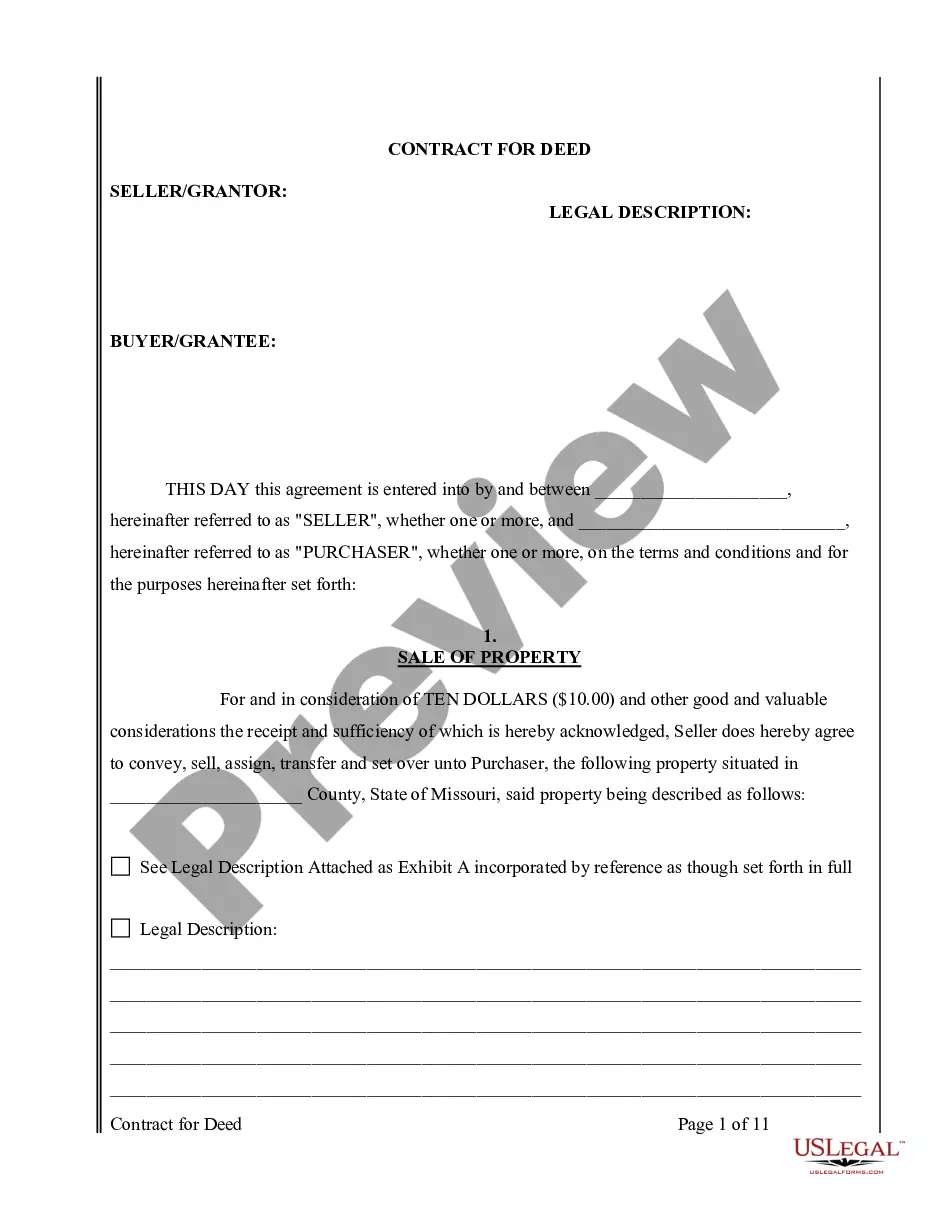

