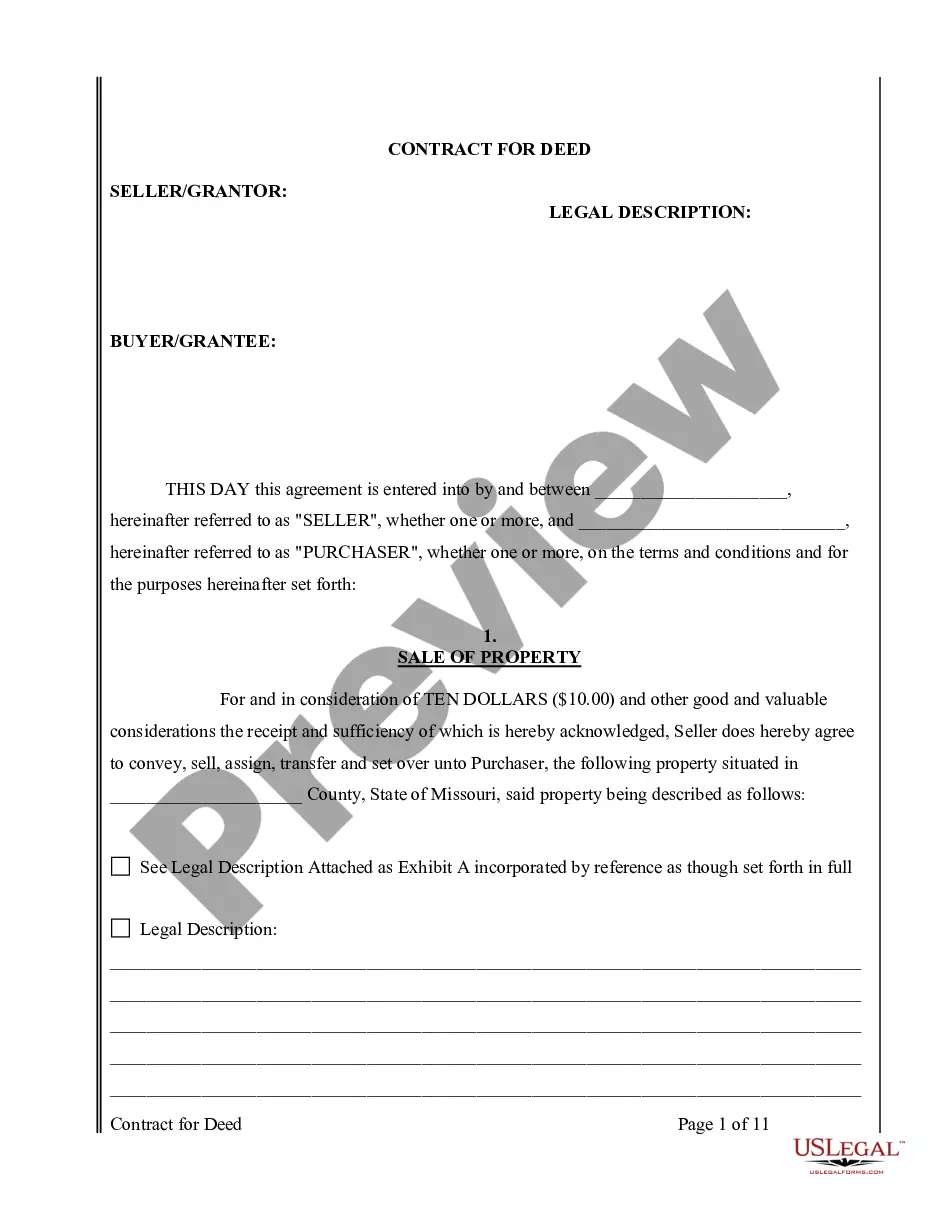

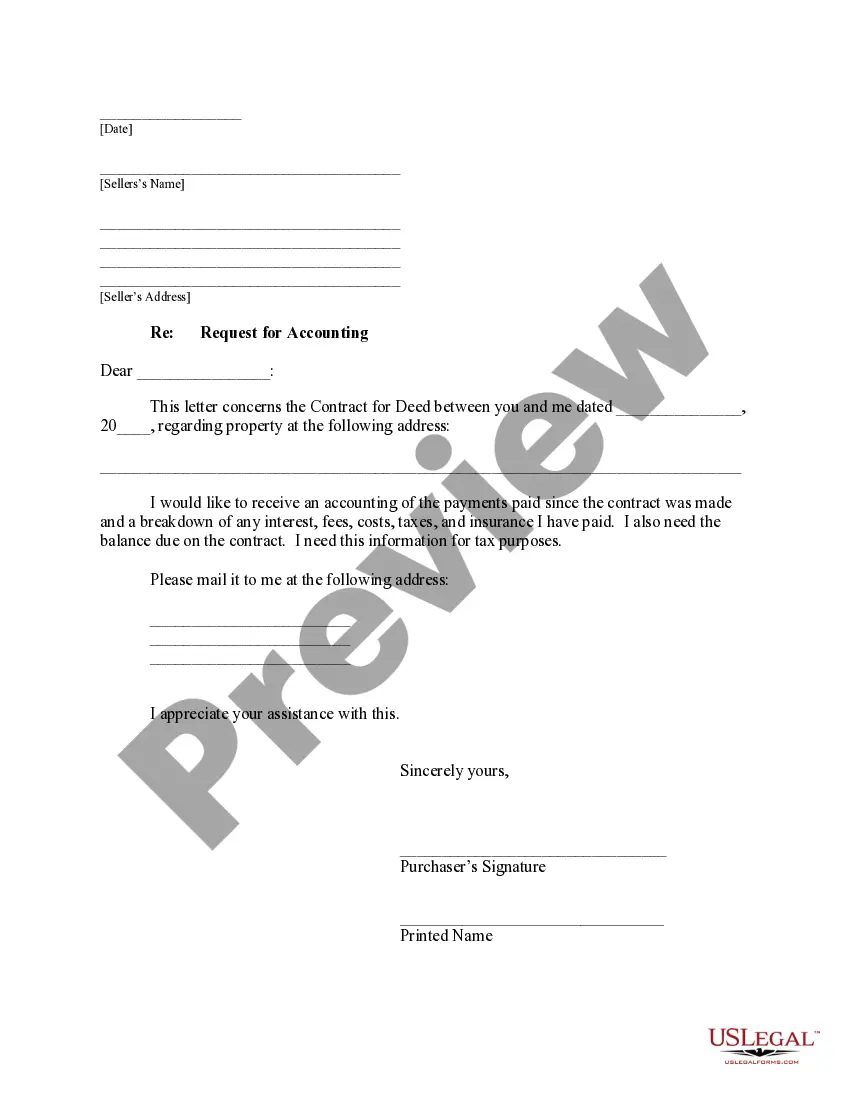

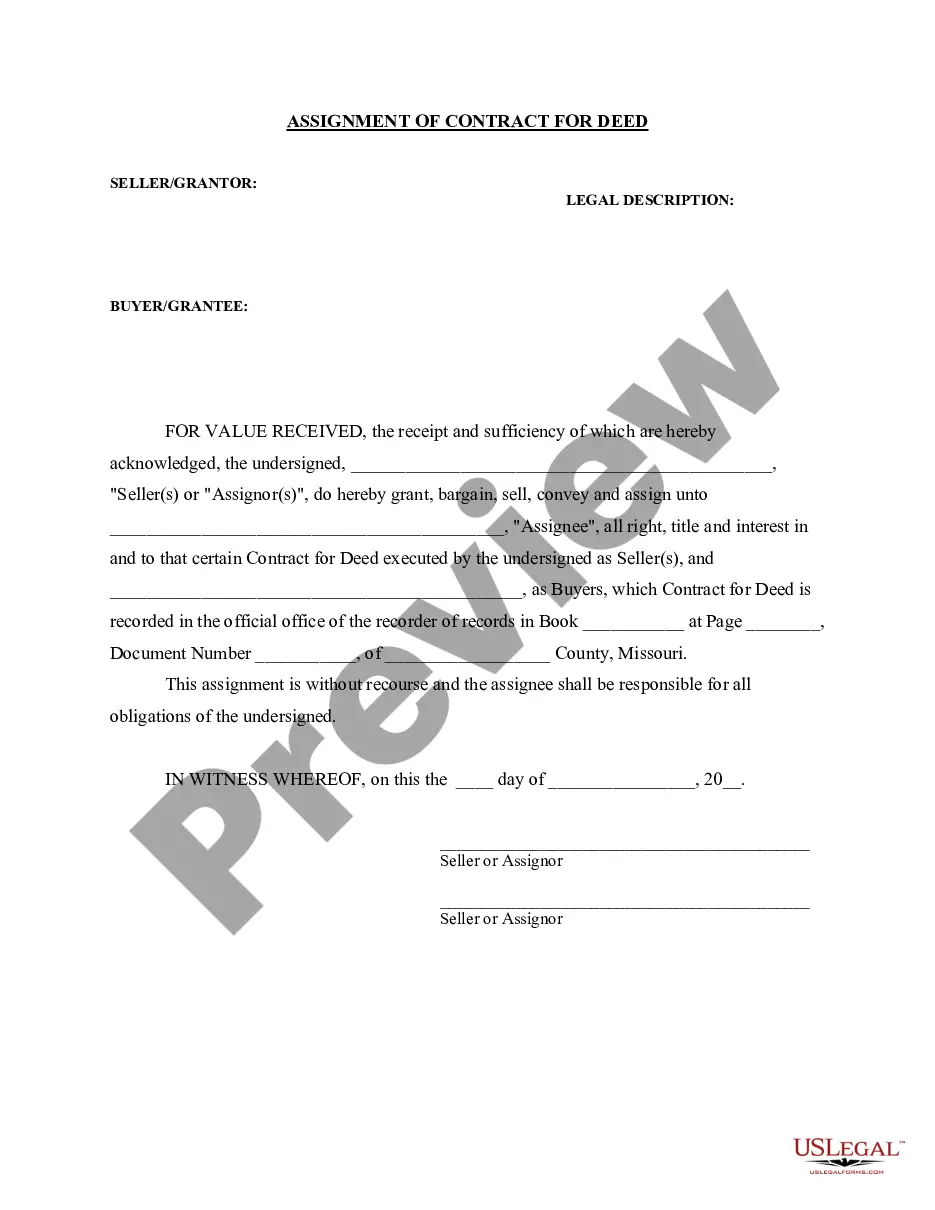

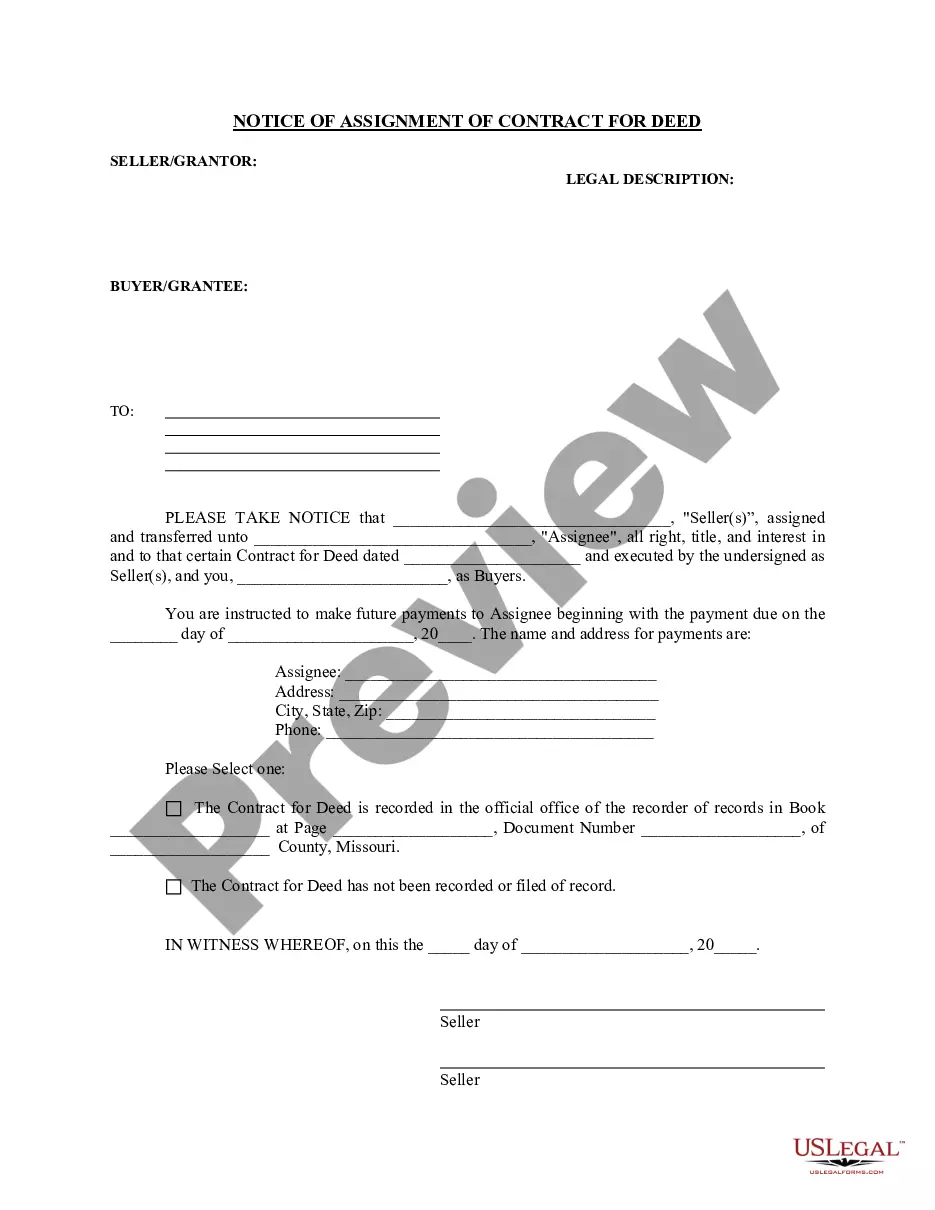

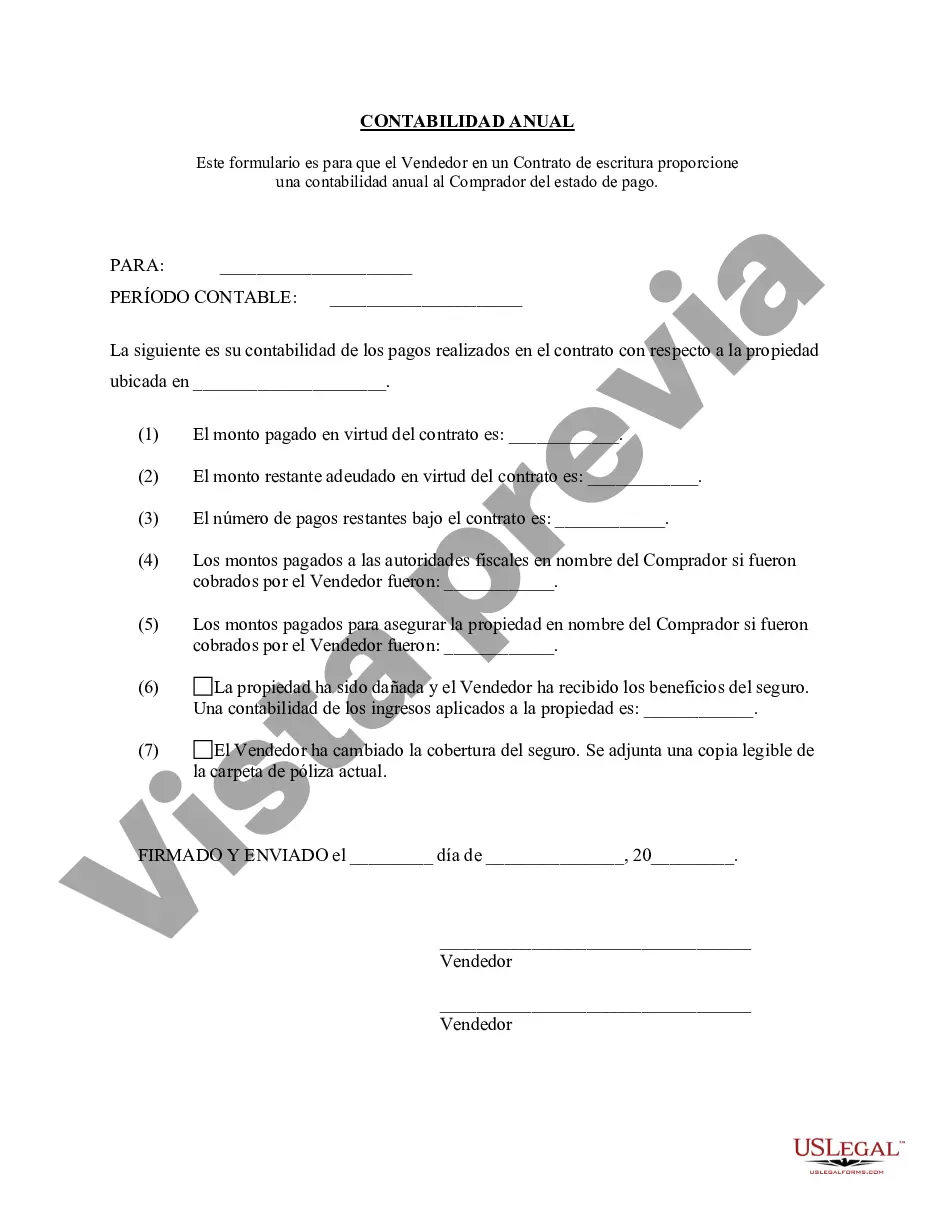

The Kansas City Missouri Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of the financial transactions and obligations between the seller and the buyer in a contract for deed agreement. This statement ensures transparency and accountability in the real estate transaction, safeguarding the rights of both parties involved. The Contract for Deed Seller's Annual Accounting Statement outlines all the financial aspects, including payments made by the buyer, expenses incurred by the seller, and any outstanding balances. It serves as a tool to assess the financial status of the contract, as well as ensure that all payments and obligations are being met in a timely manner. Key elements included in the Kansas City Missouri Contract for Deed Seller's Annual Accounting Statement are: 1. Purchase Price: This section details the agreed-upon