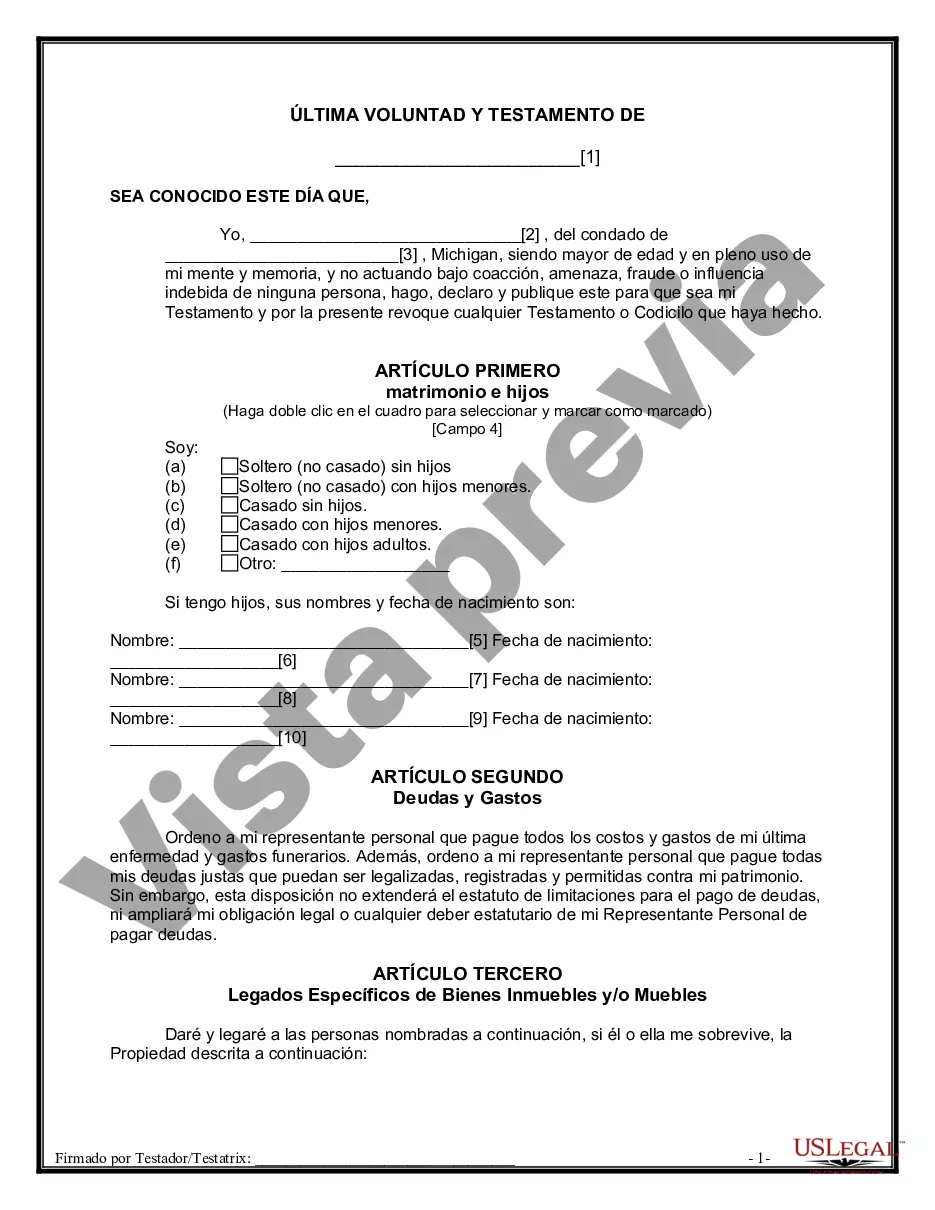

A Sterling Heights Michigan Last Will and Testament is a legal document that outlines the final wishes and instructions of an individual (testator) regarding the distribution of their assets, care of dependents, and appointment of an executor after their death. It serves as a crucial tool to ensure that their estate is managed and distributed as they desire. Creating a Last Will and Testament allows individuals to have control over their estate and make decisions on who will inherit their belongings, properties, finances, and even pets. It also provides guidance to the executor on how to manage debts, taxes, and final expenses. In Sterling Heights Michigan, there are several types of Last Will and Testament for other persons, including: 1. Simple Will: This is the most common type of Last Will and Testament, serving to cover the basic provisions for asset distribution and appointment of an executor. It is suitable for individuals with uncomplicated estates and no specific concerns about potential challenges to the will. 2. Living Will or Advance Directive: While not exactly a traditional Last Will and Testament, a living will provides instructions regarding the testator's medical treatment preferences and end-of-life decisions. It allows individuals to express their wishes concerning life-sustaining treatments or the discontinuation of medical interventions if they become incapacitated. 3. Testamentary Trust Will: This type of will establishes a trust upon the testator's death, directing their assets to be held in trust for the benefit of specified beneficiaries, such as minor children or individuals who may require ongoing financial support. A trustee is appointed to manage and distribute the trust assets according to the instructions outlined in the will. 4. Pour-Over Will: This will is typically used in conjunction with a revocable living trust. It ensures that any assets not already transferred to the trust during the testator's lifetime will be "poured over" into the trust upon their death. The trust provisions then govern the distribution of these assets outside of probate. 5. Joint Will: A joint will is created by two individuals, usually spouses, who have nearly identical estate planning wishes. It stipulates that upon the death of one spouse, the survivor will inherit all their assets. However, upon the death of the surviving spouse, the assets will be distributed according to the agreed-upon terms. When drafting a Sterling Heights Michigan Last Will and Testament, it is advisable to seek the guidance of an experienced estate planning attorney who is well-versed in Michigan probate laws. This ensures that the will is legally binding, properly executed, and reflects the testator's intentions accurately.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sterling Heights Michigan Última voluntad y testamento para otras personas - Michigan Last Will and Testament for other Persons

Description

How to fill out Sterling Heights Michigan Última Voluntad Y Testamento Para Otras Personas?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone without any legal education to create such paperwork from scratch, mostly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a massive library with more than 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Sterling Heights Michigan Last Will and Testament for other Persons or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Sterling Heights Michigan Last Will and Testament for other Persons in minutes using our trusted platform. If you are presently a subscriber, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are new to our library, make sure to follow these steps prior to obtaining the Sterling Heights Michigan Last Will and Testament for other Persons:

- Ensure the form you have found is specific to your area because the regulations of one state or area do not work for another state or area.

- Review the form and read a short outline (if available) of cases the document can be used for.

- If the one you chosen doesn’t suit your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Sterling Heights Michigan Last Will and Testament for other Persons as soon as the payment is through.

You’re all set! Now you can go on and print the form or complete it online. Should you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.