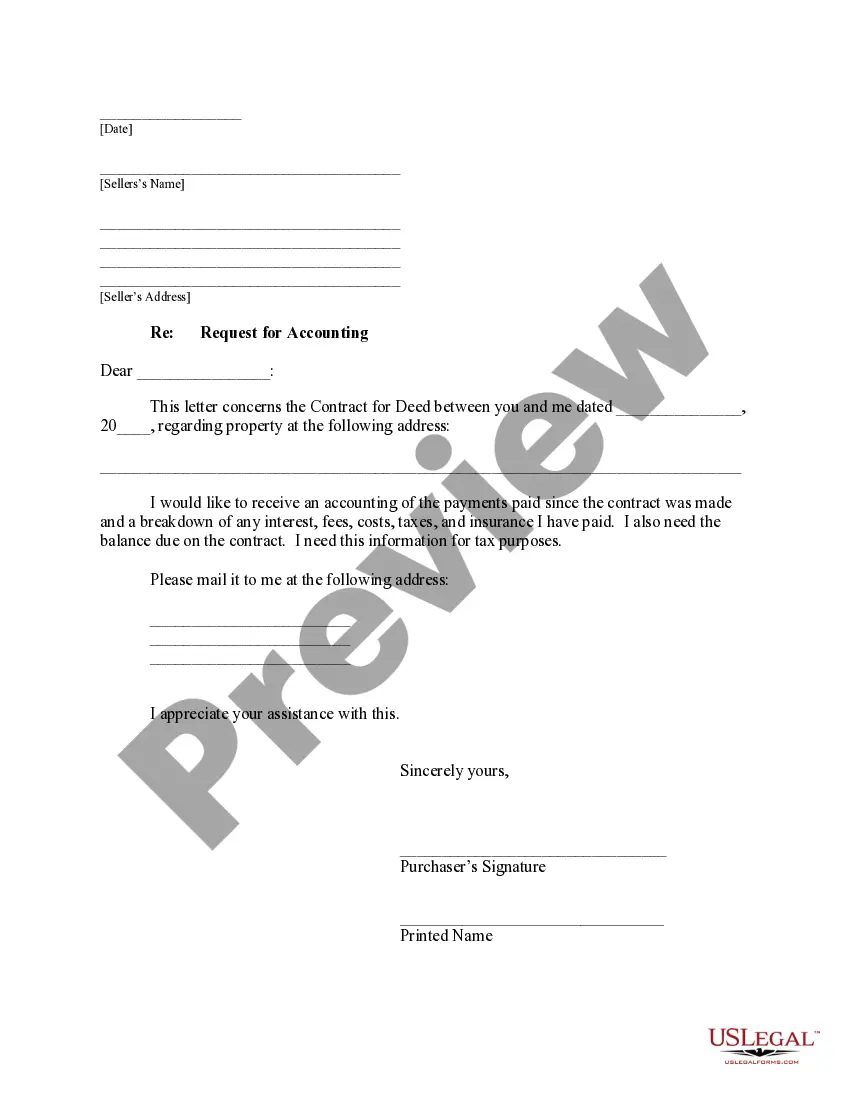

