Title: Understanding Minneapolis Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act: A Comprehensive Overview Introduction: In Minneapolis, Minnesota, when dealing with debt collection agencies, it is important to be well-versed in the Fair Debt Collection Practices Act (FD CPA). This legislation outlines guidelines and restrictions imposed on debt collectors to ensure fair and ethical practices. This article aims to provide a detailed description of the Minneapolis Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act, shedding light on its key aspects and different types. 1. What is the Minneapolis Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act? The Minneapolis Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act is a formal written communication sent by residents of Minneapolis to debt collection agencies, citing the FD CPA regulations and asserting their rights as debtors. This letter serves as a crucial tool in communicating with collectors, asserting consumer rights, and resolving any potential disputes. 2. Key Elements of a Minneapolis Minnesota Letter to Debt Collector: a) Identification: The letter must clearly identify both the debtor and the collector, including full names, addresses, and account numbers. b) Debt Validation Request: A primary purpose of the letter is to request debt validation, demanding that collectors provide necessary documentation to prove the legitimacy, amount, and ownership of the debt. c) Cease and Desist Provision: Debtors can request that collectors cease all communication pertaining to the debt, limiting any contact to legal actions or notices. d) Dispute Resolution: Debtors can use this letter to raise any discrepancies or challenges regarding the debt, seeking resolution or offering payment arrangements. e) Consumer Rights: The letter may reference various consumer rights outlined under the FD CPA, including restrictions on harassment, false representations, or unfair debt collection practices. 3. Types of Minneapolis Minnesota Letters to Debt Collectors: a) Initial Inquiry Letter: Debtors may utilize this letter to raise questions or concerns about the collection agency's contact or intent, seeking further information and clarifications. b) Debt Validation Request Letter: A debt validation letter alerts the collector that the debtor wishes to verify the legitimacy of the debt, often requesting specific documentation to support the claim. c) Cease and Desist Letter: This type of letter explicitly instructs collectors to stop all communication with the debtor, providing legal grounds to prevent further harassment or contact. d) Dispute Resolution Letter: Debtors can draft a dispute letter when they believe the debt is invalid, contains errors, or requires negotiation. This letter aims to resolve the matter and avoid further collection actions. Conclusion: Mastering the intricacies of the Minneapolis Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act can empower debtors to assert their rights and seek fair treatment during debt collection processes. Utilizing various types of letters enables debtors to manage communication, validate debts, resolve disputes, and exercise their rights under the FD CPA effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minneapolis Minnesota Carta al cobrador sobre la ley de prácticas y cobro justo de deudas - Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act

Description

How to fill out Minneapolis Minnesota Carta Al Cobrador Sobre La Ley De Prácticas Y Cobro Justo De Deudas?

Locating authenticated templates that adhere to your regional regulations can be difficult unless you access the US Legal Forms collection.

This is a digital repository of over 85,000 legal documents tailored for both personal and professional purposes as well as various real-world situations.

All the files are well-organized by category of application and jurisdiction, making it simple and straightforward to find the Minneapolis Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act.

Maintaining documentation tidy and compliant with legal standards holds substantial significance. Leverage the US Legal Forms collection to consistently have vital document templates for any requirements right at your fingertips!

- Examine the Preview mode and document description.

- Ensure you've selected the appropriate template that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the correct document. If it meets your criteria, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

