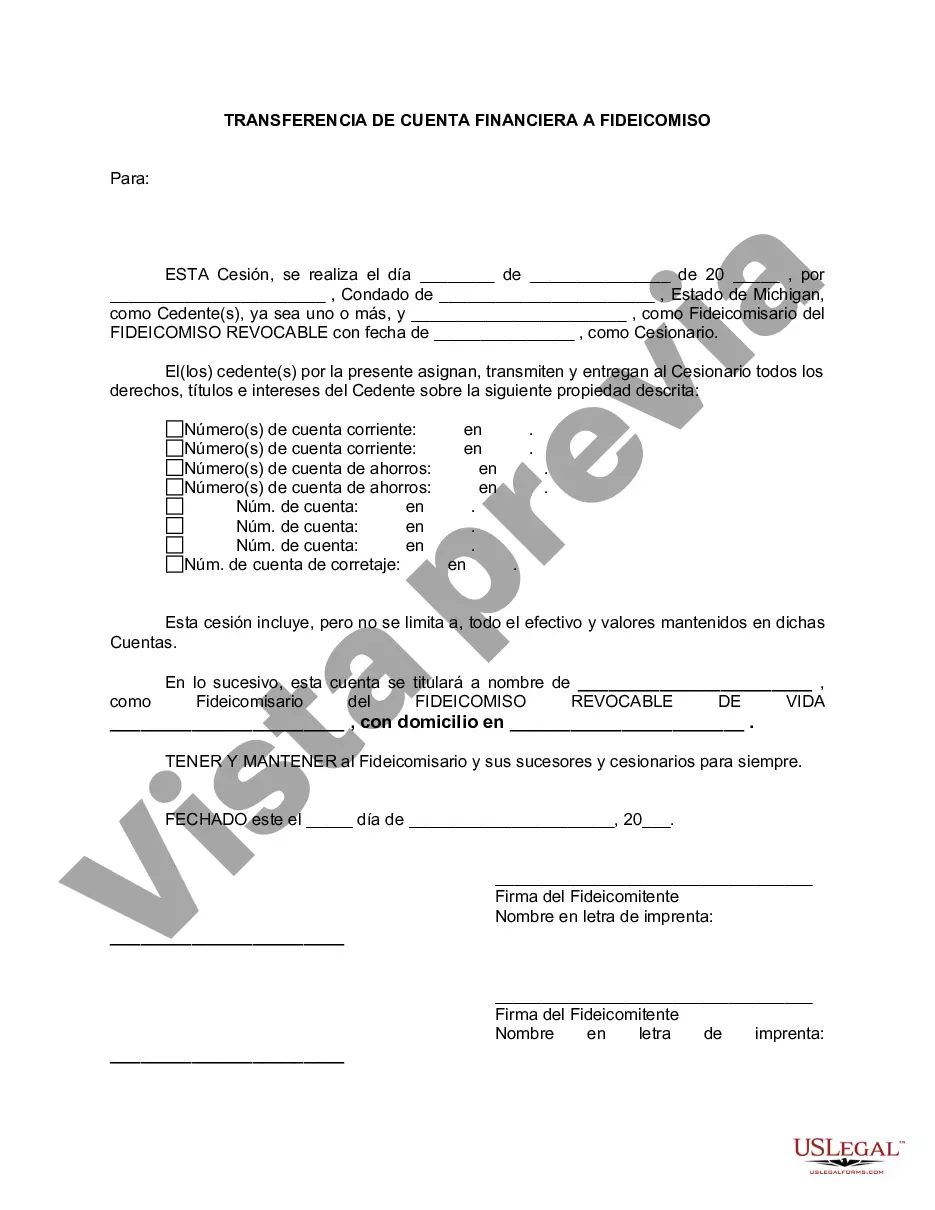

Detroit Michigan Financial Account Transfer to Living Trust is a legal process that involves the transfer of financial accounts to a living trust in the city of Detroit, located in the state of Michigan. This process allows individuals to ensure a smooth and efficient transfer of their financial assets upon their death or incapacitation. A living trust, also known as a revocable trust, is a legal document that holds ownership of assets during an individual's lifetime and allows for the distribution of those assets after their passing. By transferring financial accounts to a living trust, individuals can avoid probate, a court-supervised process that validates and administers a person's will, making the distribution of assets a lengthy and potentially costly affair. There are several types of transfers to living trusts available in Detroit, Michigan's financial account transfer process. The most common types include: 1. Detroit Michigan Financial Account Transfer to Living Trust — Traditional Method: In this method, individuals transfer their financial accounts, including bank accounts, investment accounts, retirement accounts, and brokerage accounts, to their living trust by formally changing the account ownership to the name of the trust. This involves notifying the financial institution where the accounts are held and providing them with the necessary documentation to effectuate the transfer. 2. Detroit Michigan Financial Account Transfer to Living Trust — Payable on Death (POD) or Transfer on Death (TOD) Designation: With this method, individuals can avoid the transfer process entirely by designating their living trust as the beneficiary of their financial accounts. Upon their death, the funds or assets held in these accounts are automatically transferred to the trust without going through probate. This method simplifies the transfer process and does not require formal ownership changes during an individual's lifetime. 3. Detroit Michigan Financial Account Transfer to Living Trust — Special Considerations: Depending on the specific financial accounts involved, there might be additional steps or considerations in the transfer process. For example, certain retirement accounts, such as 401(k) or IRA (Individual Retirement Account), may have specific IRS regulations that need to be followed. Consulting with a qualified attorney or financial advisor specializing in estate planning and trust administration can provide valuable guidance in navigating these complexities. Overall, the Detroit Michigan Financial Account Transfer to Living Trust is a crucial step in estate planning, allowing individuals to ensure the efficient and private transfer of their financial assets to their chosen beneficiaries. It provides the peace of mind that their assets will be distributed as per their wishes, while minimizing the time, costs, and potential complications associated with probate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Detroit Michigan Transferencia de cuenta financiera a fideicomiso en vida - Michigan Financial Account Transfer to Living Trust

Description

How to fill out Detroit Michigan Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Do you need a reliable and inexpensive legal forms supplier to get the Detroit Michigan Financial Account Transfer to Living Trust? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Detroit Michigan Financial Account Transfer to Living Trust conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Restart the search if the form isn’t good for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Detroit Michigan Financial Account Transfer to Living Trust in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal paperwork online once and for all.