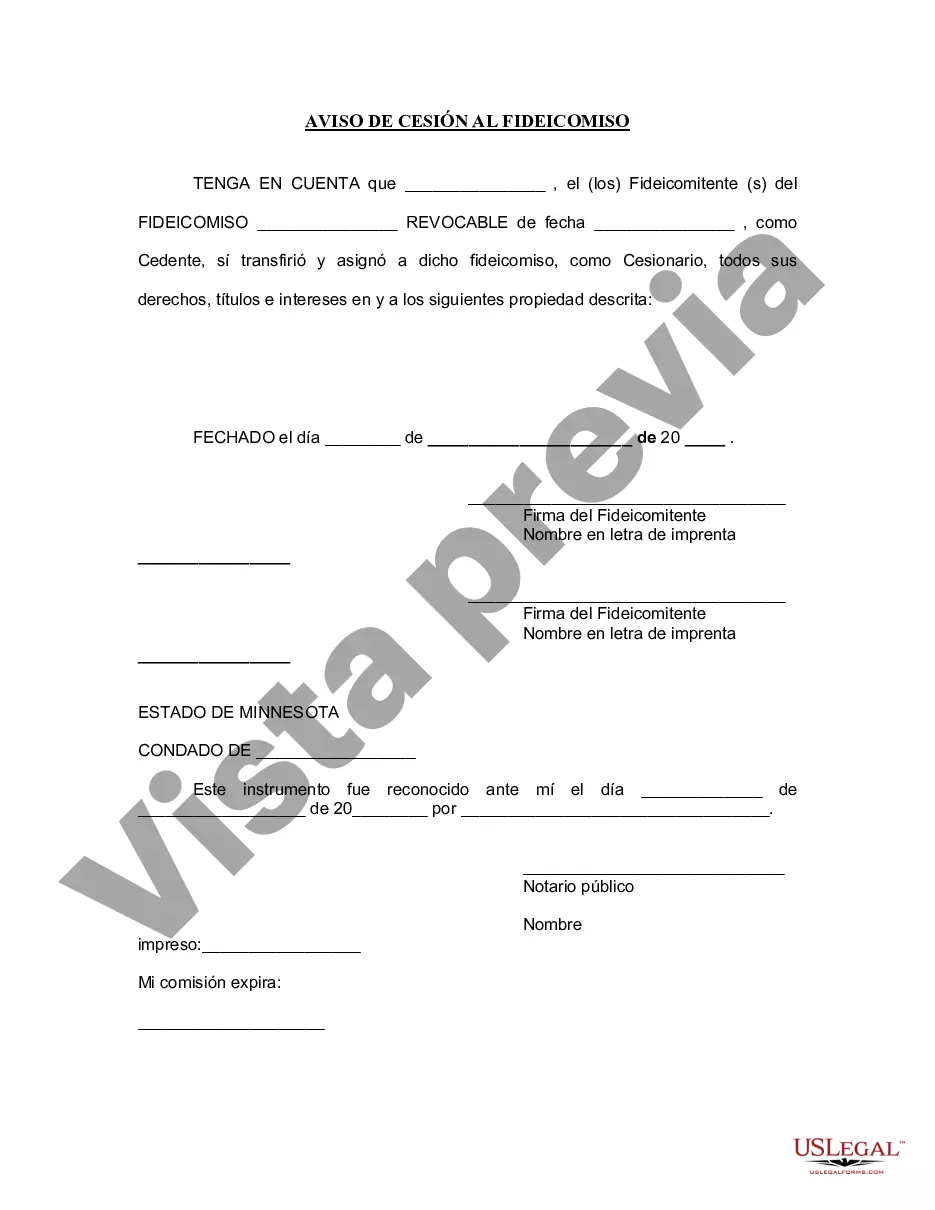

The Hennepin Minnesota Notice of Assignment to Living Trust is a legal document that conveys the transfer of assets or property to a living trust in Hennepin County, Minnesota. This assignment is a crucial step in estate planning, ensuring the smooth transition of assets to a trust while maintaining the granter's control and flexibility during their lifetime. When executing a Notice of Assignment to Living Trust in Hennepin County, Minnesota, it's essential to understand the various types available. These may include: 1. Revocable Living Trust Assignment: This type of assignment allows the granter to retain control over the assets transferred to the trust and modify or revoke it at any time. It offers flexibility and is favorable for those who anticipate changes in their estate plans over time. 2. Irrevocable Living Trust Assignment: Irrevocable living trusts, on the other hand, cannot normally be altered or revoked once established. Assigning assets to an irrevocable trust can have advantages like reducing estate taxes, protecting assets from creditors, or qualifying for certain government benefits. However, it typically requires careful consideration and professional advice due to the lack of flexibility. 3. Testamentary Living Trust Assignment: This type of assignment allows assets to be transferred to a living trust only after the granter's death. It is established within the granter's will, taking effect upon their passing. Testamentary trusts offer a streamlined transfer of assets while providing the opportunity for specific instructions and safeguards. The Hennepin Minnesota Notice of Assignment to Living Trust requires detailed information, including the granter's name, address, and contact information, as well as a clear identification of the assets being assigned. It is crucial to accurately identify the assets to ensure their proper transfer and avoid any ambiguity. Furthermore, the notice should clearly state the purpose of the assignment, which is to transfer the identified assets to the living trust, along with the trust's name and details. It is essential to specify whether the trust is revocable or irrevocable, and indicate any specific conditions or instructions related to the assignment. Consulting with an experienced attorney specializing in estate planning and trust administration is highly recommended when executing the Hennepin Minnesota Notice of Assignment to Living Trust. They can provide guidance based on the unique circumstances and goals of the granter, ensuring that the assignment is compliant with Minnesota state laws and tailored to their specific needs. In summary, the Hennepin Minnesota Notice of Assignment to Living Trust is a critical legal document used to transfer assets to a living trust in Hennepin County, Minnesota. Understanding the different types