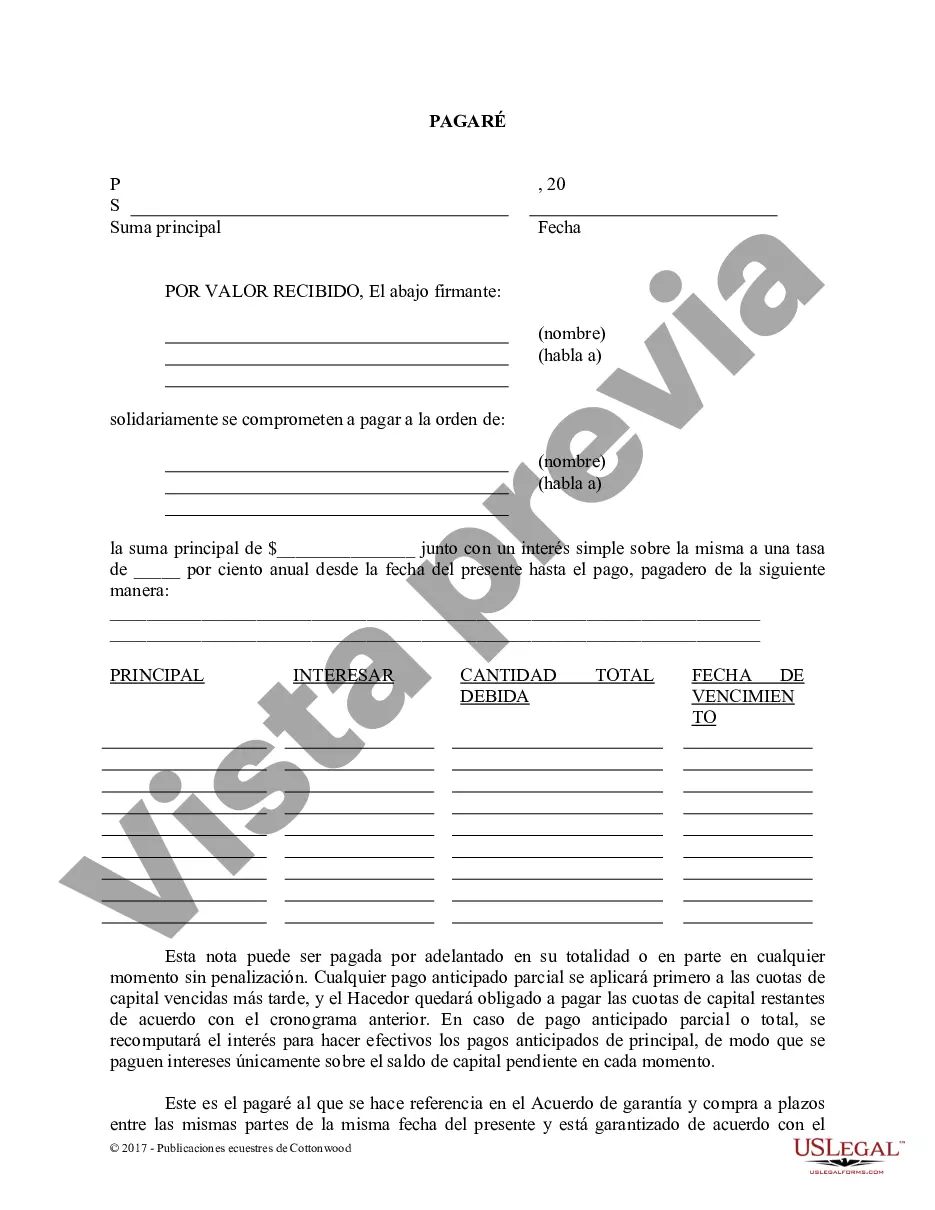

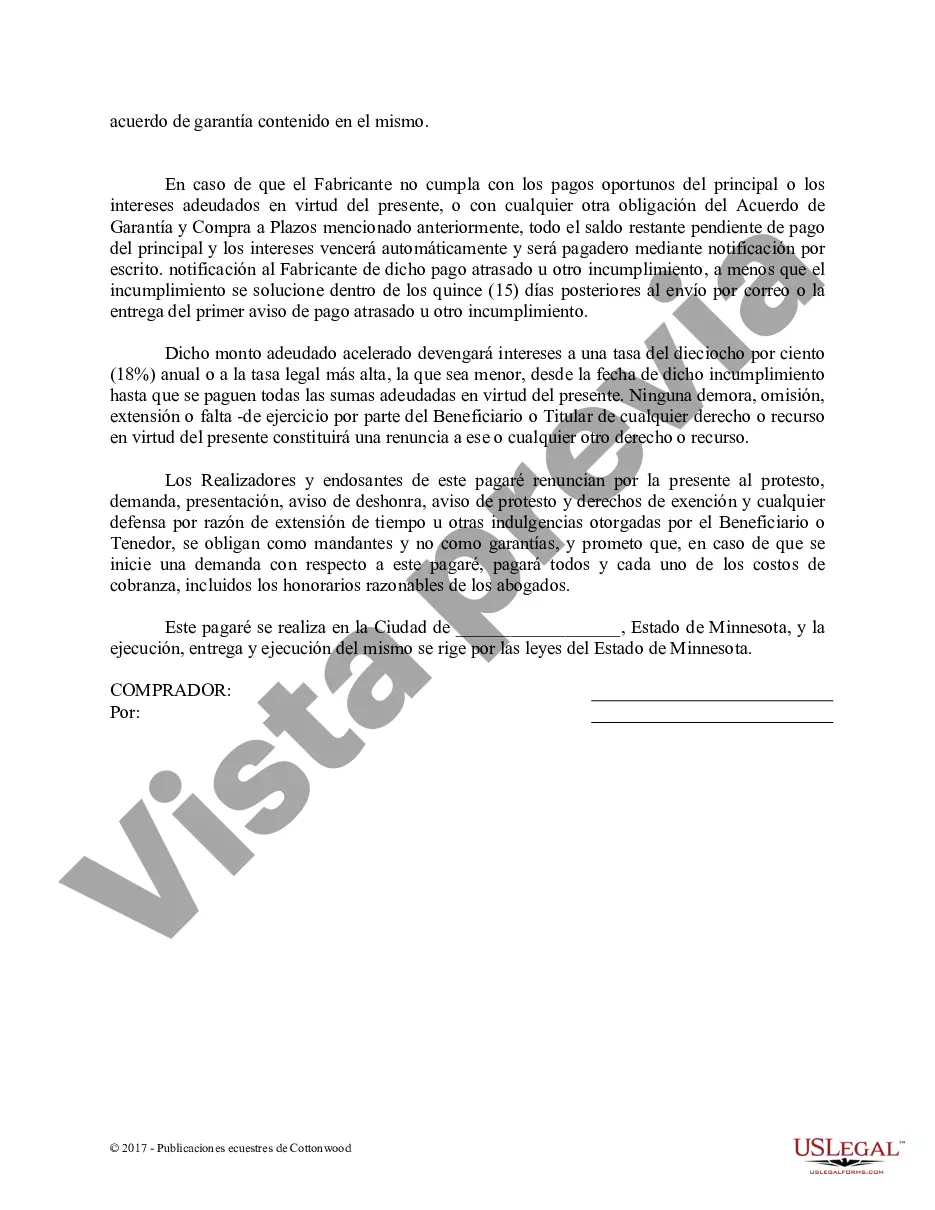

Minneapolis Minnesota Promissory Note — Horse Equine Forms are essential legal documents used in the horse industry to establish a written agreement between a borrower and a lender regarding the terms of a loan. These forms ensure that both parties are protected and provide clear guidelines for repayment. A Minneapolis Minnesota Promissory Note — Horse Equine Form typically includes the following key elements: 1. Parties Involved: The form outlines the full names and contact information of the borrower (the person receiving the loan) and the lender (the person providing the loan). It is crucial to include accurate details to establish the agreement. 2. Loan Details: This section specifies the loan amount provided by the lender to the borrower, along with the interest rate (if applicable) and the repayment schedule. This ensures transparency and clarity in the borrowing process. 3. Collateral: In equine transactions, horses often serve as collateral. This section outlines the specific details of the horse used as collateral, including its name, breed, registration number, and any other relevant identifiers. 4. Payment Terms: The form clearly defines the payment terms, including the frequency of payments (monthly, quarterly, etc.) and the due dates. It is crucial to outline whether payments are principal-only, interest-only, or a combination of both. Additionally, any late payment fees or penalties should be specified. 5. Default and Remedies: This section details the consequences if the borrower fails to make timely payments or defaults on the loan entirely. It outlines the actions the lender can take, such as repossession of the horse or legal action, to recover the outstanding amount. Different