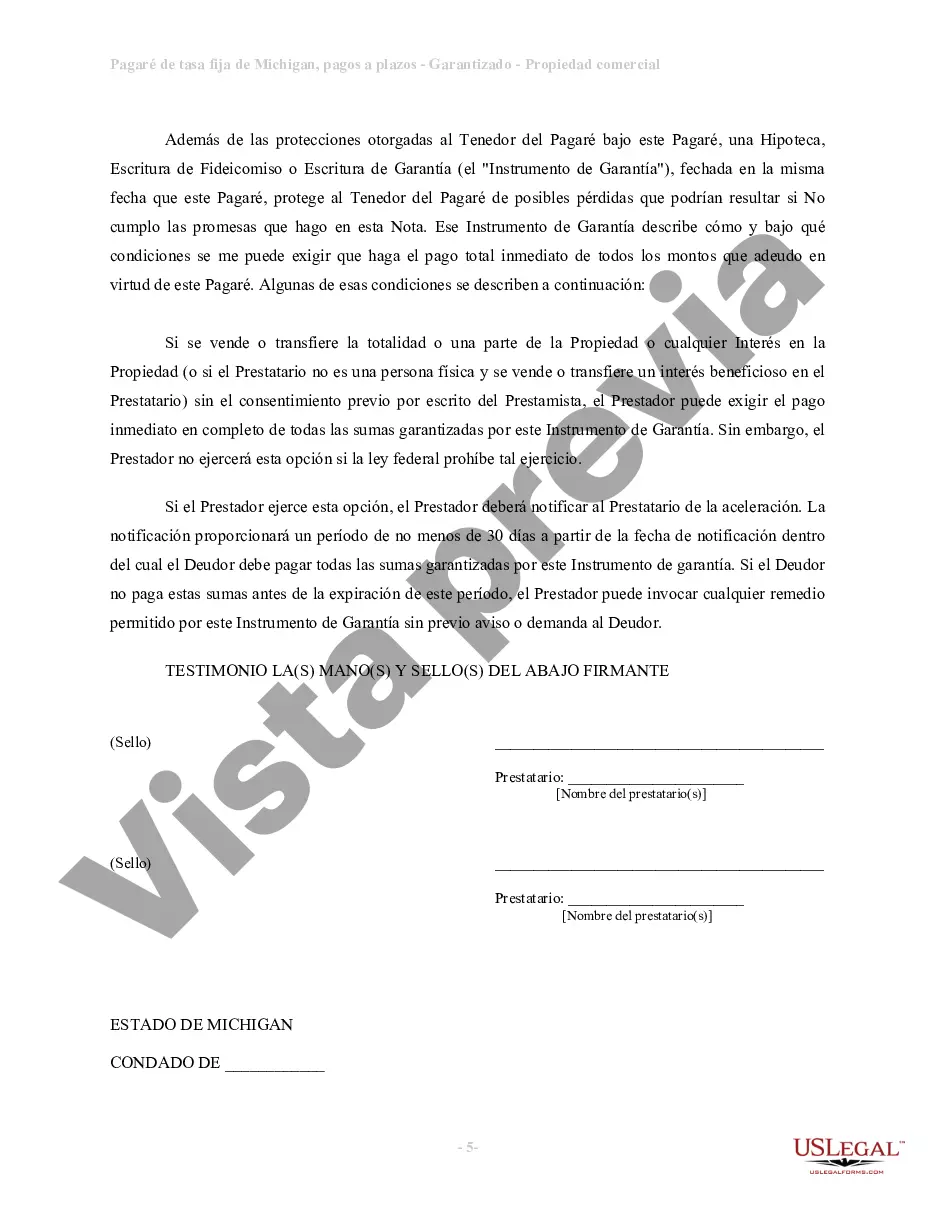

A Detroit Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that outlines a borrower's promise to repay a loan obtained to finance a commercial property in Detroit, Michigan. This promissory note follows a fixed-rate structure, which means that the interest rate remains constant throughout the loan term. The promissory note serves as evidence of the borrower's debt and includes crucial information such as loan amount, interest rate, repayment terms, and any additional terms or conditions agreed upon between the lender and borrower. Typically, the loan amount is substantial, reflecting the significant investment required for commercial real estate properties in Detroit, Michigan. The promissory note is secured by commercial real estate, which means that the borrower pledges the property itself as collateral. This provides the lender with an added layer of security, as it allows them to exercise remedies such as foreclosure in the event of default. The commercial real estate, which comprises various types such as office buildings, retail spaces, or industrial facilities, is located within the Detroit, Michigan area. Different types of Detroit Michigan Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate may exist, varying primarily in terms of the specific commercial property being financed. These could include promissory notes for office buildings, retail spaces, warehouses, manufacturing facilities, or mixed-use properties. Each type of promissory note may have slightly different terms or provisions to accommodate the unique characteristics and risks associated with the particular commercial property. The promissory note creates a legally binding agreement between the lender and borrower, establishing the borrower's obligation to make regular installment payments over a specified loan term. Installment payments typically consist of both principal and interest, allowing the borrower to gradually pay off the loan balance while also compensating the lender for providing the funds. By utilizing a fixed-rate structure, the borrower benefits from predictability and stability, as the interest rate remains constant. This shields them from potential fluctuations in market interest rates, ensuring that their monthly payments stay consistent throughout the loan term. In summary, a Detroit Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a vital legal document that facilitates borrowing for commercial property investments in Detroit, Michigan. It provides lenders with collateral protection through the placement of a lien on the specific commercial property being financed. With various types depending on the nature of the commercial property, these promissory notes establish a repayment plan involving regular installment payments while utilizing a fixed-rate structure to ensure stability and predictability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Detroit Pagaré de cuota fija en cuotas de Michigan garantizado por bienes raíces comerciales - Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Detroit Pagaré De Cuota Fija En Cuotas De Michigan Garantizado Por Bienes Raíces Comerciales?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone without any legal background to create this sort of papers from scratch, mostly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our service provides a huge collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you want the Detroit Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Detroit Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in minutes employing our trusted service. If you are already an existing customer, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are unfamiliar with our library, make sure to follow these steps before downloading the Detroit Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate:

- Ensure the template you have found is specific to your area since the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief description (if provided) of scenarios the paper can be used for.

- In case the form you selected doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Detroit Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate as soon as the payment is completed.

You’re good to go! Now you can proceed to print out the form or fill it out online. In case you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.