of living trust assignments, such as revocable, irrevocable, and testamentary, is essential for selecting the most suitable option. Seeking professional advice is highly advisable to ensure a smooth and accurate execution of the assignment while adhering to state laws and personal estate planning goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Aviso de cesión a un fideicomiso en vida - Minnesota Notice of Assignment to Living Trust

Description

How to fill out Hennepin Minnesota Aviso De Cesión A Un Fideicomiso En Vida?

Do you need a reliable and affordable legal forms provider to get the Hennepin Minnesota Notice of Assignment to Living Trust? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Hennepin Minnesota Notice of Assignment to Living Trust conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is good for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Hennepin Minnesota Notice of Assignment to Living Trust in any provided format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal papers online for good.

Form popularity

FAQ

En nuestro actual sistema legal se requiere la intervencion de por lo menos tres partes: el Fiduciante, fideicomitente o constituyente: es el propietario del bien que se trasmite en fideicomiso y es quien instruye al fiduciario acerca del encargo que debe cumplir, este ultimo es quien asume la propiedad fiduciaria y la

Se reconoce como un fideicomiso al contrato mediante el cual una persona a la que se le conoce como fideicomitente o fiduciante delega determinados bienes de su propiedad, a otra persona llamada fiduciario, para que esta administre de la mejor manera los bienes en beneficio de un tercero, llamado fideicomisario o

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

El fideicomisario es el heredero que va a recibir los bienes de la herencia por parte del fiduciario y no por el testador/fideicomitente. El fideicomisario es la persona que va a poder disponer de manera libre de los bienes de la herencia.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

El fideicomisario es el beneficiario que fue nombrado en el contrato de fideicomiso. Puede ser una persona fisica o moral, que recibira bienes, valores o recursos cuando se cumplan las condiciones establecidas.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Requisitos: Nombre y nacionalidad del fideicomitente. Nombre de la Institucion de credito (banco) que fungira como fiduciaria. Nombre y nacionalidad del fideicomisario y, si los hubiere, de los fideicomisarios en segundo lugar y de los fideicomisarios substitutos. Duracion del fideicomiso.

El fideicomisario es el beneficiario que fue nombrado en el contrato de fideicomiso. Puede ser una persona fisica o moral, que recibira bienes, valores o recursos cuando se cumplan las condiciones establecidas.

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.