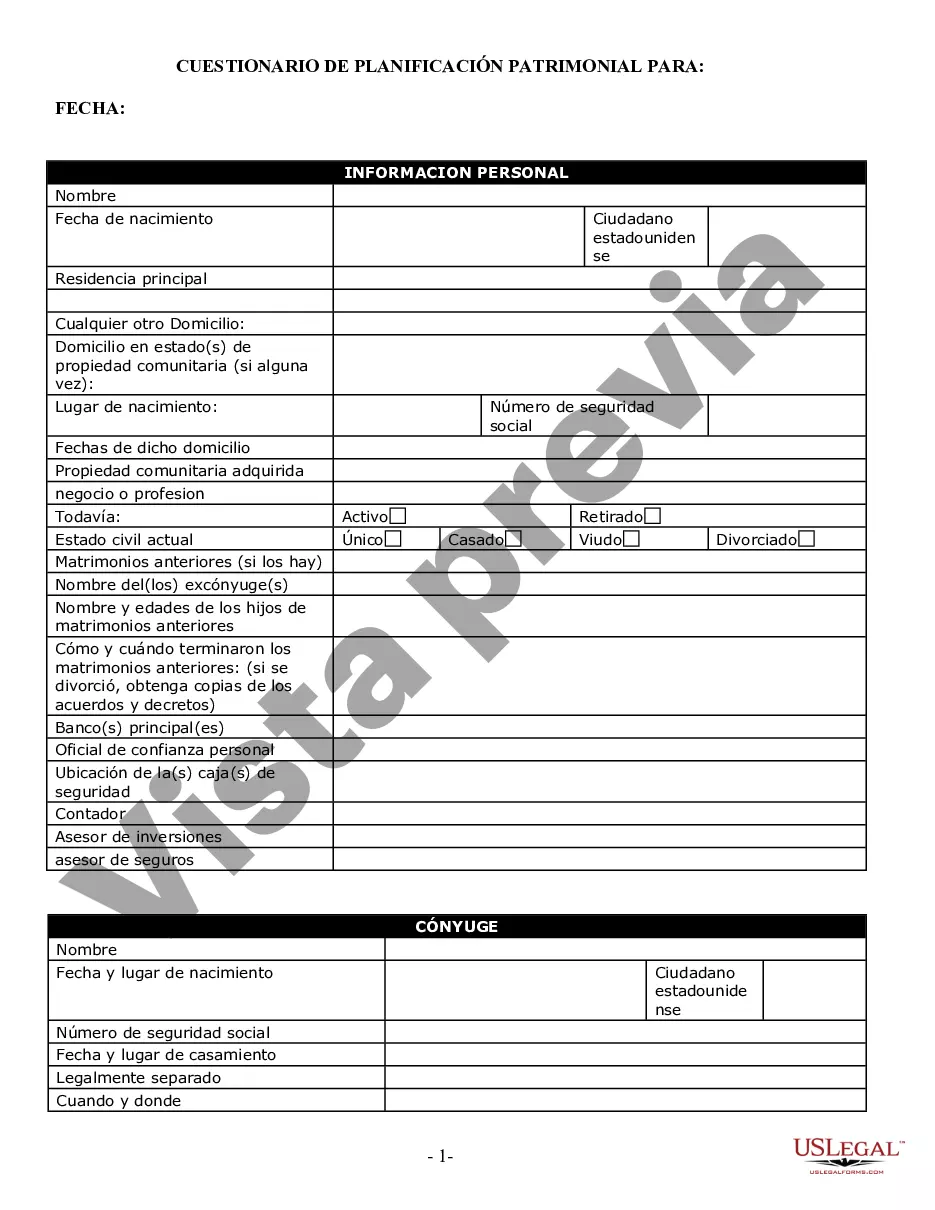

Lansing Michigan Estate Planning Questionnaire and Worksheets are essential tools designed to help individuals navigate the estate planning process effectively. These documents assist individuals in gathering and organizing vital information necessary for creating a comprehensive estate plan that aligns with their goals and desires. By utilizing these questionnaires and worksheets, individuals can ensure that their wishes are accurately recorded and eventually implemented. The Lansing Michigan Estate Planning Questionnaire and Worksheets typically encompass various key aspects of estate planning, including: 1. Personal Information: This section collects essential personal details such as full legal name, date of birth, contact information, and social security number. It may also require information about marital status, dependents, and any prior marriages. 2. Family and Beneficiary Information: Here, individuals can provide comprehensive information about their immediate family members, beneficiaries, and potential heirs, including their names, ages, and relationship to the estate planner. Additionally, it may prompt details about any specific bequests or charitable donations. 3. Assets and Liabilities: This section aims to gather information about an individual's assets and liabilities, both tangible and intangible. It may cover real estate properties, bank accounts, investments, vehicles, retirement accounts, life insurance policies, outstanding debts, mortgages, and more. 4. Healthcare Directives: These worksheets often include sections dedicated to healthcare directives, such as living wills, medical powers of attorney, and instructions for end-of-life care. These components ensure that an individual's healthcare wishes are properly documented and followed. 5. Power of Attorney: This section addresses the appointment and decision-making authority of a trusted person (attorney-in-fact) to act on behalf of the estate planner in financial or legal matters. It may detail the scope of powers granted and any limitations imposed. 6. Executor and Trustee Designations: Individuals may designate an executor who will oversee the distribution of assets and carry out other administrative tasks after their passing. Likewise, they may assign a trustee to manage any trusts established within their estate plan. Different variations or specialized Lansing Michigan Estate Planning Questionnaire and Worksheets may exist to cater to specific estate planning needs. Some possible variations include: — Lansing Michigan Estate Planning Questionnaire for Small Business Owners: This version may include additional sections tailored specifically to address the unique estate planning considerations for business owners, such as succession plans or instructions for business continuation. — Lansing Michigan Estate Planning Questionnaire for High Net Worth Individuals: