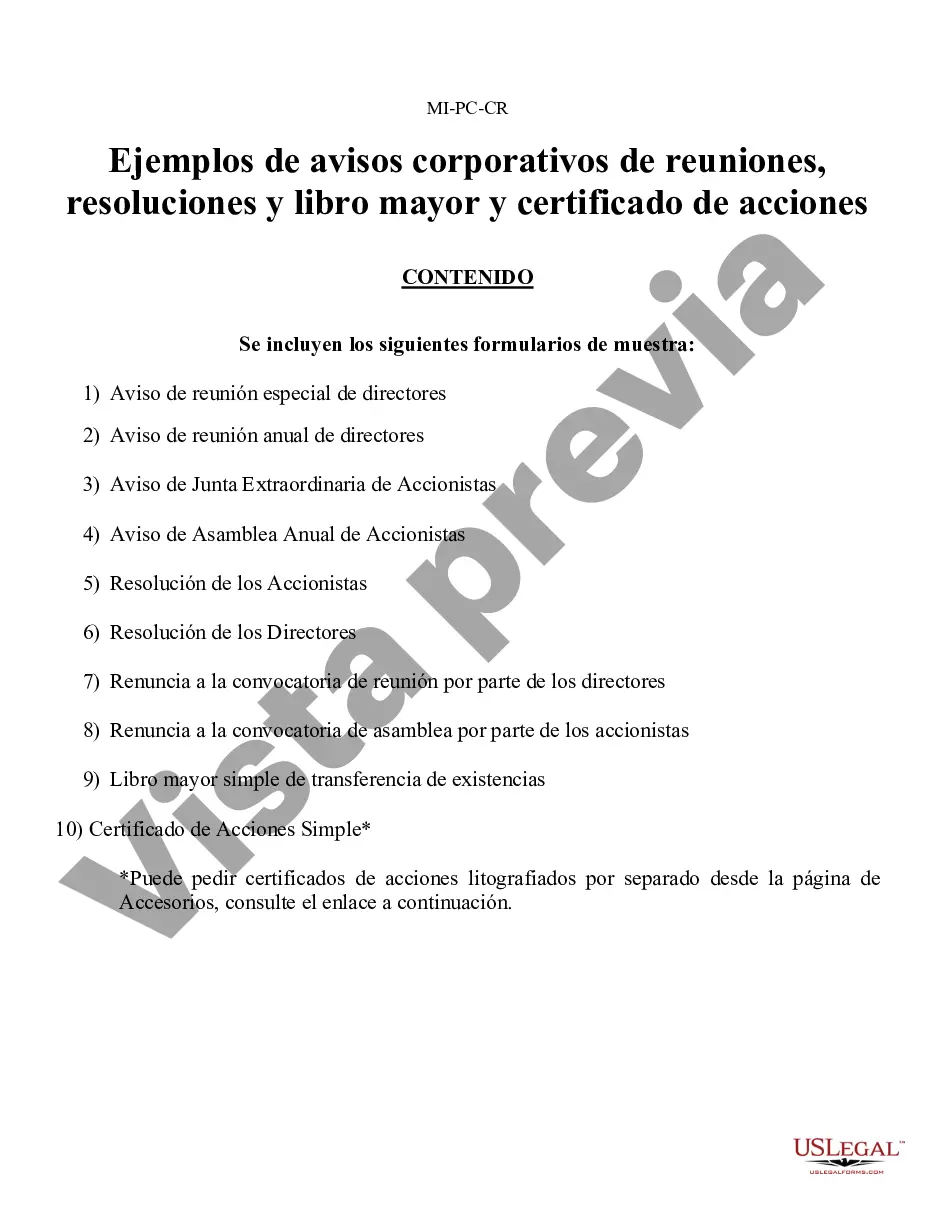

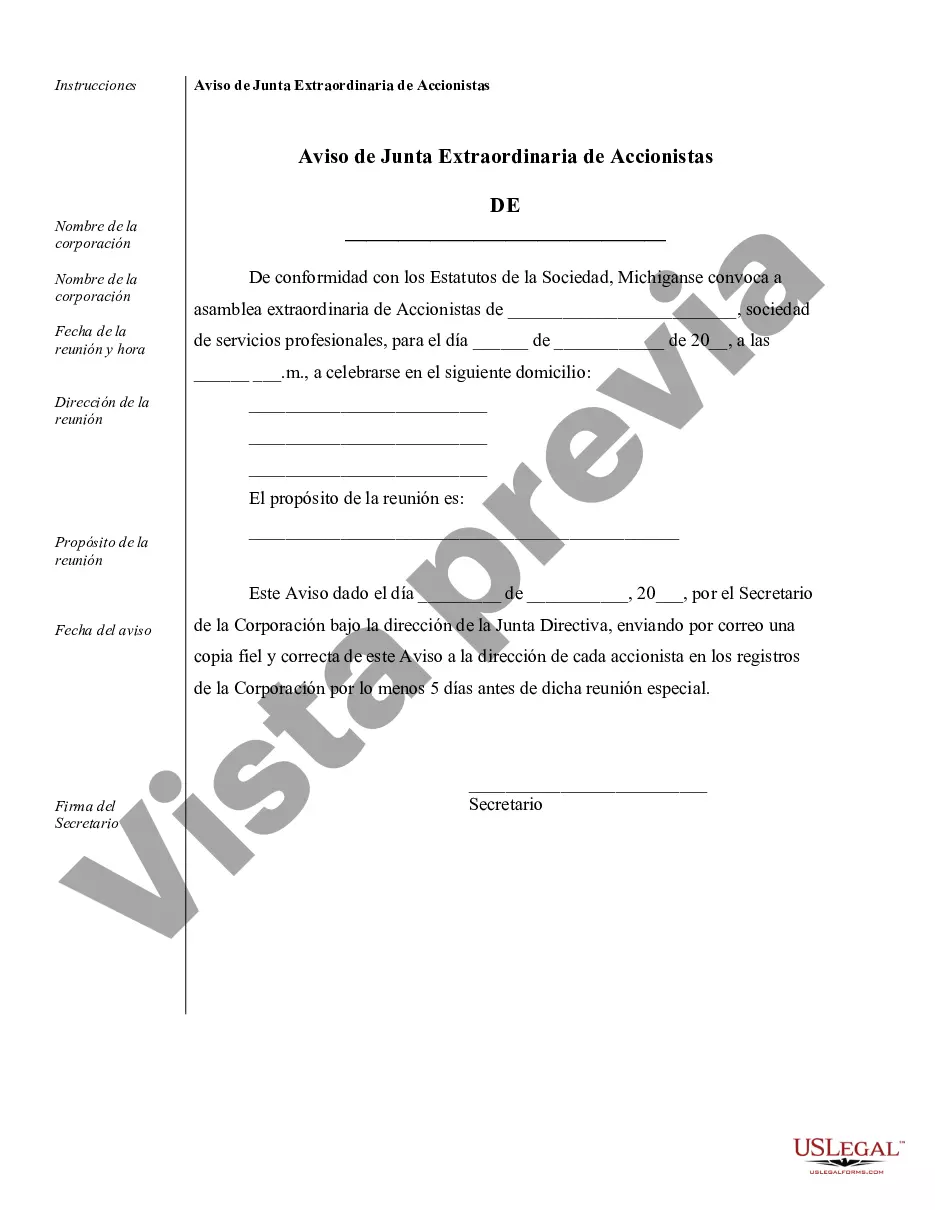

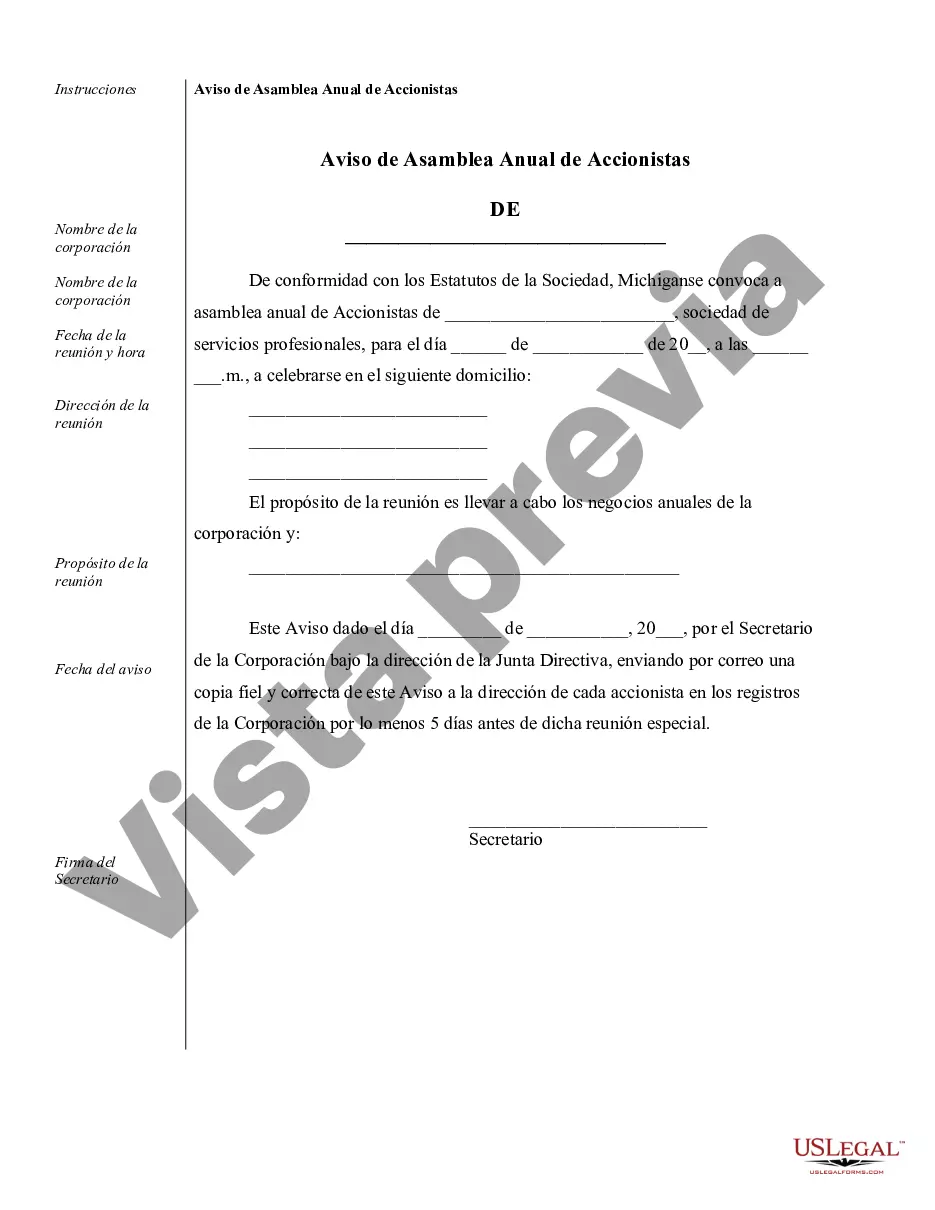

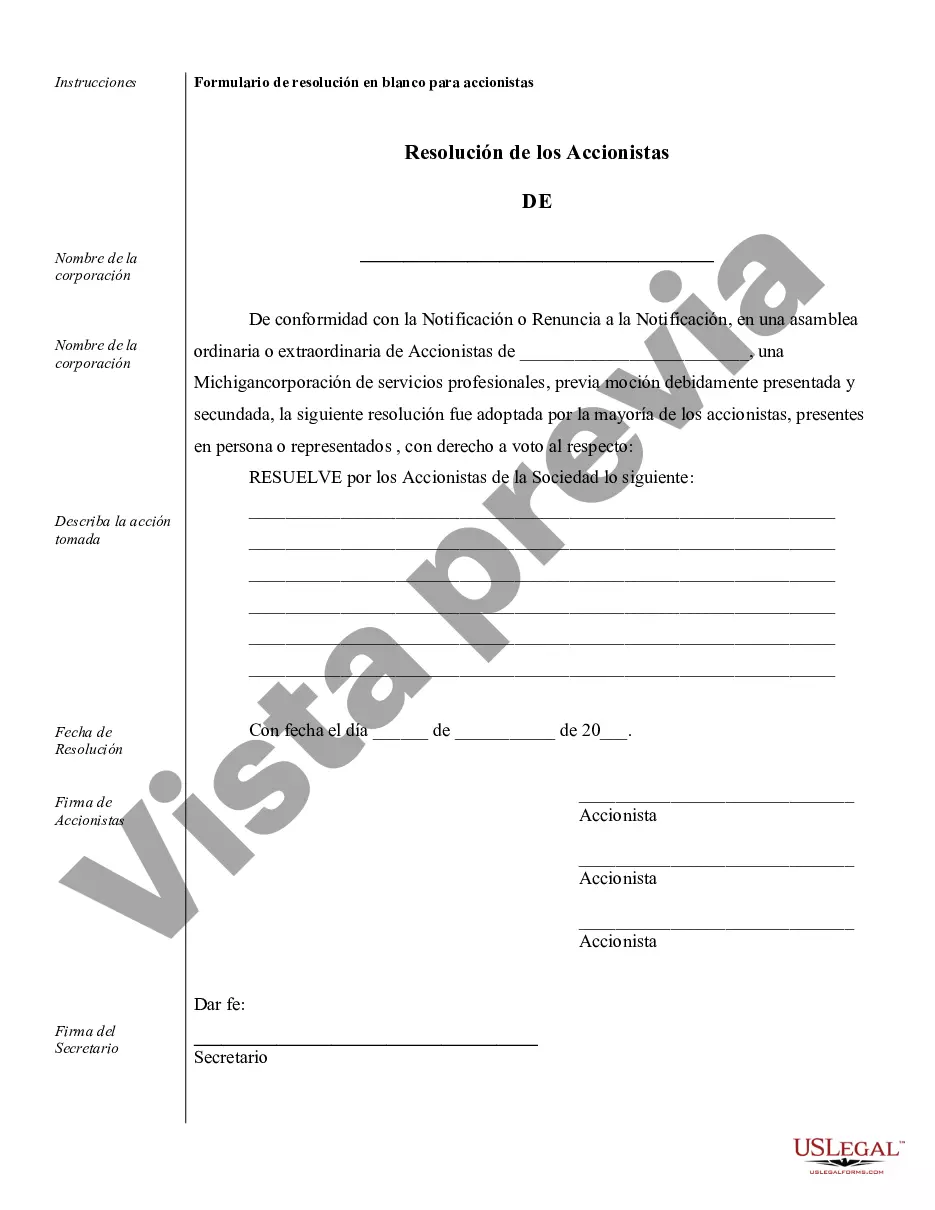

Oakland Sample Corporate Records for a Michigan Professional Corporation refer to the comprehensive documentation and paperwork that should be maintained by a professional corporation based in Oakland, Michigan, in order to meet legal requirements and ensure proper record keeping. These records are crucial for demonstrating the corporation's compliance with state regulations and maintaining transparency and accountability within the company. Key elements typically included in Oakland Sample Corporate Records for a Michigan Professional Corporation are as follows: 1. Articles of Incorporation: The articles of incorporation are the foundational documents that establish the corporation's existence, its purpose, and its structure. 