types of Minneapolis Minnesota Promissory Note — Horse Equine Forms may include variations based on the specific requirements or preferences of the parties involved. For instance, there might be forms tailored for: 1. Purchase-Specific Loans: These forms are used when a borrower is seeking a loan specifically to purchase a horse or multiple horses, outlining the loan amount and terms related to the specific purchase. 2. Breeding Loans: Breeding loans involve lenders providing funds to facilitate breeding operations. The equine form may include additional clauses related to veterinary care, insemination procedures, and the transfer of ownership if a successful breeding occurs. 3. Training or Boarding Loans: These forms cater to borrowers seeking loans to cover horse training or boarding expenses. They often highlight the duration of the training or boarding period and include terms regarding the horse's care during that time. 4. Lease-Purchase Agreements: Minneapolis Minnesota Promissory Note — Horse Equine Forms may also be used in lease-purchase agreements, where the borrower leases the horse for a specific duration before acquiring ownership. Such agreements involve additional clauses related to lease terms, purchase price, and maintenance responsibilities. In conclusion, Minneapolis Minnesota Promissory Note — Horse Equine Forms are crucial legal documents that protect the interests of both borrowers and lenders in equine transactions. Whether it's for a purchase, breeding, training, or leasing purposes, these forms play a vital role in establishing clear loan terms and facilitating smooth transactions within the horse industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minneapolis Minnesota Pagaré - Caballo Equino Formas - Minnesota Promissory Note - Horse Equine Forms

