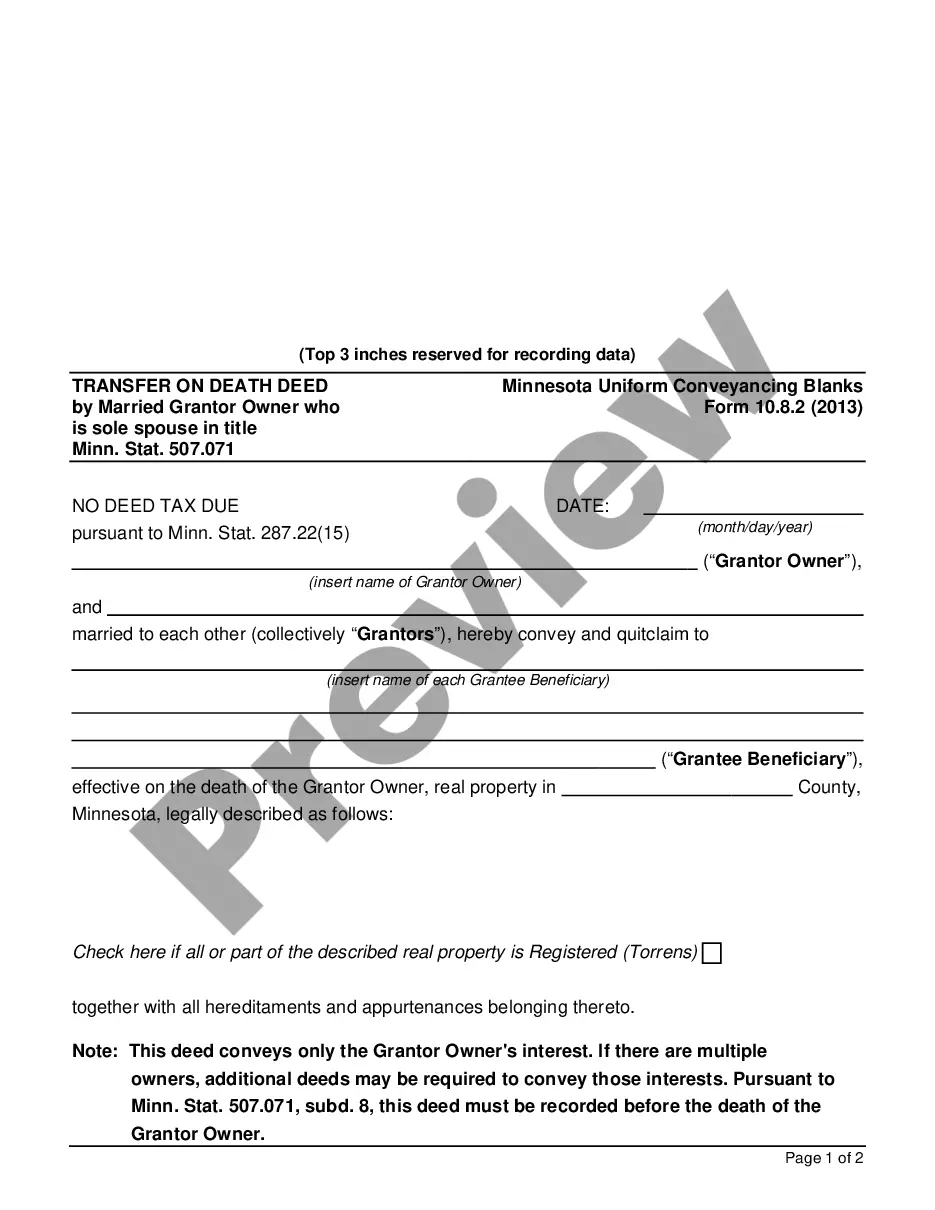

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Hennepin Minnesota Transfer on Death Deed (TODD) is a legal document that allows married granters who are the sole spouses in title to transfer their property to a designated beneficiary upon their death, without going through the probate process. Governed by Minn. Stat. 507.071, this type of deed provides flexibility and simplicity when it comes to passing the property to a chosen party. There are two main types of Hennepin Minnesota Transfer on Death Deeds by Married Granter Owners who are sole spouses in title Minn. Stat. 507.071: 1. Traditional Hennepin Minnesota TODD: This type of deed allows married granters who own real estate jointly as the sole spouses in title to designate a beneficiary or beneficiaries who will receive the property upon the death of both granters. The beneficiaries have no rights or ownership until the death of both granters, at which point the property is automatically transferred to them outside of probate. 2. Reverse Hennepin Minnesota TODD: In this variation of the TODD, the married granters retain the right to use and transfer the property during their lifetime, but upon the death of the surviving spouse, the property is automatically transferred to the designated beneficiary or beneficiaries. This option offers more flexibility and control to the granters during their lifetime while ensuring a smooth transfer of the property upon their passing. In both cases, it is important for married granters who wish to establish a Hennepin Minnesota TODD to comply with the requirements of Minn. Stat. 507.071. This includes preparing and recording the deed with the county recorder's office, clearly identifying the property, granters, and beneficiaries, and following the necessary execution formalities. Using a Hennepin Minnesota TODD can ensure the seamless transfer of property to the intended beneficiaries without the need for probate or the potential complications that may arise during the process. It is always advisable to consult with an attorney experienced in estate planning and real estate law to ensure the document is properly prepared and executed according to the applicable laws.The Hennepin Minnesota Transfer on Death Deed (TODD) is a legal document that allows married granters who are the sole spouses in title to transfer their property to a designated beneficiary upon their death, without going through the probate process. Governed by Minn. Stat. 507.071, this type of deed provides flexibility and simplicity when it comes to passing the property to a chosen party. There are two main types of Hennepin Minnesota Transfer on Death Deeds by Married Granter Owners who are sole spouses in title Minn. Stat. 507.071: 1. Traditional Hennepin Minnesota TODD: This type of deed allows married granters who own real estate jointly as the sole spouses in title to designate a beneficiary or beneficiaries who will receive the property upon the death of both granters. The beneficiaries have no rights or ownership until the death of both granters, at which point the property is automatically transferred to them outside of probate. 2. Reverse Hennepin Minnesota TODD: In this variation of the TODD, the married granters retain the right to use and transfer the property during their lifetime, but upon the death of the surviving spouse, the property is automatically transferred to the designated beneficiary or beneficiaries. This option offers more flexibility and control to the granters during their lifetime while ensuring a smooth transfer of the property upon their passing. In both cases, it is important for married granters who wish to establish a Hennepin Minnesota TODD to comply with the requirements of Minn. Stat. 507.071. This includes preparing and recording the deed with the county recorder's office, clearly identifying the property, granters, and beneficiaries, and following the necessary execution formalities. Using a Hennepin Minnesota TODD can ensure the seamless transfer of property to the intended beneficiaries without the need for probate or the potential complications that may arise during the process. It is always advisable to consult with an attorney experienced in estate planning and real estate law to ensure the document is properly prepared and executed according to the applicable laws.