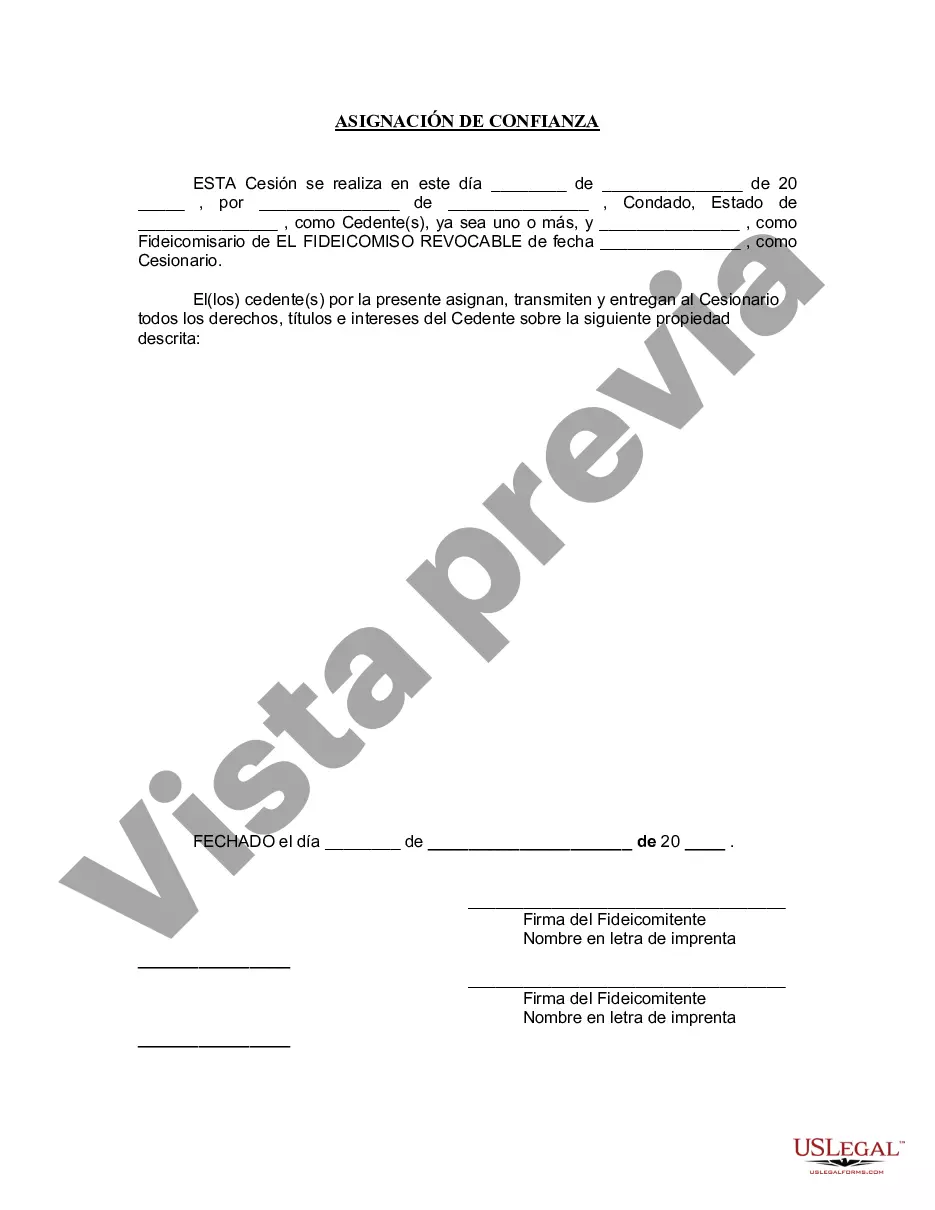

Are you considering the assignment of your property in Sterling Heights, Michigan, to a living trust? In this comprehensive description, we will explain what Sterling Heights Michigan Assignment to Living Trust entails, its benefits, and different types of trusts involved. What is Sterling Heights Michigan Assignment to Living Trust? Sterling Heights Michigan Assignment to Living Trust refers to the process of transferring ownership of property located in Sterling Heights, Michigan, to a living trust. A living trust is a legal entity created to hold and manage assets while the person (granter) is alive, and ultimately distribute them to named beneficiaries upon their passing. This alternative to a traditional will, can offer numerous advantages. Benefits of Sterling Heights Michigan Assignment to Living Trust: 1. Avoiding Probate: Probate can be a lengthy and costly process, but by assigning your assets to a living trust, they can be distributed seamlessly, saving your loved one's time, money, and stress. 2. Privacy: Unlike a will, a living trust is not made public, ensuring a higher level of privacy for your personal and financial affairs. 3. Incapacity Planning: A living trust allows you to plan for the possibility of incapacitation by appointing a successor trustee to manage your assets, ensuring your affairs continue smoothly. 4. Control and Flexibility: With a living trust, you retain control over your assets during your lifetime, determining how they are managed and distributed after your passing. 5. Tax Planning: Depending on your specific circumstances, a living trust may provide potential tax advantages, particularly regarding estate taxes. Types of Trusts used in Sterling Heights Michigan Assignment to Living Trust: 1. Revocable Living Trust: This is the most common type of trust used for Sterling Heights Michigan Assignment to Living Trust. As the granter, you maintain control and can make changes or revoke the trust at any time during your life. 2. Irrevocable Living Trust: Unlike a revocable trust, once assets are assigned to this trust, they generally cannot be changed or revoked. Irrevocable trusts may have specific advantages for Medicaid planning, asset protection, or reducing estate taxes, which should be discussed with an attorney. 3. Special Needs Trust: This trust is designed to support individuals with disabilities and can help ensure they are provided for without jeopardizing their eligibility for government assistance programs. 4. Charitable Remainder Trust: With this type of trust, you can donate assets to a charity while retaining control over them during your lifetime, and potentially receive tax benefits and income from the trust. 5. Testamentary Trust: Created within a will, this trust only becomes active after your passing; property assigned to it must go through probate before being distributed according to your instructions. In conclusion, Sterling Heights Michigan Assignment to Living Trust offers an effective way to manage and distribute your assets while protecting your loved ones from the challenges of probate. With various types of trusts available, consult with an experienced estate planning attorney in Sterling Heights, Michigan, to determine the most suitable option for your unique circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sterling Heights Michigan Asignación a un fideicomiso en vida - Michigan Assignment to Living Trust

Description

How to fill out Sterling Heights Michigan Asignación A Un Fideicomiso En Vida?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for legal services that, usually, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Sterling Heights Michigan Assignment to Living Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Sterling Heights Michigan Assignment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Sterling Heights Michigan Assignment to Living Trust is suitable for you, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!