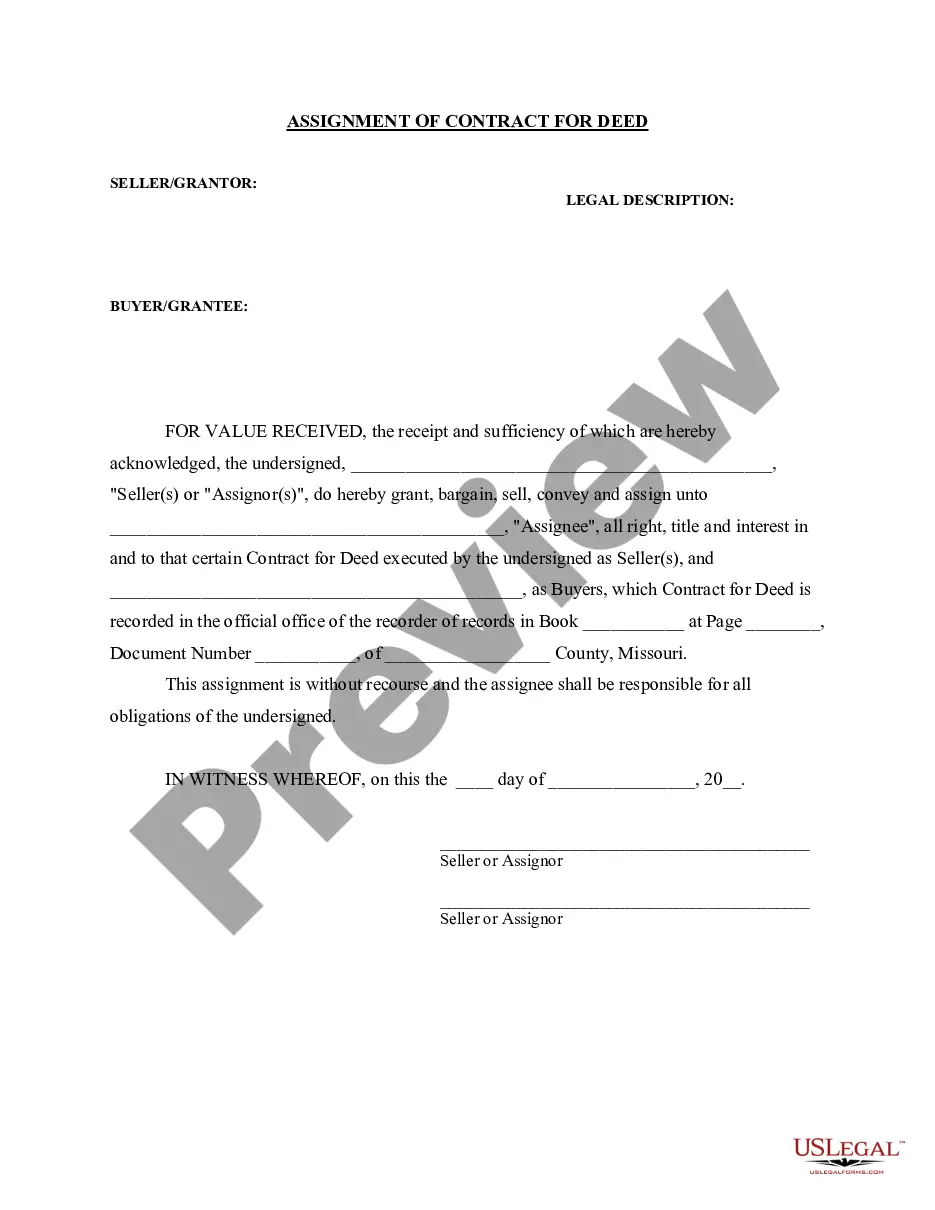

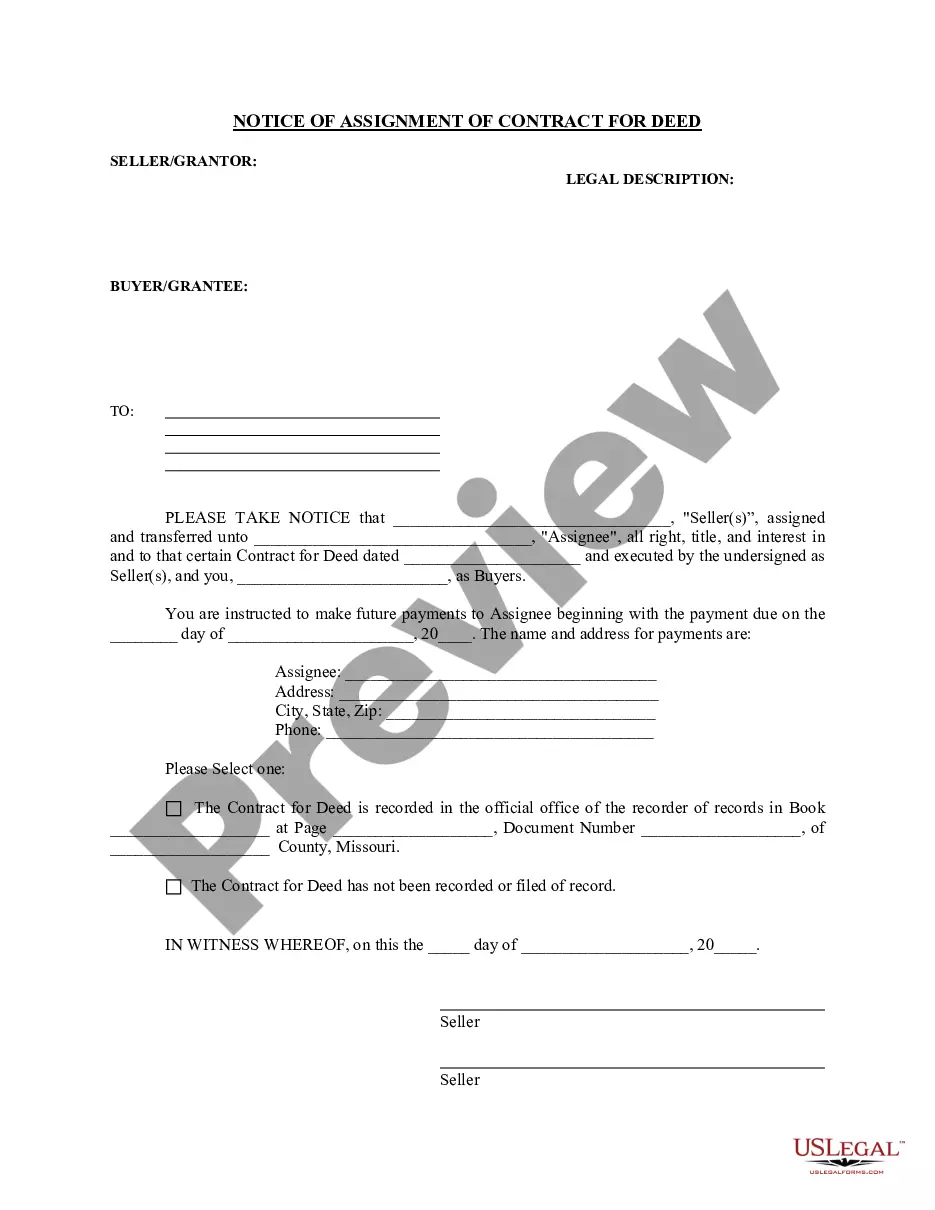

