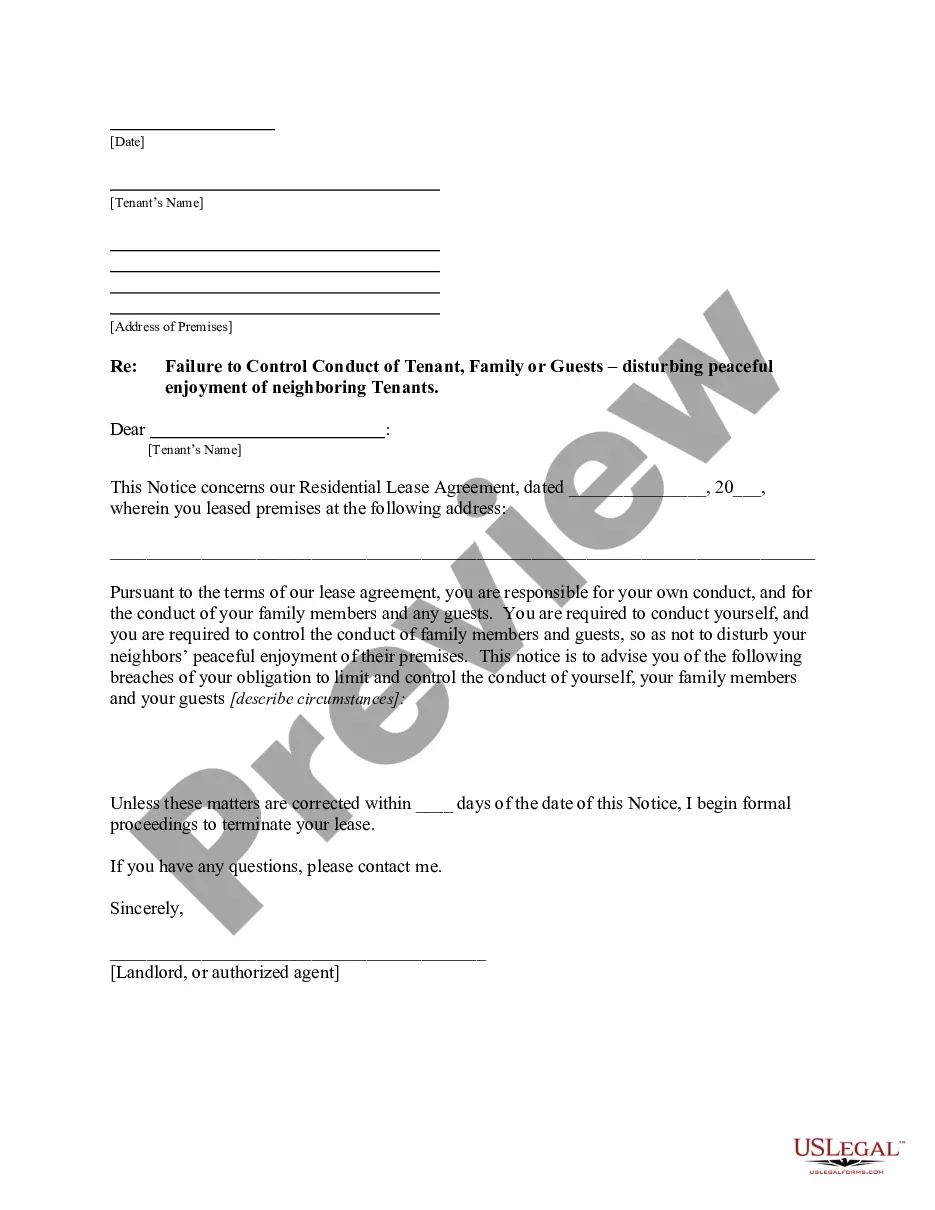

A Saint Paul Minnesota Payment Plan Agreement for Delinquent Account is a legally binding agreement between a debtor and a creditor that outlines the terms and conditions for repayment of a delinquent account in the city of Saint Paul, Minnesota. This agreement is designed to provide a structured and manageable approach for the debtor to settle their outstanding balance in regular installments over a specified period of time. Typically, there are two main types of Saint Paul Minnesota Payment Plan Agreements for Delinquent Accounts: 1. Personal Payment Plan Agreement: This type of agreement is commonly used for individual debts between a debtor and a creditor. It could be for various delinquent accounts such as credit cards, medical bills, personal loans, or utility bills. The terms of the agreement will include the total amount owed, the duration of the payment plan, the monthly installment amount, any interest or fees applied, and the consequences of defaulting on the agreement. 2. Business Payment Plan Agreement: This type of agreement is specifically tailored for delinquent accounts related to business transactions. It could involve outstanding invoices, commercial loans, or any other business-related debts. The terms and conditions will be similar to those of a personal payment plan agreement, but may also include provisions related to late payment penalties, collateral requirements, or a personal guarantee from the business owner. Key elements often included in a Saint Paul Minnesota Payment Plan Agreement for Delinquent Account are: 1. Debtor's Information: This section includes the debtor's name, address, contact details, and any other relevant identification information. 2. Creditor's Information: This section outlines the name, address, and contact details of the creditor, which could be a company, institution, or individual. 3. Account Details: This section provides a thorough description of the delinquent account, including the account number, outstanding balance, and any accrued interest or fees. 4. Payment Terms: This section outlines the repayment terms agreed upon by both parties. It includes the total amount owed, the duration of the payment plan, the frequency and amount of installments, and the method of payment. 5. Interest or Fees: If applicable, this section specifies any interest rate or fees that will be charged on the outstanding balance during the repayment period. 6. Default Clause: This section details the consequences of defaulting on the payment plan, including potential legal actions or collection efforts that may be pursued. 7. Signatures: Both the debtor and the creditor must sign and date the agreement to indicate their acceptance and commitment to its terms and conditions. Saint Paul Minnesota Payment Plan Agreements for Delinquent Accounts serve as a practical and efficient way for debtors in Saint Paul to resolve their outstanding debts without facing immediate legal action or further financial repercussions. These agreements can provide relief for debtors, allowing them to repay their debts over time and potentially avoid more severe consequences such as wage garnishment, asset seizure, or credit score damage.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Saint Paul Minnesota Acuerdo de Plan de Pago para Cuenta Morosa - Minnesota Payment Plan Agreement for Delinquent Account

Description

How to fill out Saint Paul Minnesota Acuerdo De Plan De Pago Para Cuenta Morosa?

Make use of the US Legal Forms and get immediate access to any form template you want. Our useful website with a huge number of documents allows you to find and obtain virtually any document sample you need. It is possible to export, complete, and certify the Saint Paul Minnesota Payment Plan Agreement for Delinquent Account in a couple of minutes instead of browsing the web for several hours searching for a proper template.

Using our collection is a great strategy to increase the safety of your record filing. Our experienced lawyers regularly review all the records to make certain that the templates are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the Saint Paul Minnesota Payment Plan Agreement for Delinquent Account? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Open the page with the form you need. Ensure that it is the template you were seeking: check its name and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order using a credit card or PayPal.

- Export the file. Select the format to get the Saint Paul Minnesota Payment Plan Agreement for Delinquent Account and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable document libraries on the internet. Our company is always happy to help you in any legal case, even if it is just downloading the Saint Paul Minnesota Payment Plan Agreement for Delinquent Account.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!