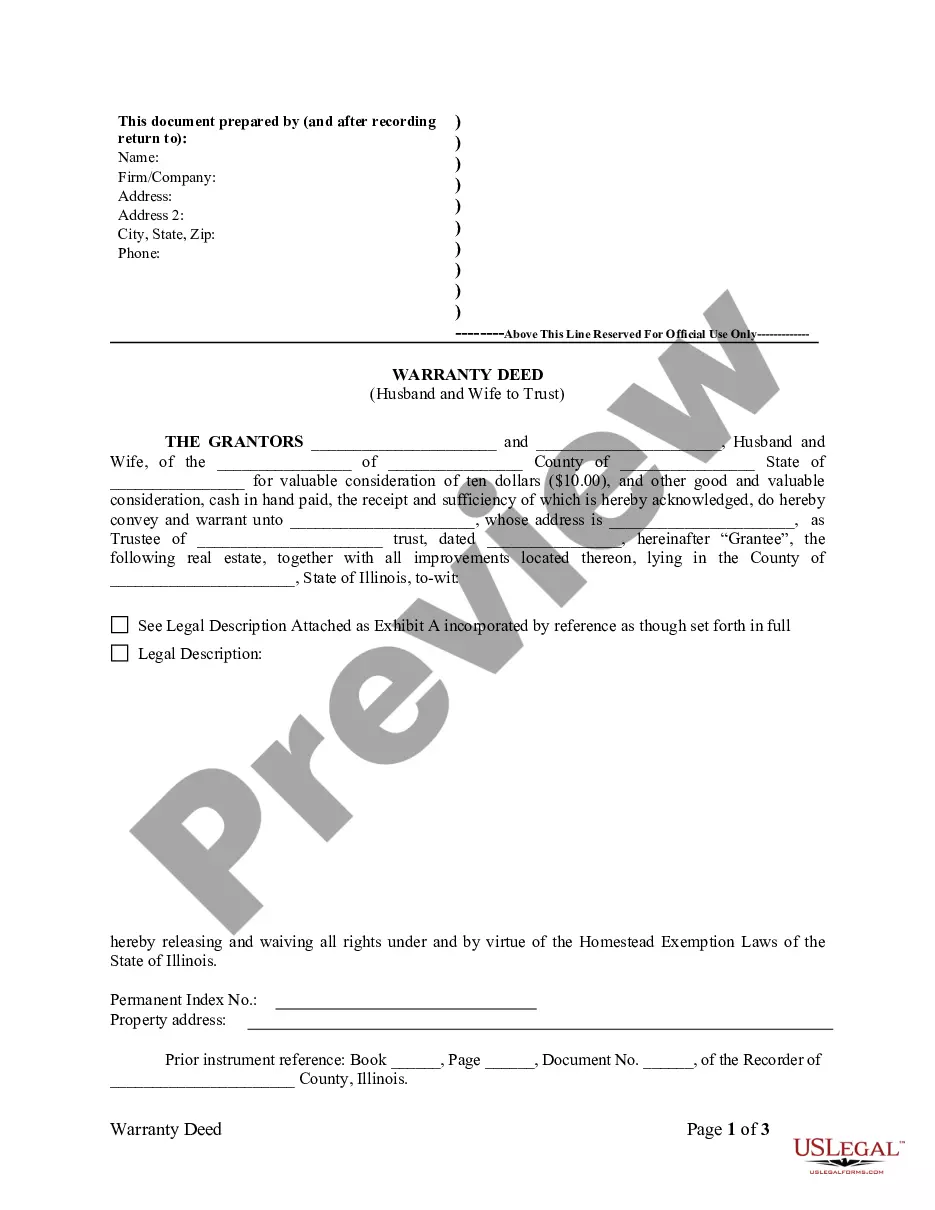

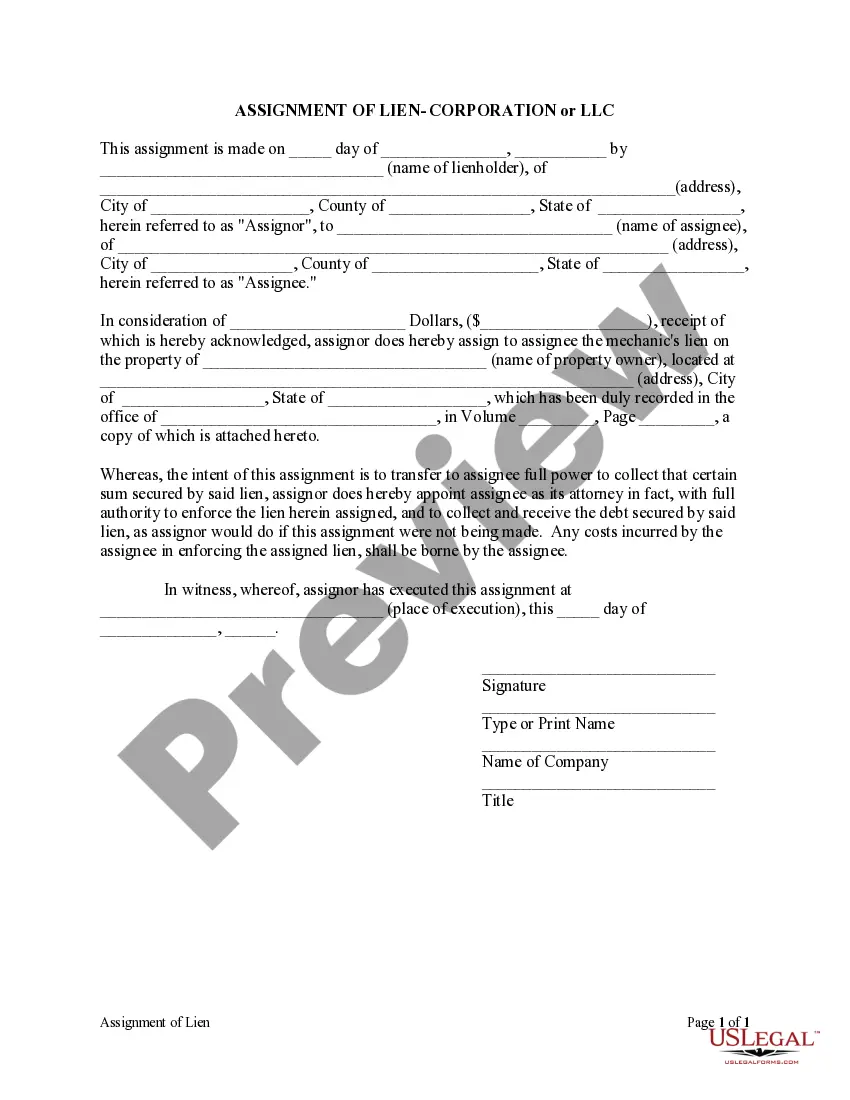

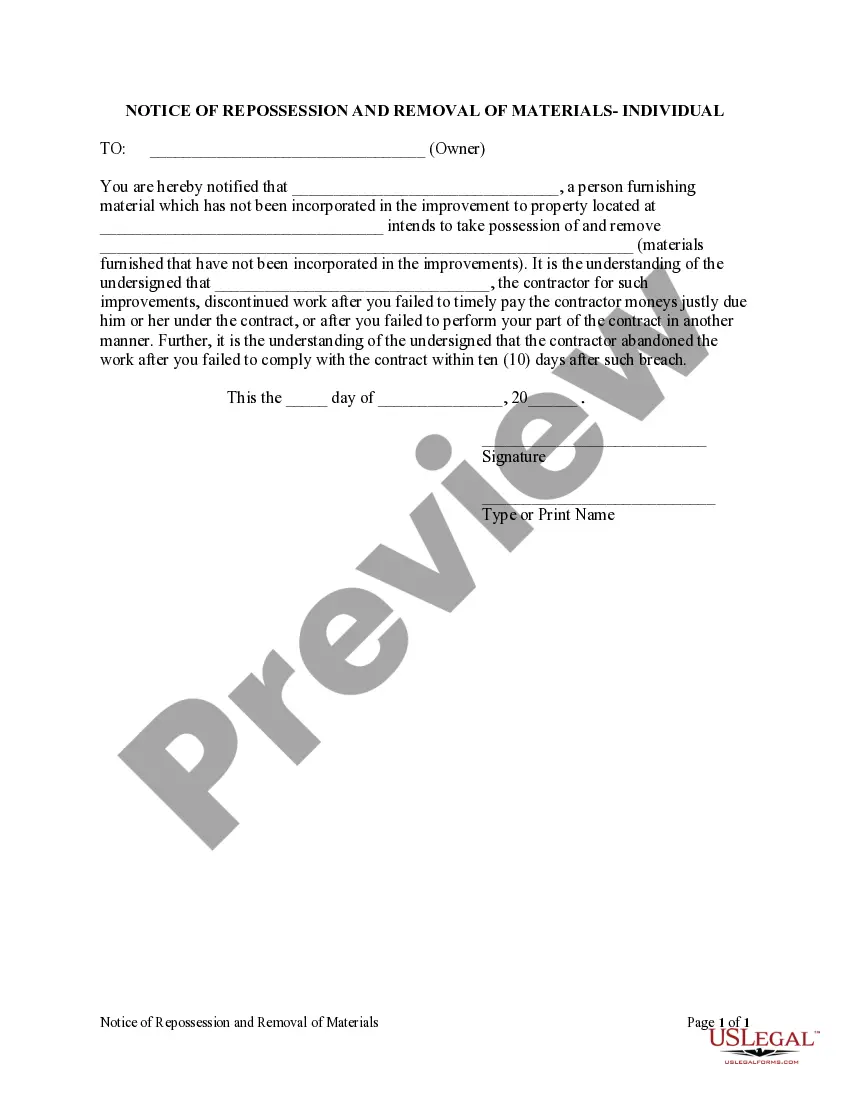

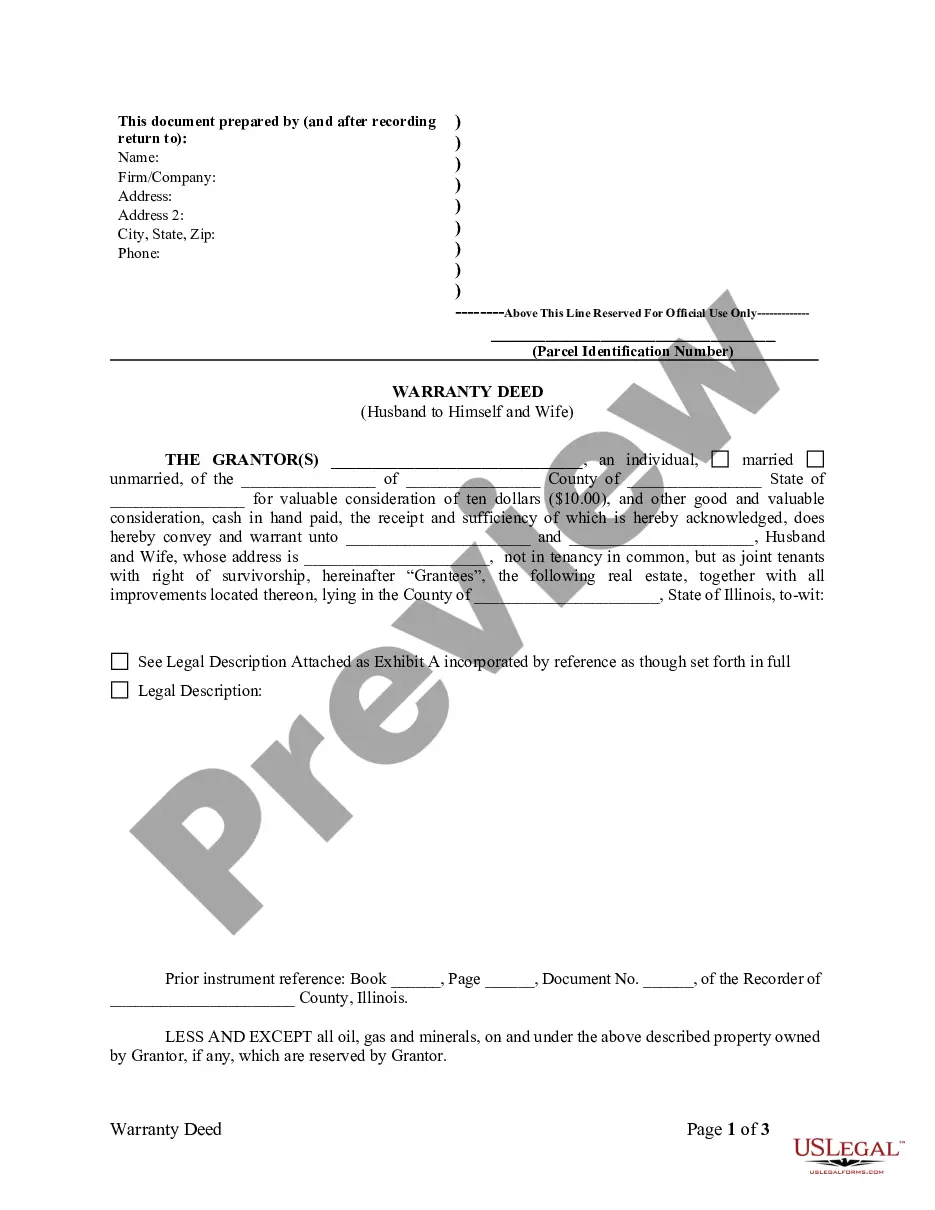

A Minneapolis postnuptial property agreement is a legal document that outlines the division and management of assets and liabilities between spouses in the state of Minnesota. It is similar to a prenuptial agreement, except that it is created after the marriage has taken place. This agreement can be entered into by married couples to address issues pertaining to property rights, financial obligations, and other important matters in the event of separation, divorce, or death. Postnuptial property agreements in Minneapolis are essential for couples who want to establish clear guidelines for the division of property and assets acquired during their marriage. These agreements are particularly important if one or both spouses