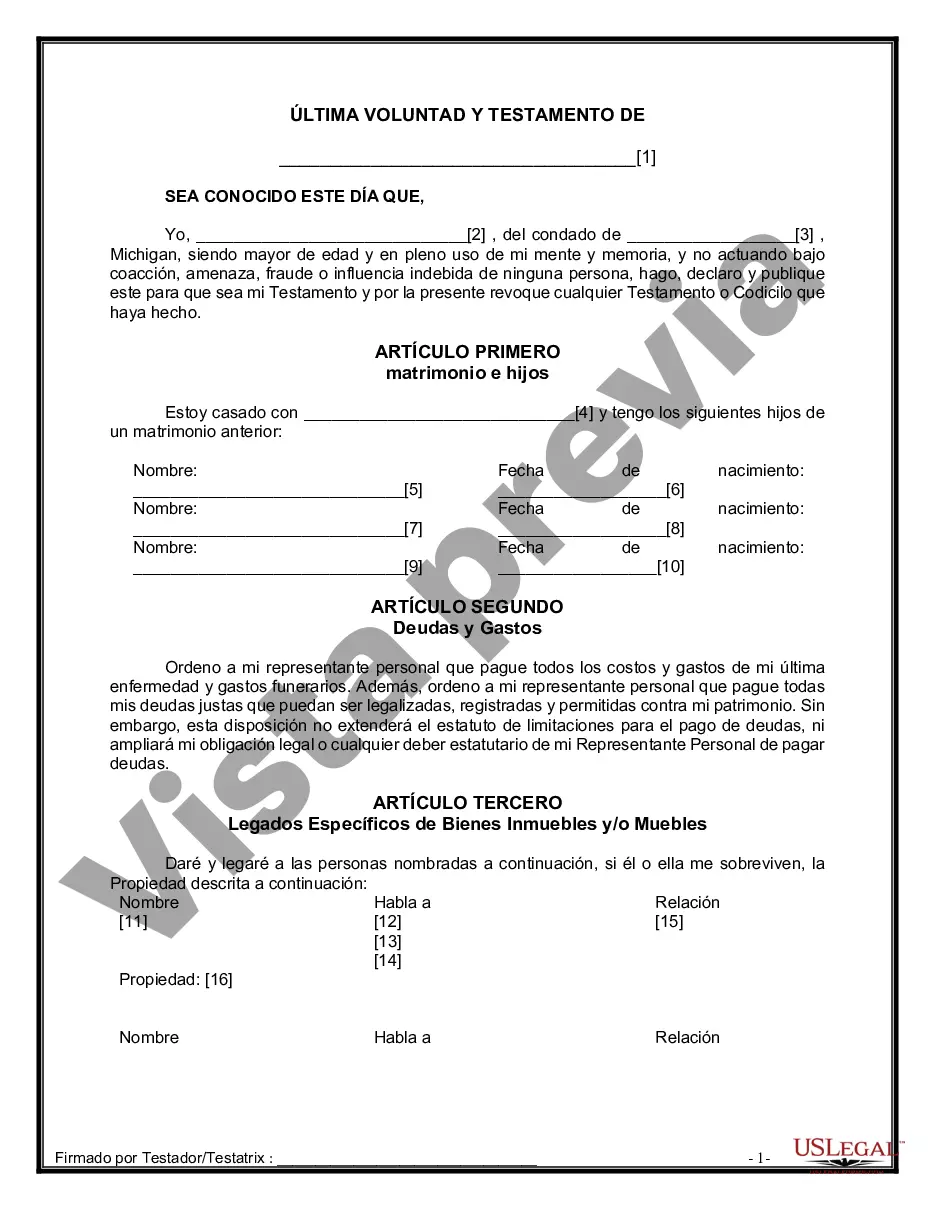

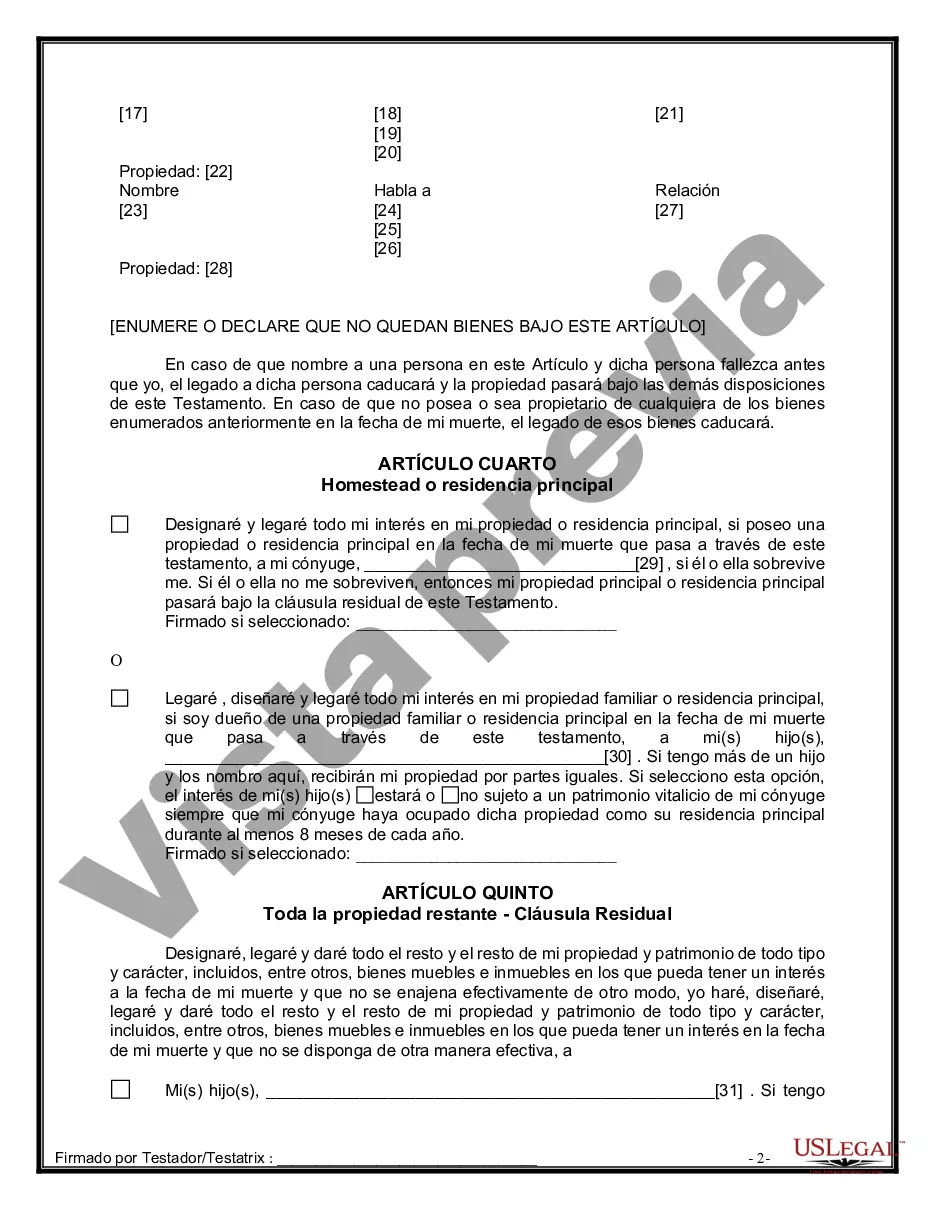

Title: Lansing Michigan Legal Last Will and Testament for Married Person with Minor Children from Prior Marriage Introduction: In Lansing, Michigan, a Legal Last Will and Testament plays a vital role in ensuring that your assets and children are properly protected, distributed, and cared for after your passing. In the case of a married person with minor children from a prior marriage, there are specific considerations to address. This article aims to provide a detailed description of Lansing Michigan's Legal Last Will and Testament for such individuals, highlighting relevant keywords to enhance clarity and understanding. 1. Components of a Lansing Michigan Legal Last Will and Testament: a. Naming an Executor: The will designates an executor, the person responsible for carrying out the deceased person's wishes and settling their estate. This appointee should be trustworthy and capable of managing financial and administrative tasks. b. Guardianship of Minor Children: A will outlines the appointed guardian(s) responsible for the care, upbringing, and welfare of minor children from the prior marriage. The individual(s) chosen should be able to provide a suitable environment for the children's physical, emotional, and financial needs. c. Distribution of Assets: Through the will, a married person with minor children from a prior marriage can specify how their assets and property should be distributed after their passing. This may include financial accounts, investments, real estate, personal belongings, and sentimental items. d. Establishing Trusts: If desired, a Lansing Michigan Legal Last Will and Testament can establish trusts to provide financial support and guidance for minor children until they reach a certain age or milestone, such as completing higher education, reaching a specific age, or becoming financially independent. 