Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding document used in real estate transactions to outline the terms and conditions of a loan. This type of promissory note provides security to the lender by leveraging residential real estate as collateral. The Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate is designed to ensure a smooth and transparent lending process between the borrower and the lender. By utilizing this note, both parties can establish clear expectations and responsibilities from the onset. Some key features of the Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate include: 1. Loan Amount: Specifies the total amount borrowed by the borrower, which is typically based on the market value of the residential property being used as collateral. 2. Interest Rate: Sets the fixed interest rate that the borrower will pay throughout the loan term. This rate remains the same, ensuring predictable monthly payments for the borrower. 3. Installment Payments: Outlines the agreed-upon payment schedule, including the frequency, amount, and due dates of the installments. 4. Late Payment Clause: Indicates the penalties or fees that the borrower would incur for late payments. 5. Default and Remedies: Details the actions that the lender may take if the borrower defaults on the loan, such as foreclosure and potential legal proceedings. 6. Prepayment Terms: Outlines whether the borrower can prepay the loan without incurring any penalties and, if applicable, specifies any prepayment fees. Different types of Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate may vary based on specific loan terms, additional provisions, or unique requirements set forth by the lender. Some possible variations may include: 1. Balloon Payment Note: This type of promissory note includes smaller monthly installments over an agreed-upon period, with a larger lump sum payment due at the end of the term. 2. Adjustable Rate Note: Rather than a fixed interest rate, this type of promissory note allows for the interest rate to adjust periodically, typically based on market conditions. 3. Interest-Only Note: In an interest-only promissory note, the borrower pays only the interest portion for an agreed-upon period, with the principal repayment due later in the term or upon a particular event. 4. Non-Recourse Note: This type of promissory note limits the lender's recourse to the collateral (residential real estate). If the borrower defaults, the lender can seize the property but cannot pursue further action against the borrower's other assets. It is essential for both borrowers and lenders to thoroughly review and understand the terms and provisions outlined in the Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate before entering into a loan agreement. Seeking professional legal advice is highly recommended ensuring compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Pagaré de tasa fija a plazos de Minnesota garantizado por bienes raíces residenciales - Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate

State:

Minnesota

County:

Hennepin

Control #:

MN-NOTESEC

Format:

Word

Instant download

Description

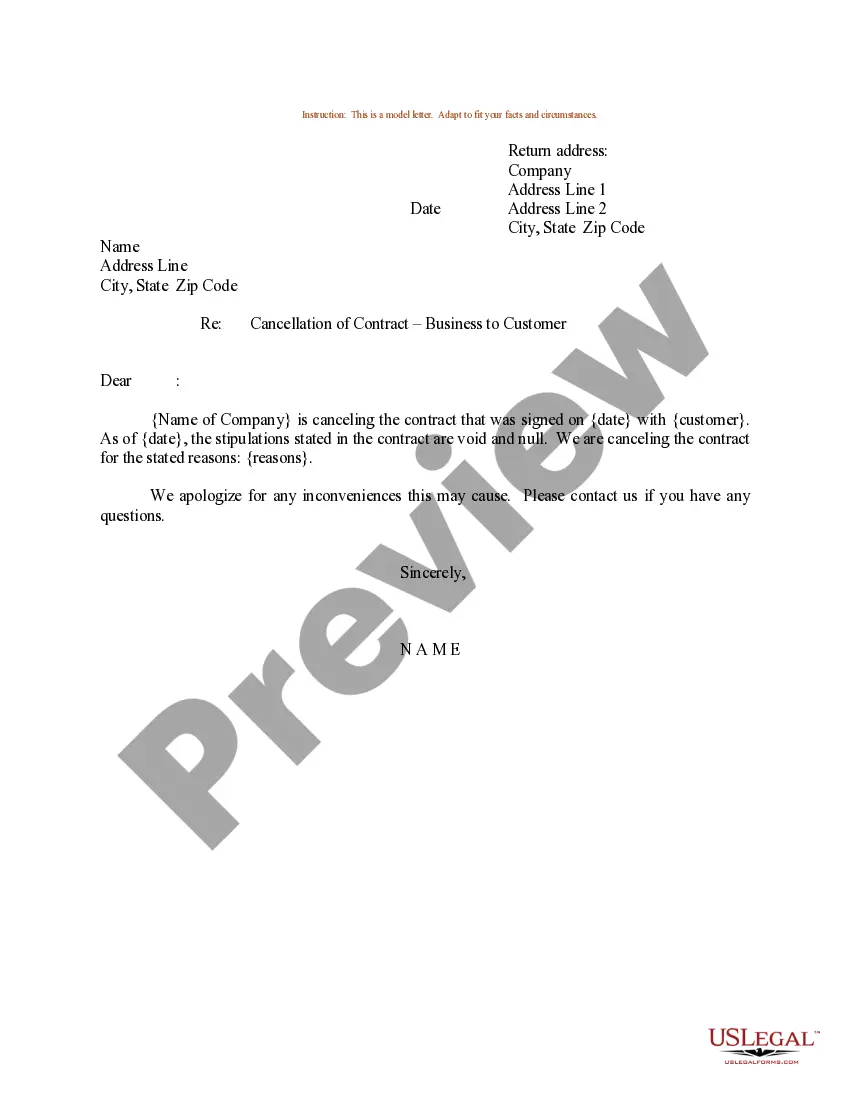

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding document used in real estate transactions to outline the terms and conditions of a loan. This type of promissory note provides security to the lender by leveraging residential real estate as collateral. The Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate is designed to ensure a smooth and transparent lending process between the borrower and the lender. By utilizing this note, both parties can establish clear expectations and responsibilities from the onset. Some key features of the Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate include: 1. Loan Amount: Specifies the total amount borrowed by the borrower, which is typically based on the market value of the residential property being used as collateral. 2. Interest Rate: Sets the fixed interest rate that the borrower will pay throughout the loan term. This rate remains the same, ensuring predictable monthly payments for the borrower. 3. Installment Payments: Outlines the agreed-upon payment schedule, including the frequency, amount, and due dates of the installments. 4. Late Payment Clause: Indicates the penalties or fees that the borrower would incur for late payments. 5. Default and Remedies: Details the actions that the lender may take if the borrower defaults on the loan, such as foreclosure and potential legal proceedings. 6. Prepayment Terms: Outlines whether the borrower can prepay the loan without incurring any penalties and, if applicable, specifies any prepayment fees. Different types of Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate may vary based on specific loan terms, additional provisions, or unique requirements set forth by the lender. Some possible variations may include: 1. Balloon Payment Note: This type of promissory note includes smaller monthly installments over an agreed-upon period, with a larger lump sum payment due at the end of the term. 2. Adjustable Rate Note: Rather than a fixed interest rate, this type of promissory note allows for the interest rate to adjust periodically, typically based on market conditions. 3. Interest-Only Note: In an interest-only promissory note, the borrower pays only the interest portion for an agreed-upon period, with the principal repayment due later in the term or upon a particular event. 4. Non-Recourse Note: This type of promissory note limits the lender's recourse to the collateral (residential real estate). If the borrower defaults, the lender can seize the property but cannot pursue further action against the borrower's other assets. It is essential for both borrowers and lenders to thoroughly review and understand the terms and provisions outlined in the Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate before entering into a loan agreement. Seeking professional legal advice is highly recommended ensuring compliance with local laws and regulations.

Free preview

How to fill out Hennepin Pagaré De Tasa Fija A Plazos De Minnesota Garantizado Por Bienes Raíces Residenciales?

If you’ve already utilized our service before, log in to your account and save the Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Hennepin Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!