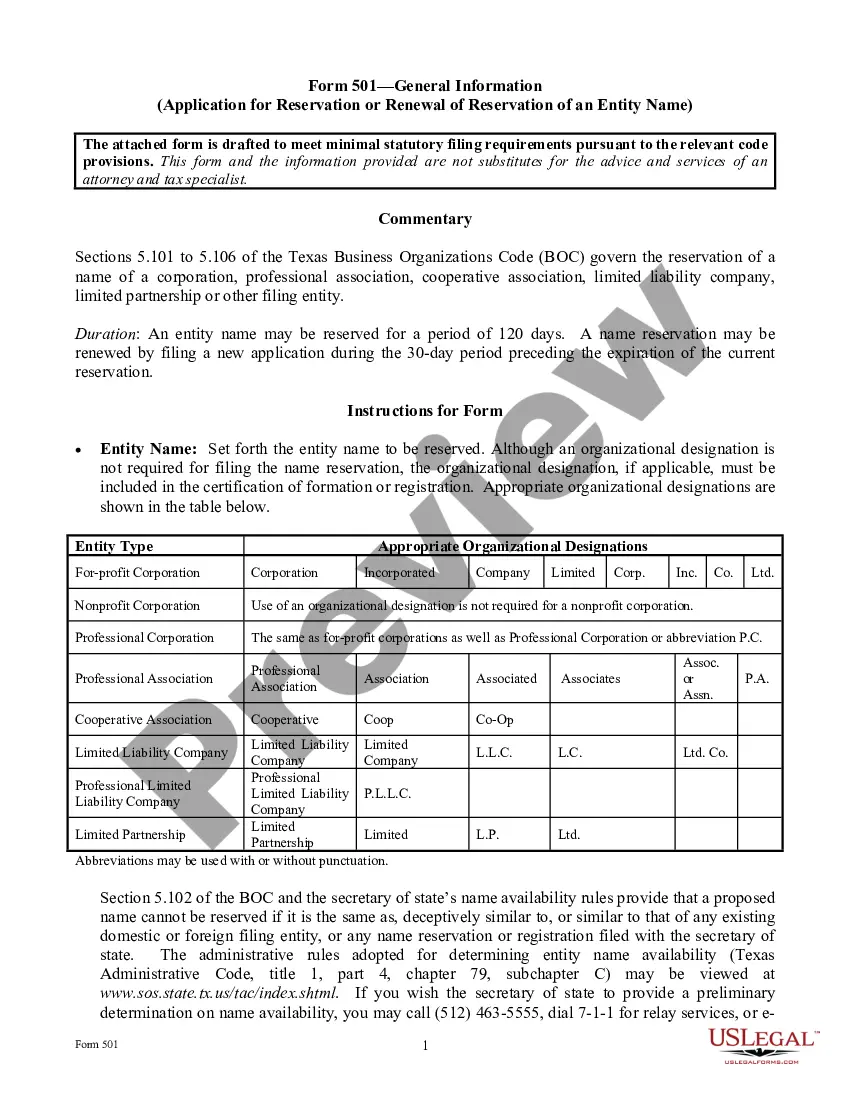

A Minneapolis Minnesota Living Trust for Husband and Wife with Minor and/or Adult Children is a legal document that allows a couple to plan for the distribution of their assets and provide for their children in the event of their incapacitation or death. It serves as an effective estate planning tool that offers several benefits, including avoiding probate, minimizing estate taxes, and ensuring privacy and control over asset distribution. The living trust is customizable to meet the unique needs of each couple and their family dynamic. There are different types of living trusts designed specifically for couples with minor and/or adult children. Some variations include: 1. Revocable Living Trust: This type of trust allows the couple to maintain control over their assets during their lifetime and make changes or revoke it as needed. It offers flexibility and enables easy modification of beneficiary designations. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable trust cannot be modified or revoked once established. It provides added asset protection, as assets transferred into the trust generally cannot be reached by creditors or other legal claims. 3. Testamentary Living Trust: This trust is created through a will and becomes effective upon the death of both spouses. It allows for the smooth transfer of assets to the surviving spouse and ensures assets are properly allocated to the minor and adult children as per the couple's wishes. 4. Education Trust: This specific type of living trust is designed to provide for the education and related expenses of minor and/or adult children. It can be structured to distribute funds for tuition, books, housing, and other educational needs while ensuring responsible use of the trust assets. When establishing a Minneapolis Minnesota Living Trust for Husband and Wife with Minor and/or Adult Children, it is essential to consider the following key details: — Designation of Trustees: Couples must appoint a trustee or co-trustees who will manage the trust and make decisions regarding asset distribution on behalf of the children. They can choose a family member, a trusted friend, or even a financial institution to act as the trustee. — Guardianship for Minor Children: It's crucial to name guardians for minor children in the living trust. These individuals will be responsible for their upbringing and welfare in the event that both parents pass away or become incapacitated. — Inheritance of Adult Children: The living trust should clearly outline how the couple wishes to distribute their assets among adult children, ensuring fairness and addressing any specific considerations unique to each child's circumstances. — Successor Trustees: Couples should name successor trustees who can step in and manage the trust if the initial trustees are unable or unwilling to fulfill their duties. In conclusion, a properly drafted and executed Minneapolis Minnesota Living Trust for Husband and Wife with Minor and/or Adult Children provides peace of mind by ensuring their assets are protected, their children are provided for, and their wishes are followed. It is recommended to consult with an experienced estate planning attorney to create an appropriate living trust that best suits individual circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minneapolis Minnesota Fideicomiso en vida para esposo y esposa con hijos menores o adultos - Minnesota Living Trust for Husband and Wife with Minor and or Adult Children

