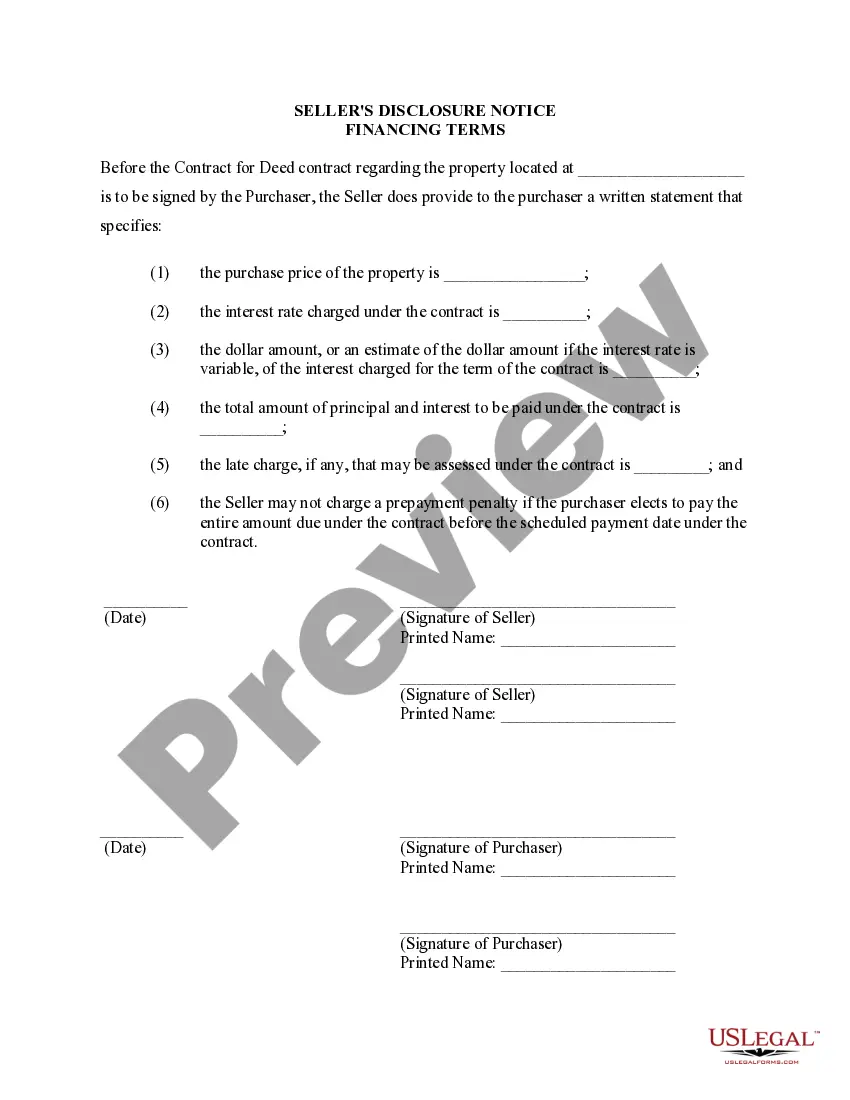

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Springfield Missouri Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Missouri Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you have previously used our service, Log In to your account and store the Springfield Missouri Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also known as Land Contract on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it as per your payment plan.

If this is your initial engagement with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all documents you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

