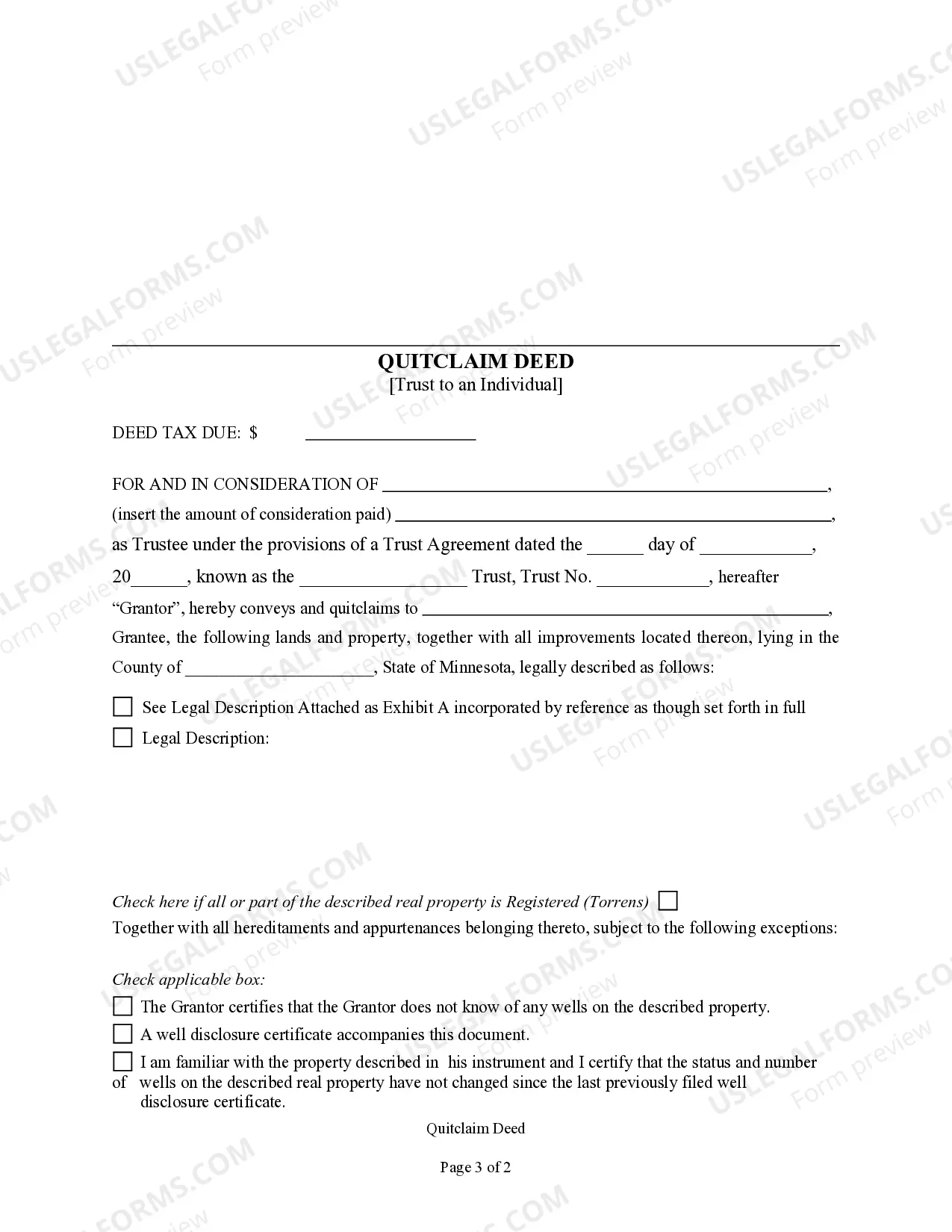

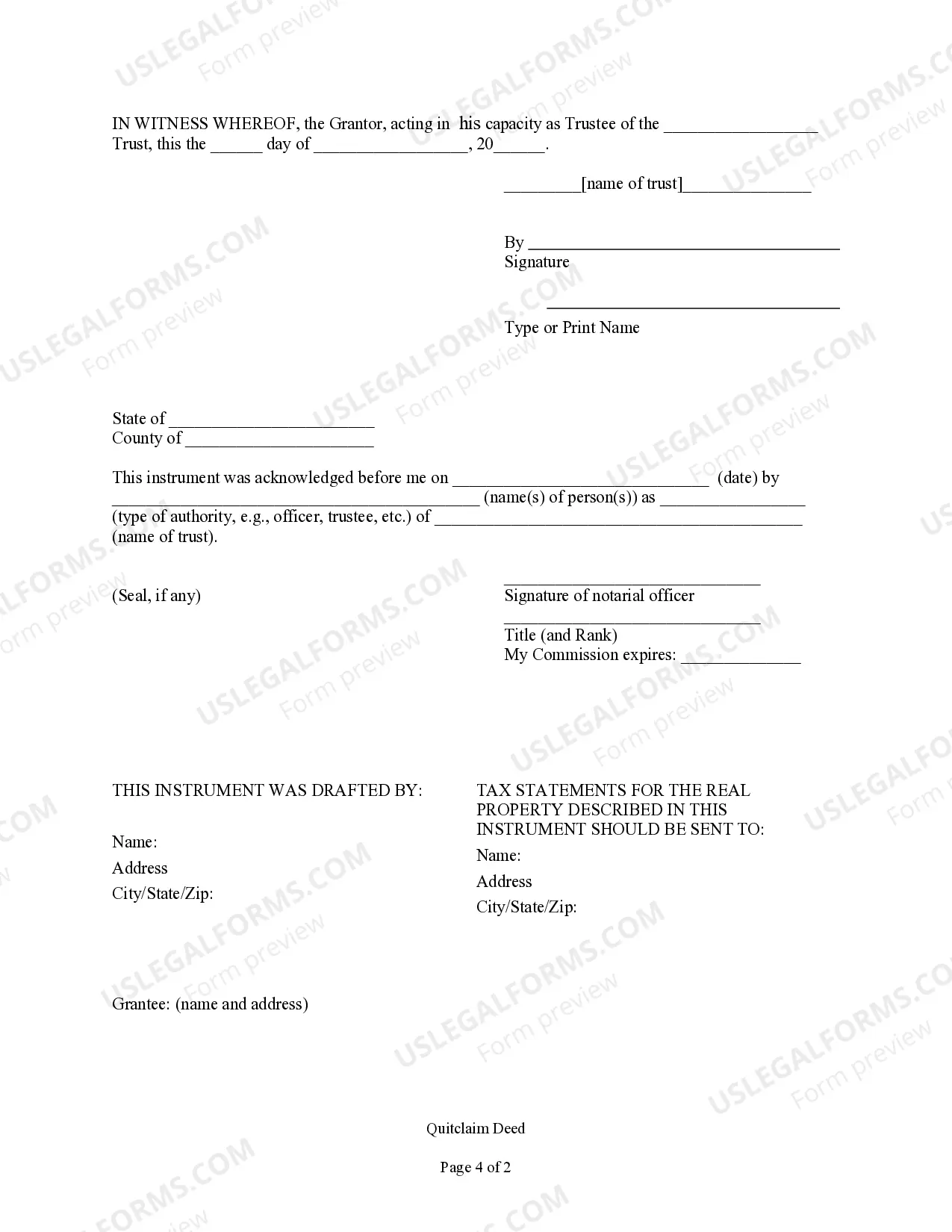

This form is a Quitclaim Deed where the grantor is the trustee of a trust acting on behalf of the trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Saint Paul Minnesota Quitclaim Deed — Trust to an Individual is a legal document that allows for the transfer of ownership or interest in a property from a trust to an individual. This type of deed is commonly used in trust administration, estate planning, or when transferring property to a beneficiary. A quitclaim deed is a specific type of deed that carries no warranties or guarantees for the buyer. It means that the person transferring the property is only transferring their interest or rights in the property, if any. By using a trust to execute the quitclaim deed, the property is transferred to an individual without going through the probate process, which can potentially save time and reduce costs. There are a few different types of Saint Paul Minnesota Quitclaim Deed — Trust to an Individual that can be used depending on the specific circumstances: 1. Trust Revocable Quitclaim Deed: This type of quitclaim deed is commonly used when the trust is revocable, meaning that the trust creator has the ability to make changes or revoke it entirely. In this case, the property transfer is executed by the trustee(s) on behalf of the trust, transferring the property to an individual. 2. Trust Irrevocable Quitclaim Deed: An irrevocable trust cannot be changed or revoked by the trust creator once it is established. When transferring property from an irrevocable trust to an individual, an irrevocable quitclaim deed is used. This type of deed finalizes the transfer of ownership without the ability to undo it. 3. Trust Quitclaim Deed with Special Conditions: In some cases, specific conditions or restrictions may be imposed on the transfer of property from a trust to an individual. This type of deed includes these special conditions, outlining any restrictions, encumbrances, or requirements that should be followed during the transfer. It is important to consult with a legal professional when preparing any type of quitclaim deed, including those