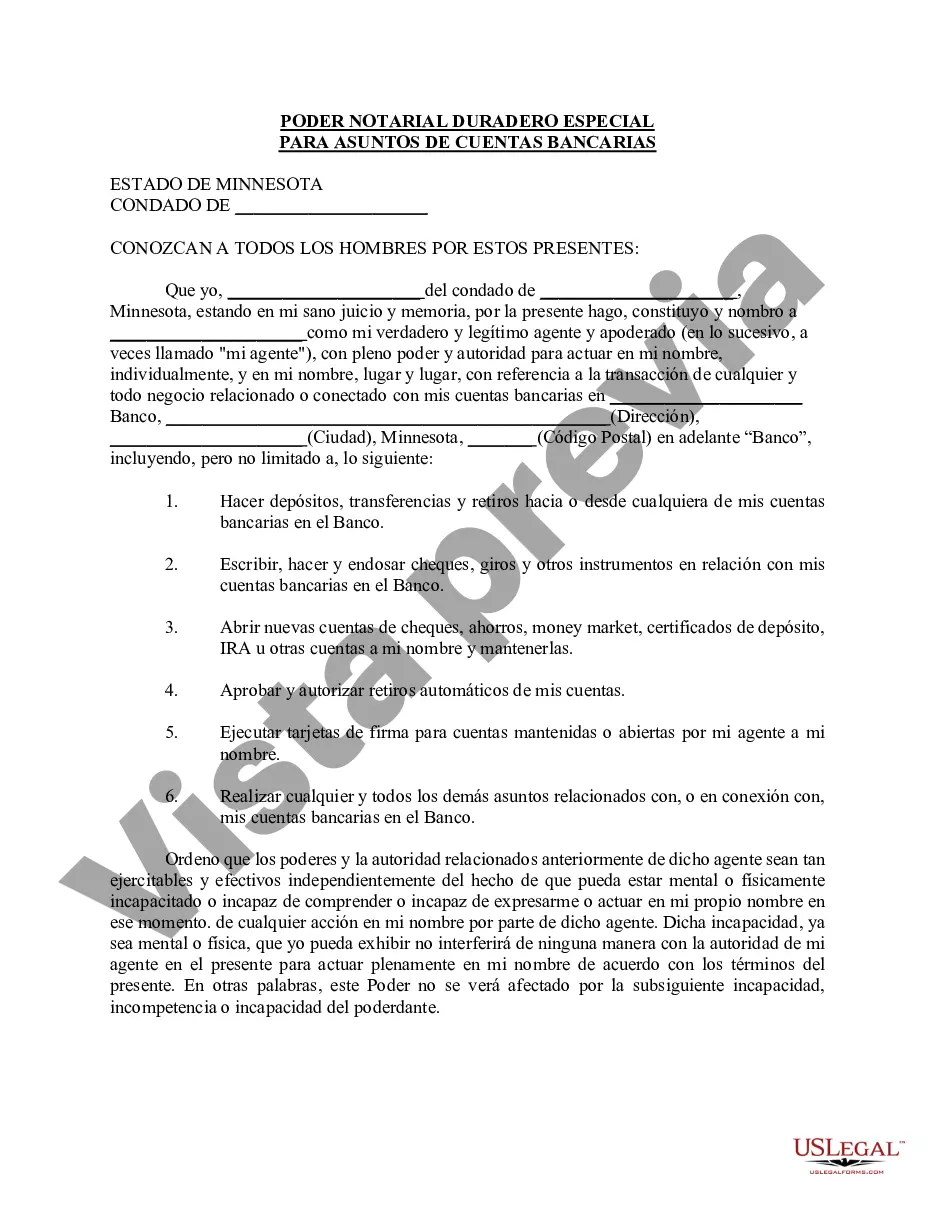

Description: A Special Durable Power of Attorney is an important legal document that allows an individual, known as the principal, to grant another person, known as the agent, the authority to handle their bank account matters in Saint Paul, Minnesota. This power of attorney is designed to specifically address the financial aspects of the principal's bank accounts, providing the agent with the legal ability to make financial decisions, manage funds, and carry out transactions on behalf of the principal. In Saint Paul, Minnesota, there are several types of Special Durable Power of Attorney for Bank Account Matters that individuals can consider, each tailored to specific situations and needs. These variations include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney assigns specific limited powers to the agent. The principal can outline certain financial tasks or transactions the agent is authorized to handle, such as depositing or withdrawing funds, paying bills, or managing investments. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, this type grants the agent the authority to handle a broader range of financial matters related to the principal's bank accounts. The agent may have the ability to open or close accounts, make investment decisions, manage loans, and engage in other financial activities as authorized by the principal. 3. Contingent Special Durable Power of Attorney for Bank Account Matters: This power of attorney comes into effect only if certain conditions specified by the principal are met. For example, it may be activated if the principal becomes incapacitated or unable to manage their own financial affairs. The agent will have the authority to handle the bank account matters until the conditions are no longer met. The Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters allows individuals in the area to plan for potential incapacity or delegate financial decision-making responsibilities to a trusted person of their choice. It is crucial to consult with a qualified attorney while creating this legal document to ensure it complies with the specific laws and requirements of Saint Paul, Minnesota.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Saint Paul Minnesota Poder especial duradero para asuntos de cuentas bancarias - Minnesota Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Saint Paul Minnesota Poder Especial Duradero Para Asuntos De Cuentas Bancarias?

If you are looking for a relevant form template, it’s extremely hard to choose a more convenient place than the US Legal Forms website – one of the most comprehensive libraries on the internet. Here you can find a large number of templates for business and individual purposes by types and states, or keywords. Using our advanced search option, getting the most up-to-date Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters is as elementary as 1-2-3. Furthermore, the relevance of each and every file is verified by a team of expert attorneys that on a regular basis check the templates on our website and revise them in accordance with the newest state and county laws.

If you already know about our platform and have a registered account, all you need to get the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have opened the sample you require. Look at its explanation and make use of the Preview feature (if available) to check its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the needed file.

- Affirm your decision. Click the Buy now button. Following that, pick your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Select the format and save it to your system.

- Make changes. Fill out, modify, print, and sign the received Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters.

Every single template you add to your profile does not have an expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you need to receive an additional duplicate for editing or printing, you can return and download it once more anytime.

Take advantage of the US Legal Forms extensive library to gain access to the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters you were seeking and a large number of other professional and state-specific templates in a single place!