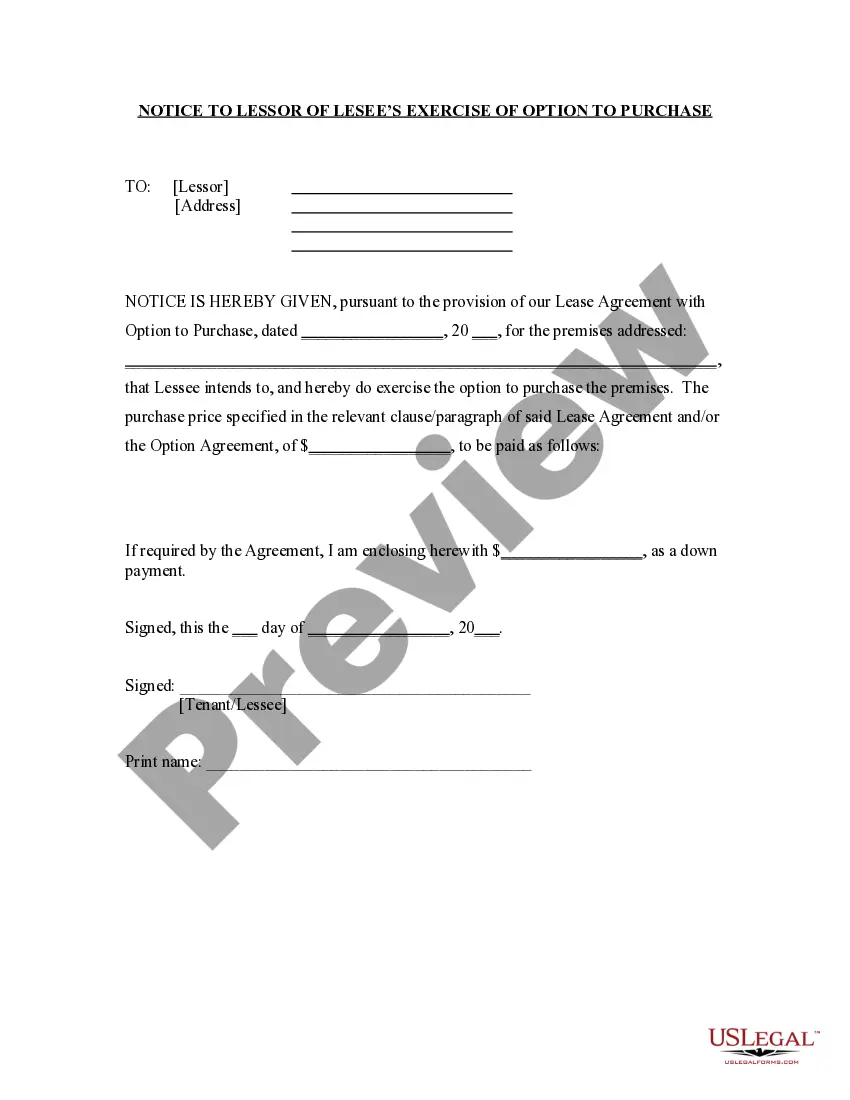

- Confirm you’ve located an appropriate document. Browse the description and utilize the Preview feature, if available, to verify it satisfies your needs. If it is not suitable, use the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Springfield Missouri Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also known as Land Contract. Choose the file format for your document and download it to your device.

- Complete your document. Print it or utilize professional online editing tools to fill it out and sign it digitally.

Form popularity

FAQ

Write the contract in six steps Start with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons. During the term of the contract, the purchaser has ?equitable title? to the property.

How do I write a Sales Agreement? Specify your location.Provide the buyer's and seller's information.Describe the goods and services.State the price and deposit details (if applicable)Outline payment details.Provide delivery terms.Include liability details.State if there's a warranty on the goods.

A contract of sale of land is an agreement between a buyer and a seller of land stating the considerations, obligations and other terms for the transfer of land ownership. Where there is a contract to buy land, no party can rescind from the contract without being liable for a breach of contract.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.

An agreement for deed is often referred to as ?land contract.? This arrangement is where a seller provides owner financing to a buyer. In turn, this allows a buyer to make monthly payments to the seller (instead of a bank). The seller will transfer the property title once receiving a certain amount of money.

Sale agreement format The price of the property more fully set out in the Schedule is fixed at Rs???????..The purchaser has paid to the vendor this day the sum of Rs???????.The time for performance of the agreement shall be???????.The purchaser shall pay to the vendor the balance sale price of Rs????.

Clauses That go Into an Agreement to Sell Names of the buyer and seller, their age, and residential addresses. Date and place of execution of the agreement. Competence of parties to enter into the agreement. Rights and liabilities. Details and documents of how the seller came to own the property.