involving trusts. This ensures that the process is executed properly and that all relevant legal requirements are met.A Saint Paul Minnesota Quitclaim Deed — Trust to an Individual is a legal document that allows for the transfer of ownership or interest in a property from a trust to an individual. This type of deed is commonly used in trust administration, estate planning, or when transferring property to a beneficiary. A quitclaim deed is a specific type of deed that carries no warranties or guarantees for the buyer. It means that the person transferring the property is only transferring their interest or rights in the property, if any. By using a trust to execute the quitclaim deed, the property is transferred to an individual without going through the probate process, which can potentially save time and reduce costs. There are a few different types of Saint Paul Minnesota Quitclaim Deed — Trust to an Individual that can be used depending on the specific circumstances: 1. Trust Revocable Quitclaim Deed: This type of quitclaim deed is commonly used when the trust is revocable, meaning that the trust creator has the ability to make changes or revoke it entirely. In this case, the property transfer is executed by the trustee(s) on behalf of the trust, transferring the property to an individual. 2. Trust Irrevocable Quitclaim Deed: An irrevocable trust cannot be changed or revoked by the trust creator once it is established. When transferring property from an irrevocable trust to an individual, an irrevocable quitclaim deed is used. This type of deed finalizes the transfer of ownership without the ability to undo it. 3. Trust Quitclaim Deed with Special Conditions: In some cases, specific conditions or restrictions may be imposed on the transfer of property from a trust to an individual. This type of deed includes these special conditions, outlining any restrictions, encumbrances, or requirements that should be followed during the transfer. It is important to consult with a legal professional when preparing any type of quitclaim deed, including those involving trusts. This ensures that the process is executed properly and that all relevant legal requirements are met.