2. Bylaws: Bylaws detail the internal rules and procedures of the corporation, including the roles and responsibilities of officers, directors, and shareholders. They often cover topics such as shareholder meetings, voting rights, and responsibilities of the board of directors. 3. Shareholder Agreements: Shareholder agreements outline the rights and obligations of the corporation's shareholders, including restrictions on the transfer of shares, provisions for dispute resolution, and mechanisms for decision-making. 4. Meeting Minutes: Meeting minutes document the discussions, resolutions, and actions taken at board of directors' meetings and shareholder meetings. They serve as an official record of decisions made and assist in demonstrating compliance with legal requirements. 5. Stock Certificates/Share Ledgers: These records track the issuance and ownership of company stock, including the names of shareholders, the number of shares held, and any changes in ownership. 6. Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial performance. These records are essential for tax purposes, audits, and assessing the company's financial health. 7. Tax Records: Tax records include copies of filed tax returns, supporting documents, and any correspondence with tax authorities. 8. Licenses and Permits: Records of licenses and permits obtained by the corporation, including professional licenses specific to the industries in which the corporation operates. 9. Contracts and Agreements: Copies of contracts and agreements entered into by the corporation with clients, vendors, employees, or other stakeholders. These records help maintain a record of obligations, rights, and responsibilities. 