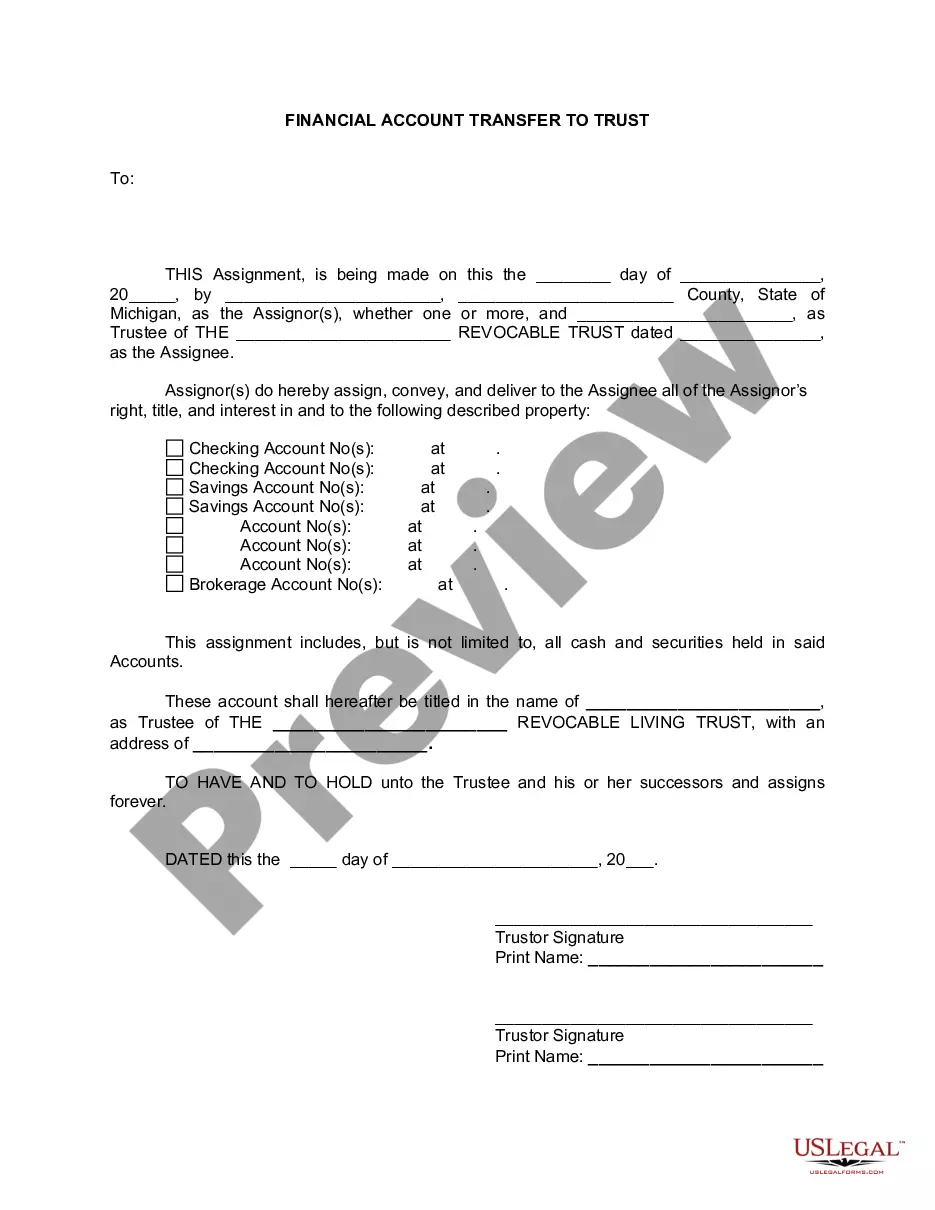

A Grand Rapids Michigan Financial Account Transfer to Living Trust allows individuals in the Grand Rapids area to transfer their financial accounts to a living trust for more efficient management and distribution of assets. This process ensures that the individual's finances are properly accounted for and distributed according to their wishes. There are several types of Grand Rapids Michigan Financial Account Transfer to Living Trust, including: 1. Grand Rapids Michigan Revocable Living Trust: This type of living trust allows individuals to transfer their financial accounts to a trust that they can amend or revoke at any time. It provides flexibility and control over assets while avoiding probate. 2. Grand Rapids Michigan Irrevocable Living Trust: An irrevocable living trust ensures that the transferred financial accounts cannot be modified or revoked without the consent of the beneficiaries. This trust is often established to minimize estate taxes or protect assets from creditors. 3. Grand Rapids Michigan Testamentary Trust: This type of living trust becomes effective upon the individual's death and allows for the transfer of financial accounts to beneficiaries named in the trust document. Testamentary trusts are commonly created to provide ongoing financial support for minor children or individuals with special needs. 4. Grand Rapids Michigan Special Needs Trust: A special needs trust is designed to protect the financial accounts of individuals with disabilities while allowing them to retain eligibility for government assistance programs. This trust provides for their specific needs without jeopardizing their access to public benefits. The Grand Rapids Michigan Financial Account Transfer to Living Trust process involves several steps: 1. Evaluation and Planning: Individuals consider their financial goals, beneficiaries, and estate planning objectives. They assess their financial accounts and determine which assets to transfer to the living trust. 2. Creation of Living Trust: An attorney assists in drafting a comprehensive living trust document that outlines the transfer of financial accounts to the trust. The document includes provisions for asset management, distribution, and any specific instructions. 3. Transfer of Financial Accounts: The individual then contacts their financial institutions to initiate the transfer process. They provide the necessary documentation, such as the living trust document and account information. 4. Updating Account Beneficiary Designations: It is important to update beneficiary designations on financial accounts to align with the living trust. This step ensures assets are distributed per the trust's instructions, overriding any previous designations. 5. Ongoing Account Management: After the transfer, the individual, or their designated trustee, assumes responsibility for managing the financial accounts within the living trust. They must ensure proper record-keeping, tax filings, and adherence to trust provisions. Overall, a Grand Rapids Michigan Financial Account Transfer to Living Trust allows individuals in the area to streamline their estate planning efforts, safeguard assets, minimize probate, and ensure a smooth distribution of their financial accounts to intended beneficiaries. Seeking professional legal advice is crucial for a proper understanding and implementation of this process.

