Ann Arbor Michigan Financial Account Transfer to Living Trust: A Comprehensive Guide In Ann Arbor, Michigan, financial account transfer to a living trust is a strategic financial planning tool that allows individuals to protect and manage their assets while ensuring a seamless transition of their financial accounts. By transferring these accounts to a living trust, individuals can maintain control over their finances during their lifetime, as well as facilitate the transfer of assets to beneficiaries after their passing, all while avoiding the costly and time-consuming process of probate. There are various types of Ann Arbor Michigan financial account transfers to a living trust, each designed to suit different financial needs and preferences. These types include: 1. Revocable Living Trust: This is the most common type of living trust wherein the individual (granter) retains full control over their assets during their lifetime. They have the freedom to amend or revoke the trust at any time, making it a flexible option for financial planning. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of the beneficiaries or a court order. This type of trust provides protection against creditors, potential lawsuits, and ensures a more secure transfer of assets. 3. Testamentary Trust: While not technically a living trust, a testamentary trust is created within a will and only becomes effective upon the death of the individual. It allows for the transfer of financial accounts to the trust after probate has occurred. 4. Special Needs Trust: This type of living trust is specifically designed to provide financial support for a disabled or mentally incapacitated beneficiary. It ensures that the beneficiary's eligibility for government benefits is not jeopardized by a sudden influx of assets. The process of transferring financial accounts to a living trust in Ann Arbor, Michigan involves several important steps. Firstly, it is essential to consult with an experienced estate planning attorney who can draft the living trust document according to individual circumstances and goals. Next, the granter must identify the financial accounts they wish to transfer and update the account registrations to reflect the trust as the new owner. To ensure a smooth transfer, the granter should then notify the financial institutions where the accounts are held about the change in ownership. The institutions may require specific documentation, such as a certification of trust, to facilitate the transfer. It is important to note that certain financial accounts, such as retirement accounts like IRAs or 401(k)s, may have additional requirements or restrictions for transfer. Throughout this process, maintaining accurate and organized records is essential. The granter should keep copies of all documents related to the transfer, such as trust agreements, account statements, and correspondence with financial institutions. In conclusion, Ann Arbor Michigan financial account transfer to a living trust provides individuals with the means to protect and efficiently manage their assets during their lifetime, as well as ensure a seamless transfer to beneficiaries after their passing. By exploring the different types of living trusts available and consulting with a knowledgeable estate planning attorney, individuals can develop a tailored financial plan that aligns with their specific needs and goals.

