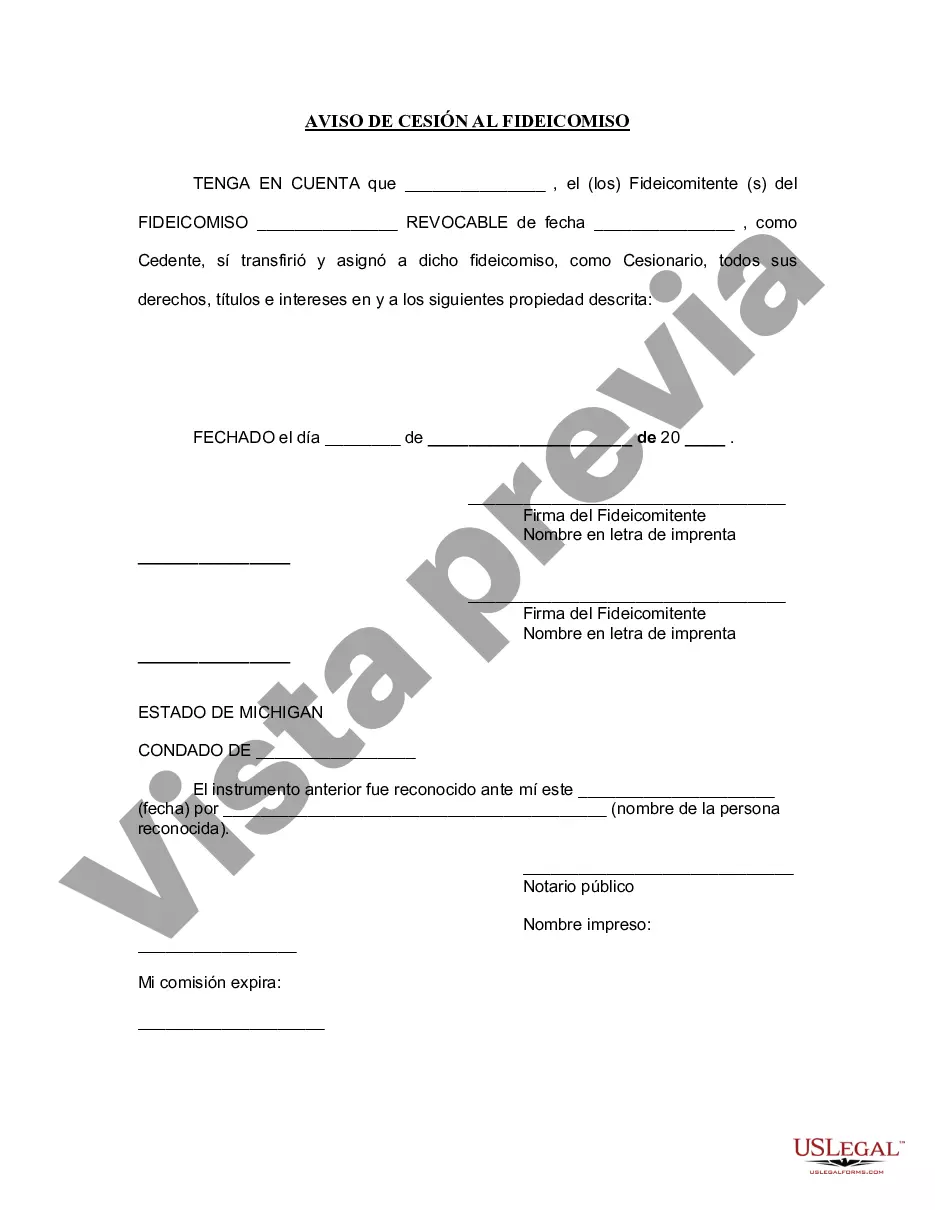

Ann Arbor Michigan Notice of Assignment to Living Trust is a legal document used to transfer ownership of assets or property into a living trust. This document is vital for residents of Ann Arbor, Michigan, who wish to establish and manage their estates efficiently and according to their preferences. By utilizing this notice, individuals can ensure that their assets are protected, avoid probate, and control their legacies. The Ann Arbor Michigan Notice of Assignment to Living Trust includes various important details and keywords such as: 1. Living Trust: The living trust, also known as a revocable trust, is a legal entity created to hold assets during an individual's lifetime and dictate their distribution upon their passing. This document enables individuals to avoid the often lengthy, costly, and public process of probate. 2. Assignment of Assets: An essential element of this notice, the assignment of assets refers to the act of transferring ownership of various types of assets into the living trust. These assets may include but are not limited to real estate properties, bank accounts, investments, personal possessions, and business interests. 3. Property Transfer: The notice facilitates the transfer of property titles from the individual's name to the trustee of the living trust. Through this transfer, the individual formally relinquishes ownership and places the assets under the control and management of the living trust. 4. Successor Trustee: The notice may also mention the appointment of a successor trustee. A successor trustee is an individual or entity designated to manage the living trust and handle its administration in case the initial trustee becomes unable or unwilling to perform their duties. 5. Personal Information: The notice typically requires the inclusion of personal information such as the individual's name, address, and contact details. The details of the living trust, trust date, and the beneficiaries' names may also be included. It's important to note that while specific types of Ann Arbor Michigan Notice of Assignment to Living Trust do not exist, variations may arise due to individual circumstances or specific estate planning requirements. Some individuals may require additional provisions, such as special instructions for certain assets, specific tax planning, or provisions for charitable giving. However, the basic elements mentioned above remain pertinent to all versions of this notice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ann Arbor Michigan Aviso de cesión a un fideicomiso en vida - Michigan Notice of Assignment to Living Trust

Description

How to fill out Ann Arbor Michigan Aviso De Cesión A Un Fideicomiso En Vida?

Do you need a trustworthy and affordable legal forms provider to get the Ann Arbor Michigan Notice of Assignment to Living Trust? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of separate state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Ann Arbor Michigan Notice of Assignment to Living Trust conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is intended for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Ann Arbor Michigan Notice of Assignment to Living Trust in any available file format. You can return to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal papers online for good.