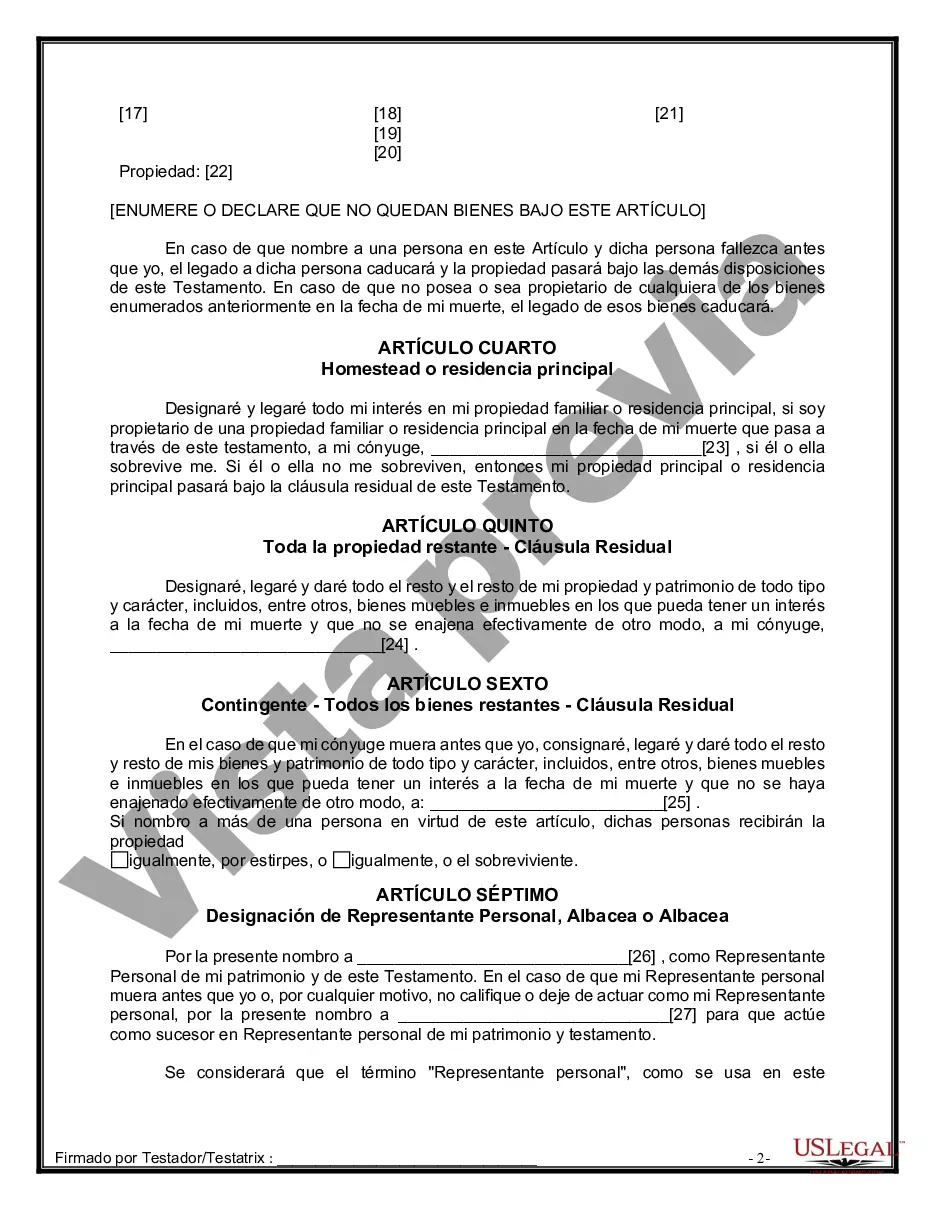

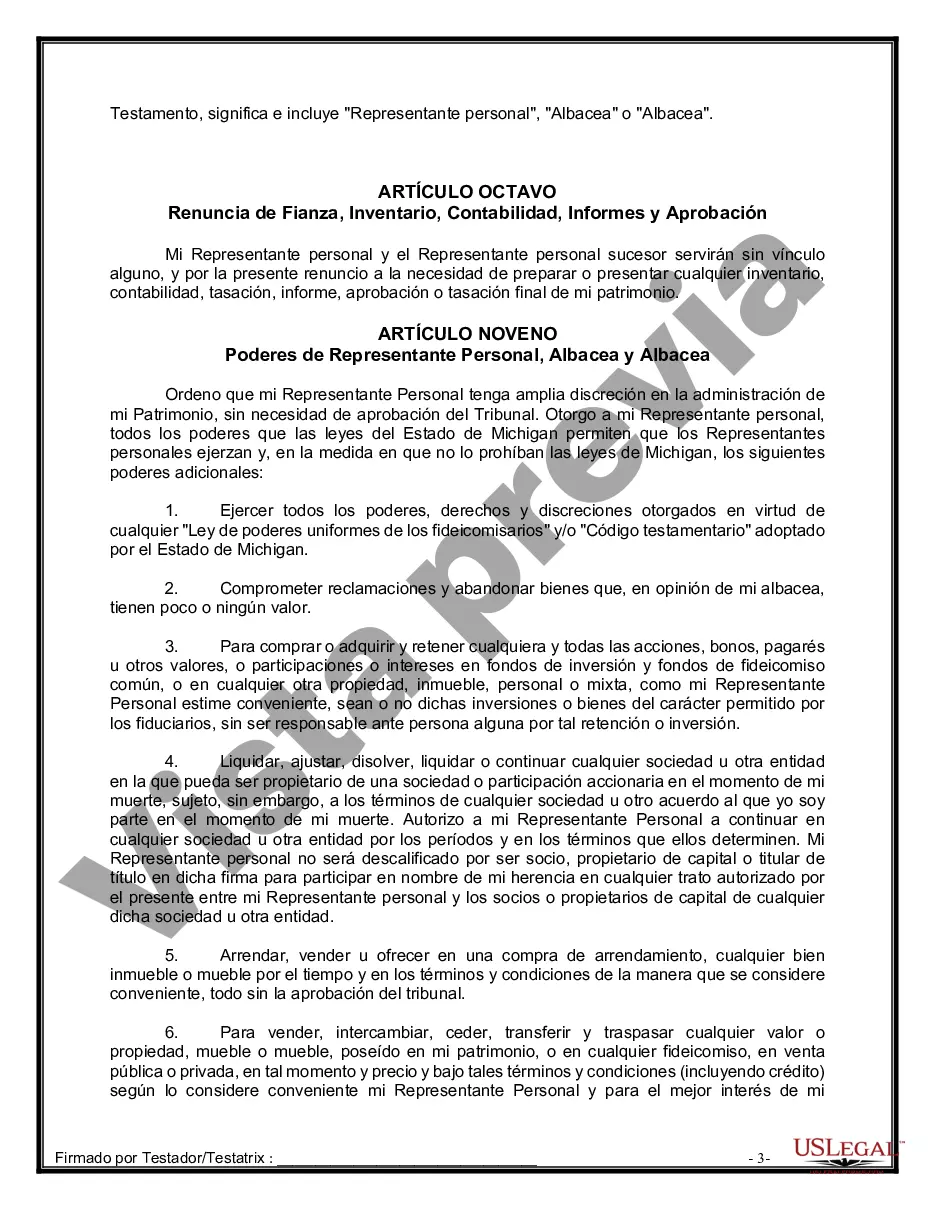

The Detroit Michigan Legal Last Will and Testament Form for a Married Person with No Children is a legal document that allows individuals who are married but have no children to outline their final wishes regarding the distribution of their assets and the appointment of an executor. This form ensures that their estate is administered according to their desires and provides clarity for their loved ones during the probate process. The Detroit Michigan Legal Last Will and Testament Form for a Married Person with No Children typically includes several key components. Firstly, it starts with an introductory clause, wherein the person creating the will, referred to as the testator, identifies themselves and affirms their legal capacity to make a will. The next section of the form involves naming an executor, responsible for managing and distributing the estate. The testator should provide the executor's full name and address. It is essential to select a trusted individual capable of fulfilling the duties, such as a spouse, close friend, or family member. The will then proceeds to specify how the testator's assets should be distributed upon their passing. It allows the individual to name beneficiaries, who will receive various parts of the estate. These beneficiaries can include immediate family members, extended relatives, friends, or charitable organizations. The testator may also indicate specific assets or properties they want to bequeath to certain individuals. Furthermore, the form may include provisions for alternative beneficiaries or contingent beneficiaries. These are individuals who will inherit the assets if the primary beneficiaries predecease the testator or are unable to inherit for any reason. In addition to asset distribution, the will may address other important matters. For instance, it can specify funeral and burial arrangements, including the desired location, type of service, and any specific wishes the testator may have. The testator may also include instructions regarding organ donation or medical research. While addressing financial matters, the will may include provisions for debts and taxes. The testator can state that any outstanding debts should be paid from their estate before distribution to beneficiaries, ensuring that creditors are appropriately settled. If desired, the testator may also set up a trust or designate funds to handle specific ongoing expenses, such as the care of a beloved pet. It is worth noting that there may be variations of the Detroit Michigan Legal Last Will and Testament Form for a Married Person with No Children. These might include specific sections tailored to the individual's requirements, preferences, or unique circumstances. However, the aforementioned components are typically found in most standard forms within the jurisdiction of Detroit, Michigan. Creating a last will and testament is essential, regardless of an individual's marital or parental status. It provides peace of mind by ensuring that their estate is distributed in accordance with their wishes and helps avoid potential family disputes or uncertainties during difficult times. When drafting a will, it is advisable to consult with an attorney or legal professional to ensure compliance with state laws and to address any specific concerns or complexities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Detroit Michigan Formulario de última voluntad y testamento legal para una persona casada sin hijos - Michigan Last Will and Testament for a Married Person with No Children