Description

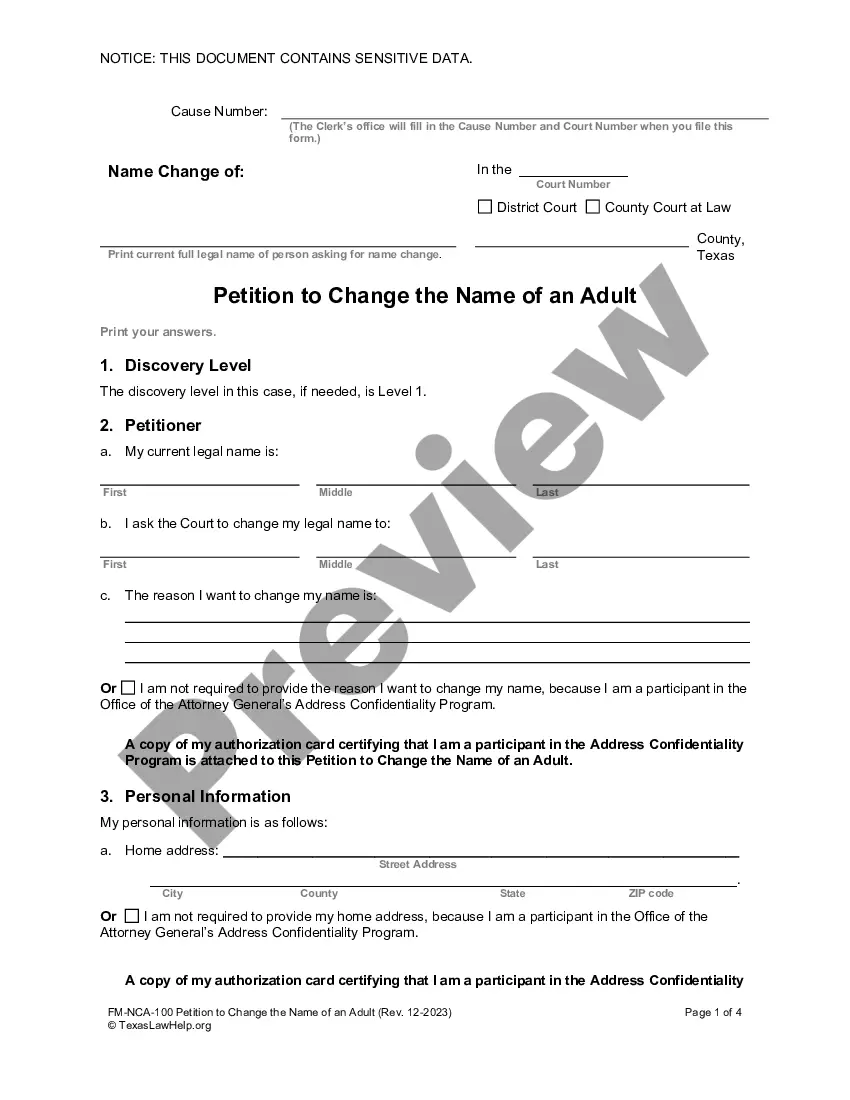

How to fill out Minneapolis Minnesota Fideicomiso En Vida Para Esposo Y Esposa Con Hijos Menores O Adultos?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, usually, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Minneapolis Minnesota Living Trust for Husband and Wife with Minor and or Adult Children or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Minneapolis Minnesota Living Trust for Husband and Wife with Minor and or Adult Children complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Minneapolis Minnesota Living Trust for Husband and Wife with Minor and or Adult Children is proper for you, you can select the subscription plan and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!