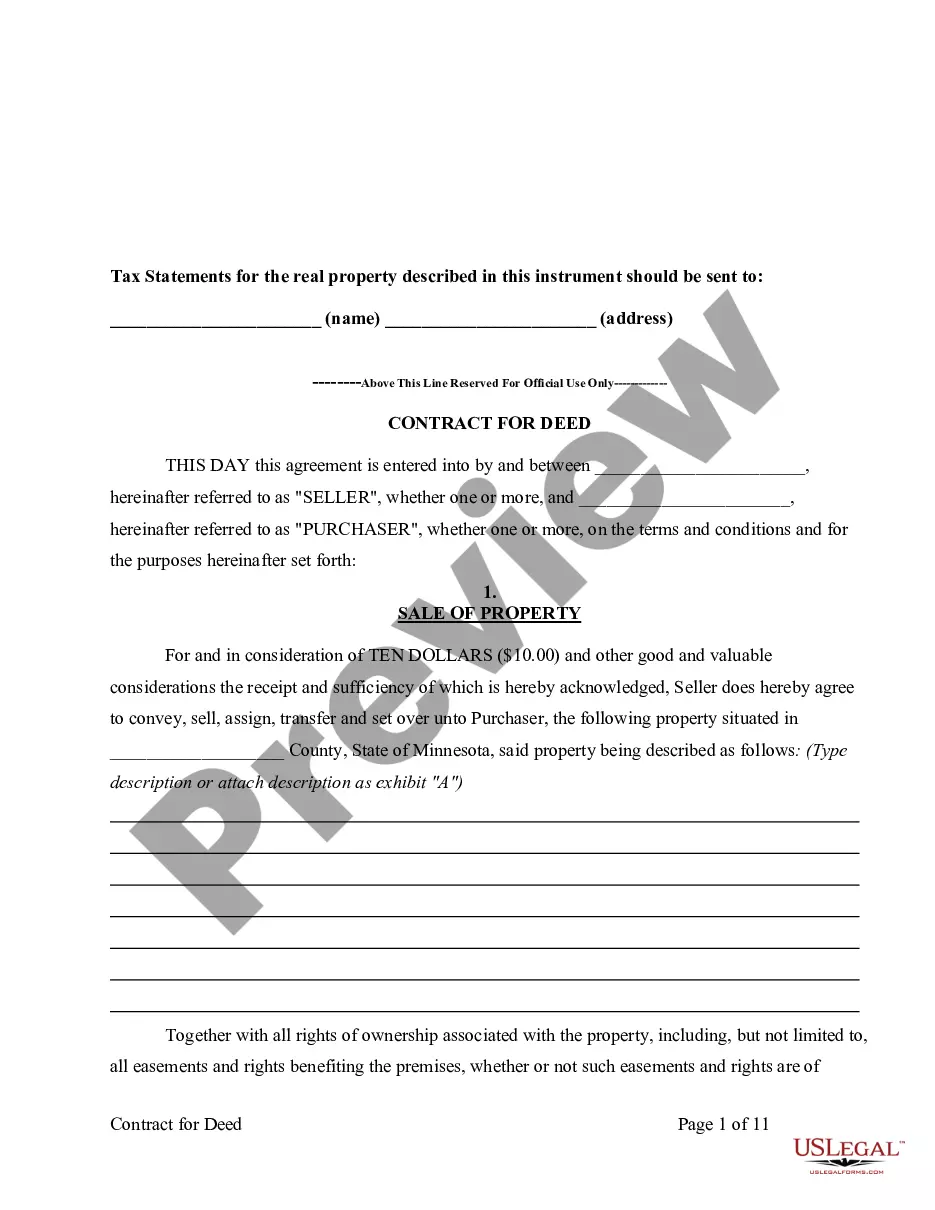

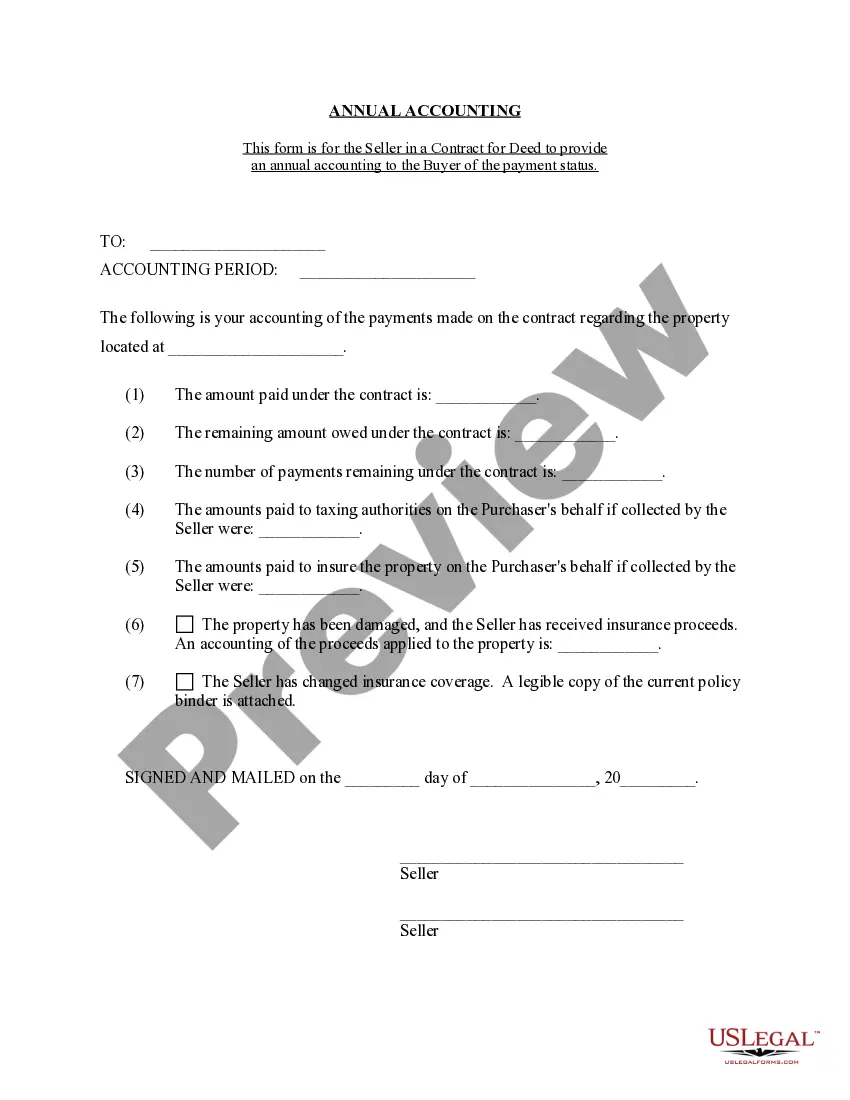

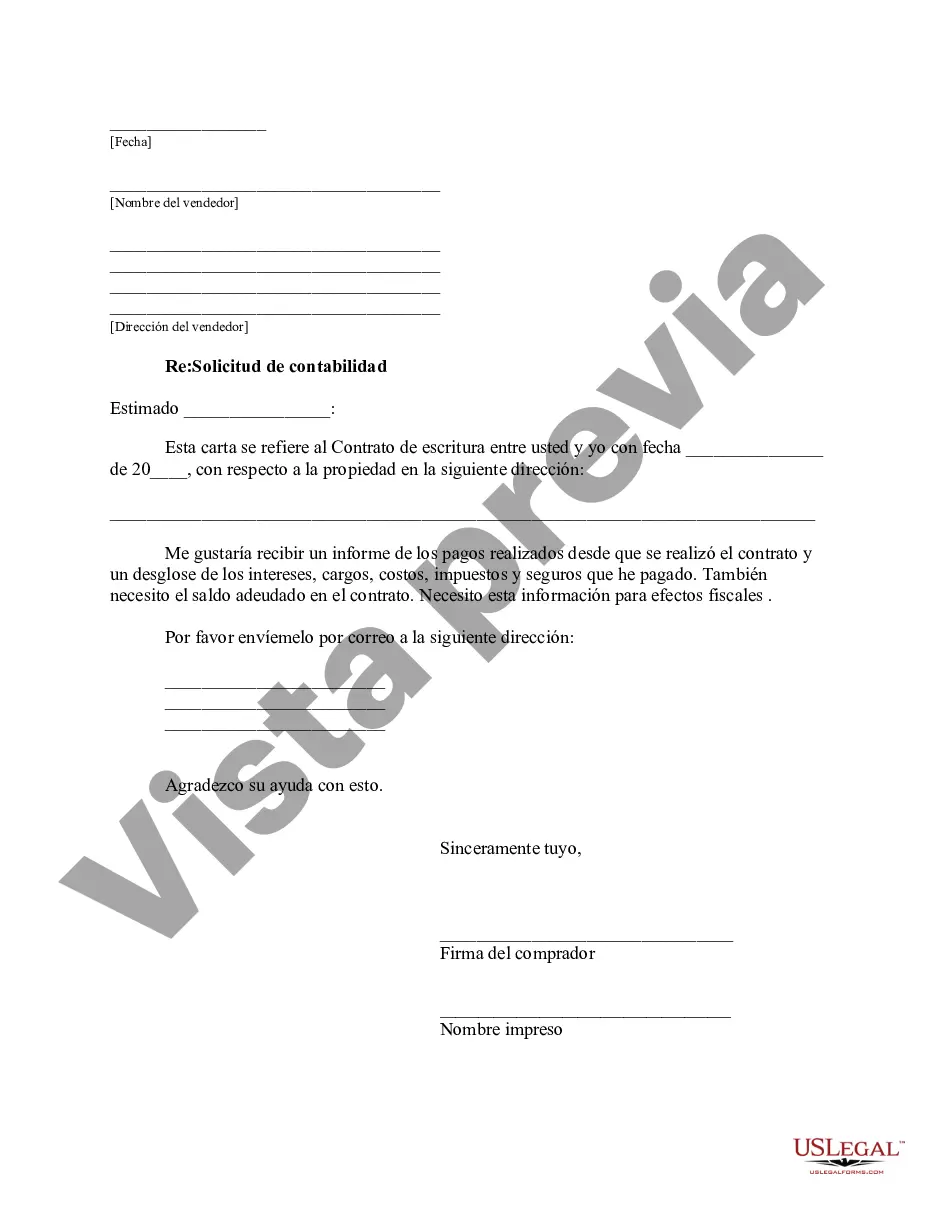

When entering into a Contract for Deed in Hennepin County, Minnesota, it is crucial for buyers to understand their rights and responsibilities. One essential aspect of this transaction is the Buyer's Request for Accounting from the Seller. This request allows buyers to ensure that they are receiving accurate and detailed financial information from the seller pertaining to the property being sold. The Buyer's Request for Accounting is a formal document presented by the buyer to the seller, typically prepared by the buyer's attorney or accountant. It serves as a means to request relevant financial records and documentation from the seller, enabling the buyer to assess the true financial status of the property. In Hennepin County, there are a few different types of Buyer's Requests for Accounting that buyers may consider, depending on their specific needs and objectives: 1. Basic Financial