have substantial assets, own a business or property, or have significant debts. Minneapolis offers different types of postnuptial property agreements to cater to the unique needs of couples: 1. Standard Postnuptial Property Agreement: This is a general agreement that covers the division and management of all marital assets, including real estate, investments, bank accounts, and personal property. 2. Debt Allocation Agreement: This type of postnuptial property agreement specifies how marital debts, such as mortgages, loans, credit card debts, and tax liabilities, will be allocated between the spouses in case of separation or divorce. 3. Business Ownership Agreement: Couples who own a business together may opt for this type of postnuptial property agreement to address issues related to the division of business assets, profits, and losses. 4. Property Separation Agreement: In situations where spouses wish to maintain separate ownership of specific assets, such as inheritance, gifts, or personal investments made during the marriage, a property separation agreement can be created to clearly outline the division of these assets in the event of divorce or separation. 5. Child Custody and Support Agreement: Although child-related matters are primarily determined by the court based on the best interests of the child, couples can include provisions regarding child custody, visitation, and support in their postnuptial property agreement to establish a framework for future decisions. It is important to consult with an experienced family law attorney in Minneapolis to ensure that the postnuptial property agreement complies with Minnesota state laws and is enforceable. The attorney will help draft a comprehensive agreement that reflects the couple's specific needs and protects their interests in case of future disputes or legal proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minneapolis Acuerdo de propiedad posnupcial - Minnesota - Minnesota Postnuptial Property Agreement

Description

How to fill out Minneapolis Acuerdo De Propiedad Posnupcial - Minnesota?

Do you need a reliable and affordable legal forms provider to get the Minneapolis Postnuptial Property Agreement - Minnesota? US Legal Forms is your go-to option.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Minneapolis Postnuptial Property Agreement - Minnesota conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the form is good for.

- Start the search over if the form isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Minneapolis Postnuptial Property Agreement - Minnesota in any available format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal papers online for good.