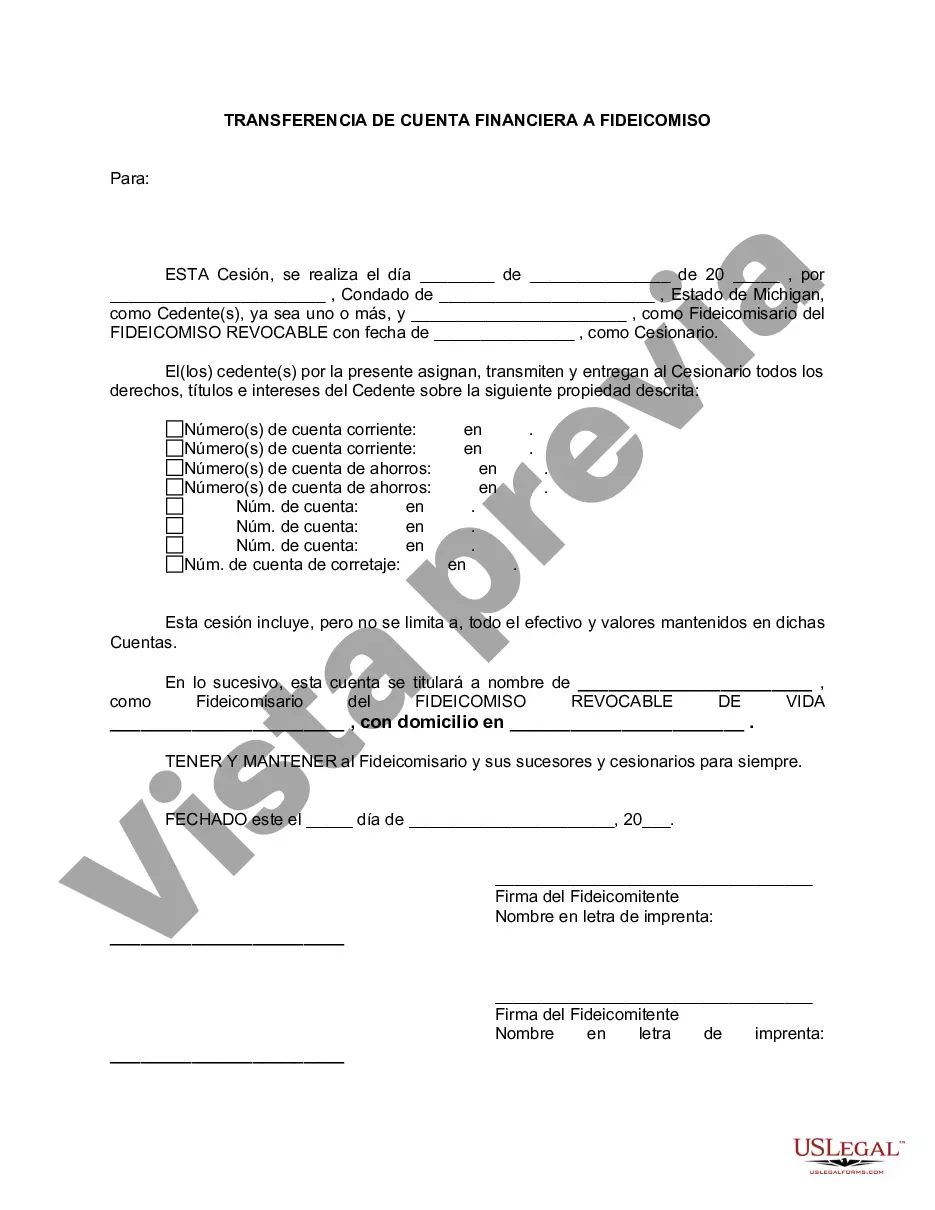

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ann Arbor Michigan Transferencia de cuenta financiera a fideicomiso en vida - Michigan Financial Account Transfer to Living Trust

State:

Michigan

City:

Ann Arbor

Control #:

MI-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Ann Arbor Michigan Financial Account Transfer to Living Trust: A Comprehensive Guide In Ann Arbor, Michigan, financial account transfer to a living trust is a strategic financial planning tool that allows individuals to protect and manage their assets while ensuring a seamless transition of their financial accounts. By transferring these accounts to a living trust, individuals can maintain control over their finances during their lifetime, as well as facilitate the transfer of assets to beneficiaries after their passing, all while avoiding the costly and time-consuming process of probate. There are various types of Ann Arbor Michigan financial account transfers to a living trust, each designed to suit different financial needs and preferences. These types include: 1. Revocable Living Trust: This is the most common type of living trust wherein the individual (granter) retains full control over their assets during their lifetime. They have the freedom to amend or revoke the trust at any time, making it a flexible option for financial planning. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of the beneficiaries or a court order. This type of trust provides protection against creditors, potential lawsuits, and ensures a more secure transfer of assets. 3. Testamentary Trust: While not technically a living trust, a testamentary trust is created within a will and only becomes effective upon the death of the individual. It allows for the transfer of financial accounts to the trust after probate has occurred. 4. Special Needs Trust: This type of living trust is specifically designed to provide financial support for a disabled or mentally incapacitated beneficiary. It ensures that the beneficiary's eligibility for government benefits is not jeopardized by a sudden influx of assets. The process of transferring financial accounts to a living trust in Ann Arbor, Michigan involves several important steps. Firstly, it is essential to consult with an experienced estate planning attorney who can draft the living trust document according to individual circumstances and goals. Next, the granter must identify the financial accounts they wish to transfer and update the account registrations to reflect the trust as the new owner. To ensure a smooth transfer, the granter should then notify the financial institutions where the accounts are held about the change in ownership. The institutions may require specific documentation, such as a certification of trust, to facilitate the transfer. It is important to note that certain financial accounts, such as retirement accounts like IRAs or 401(k)s, may have additional requirements or restrictions for transfer. Throughout this process, maintaining accurate and organized records is essential. The granter should keep copies of all documents related to the transfer, such as trust agreements, account statements, and correspondence with financial institutions. In conclusion, Ann Arbor Michigan financial account transfer to a living trust provides individuals with the means to protect and efficiently manage their assets during their lifetime, as well as ensure a seamless transfer to beneficiaries after their passing. By exploring the different types of living trusts available and consulting with a knowledgeable estate planning attorney, individuals can develop a tailored financial plan that aligns with their specific needs and goals.

Free preview

How to fill out Ann Arbor Michigan Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve already utilized our service before, log in to your account and save the Ann Arbor Michigan Financial Account Transfer to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Ann Arbor Michigan Financial Account Transfer to Living Trust. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!