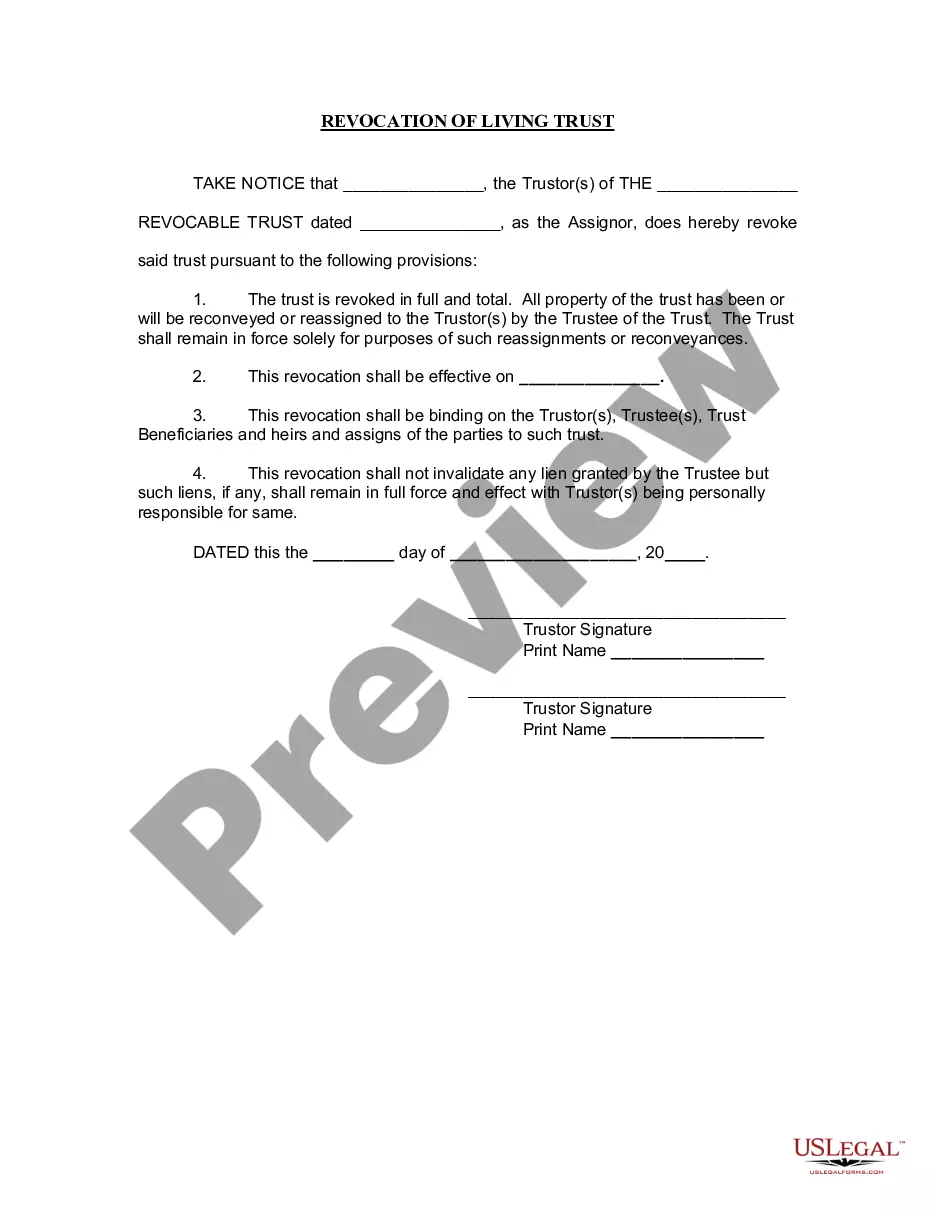

Detroit Michigan Revocation of Living Trust

Description

How to fill out Michigan Revocation Of Living Trust?

If you are searching for an appropriate form, it’s incredibly challenging to select a more suitable service than the US Legal Forms website – likely the most comprehensive online libraries.

With this collection, you can obtain a vast array of form samples for business and personal uses by categories and states, or keywords.

With the superior search feature, acquiring the latest Detroit Michigan Revocation of Living Trust is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the file format and store it on your device.

- Moreover, the validity of each document is confirmed by a team of skilled attorneys who routinely examine the templates on our site and update them based on the most recent state and county requirements.

- If you are already familiar with our platform and possess a registered account, all you must do to obtain the Detroit Michigan Revocation of Living Trust is to Log In to your profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have accessed the form you desire. Review its description and utilize the Preview option (if available) to examine its content. If it doesn’t satisfy your needs, use the Search field at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now button. Next, select the preferred pricing option and provide details to register for an account.

Form popularity

FAQ

The trust deed is the founding document of a trust and is a public document which is lodged with the Master of the High Court.

The contents of your Trust remain private because a Living Trust in Michigan avoids Probate Court. A Last Will and Testament and its contents, on the other hand, are made public only when they enter Probate Court, usually within a few weeks after there has been a passing.

For taxable trusts created on or after 6 April 2021, the trustees have had to register the trust within 90 days of becoming liable for tax or 1 September 2022 ? whichever is later. Different registration deadlines applied for taxable trusts created before 6 April 2021.

Sec. 7604. (1) A person may commence a judicial proceeding to contest the validity of a trust that was revocable at the settlor's death within the earlier of the following: (a) Two years after the settlor's death.

(1) The settlor, a cotrustee, or a qualified trust beneficiary may request the court to remove a trustee, or a trustee may be removed by the court on its own initiative. (2) The court may remove a trustee if 1 or more of the following occur: (a) The trustee commits a serious breach of trust.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

Once you know that your interest has vested, you can simply write a letter to the Trustee stating that you are legally entitled to a copy of the Trust and asking that the Trustee send it to you.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

(i) If the trust is created pursuant to a writing, by another writing manifesting clear and convincing evidence of the settlor's intent to revoke or amend the trust. (ii) If the trust is an oral trust, by any method manifesting clear and convincing evidence of the settlor's intent.