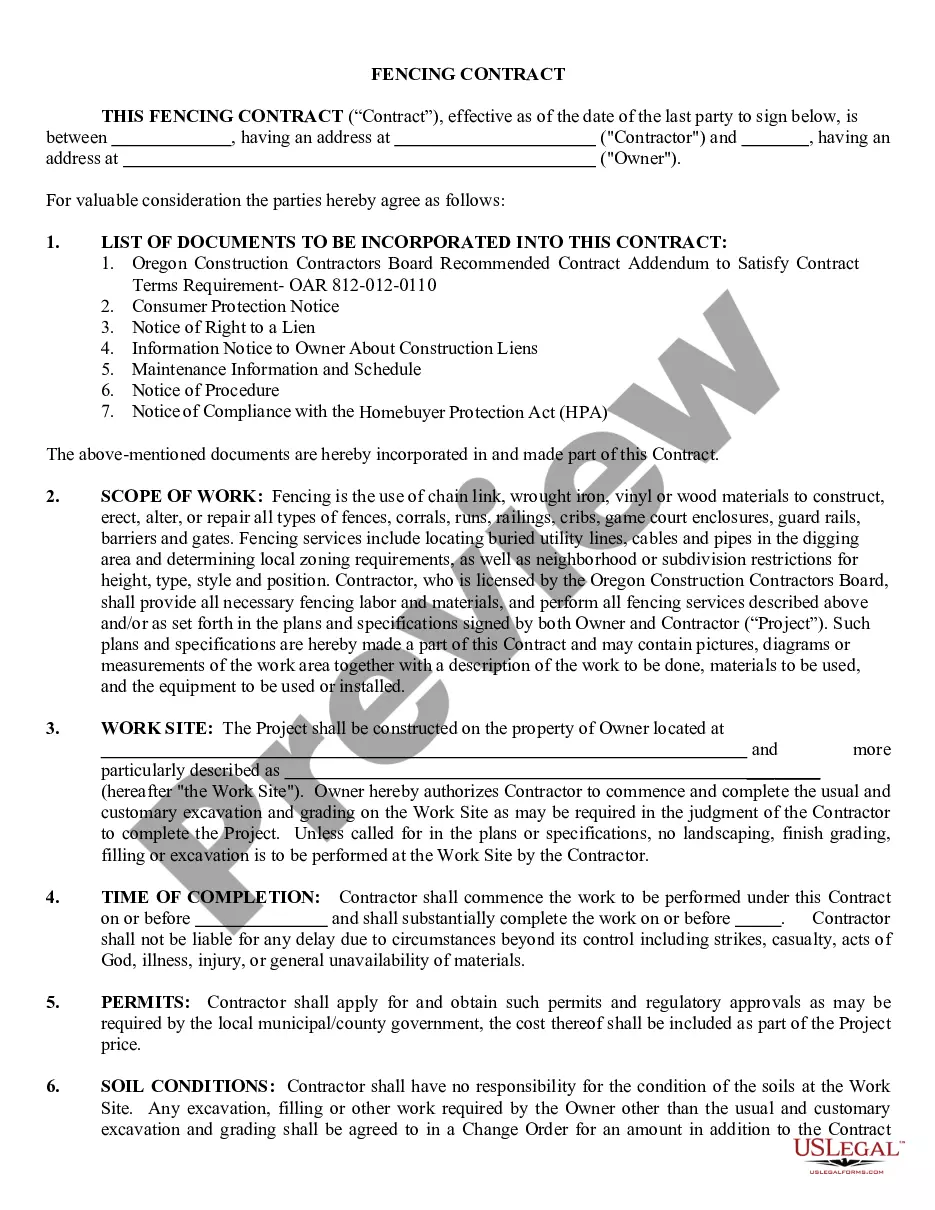

Description

How to fill out Detroit Michigan Formulario De última Voluntad Y Testamento Legal Para Una Persona Casada Sin Hijos?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney services that, usually, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Detroit Michigan Legal Last Will and Testament Form for a Married Person with No Children or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Detroit Michigan Legal Last Will and Testament Form for a Married Person with No Children complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Detroit Michigan Legal Last Will and Testament Form for a Married Person with No Children would work for your case, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!