Grand Rapids Michigan Financial Account Transfer to Living Trust

Description

How to fill out Michigan Financial Account Transfer To Living Trust?

We consistently aim to minimize or evade legal complications when managing intricate legal or financial matters.

To achieve this, we seek legal assistance that is typically very expensive.

Nonetheless, not every legal matter is equally intricate. Many issues can be handled by ourselves.

US Legal Forms is an online repository of up-to-date DIY legal documents encompassing everything from wills and power of attorneys to articles of incorporation and petitions for dissolution. Our library empowers you to manage your affairs independently without resorting to a lawyer's services.

If you happen to misplace the form, you can always re-download it from the My documents section. The procedure is equally straightforward if you are new to the platform! You can establish your account within minutes.

- We offer access to legal document templates that may not always be publicly available.

- Our templates are tailored to specific states and areas, significantly easing the search process.

- Take advantage of US Legal Forms whenever you wish to effortlessly and securely find and download the Grand Rapids Michigan Financial Account Transfer to Living Trust or any other document.

- Simply Log In to your account and click the Get button next to it.

Form popularity

FAQ

To place your home in a trust in Michigan, you must draft a deed that transfers ownership from you to the trust. After preparing the deed, file it with the appropriate county register of deeds. This step is a key component of your Grand Rapids Michigan Financial Account Transfer to Living Trust, helping you protect your home and streamline estate management.

Funding a trust in Michigan includes transferring legal titles of assets like real estate, bank accounts, and investments into the trust's name. It is essential to complete appropriate paperwork for each asset to ensure they are legally bound to the trust. This process is vital for an effective Grand Rapids Michigan Financial Account Transfer to Living Trust.

The most common trust for placing your house is a revocable living trust. This option allows you to manage your property while retaining control during your lifetime. Additionally, it simplifies the Grand Rapids Michigan Financial Account Transfer to Living Trust, eliminates probate issues, and provides privacy for your estate.

Transferring accounts into a trust requires you to change the designated account owner to the trust's name. Begin by contacting your bank or financial institution to understand their specific transfer process. This action is crucial for a successful Grand Rapids Michigan Financial Account Transfer to Living Trust, ensuring that your assets are managed according to your wishes.

Transferring items into a trust involves changing the title or ownership of the items to the trust. This applies to real property, like your home, and personal items, like vehicles. Ensure you have all necessary documents prepared and consider consulting a professional to facilitate the Grand Rapids Michigan Financial Account Transfer to Living Trust effectively.

To fund a trust in Michigan, you must transfer your assets into it. This includes real estate, bank accounts, and personal property. Start by listing all the assets you wish to include. Then, follow the necessary steps to legally transfer ownership, ensuring a smooth Grand Rapids Michigan Financial Account Transfer to Living Trust.

Choosing between a will or a trust in Michigan depends on your individual circumstances. A will goes through probate, which can delay asset distribution, while a trust can allow for quicker transfers, like the Grand Rapids Michigan Financial Account Transfer to Living Trust. Many people find that having a trust provides better control over asset distribution and privacy for their heirs.

To put your house in a trust in Michigan, you need to create a trust document that outlines the terms of the trust. Then, prepare a deed to transfer ownership from your name to the trust's name. This process can simplify the Grand Rapids Michigan Financial Account Transfer to Living Trust, making it easier to manage your property and assets in the future.

Yes, you can create your own living trust in Michigan. However, it is essential to ensure that the trust complies with state laws and effectively addresses your needs. Mistakes in the documentation can lead to issues during the Grand Rapids Michigan Financial Account Transfer to Living Trust. Using a reputable service like uslegalforms can provide guidance and ensure accuracy.

To file a living trust in Michigan, you first need to create a trust document that outlines your wishes for managing and distributing your assets. Once you have a completed trust document, you must transfer your financial accounts, such as bank accounts and investments, into the name of the trust. This process includes completing the necessary paperwork for the financial institutions involved. For a seamless Grand Rapids Michigan Financial Account Transfer to Living Trust, consider using US Legal Forms to access customizable templates and guidance for your specific needs.