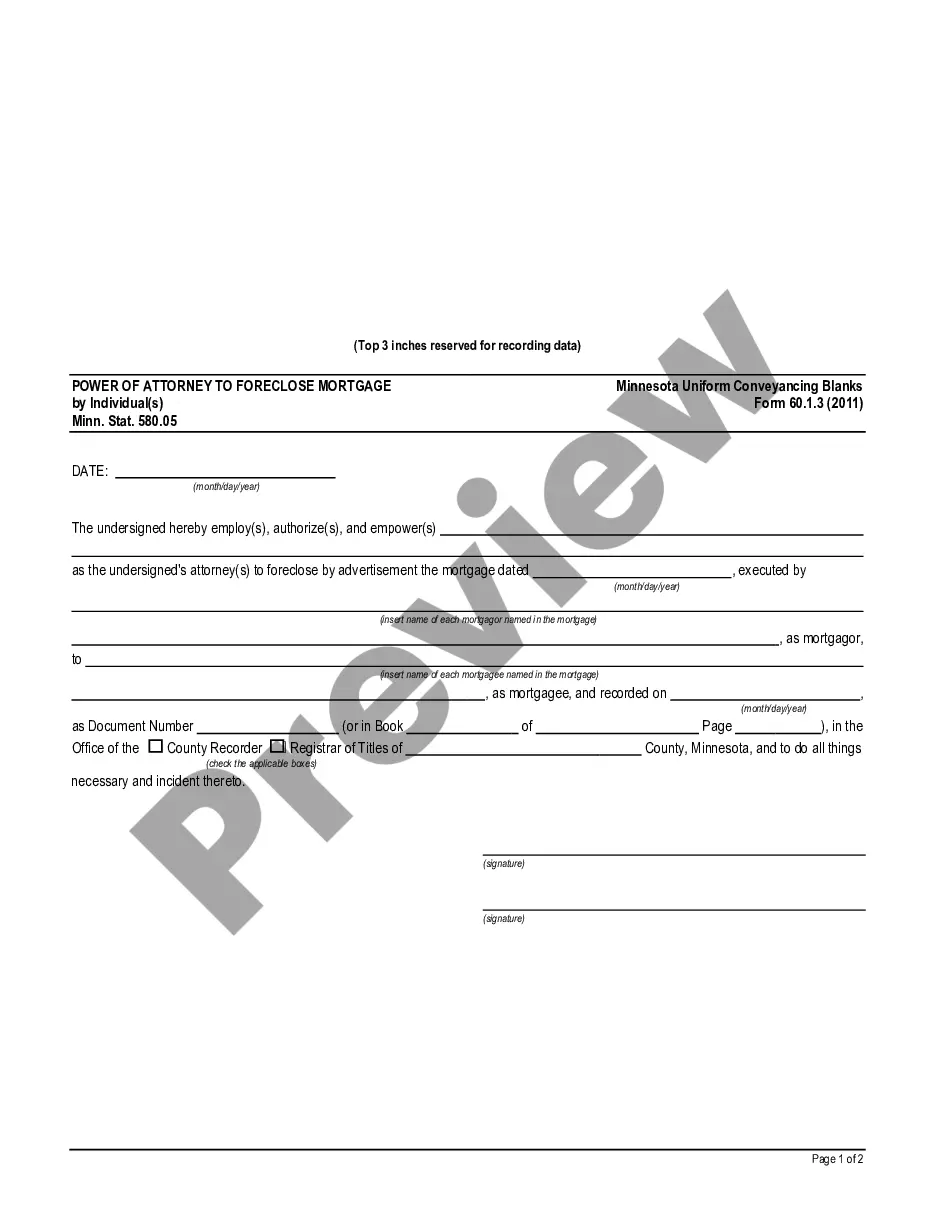

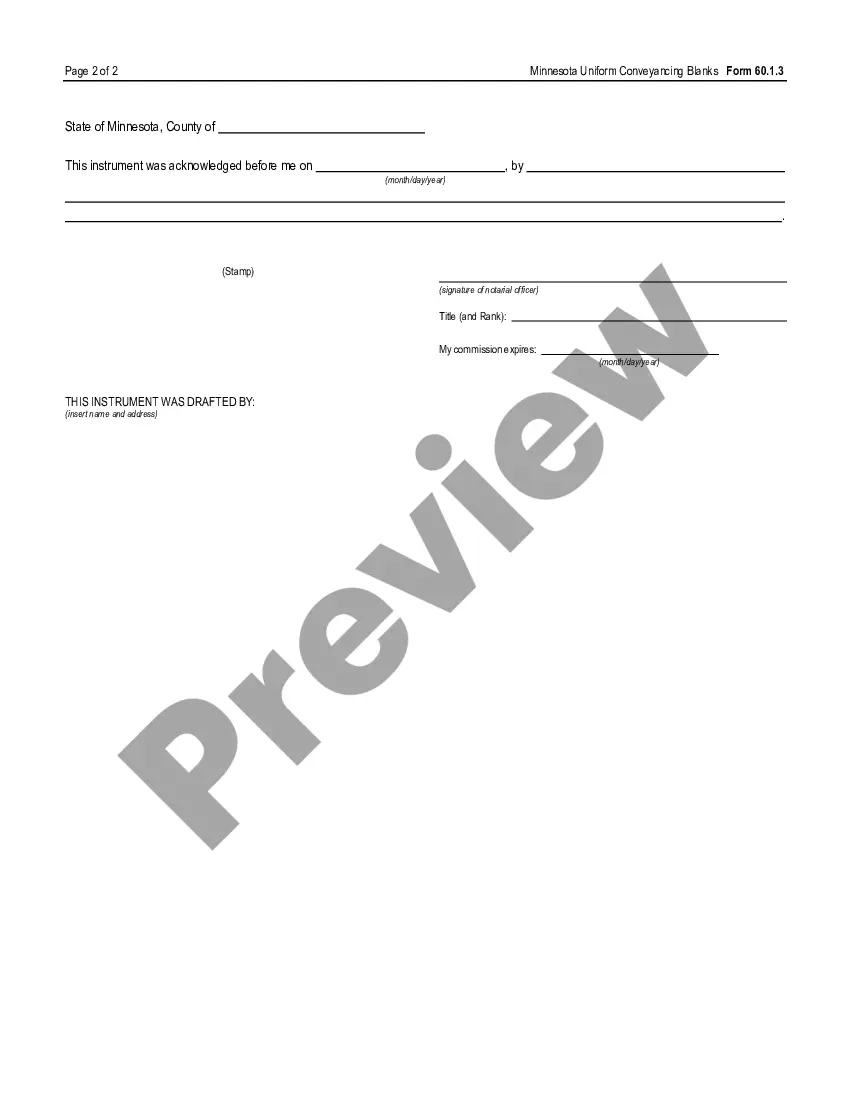

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is a legal document that grants individuals the authority to initiate foreclosure proceedings on behalf of a mortgage lender. This power of attorney is governed by Minnesota Statute 580.05, which sets out the specific requirements and procedures for this type of foreclosure. One type of Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is the "Limited Power of Attorney to Foreclose Mortgage." This type of power of attorney authorizes a specific individual to act on behalf of the mortgage lender for a limited period and for a specific property. It is often used when the mortgage lender wants to delegate the foreclosure process to a trusted representative but wants to retain control over the decision-making. Another type of Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is the "General Power of Attorney to Foreclose Mortgage." This type of power of attorney grants broader authority to the designated individual, allowing them to initiate foreclosure proceedings on any property owned by the mortgage lender. It is typically used when the mortgage lender wants to entrust the entire foreclosure process to a representative without needing to review or approve each foreclosure case individually. Both types of power of attorney contain specific provisions outlining the scope of authority granted, the responsibilities of the designated individual, and the process for initiating foreclosure proceedings. It is crucial for all parties involved to carefully review and understand the terms of the power of attorney before proceeding with any foreclosure actions. In summary, the Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is a legal instrument that allows individuals to act on behalf of a mortgage lender to initiate foreclosure proceedings. With different types available, such as the Limited Power of Attorney to Foreclose Mortgage or the General Power of Attorney to Foreclose Mortgage, it is essential to select the appropriate one based on the lender's specific needs and requirements. Compliance with Minnesota Statute 580.05 is crucial to ensure that all foreclosure actions are conducted