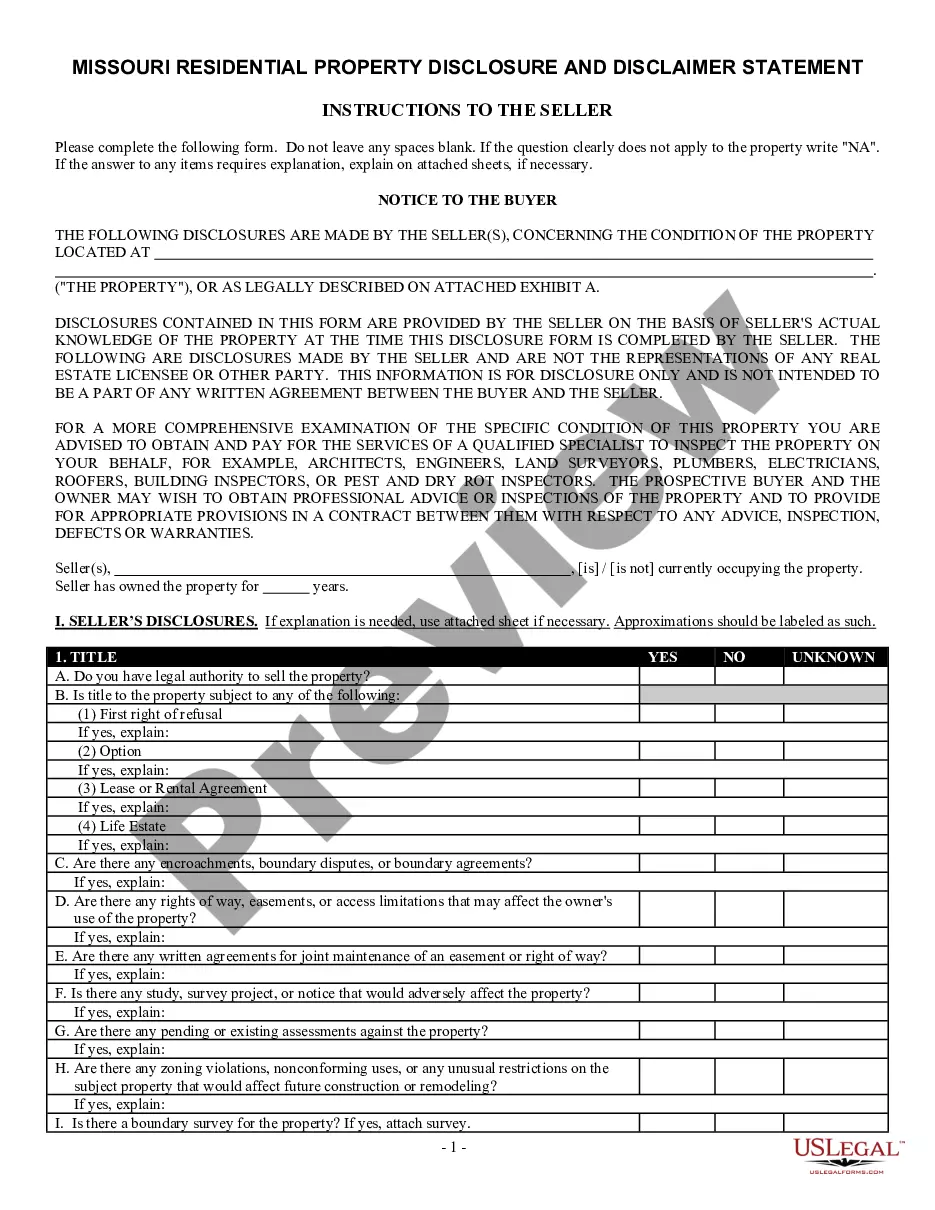