2. Different Types of Lansing Michigan Legal Last Will and Testament: a. Simple Last Will and Testament: This type of will is the most basic and straightforward. It allows individuals to outline their wishes regarding asset distribution and guardianship. b. Pour-Over Will: In addition to a traditional Last Will and Testament, a pour-over will works in conjunction with a revocable living trust, ensuring any assets not previously transferred into the trust during the person's lifetime are directed into it upon their passing. c. Testamentary Trust Will: This type of will establishes one or more testamentary trusts for the benefit of minor children from a prior marriage. The trust holds and manages assets until the children reach a specific age or milestone. d. Mutual/Mirror Will: These wills are created by spouses or partners to reflect their mutual wishes. They often include provisions for the guardianship of minor children from a prior marriage, asset distribution, and specify how future changes should be handled. Conclusion: Creating a Lansing Michigan Legal Last Will and Testament is crucial for married individuals with minor children from a prior marriage to protect their loved ones and assets. By specifically addressing key components such as appointing an executor, determining guardianship, and outlining asset distribution, they can ensure their wishes are followed. Explore different types of wills like simple, pour-over, testamentary trust, or mutual/mirror wills to find the most appropriate option for your unique circumstances. Seeking professional legal advice can provide additional guidance and ensure compliance with Michigan laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Lansing Michigan Última voluntad y testamento legal para persona casada con hijos menores de edad de un matrimonio anterior - Michigan Legal Last Will and Testament for Married person with Minor Children from Prior Marriage

