A Detroit, Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines a borrower's agreement to repay a loan taken for residential real estate in the city of Detroit, Michigan. This promissory note carries a fixed interest rate and is designed to provide security to the lender by using the borrower's residential property as collateral. This type of promissory note serves as a binding contract between the borrower and the lender. The borrower acknowledges their debt and promises to repay the principal loan amount in scheduled installments, along with the accrued interest. The promissory note details the terms of the loan, including the principal amount, specified interest rate, payment schedule, prepayment penalties (if any), and any default provisions. The Residential Real Estate mentioned in the promissory note refers specifically to properties used for residential purposes, like single-family homes, apartments, townhouses, or condominiums, located in the city of Detroit, Michigan. The note ensures that the lender has a legal claim on the property mentioned as collateral in case of default or failure to repay the loan. Different types or variations of Detroit, Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate might include specific terms regarding the repayment duration, interest rate, and other financial aspects. For instance, there could be promissory notes with shorter repayment periods, such as 5-year or 10-year notes. Similarly, there may be differing interest rates depending on the borrower's creditworthiness or the prevailing market conditions. Ultimately, a Detroit, Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate serves as a legally binding agreement between the borrower and the lender, outlining the terms and conditions of a loan taken to finance residential property in the city of Detroit. It provides clarity and protection to both parties involved, ensuring that the borrower understands their repayment obligations and the lender has a secured claim on the property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Detroit Pagaré de cuota fija en cuotas de Michigan garantizado por bienes raíces residenciales - Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Category:

State:

Michigan

City:

Detroit

Control #:

MI-NOTESEC

Format:

