recipients. 2. Amendment of Trustee Appointment: This type of amendment enables the granter to alter the individuals or entities named as trustees responsible for administering the trust. It may involve replacing the original trustee with a new one, adding co-trustees, or selecting successor trustees in case the original trustee becomes incapacitated or passes away. 3. Amendment of Trust Terms: This type of amendment is used to modify the terms and conditions stipulated in the original living trust document. It could involve changing provisions related to asset management, distribution, or even revoking certain terms altogether. 4. Amendment for Special Provisions: In certain cases, a granter may require more specific amendments, such as establishing new charitable provisions, creating special needs trusts, or providing instructions for the care of pets or other dependents after their passing. It is important to consult with an attorney specializing in estate planning or a legal professional familiar with the laws and regulations of Detroit, Michigan, to ensure the proper creation and execution of the Detroit Michigan Amendment to Living Trust. The amendment should be drafted in accordance with applicable state laws to avoid any legal complications and ensure the granter's intentions are accurately represented.

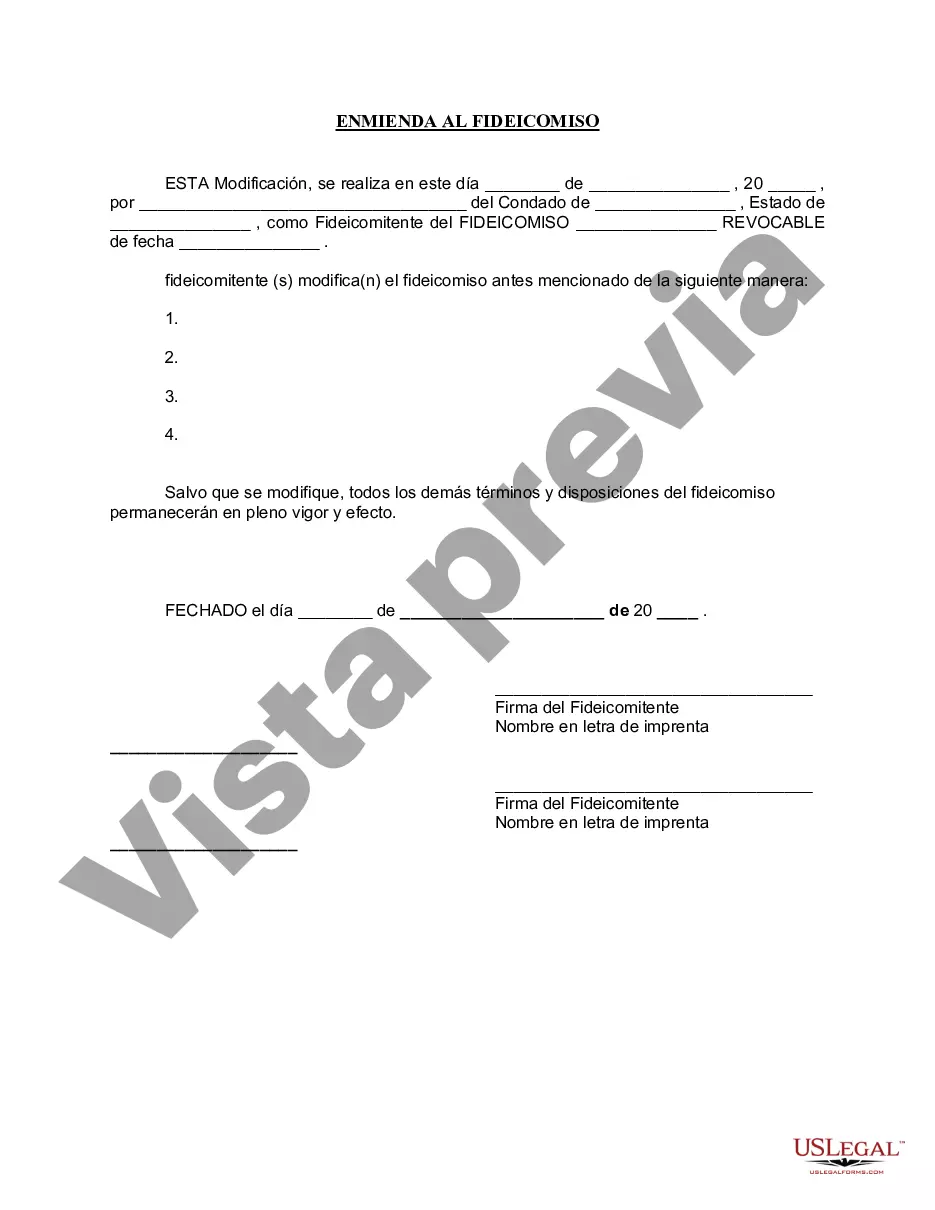

Free preview

How to fill out Detroit Michigan Enmienda Al Fideicomiso En Vida?

Obtaining verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

It is an online repository of over 85,000 legal documents designed for both personal and professional requirements and real-world scenarios.

All the papers are appropriately categorized by usage area and jurisdiction, making the search for the Detroit Michigan Amendment to Living Trust as straightforward as possible.

Maintaining organized and law-compliant paperwork is critically important. Take advantage of the US Legal Forms library to always have vital document templates readily available for all your needs!

- Review the Preview mode and form description.

- Ensure you've selected the correct one that fits your needs and is fully in line with your local jurisdiction criteria.

- Look for another template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it meets your requirements, proceed to the next step.

- Purchase the document.