Minneapolis, Minnesota Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an appointed individual the authority to handle specific financial matters on behalf of the account holder. This authorized representative, known as the attorney-in-fact, can perform various tasks related to bank accounts. This article will provide a detailed description of this type of power of attorney, its purpose, and the different variations available in Minneapolis, Minnesota. A Special Durable Power of Attorney for Bank Account Matters specifically concentrates on granting powers related to financial decisions concerning bank accounts. The durable aspect ensures that the authority of the attorney-in-fact remains valid even if the account holder becomes incapacitated or unable to make decisions on their own. This type of power of attorney allows individuals to plan for unforeseen circumstances where they may be unable to manage their bank accounts. By establishing a Minneapolis, Minnesota Special Durable Power of Attorney, individuals can ensure that someone they trust will be able to handle their financial affairs without the need for court intervention. Some of the tasks that an attorney-in-fact can perform under this power of attorney include: 1. Depositing and withdrawing funds: The appointed representative is authorized to deposit or withdraw money from the account holder's bank accounts. They can handle routine banking transactions, make payments, and cover necessary expenses. 2. Account management: The attorney-in-fact can manage and monitor the account holder's financial accounts, including checking, savings, or investment accounts. This involves reviewing statements, reconciling balances, and ensuring funds are properly allocated. 3. Bill payment: The attorney-in-fact can pay bills on behalf of the account holder, including utilities, mortgages, credit cards, and other financial obligations. 4. Access to financial information: The power of attorney allows the attorney-in-fact to access account statements, transaction history, and other relevant financial information. This access enables them to make informed decisions regarding the account holder's finances. 5. Financial decision-making: In certain situations, the attorney-in-fact may be authorized to make financial decisions on behalf of the account holder. This may include investing funds, managing assets, or executing financial agreements. Minneapolis, Minnesota offers several variations of the Special Durable Power of Attorney for Bank Account Matters, tailored to meet specific needs: 1. Limited Special Durable Power of Attorney: This grants the attorney-in-fact a limited set of powers, usually specified by the account holder. It allows the account holder to control the extent of authority granted to the attorney-in-fact. 2. General Special Durable Power of Attorney: This grants the attorney-in-fact broad authority over all financial matters related to the account holder's bank accounts. They can handle a wide range of financial transactions and decisions. 3. Springing Special Durable Power of Attorney: This power of attorney becomes effective only upon the occurrence of a specified event, typically the incapacitation or disability of the account holder. Until then, the attorney-in-fact does not have any authority. In conclusion, the Minneapolis, Minnesota Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that allows individuals to designate a trusted representative to handle their financial affairs related to bank accounts. By selecting the appropriate type of power of attorney, individuals can ensure that their financial needs are well-managed, even in unforeseen circumstances.

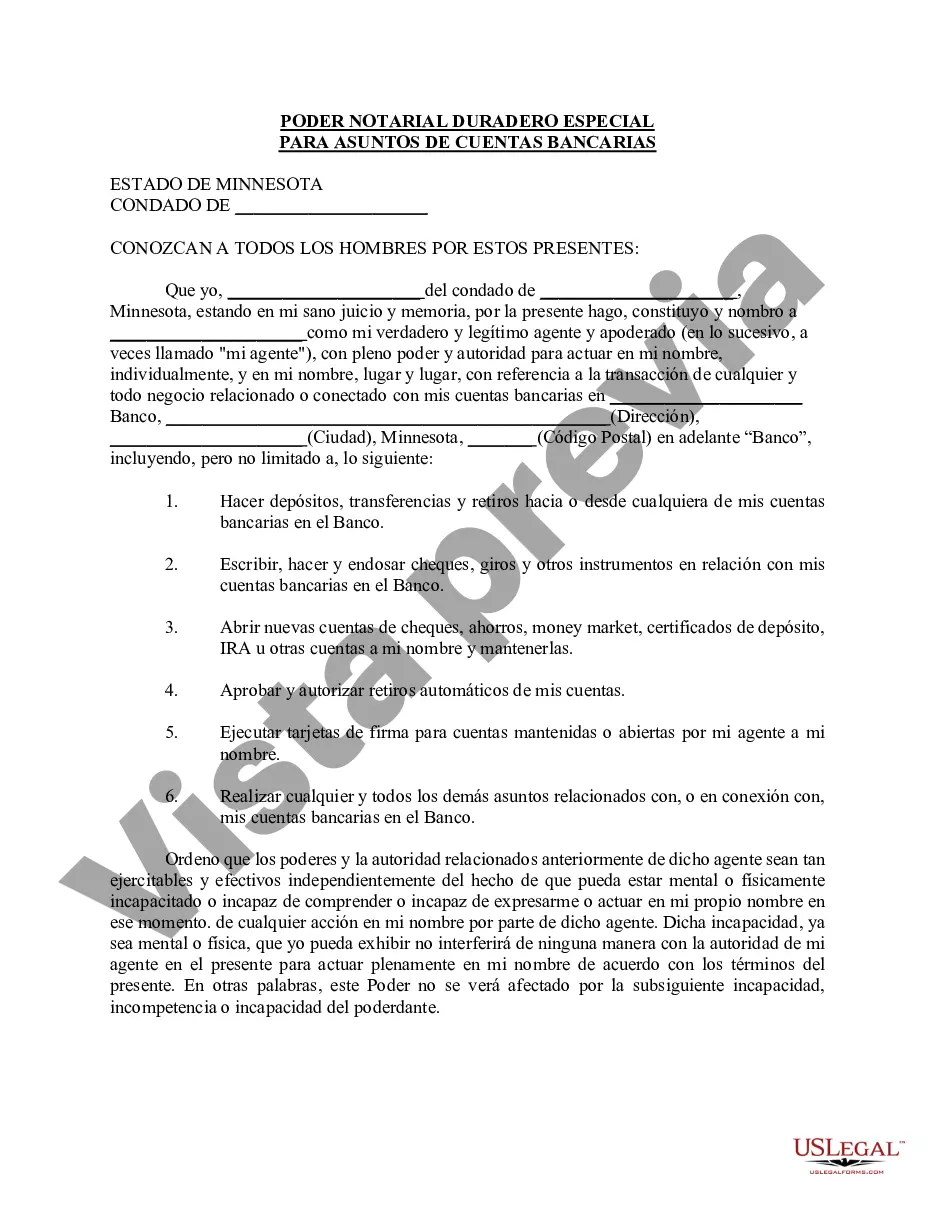

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minneapolis Minnesota Poder especial duradero para asuntos de cuentas bancarias - Minnesota Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Minneapolis Minnesota Poder Especial Duradero Para Asuntos De Cuentas Bancarias?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney services that, usually, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Minneapolis Minnesota Special Durable Power of Attorney for Bank Account Matters or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Minneapolis Minnesota Special Durable Power of Attorney for Bank Account Matters adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Minneapolis Minnesota Special Durable Power of Attorney for Bank Account Matters would work for you, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!