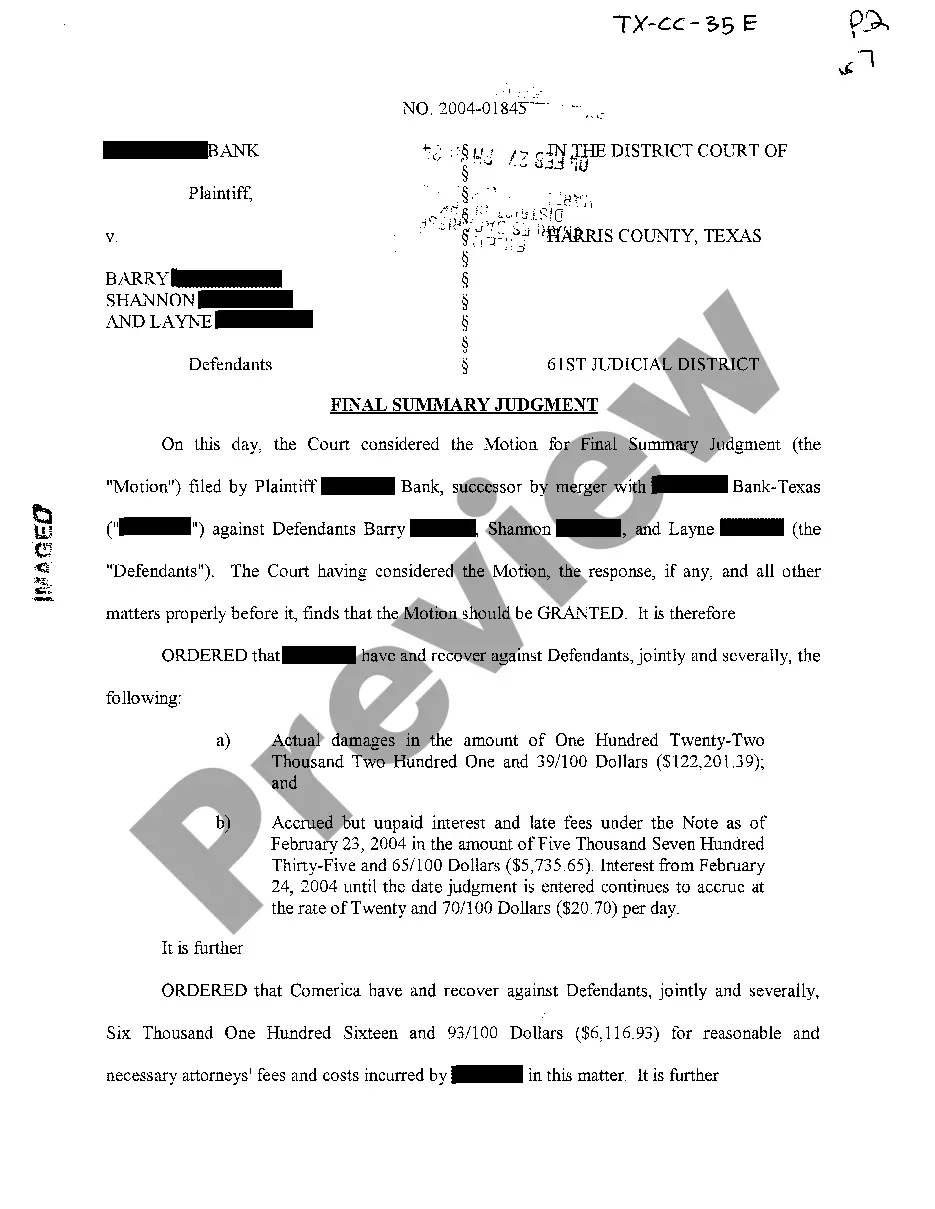

Unpaid debt doesn't go away. Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency and even if you think it's unfair.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Yes, but again the debt collector will be allowed to continue debt collection activities and will not have to verify the debt. If you want to assert your right to verify the debt, you must send your dispute letter within 30 days of receiving notice of the debt from the debt collector.

Accounts that are incorrectly reported as late or delinquent, such as by a collection agency or other creditor. Debts listed on your credit report more than once. Incorrect dates of payments or delinquencies. Accounts with an incorrect balance.

While creditors are not subject to the FDCPA, their collection activities are subject to similar prohibitions on unfair, deceptive and abusive acts and practices under the federal ?UDAAP? law and various state ?UDAP? laws.

When a debt has been purchased in full by a collection agency, the new account owner (the collector) will usually notify the debtor by phone or in writing. Selling or transferring debt from one creditor or collector to another can happen without your permission.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

You should respond in one of three ways: Admit. Admit the paragraph if you agree with everything in the paragraph. Deny. Deny the paragraph if you want to make the debt collector prove that it is true. Defendant denies the allegation for lack of knowledge sufficient to know the truth or falsity thereof.

Summary: You have 21 days to respond to a Minnesota debt collection lawsuit before you lose by default. You should respond by filing a written Answer with the court. In the Answer document, reply to each claim listed in the Complaint and assert your affirmative defenses.

Filing Your Answer. Contact the clerk's office of the court where the lawsuit was filed. You'll find a phone number and address for the clerk's office on your summons. The clerk will be able to tell you exactly what documents you should file with your answer and whether any filing fee is required.