Accounting: This is the most common type of request, where buyers ask sellers to provide a detailed breakdown of income, expenses, and financial statements related to the property. This accounting request includes information such as rental income, property taxes, insurance costs, maintenance expenses, and any outstanding liens or mortgages on the property. 2. Tax Accounting: Buyers may also request specific tax-related information from the seller. This includes past tax returns related to the property, property tax assessments, and any tax credits or deductions associated with the property. Tax accounting requests are typically utilized when buyers want to understand the property's tax history and potential tax obligations. 3. Maintenance and Repair Accounting: In some cases, buyers may be interested in assessing the property's maintenance and repair history. This type of accounting request focuses on detailed records of repairs and improvements made to the property, including dates, cost breakdowns, and invoices. Buyers may require this information to better understand the potential ongoing maintenance costs associated with the property. It is important for buyers to include specific deadlines and expected formats for the requested accounting information in their formal request. Sellers are generally obligated to comply with the buyer's request within a certain timeframe agreed upon in the Contract for Deed. By requesting an accounting from the seller, buyers can make informed decisions regarding the property's financial health and overall value. This allows them to assess the risks and ensure a smooth and transparent transaction. Consulting with an attorney or a professional accountant experienced in real estate transactions is highly recommended ensuring all relevant aspects are addressed and accounted for.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Solicitud del Comprador para la Contabilidad del Vendedor bajo el Contrato de Escritura - Minnesota Buyer's Request for Accounting from Seller under Contract for Deed

