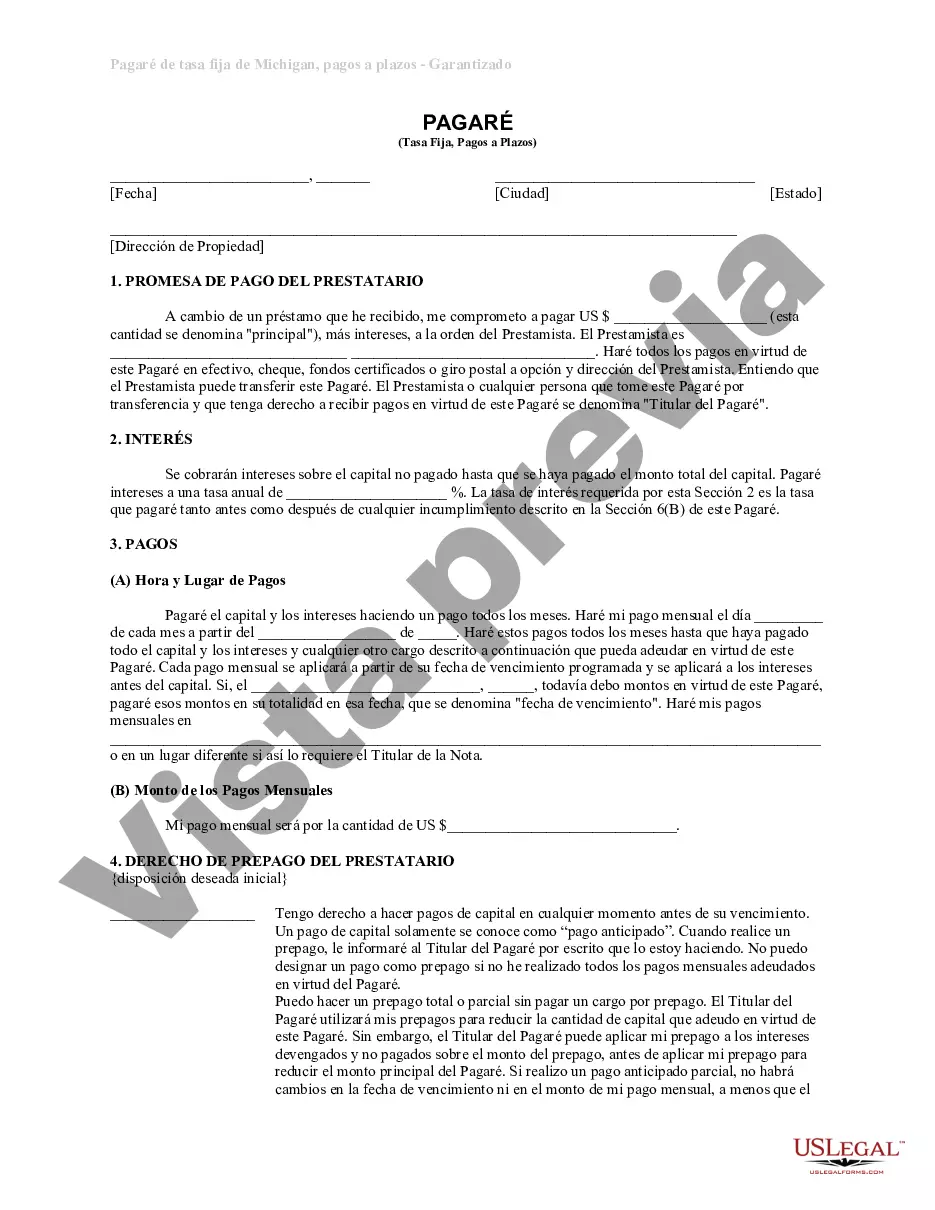

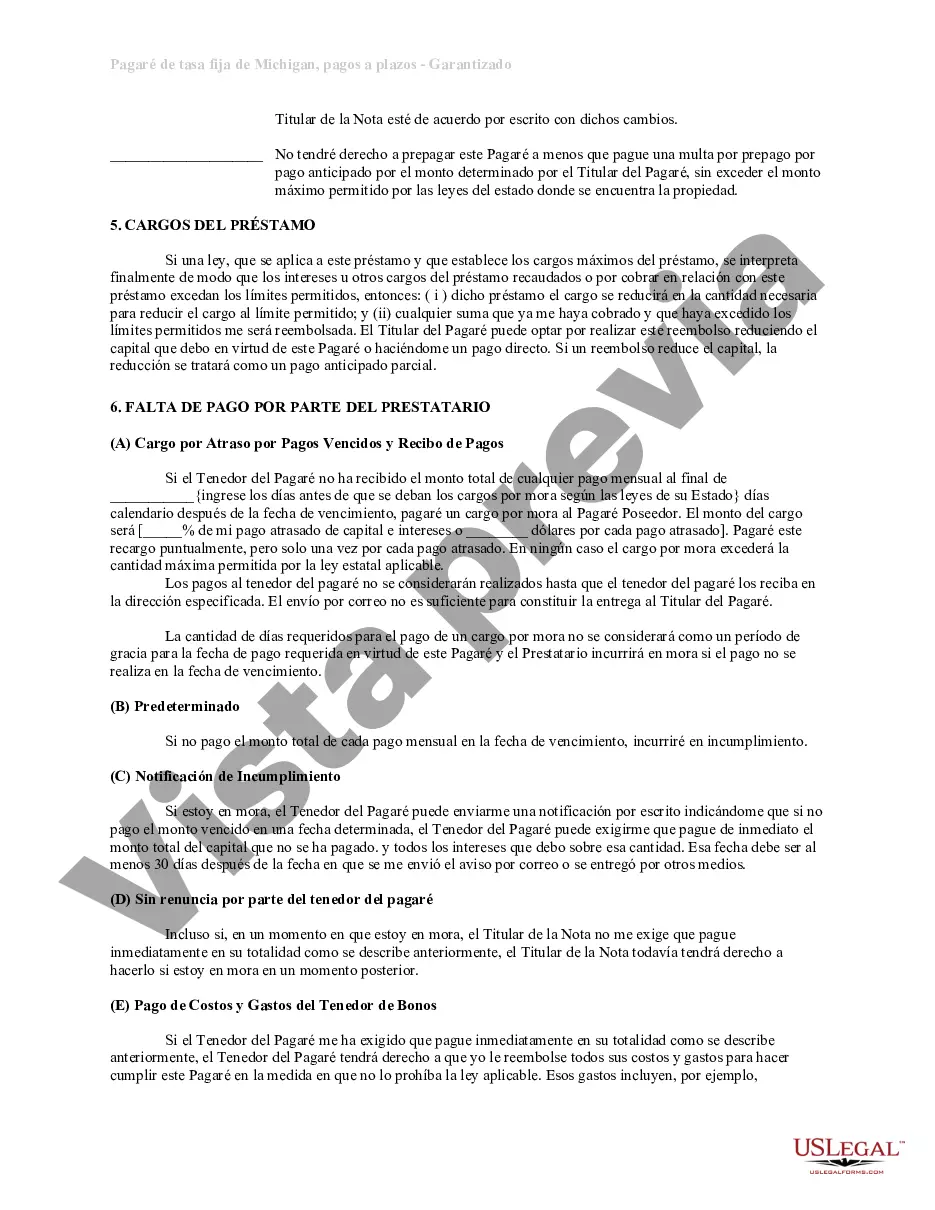

A Sterling Heights Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate refers to a legal document that outlines the terms and conditions of a loan agreement specifically related to residential real estate in Sterling Heights, Michigan. This type of promissory note offers stability and predictability to both the lender and borrower. It is crucial to understand the various types of Sterling Heights Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate available to make an informed decision. Let's explore some of these types: 1. Traditional Residential Mortgage: — This type of promissory note is the most common and straightforward. — It is typically designed for long-term loans, such as 15 or 30 years. — The interest rate remains fixed throughout the loan term, ensuring consistent monthly payments. 2. Adjustable-Rate Mortgage (ARM): — An ARM Sterling Heights promissory note has an interest rate that adjusts periodically based on market factors. — The initial interest rate remains fixed for a specific period, then adjusts annually or semi-annually. — Borrowers benefit from lower initial rates, although they should be prepared for potential rate fluctuations. 3. Balloon Mortgage: — In this arrangement, the borrower makes smaller monthly payments for a fixed period, often 5 or 7 years. — At the end of the term, a significant lump sum payment (balloon payment) is due. — Balloon mortgages can be advantageous for those planning to sell the property or refinance before the balloon payment is due. 4. Interest-Only Loan: — An interest-only promissory note requires the borrower to make payments towards only the interest for a specific initial period, typically 5 to 10 years. — During this period, the principal amount remains unchanged, resulting in lower monthly payments. — After the interest-only period, payments include both principal and interest, resulting in higher monthly payments. No matter the type of Sterling Heights Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is essential to understand the terms, repayment schedule, interest rate, and consequences of default. Consulting with a reputable mortgage professional or attorney is highly recommended ensuring compliance with local laws and regulations and to make an informed decision.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sterling Heights Pagaré de cuota fija en cuotas de Michigan garantizado por bienes raíces residenciales - Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Sterling Heights Pagaré De Cuota Fija En Cuotas De Michigan Garantizado Por Bienes Raíces Residenciales?

If you are looking for a relevant form, it’s extremely hard to find a more convenient place than the US Legal Forms website – probably the most considerable libraries on the web. Here you can find thousands of form samples for organization and personal purposes by categories and regions, or key phrases. With the advanced search option, discovering the latest Sterling Heights Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as elementary as 1-2-3. Furthermore, the relevance of each and every record is proved by a team of expert attorneys that on a regular basis check the templates on our website and revise them according to the latest state and county demands.

If you already know about our system and have an account, all you need to get the Sterling Heights Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the form you want. Read its information and utilize the Preview feature to explore its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the appropriate record.

- Affirm your selection. Click the Buy now option. After that, pick the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the file format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Sterling Heights Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Every form you add to your profile has no expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to have an additional duplicate for editing or printing, you may come back and download it again at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Sterling Heights Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate you were seeking and thousands of other professional and state-specific samples on one platform!