purchase price of the property as specified in the contract for deed. 2. Payment Schedule: The annual accounting statement provides a breakdown of the payment schedule for the buyer, specifying the amount due each year, including principal and interest. 3. Payments Received: The statement includes a detailed record of all payments received from the buyer during the accounting period, including dates and amounts. 4. Expenses Incurred: The seller's expenses related to the property, such as property taxes, insurance, maintenance, or repairs, are itemized and documented in this section. 5. Outstanding Balances: Any remaining balance owed by the buyer is highlighted, along with any applicable penalties or interest that may have accrued. 6. Escrow Account: In some cases, a contract for deed may require the establishment of an escrow account to ensure the buyer's compliance with financial obligations. This section outlines the status of the escrow account, including any funds held and disbursements made. 7. Legal Obligations: The annual accounting statement may include information regarding legal obligations related to the contract for deed, such as liens, judgments, or pending legal actions that may affect the property or the parties involved. Types of Kansas City Missouri Contract for Deed Seller's Annual Accounting Statements: 1. Residential Contract for Deed Seller's Annual Accounting Statement: This statement applies to residential properties, including single-family homes, condos, or townhouses. 2. Commercial Contract for Deed Seller's Annual Accounting Statement: Specifically designed for commercial properties, this statement encompasses financial details related to office buildings, retail spaces, industrial properties, or vacant land intended for commercial use. By maintaining a detailed Kansas City Missouri Contract for Deed Seller's Annual Accounting Statement, both the seller and the buyer can ensure transparency, monitor financial responsibilities, and resolve any potential disputes with clarity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas City Missouri