Description

How to fill out Hennepin Minnesota Solicitud Del Comprador Para La Contabilidad Del Vendedor Bajo El Contrato De Escritura?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Hennepin Minnesota Buyer's Request for Accounting from Seller under Contract for Deed? US Legal Forms is your go-to solution.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Hennepin Minnesota Buyer's Request for Accounting from Seller under Contract for Deed conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is intended for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Hennepin Minnesota Buyer's Request for Accounting from Seller under Contract for Deed in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal papers online for good.

Form popularity

FAQ

La ley establece que es el vendedor, al tratarse del propietario original del inmueble que participa en la operacion, el sujeto que esta obligado a satisfacer todos los gastos necesarios para proceder a su entrega.

Suggested clip · 59 seconds contrato de compraventa de vehiculo automotor - YouTube YouTube Start of suggested clip End of suggested clip

Es el documento donde se firma el acuerdo de compraventa entre las dos partes.... Datos del comprador y del vendedor. Tanto el comprador como el vendedor deben hacer constar sus datos en el contrato de compraventa.Datos del vehiculo.Importe de la venta y forma de pago.Firma de ambas partes.

Manifiesto de Carga. Es el documento que ampara el transporte de mercancias ante las distintas autoridades, cuando estas se movilizan en vehiculos de servicio publico, mediante contratacion a traves de empresas de transporte de carga legalmente constituidas y debidamente habilitadas por el Ministerio de Transporte.

Comprador. Es la persona que se compromete a pagar el precio (en dinero o en especie) establecido en el contrato de compraventa para adquirir el inmueble.

En caso de que no sea posible contar con la colaboracion de quien debe firmar como vendedor la escritura publica de formalizacion, se debera de solicitar a un Juez local en materia civil, que obligue al vendedor a firmar ante notario el documento publico necesario. A esta accion legal se le llama Accion Pro Forma.

El vendedor se hara cargo de los gastos de la escritura publica. El comprador tendra que enfrentarse a los gastos de la primera copia y a los posteriores a la venta.

Contenido basico para hacer contratos de trabajo Lugar y fecha del contrato. Identificacion plena de las partes. Fecha de ingreso del trabajador a la empresa. Descripcion clara de las obligaciones y funciones del trabajador. Monto, forma y periodo de pago de la remuneracion.

¿Como se hace un contrato de compraventa? Nombres completos y documentos de identidad de vendedor y comprador, o del representante legal. Caracteristicas del vehiculo en venta (marca, modelo, placas, color, numero de chasis, etc). El precio acordado y la forma en como se realizara el pago con fechas especificas.

Es indispensable que se incluya el nombre completo del actual dueno, los datos del comprador, la direccion completa del inmueble, el precio acordado y las condiciones actuales en las que se encuentra la propiedad. Ademas, debes revisar la documentacion del inmueble para verificar que todo este en regla.