within the boundaries of the law.The Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is a legal document that grants individuals the authority to initiate foreclosure proceedings on behalf of a mortgage lender. This power of attorney is governed by Minnesota Statute 580.05, which sets out the specific requirements and procedures for this type of foreclosure. One type of Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is the "Limited Power of Attorney to Foreclose Mortgage." This type of power of attorney authorizes a specific individual to act on behalf of the mortgage lender for a limited period and for a specific property. It is often used when the mortgage lender wants to delegate the foreclosure process to a trusted representative but wants to retain control over the decision-making. Another type of Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is the "General Power of Attorney to Foreclose Mortgage." This type of power of attorney grants broader authority to the designated individual, allowing them to initiate foreclosure proceedings on any property owned by the mortgage lender. It is typically used when the mortgage lender wants to entrust the entire foreclosure process to a representative without needing to review or approve each foreclosure case individually. Both types of power of attorney contain specific provisions outlining the scope of authority granted, the responsibilities of the designated individual, and the process for initiating foreclosure proceedings. It is crucial for all parties involved to carefully review and understand the terms of the power of attorney before proceeding with any foreclosure actions. In summary, the Saint Paul Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is a legal instrument that allows individuals to act on behalf of a mortgage lender to initiate foreclosure proceedings. With different types available, such as the Limited Power of Attorney to Foreclose Mortgage or the General Power of Attorney to Foreclose Mortgage, it is essential to select the appropriate one based on the lender's specific needs and requirements. Compliance with Minnesota Statute 580.05 is crucial to ensure that all foreclosure actions are conducted within the boundaries of the law.