Contrato de Escrituración Estado Contable Anual del Vendedor - Missouri Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Kansas City Missouri Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you are searching for a relevant form, it’s difficult to find a better service than the US Legal Forms site – one of the most extensive libraries on the internet. Here you can get a large number of templates for business and individual purposes by types and regions, or keywords. Using our high-quality search feature, discovering the latest Kansas City Missouri Contract for Deed Seller's Annual Accounting Statement is as easy as 1-2-3. In addition, the relevance of every record is proved by a team of skilled attorneys that on a regular basis review the templates on our platform and update them in accordance with the newest state and county demands.

If you already know about our platform and have a registered account, all you need to get the Kansas City Missouri Contract for Deed Seller's Annual Accounting Statement is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have chosen the form you require. Look at its explanation and use the Preview feature (if available) to explore its content. If it doesn’t meet your needs, use the Search option at the top of the screen to get the needed file.

- Affirm your selection. Choose the Buy now button. After that, pick the preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Get the template. Pick the format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Kansas City Missouri Contract for Deed Seller's Annual Accounting Statement.

Every single template you save in your profile has no expiry date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you need to get an extra copy for modifying or creating a hard copy, you may return and download it again whenever you want.

Make use of the US Legal Forms professional catalogue to gain access to the Kansas City Missouri Contract for Deed Seller's Annual Accounting Statement you were looking for and a large number of other professional and state-specific templates on one website!