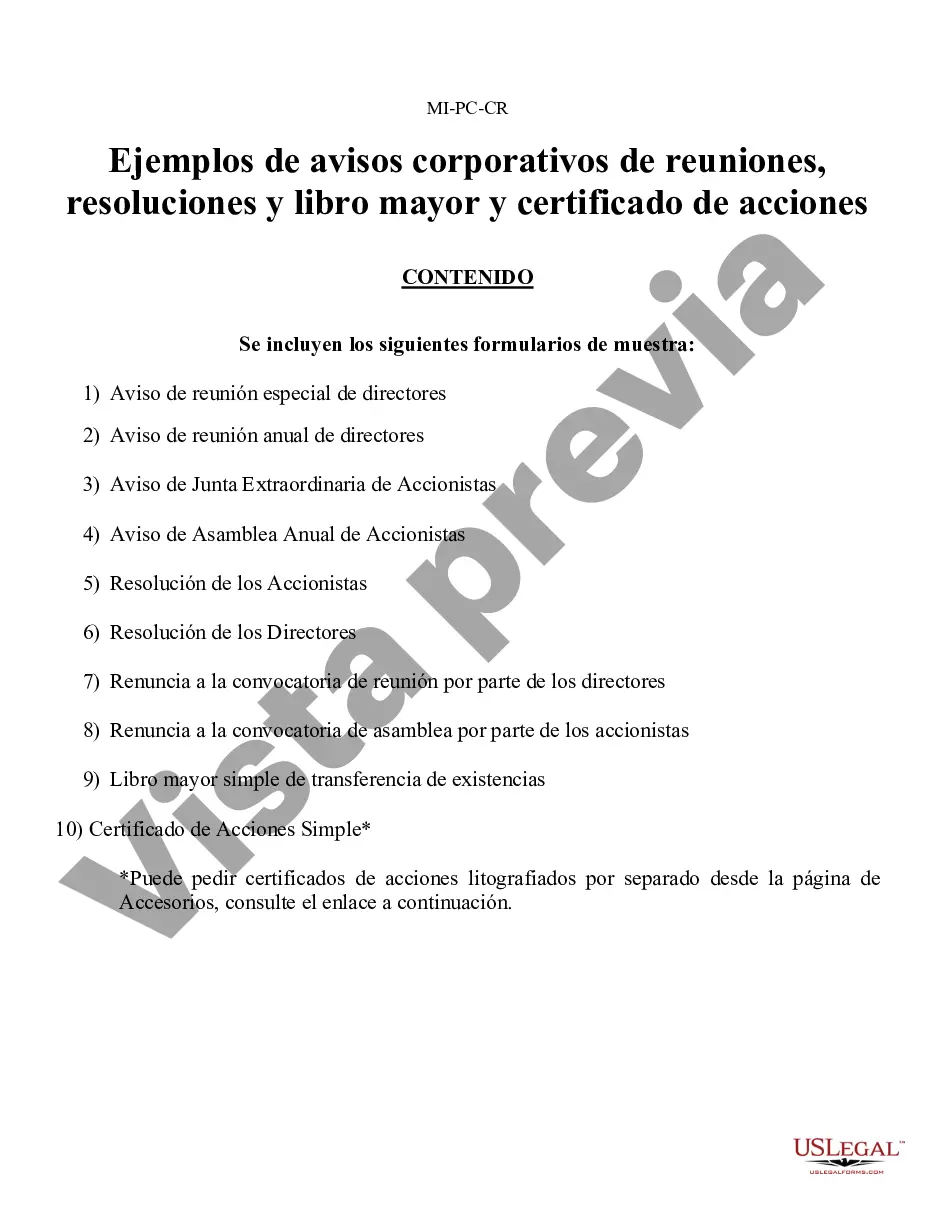

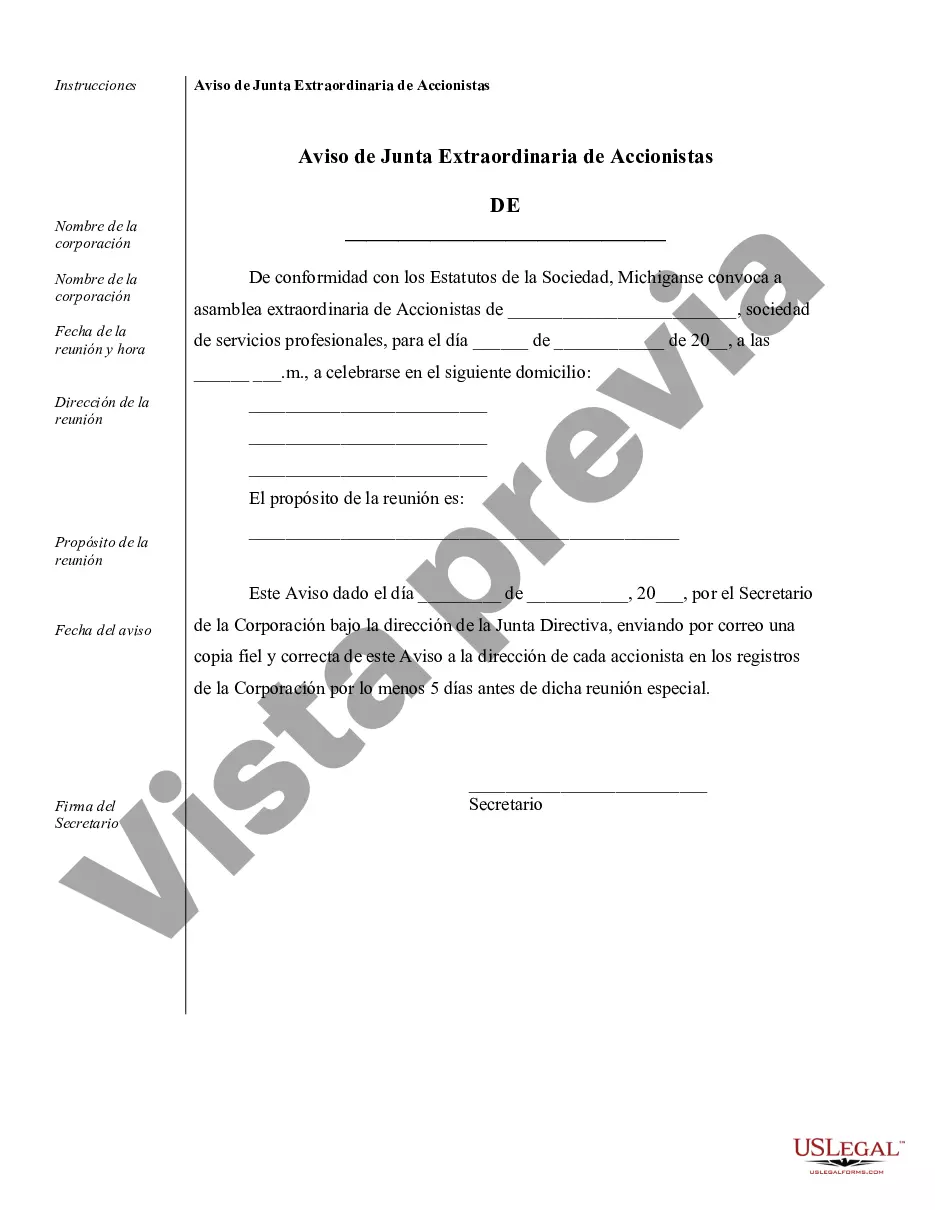

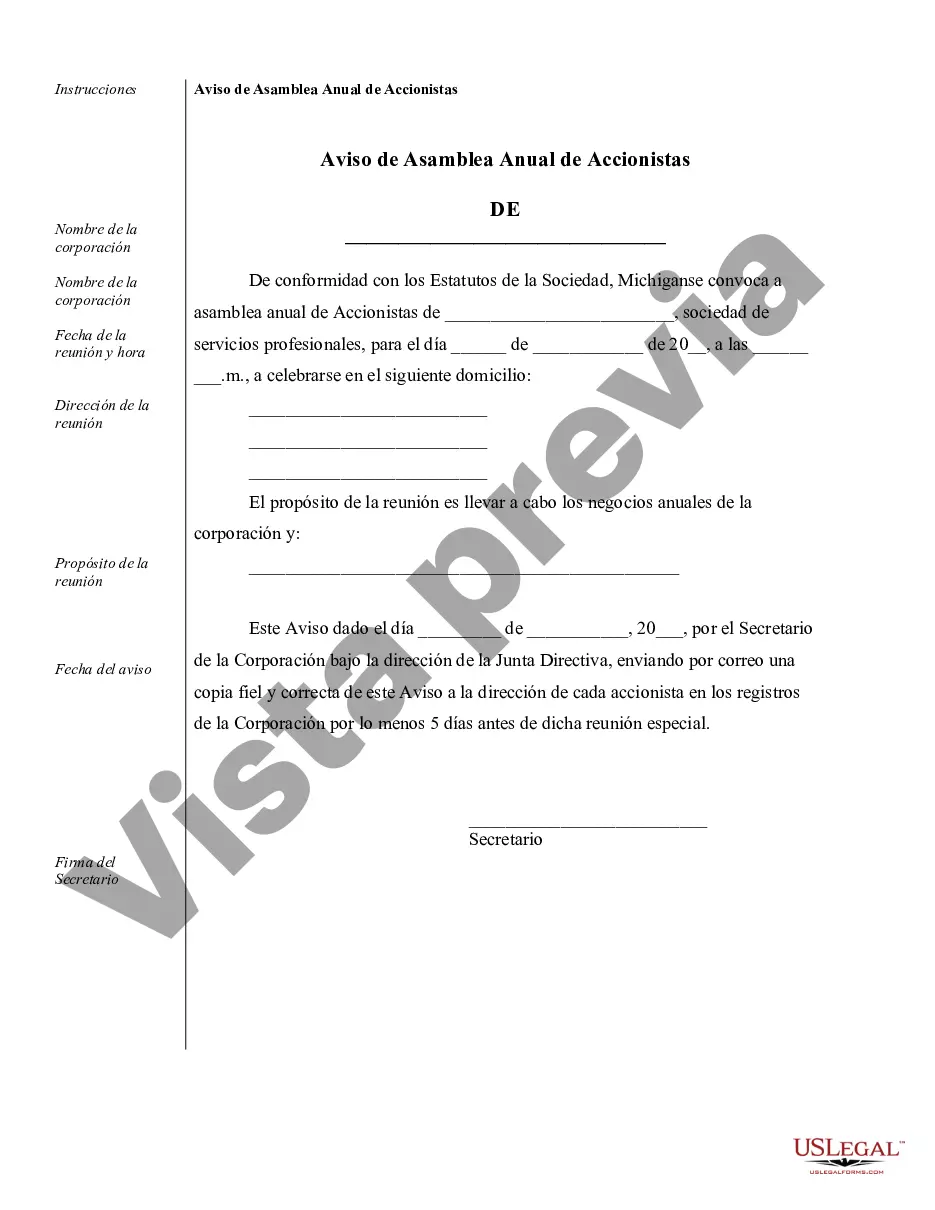

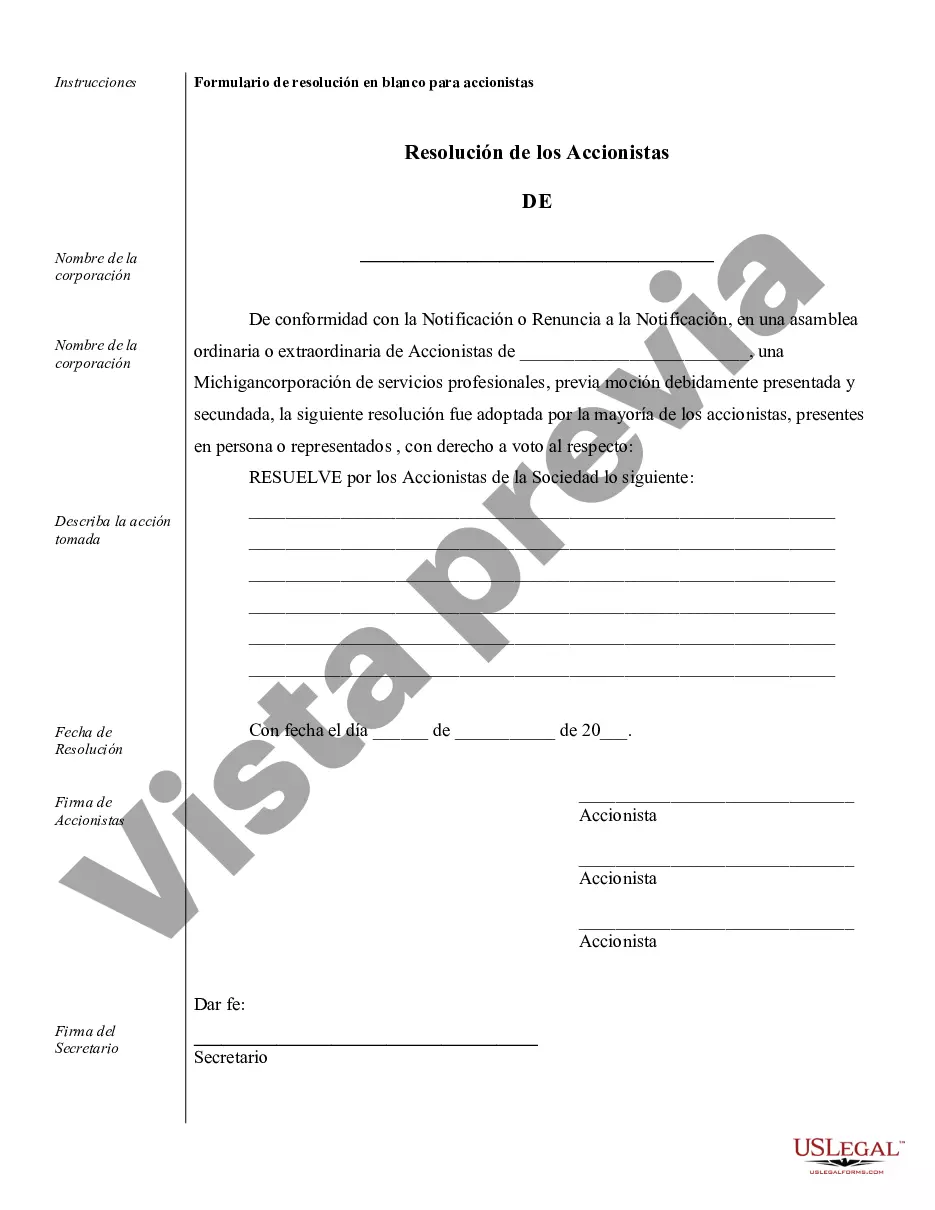

Ann Arbor Sample Corporate Records for a Michigan Professional Corporation serve as essential documentation that reflects the structure and operations of a professional corporation located in Ann Arbor, Michigan. These records are crucial for maintaining legal compliance, preserving corporate history, as well as providing transparency and accountability within the corporation. Here are some key types of Ann Arbor Sample Corporate Records for a Michigan Professional Corporation: 1. Articles of Incorporation: This document establishes the legal existence of the corporation and includes essential information such as the corporation's name, purpose, registered agent, and initial directors. 2. Bylaws: The bylaws outline the internal rules and regulations that govern the corporation's operations, including procedures for shareholder meetings, director appointments, voting, and corporate decision-making. 