10. Annual Reports: Annual reports summarize the corporation's activities, financial performance, and future plans. They are often required by state authorities and provide a comprehensive overview of the corporation's operations. Different types of Oakland Sample Corporate Records for a Michigan Professional Corporation can vary depending on the specific industry, size, and unique circumstances of the corporation. For example, medical professional corporations may also maintain records related to malpractice insurance, medical licenses, and compliance with healthcare regulations. Legal professional corporations may have additional records related to client confidentiality and case files. In conclusion, Oakland Sample Corporate Records for a Michigan Professional Corporation encompass a range of documents essential for legal compliance, transparency, and proper record keeping. Maintaining these records is crucial for the smooth operation and governance of the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Muestra de registros corporativos para una corporación profesional de Michigan - Sample Corporate Records for a Michigan Professional Corporation

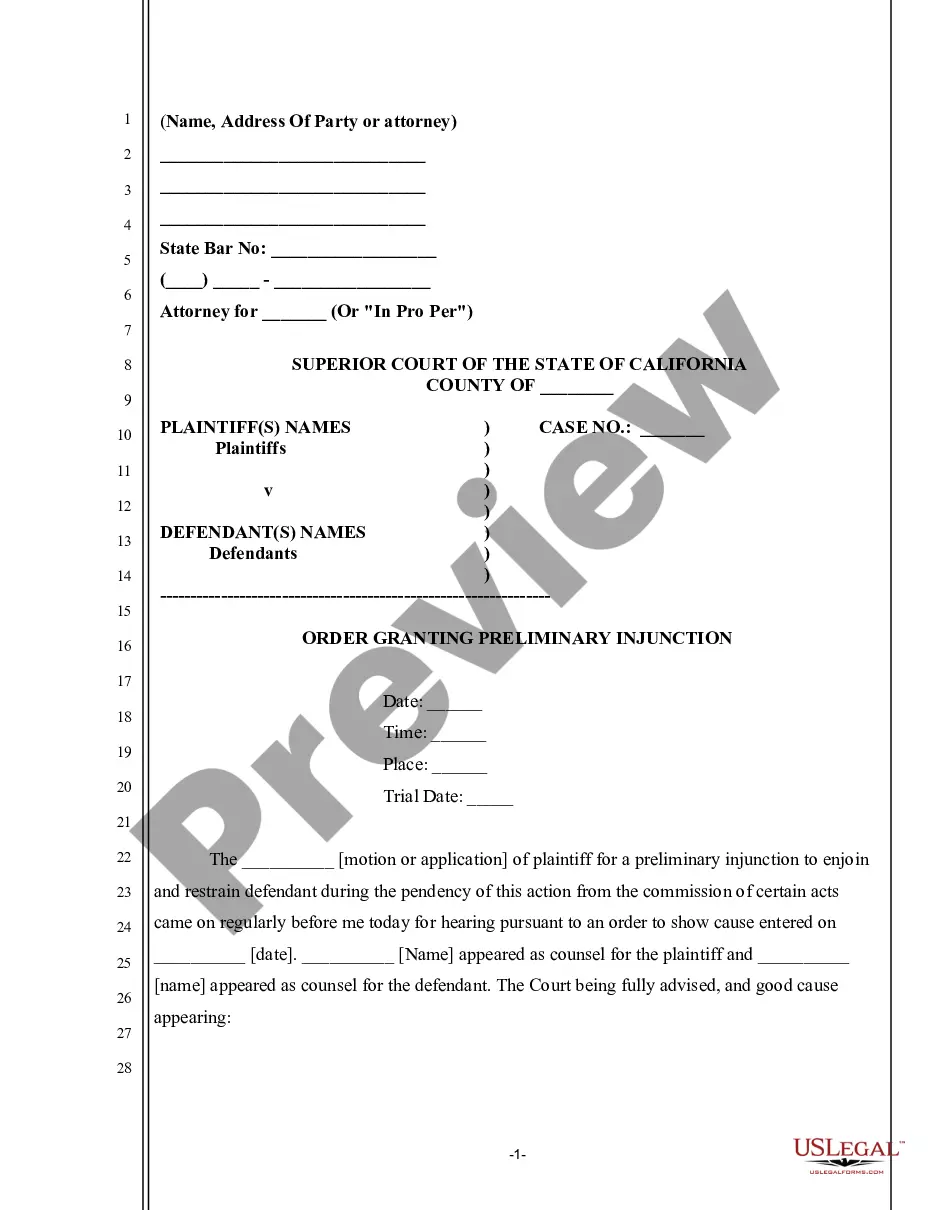

Description

How to fill out Oakland Muestra De Registros Corporativos Para Una Corporación Profesional De Michigan?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Oakland Sample Corporate Records for a Michigan Professional Corporation? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Oakland Sample Corporate Records for a Michigan Professional Corporation conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Restart the search in case the form isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Oakland Sample Corporate Records for a Michigan Professional Corporation in any provided format. You can return to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal papers online once and for all.