Wayne Michigan Revocación de fideicomiso en vida - Michigan Revocation of Living Trust

Description

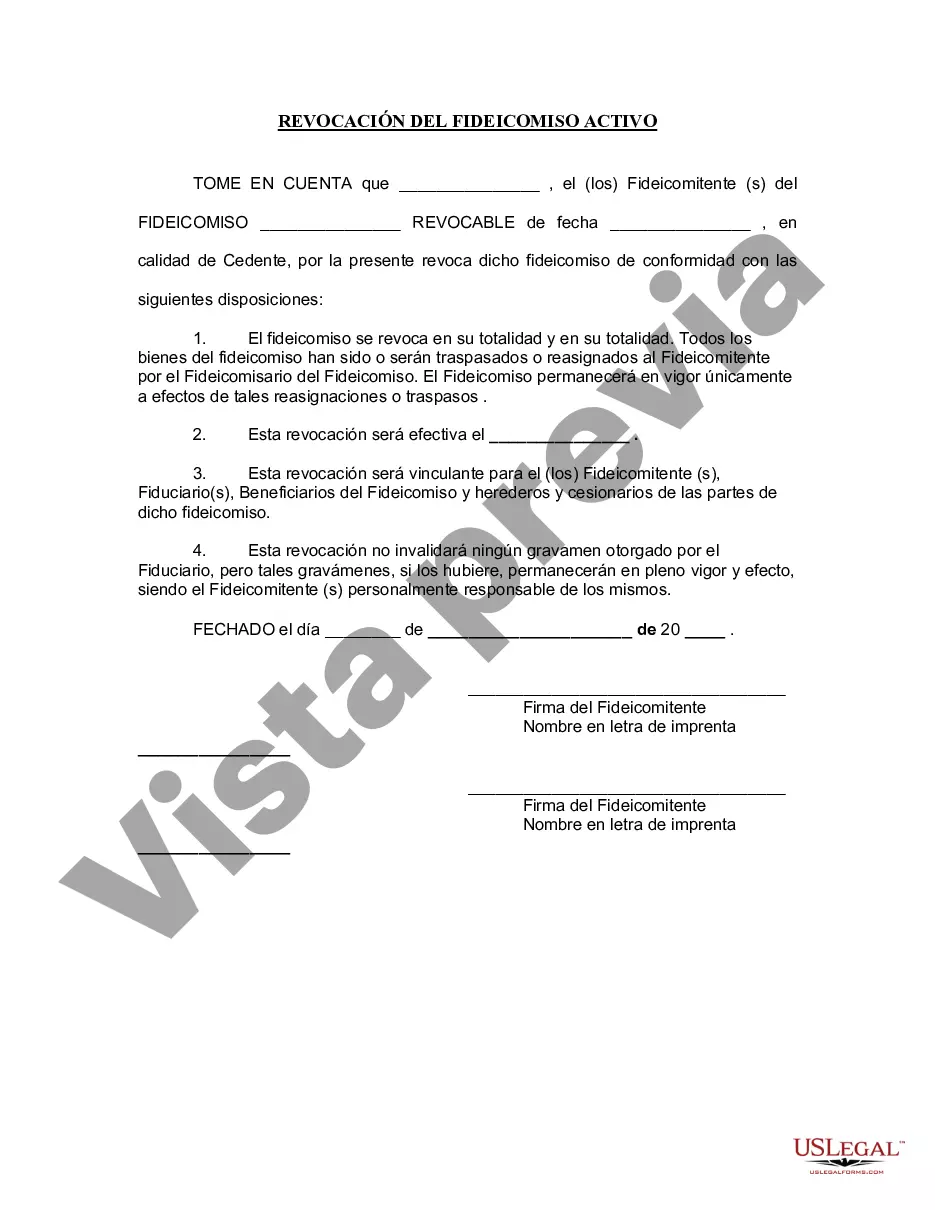

How to fill out Michigan Revocación De Fideicomiso En Vida?

We consistently aim to reduce or avert legal harm when navigating intricate legal or financial issues.

To achieve this, we enroll in legal solutions that are typically quite costly.

However, not every legal problem is equally intricate. Many of those can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button adjacent to it. If you misplace the form, you can always retrieve it again from the My documents tab. The procedure is equally simple if you are unfamiliar with the platform! You can establish your account within a few minutes. Ensure to verify if the Wayne Michigan Revocation of Living Trust adheres to the laws and regulations of your state and area. Additionally, it’s essential that you review the form’s description (if available), and if you notice any inconsistencies with what you initially sought, look for a different template. Once you’ve confirmed that the Wayne Michigan Revocation of Living Trust suits your case, you can select a subscription plan and complete the payment. After that, you can download the form in any available file format. With more than 24 years in the market, we’ve assisted millions of individuals by offering ready-to-customize and up-to-date legal documents. Utilize US Legal Forms now to conserve effort and resources!

- Our platform empowers you to handle your affairs without the need for an attorney.

- We offer access to legal form templates that are not always available to the public.

- Our templates are specific to states and regions, which significantly eases the search process.

- Take advantage of US Legal Forms whenever you require to obtain and download the Wayne Michigan Revocation of Living Trust or any other form promptly and securely.

Form popularity

FAQ

La extincion del Fideicomiso, procede por las siguientes razones: 1. - Cumplimiento de los fines para los cuales fue constituido; 2. - Hacerse imposible su cumplimiento; 3. - Renuncia o muerte del Beneficiario sin tener sustituto; 4.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

La extincion del Fideicomiso, procede por las siguientes razones: 1. - Cumplimiento de los fines para los cuales fue constituido; 2. - Hacerse imposible su cumplimiento; 3. - Renuncia o muerte del Beneficiario sin tener sustituto; 4.

Los bienes cobijados por una propiedad fiduciaria son inembargables. Asi lo establece expresamente el Codigo de Procedimiento Civil. La propiedad fiduciaria elimina los procesos sucesora les cuando se utiliza como condicion el fallecimiento de quien la constituye.

Cuando en un fideicomiso hay varios lotes y el fideicomitente va a ceder algunos derechos o transmision del inmueble. mexicana o persona Moral Mexicana).

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

Las causales por las que se extingue el fideicomiso civil estan senaladas en el articulo 822 del codigo civil que son: Por la restitucion. Por la resolucion del derecho de su autor, como cuando se ha constituido el fideicomiso sobre una cosa que se ha comprado con pacto de retrovendenta, y se verifica la retroventa.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Causas de extincion del fideicomiso El cumplimiento total de sus fines o la imposibilidad absoluta de cumplirlos.El cumplimiento del plazo o condicion resolutoria a que se hubiese sometido.El acuerdo entre fideicomitente y beneficiario, sin perjuicio de los derechos del fiduciario.