Category:

State:

Michigan

City:

Lansing

Control #:

MI-WIL-0002

Format:

Word

Instant download

Description

Descarga en línea en formato Word. Formulario de testamento redactado profesionalmente con instrucciones.

Title: Lansing Michigan Legal Last Will and Testament for Married Person with Minor Children from Prior Marriage Introduction: In Lansing, Michigan, a Legal Last Will and Testament plays a vital role in ensuring that your assets and children are properly protected, distributed, and cared for after your passing. In the case of a married person with minor children from a prior marriage, there are specific considerations to address. This article aims to provide a detailed description of Lansing Michigan's Legal Last Will and Testament for such individuals, highlighting relevant keywords to enhance clarity and understanding. 1. Components of a Lansing Michigan Legal Last Will and Testament: a. Naming an Executor: The will designates an executor, the person responsible for carrying out the deceased person's wishes and settling their estate. This appointee should be trustworthy and capable of managing financial and administrative tasks. b. Guardianship of Minor Children: A will outlines the appointed guardian(s) responsible for the care, upbringing, and welfare of minor children from the prior marriage. The individual(s) chosen should be able to provide a suitable environment for the children's physical, emotional, and financial needs. c. Distribution of Assets: Through the will, a married person with minor children from a prior marriage can specify how their assets and property should be distributed after their passing. This may include financial accounts, investments, real estate, personal belongings, and sentimental items. d. Establishing Trusts: If desired, a Lansing Michigan Legal Last Will and Testament can establish trusts to provide financial support and guidance for minor children until they reach a certain age or milestone, such as completing higher education, reaching a specific age, or becoming financially independent. 2. Different Types of Lansing Michigan Legal Last Will and Testament: a. Simple Last Will and Testament: This type of will is the most basic and straightforward. It allows individuals to outline their wishes regarding asset distribution and guardianship. b. Pour-Over Will: In addition to a traditional Last Will and Testament, a pour-over will works in conjunction with a revocable living trust, ensuring any assets not previously transferred into the trust during the person's lifetime are directed into it upon their passing. c. Testamentary Trust Will: This type of will establishes one or more testamentary trusts for the benefit of minor children from a prior marriage. The trust holds and manages assets until the children reach a specific age or milestone. d. Mutual/Mirror Will: These wills are created by spouses or partners to reflect their mutual wishes. They often include provisions for the guardianship of minor children from a prior marriage, asset distribution, and specify how future changes should be handled. Conclusion: Creating a Lansing Michigan Legal Last Will and Testament is crucial for married individuals with minor children from a prior marriage to protect their loved ones and assets. By specifically addressing key components such as appointing an executor, determining guardianship, and outlining asset distribution, they can ensure their wishes are followed. Explore different types of wills like simple, pour-over, testamentary trust, or mutual/mirror wills to find the most appropriate option for your unique circumstances. Seeking professional legal advice can provide additional guidance and ensure compliance with Michigan laws.

Free preview

How to fill out Lansing Michigan Última Voluntad Y Testamento Legal Para Persona Casada Con Hijos Menores De Edad De Un Matrimonio Anterior?

If you’ve already utilized our service before, log in to your account and save the Lansing Michigan Legal Last Will and Testament for Married person with Minor Children from Prior Marriage on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Lansing Michigan Legal Last Will and Testament for Married person with Minor Children from Prior Marriage. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!