3. Meeting Minutes: These records provide a detailed account of the discussions, actions, and resolutions taken during corporate meetings, including shareholder meetings, board of directors meetings, and special meetings. Meeting minutes clearly document who attended the meeting, the topics discussed, and the decisions made. 4. Stock Ledger: This ledger tracks the ownership of shares in the corporation, listing shareholders, the number of shares owned, and any transfers or changes in ownership. It showcases the distribution of ownership among shareholders. 5. Resolutions: Resolutions are formal documents that record an official decision or action taken by the board of directors or shareholders. These may include approving financial matters, electing officers or directors, issuing new shares, or making significant corporate policy changes. 6. Annual Reports: Michigan law often requires professional corporations to file annual reports with the state government. These reports summarize the corporation's financial statements, officers, registered agent, and provide updates on its activities and any changes in ownership. 7. Financial Statements: Comprehensive financial statements including balance sheets, income statements, and cash flow statements provide a snapshot of the corporation's financial position, performance, and cash flows. These records are crucial for tax purposes, ensuring compliance, and reporting to stakeholders. 8. Shareholder Agreements: These agreements detail the rights, obligations, and responsibilities of shareholders and can cover topics such as share transfers, shareholder disputes, dividend policies, and voting rights. It is important for a Michigan Professional Corporation in Ann Arbor to maintain accurate, up-to-date records of these various documents. These records not only facilitate legal compliance but also demonstrate the corporation's commitment to transparency, sound governance, and adherence to any industry-specific regulations. Properly maintaining and organizing these corporate records can help protect the corporation's assets and ensure its long-term success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ann Arbor Muestra de registros corporativos para una corporación profesional de Michigan - Sample Corporate Records for a Michigan Professional Corporation

Description

How to fill out Ann Arbor Muestra De Registros Corporativos Para Una Corporación Profesional De Michigan?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Ann Arbor Sample Corporate Records for a Michigan Professional Corporation gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Ann Arbor Sample Corporate Records for a Michigan Professional Corporation takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Ann Arbor Sample Corporate Records for a Michigan Professional Corporation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!