Such questionnaires and worksheets may encompass exhaustive sections to capture complex financial holdings, multiple properties, international assets, tax planning considerations, and more. — Lansing Michigan Estate Planning Questionnaire for Individuals with Special Needs Dependents: This variation would include sections focused on providing for special needs dependents, covering topics like guardianship arrangements, government benefit preservation, and detailed instructions for their care. In conclusion, Lansing Michigan Estate Planning Questionnaire and Worksheets are comprehensive tools aiming at assisting individuals in compiling all necessary information to create an effective and customized estate plan. These documents help centralize personal, financial, healthcare, and legal details, ensuring individuals have a clear blueprint for the future disposition of their assets and wishes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Lansing Michigan Cuestionario y hojas de trabajo de planificación patrimonial - Michigan Estate Planning Questionnaire and Worksheets

Description

How to fill out Lansing Michigan Cuestionario Y Hojas De Trabajo De Planificación Patrimonial?

If you are looking for a valid form template, it’s extremely hard to choose a more convenient service than the US Legal Forms website – probably the most comprehensive online libraries. Here you can get thousands of document samples for company and personal purposes by types and regions, or key phrases. With the advanced search feature, getting the most recent Lansing Michigan Estate Planning Questionnaire and Worksheets is as elementary as 1-2-3. Additionally, the relevance of each document is proved by a team of skilled lawyers that on a regular basis check the templates on our website and update them in accordance with the latest state and county requirements.

If you already know about our system and have a registered account, all you should do to receive the Lansing Michigan Estate Planning Questionnaire and Worksheets is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have discovered the sample you need. Read its description and use the Preview function (if available) to check its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to get the appropriate record.

- Affirm your selection. Choose the Buy now option. Following that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the received Lansing Michigan Estate Planning Questionnaire and Worksheets.

Every template you add to your user profile has no expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you want to have an additional copy for enhancing or printing, feel free to return and save it once more at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the Lansing Michigan Estate Planning Questionnaire and Worksheets you were looking for and thousands of other professional and state-specific templates in a single place!