Word

Instant download

Description

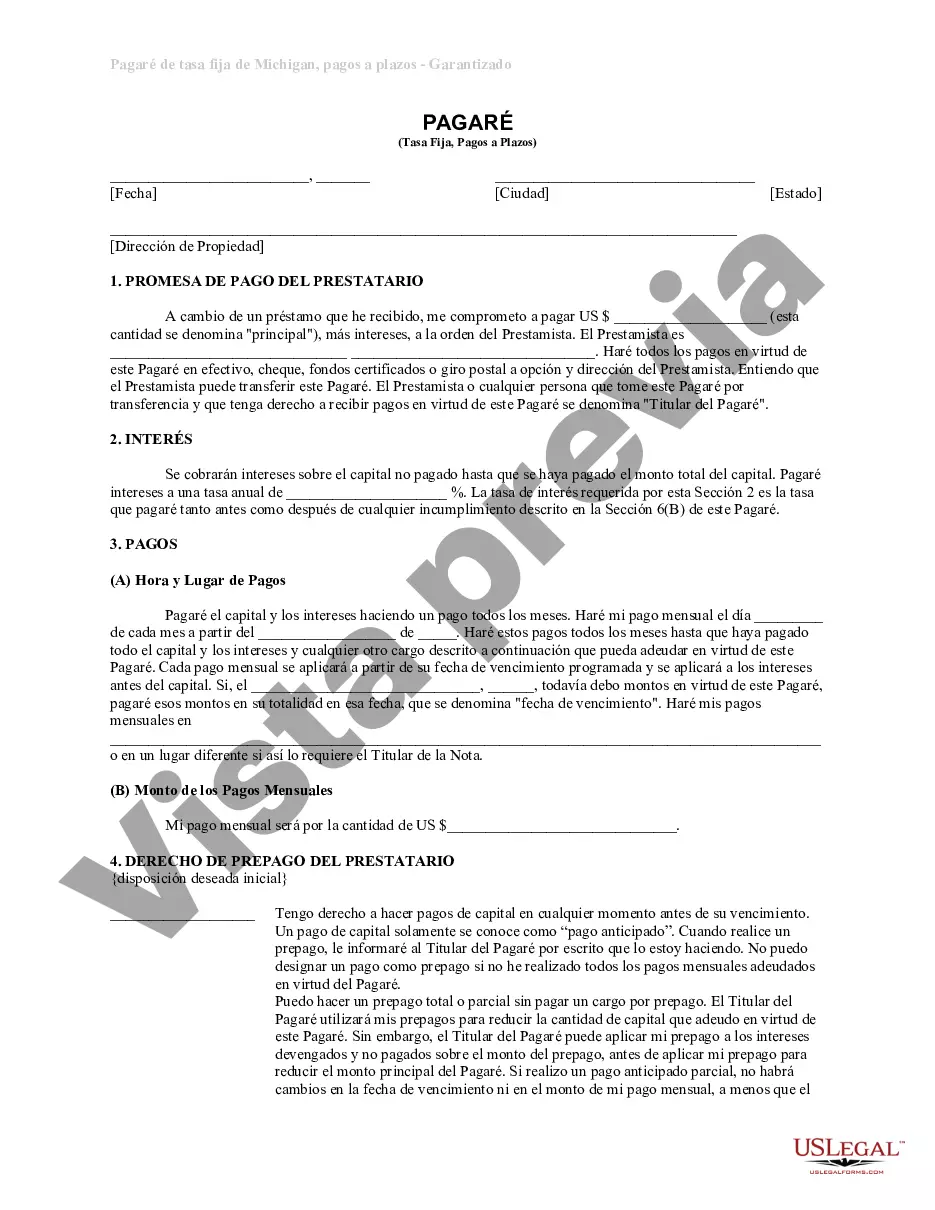

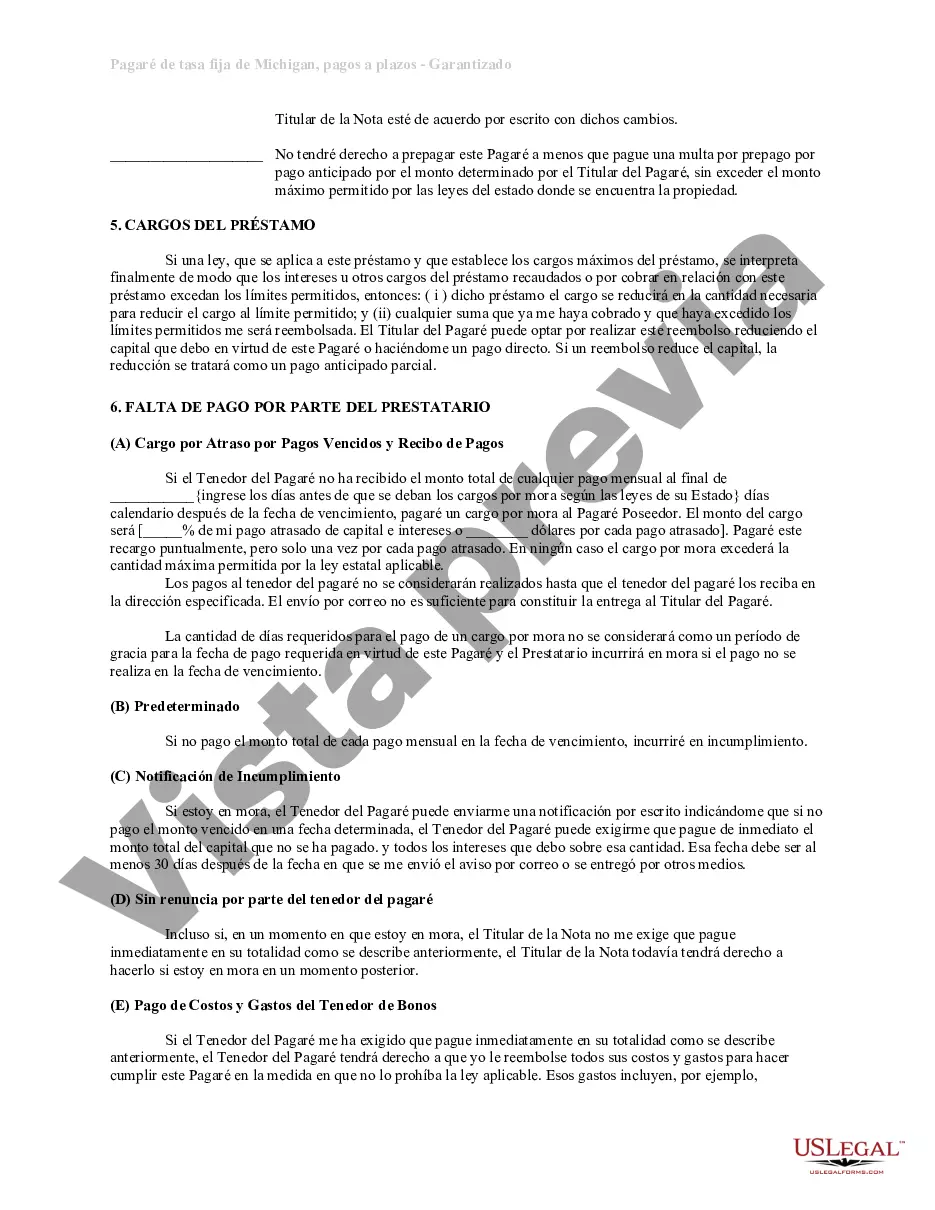

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Detroit, Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines a borrower's agreement to repay a loan taken for residential real estate in the city of Detroit, Michigan. This promissory note carries a fixed interest rate and is designed to provide security to the lender by using the borrower's residential property as collateral. This type of promissory note serves as a binding contract between the borrower and the lender. The borrower acknowledges their debt and promises to repay the principal loan amount in scheduled installments, along with the accrued interest. The promissory note details the terms of the loan, including the principal amount, specified interest rate, payment schedule, prepayment penalties (if any), and any default provisions. The Residential Real Estate mentioned in the promissory note refers specifically to properties used for residential purposes, like single-family homes, apartments, townhouses, or condominiums, located in the city of Detroit, Michigan. The note ensures that the lender has a legal claim on the property mentioned as collateral in case of default or failure to repay the loan. Different types or variations of Detroit, Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate might include specific terms regarding the repayment duration, interest rate, and other financial aspects. For instance, there could be promissory notes with shorter repayment periods, such as 5-year or 10-year notes. Similarly, there may be differing interest rates depending on the borrower's creditworthiness or the prevailing market conditions. Ultimately, a Detroit, Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate serves as a legally binding agreement between the borrower and the lender, outlining the terms and conditions of a loan taken to finance residential property in the city of Detroit. It provides clarity and protection to both parties involved, ensuring that the borrower understands their repayment obligations and the lender has a secured claim on the property.

Free preview

How to fill out Detroit Pagaré De Cuota Fija En Cuotas De Michigan Garantizado Por Bienes Raíces Residenciales?

If you’ve already used our service before, log in to your account and save the Detroit Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Detroit Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!