Category:

State:

Minnesota

City:

Minneapolis

Control #:

MN-14-06

Format:

Word

Instant download

Description

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Free preview

How to fill out Minneapolis Minnesota Pagaré - Caballo Equino Formas?

We consistently endeavor to minimize or eliminate legal repercussions when engaging with intricate legal matters or financial issues.

To achieve this, we seek legal assistance that, generally, incurs significant expenses.

However, not every legal concern is equally complicated.

Many can be managed independently.

Take advantage of US Legal Forms whenever you need to locate and retrieve the Minneapolis Minnesota Promissory Note - Horse Equine Forms or any other document efficiently and securely.

- US Legal Forms serves as an online compilation of current DIY legal documents covering a range from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to manage your affairs autonomously, without the necessity of legal advisors.

- We provide access to legal template documents that are not always readily available to the public.

- Our documents are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

Interesting Questions

More info

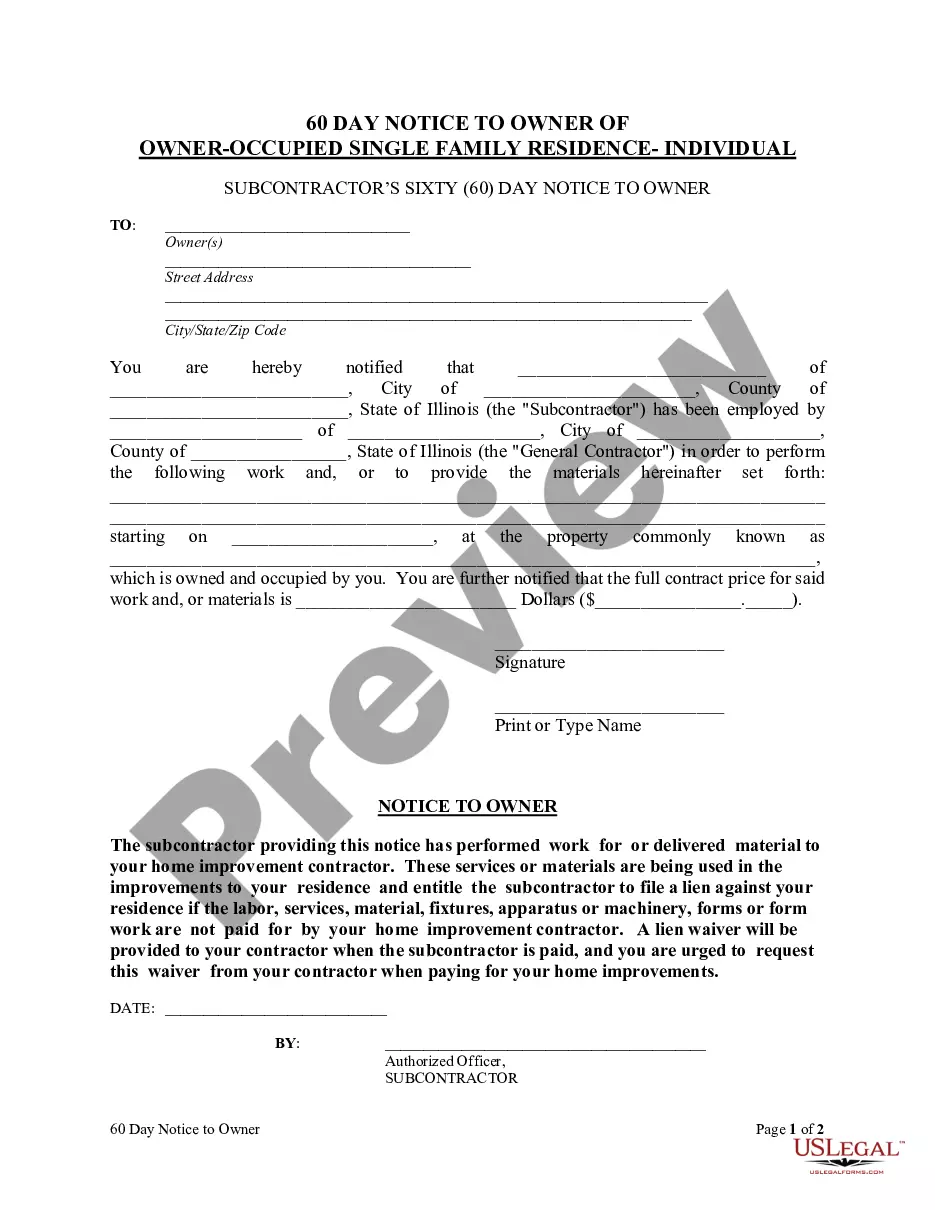

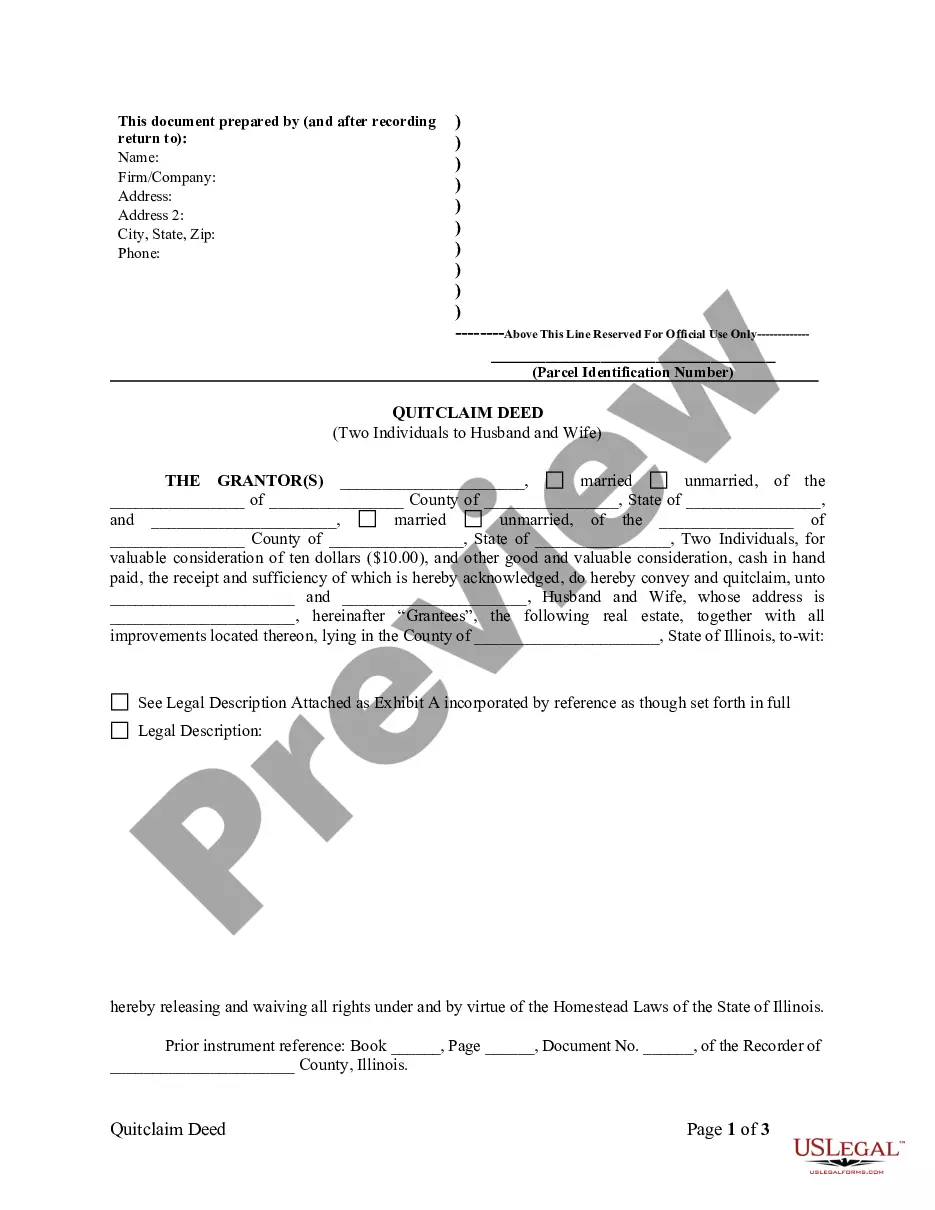

Completing your commercial real estate transactions has never been easier! Completing this form does not transfer the title or act as a Report of Sale.If you choose this option, you must fill out the Application to Have the. Chapter 7 Filing Fee Waived (Official Form 103B) and file it with your petition. Exemptions Chart (Federal vs. Review pursuant to Minnesota Statutes Section 473. Melvin H. Siegel, Minneapolis, Minn. , for Fred and Harry H. Isaacs.