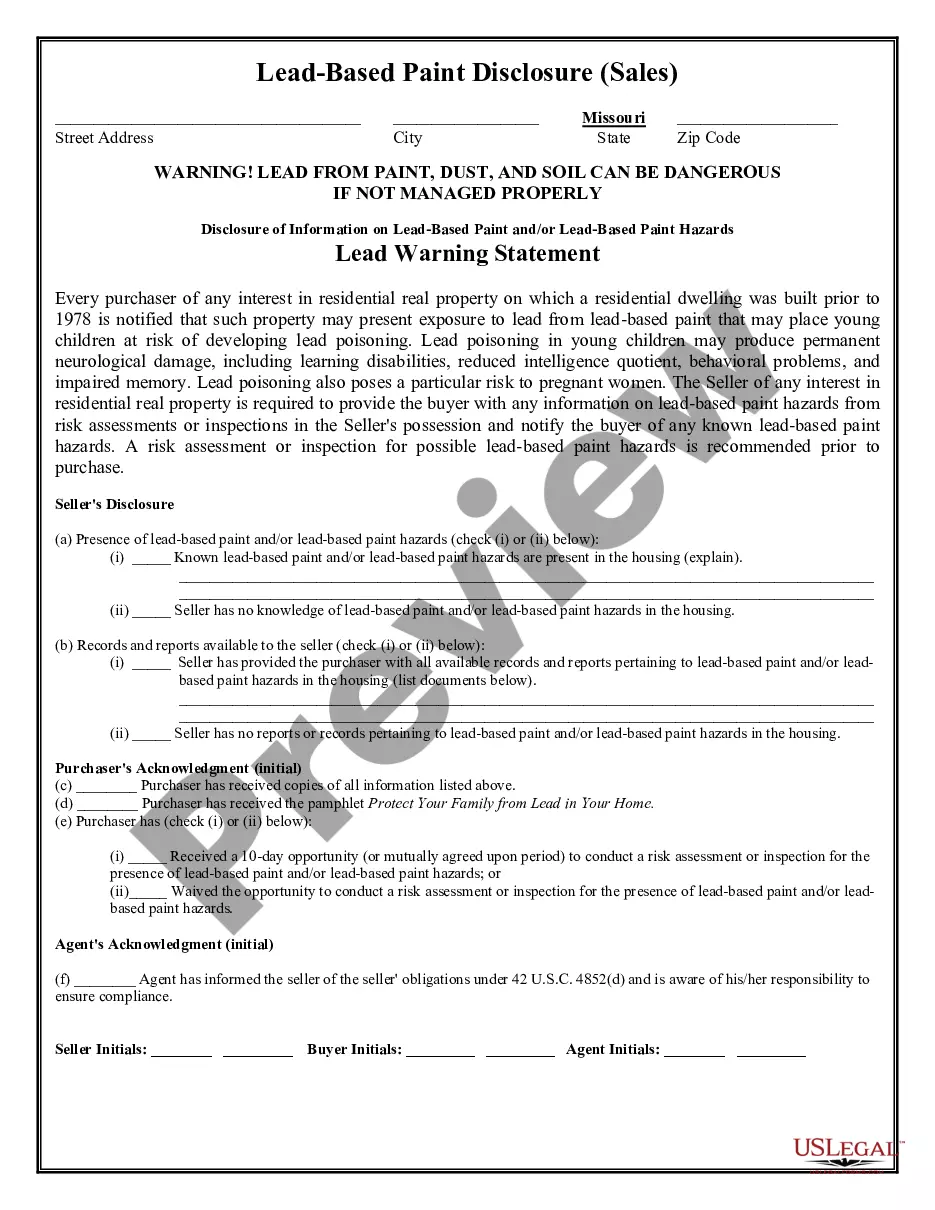

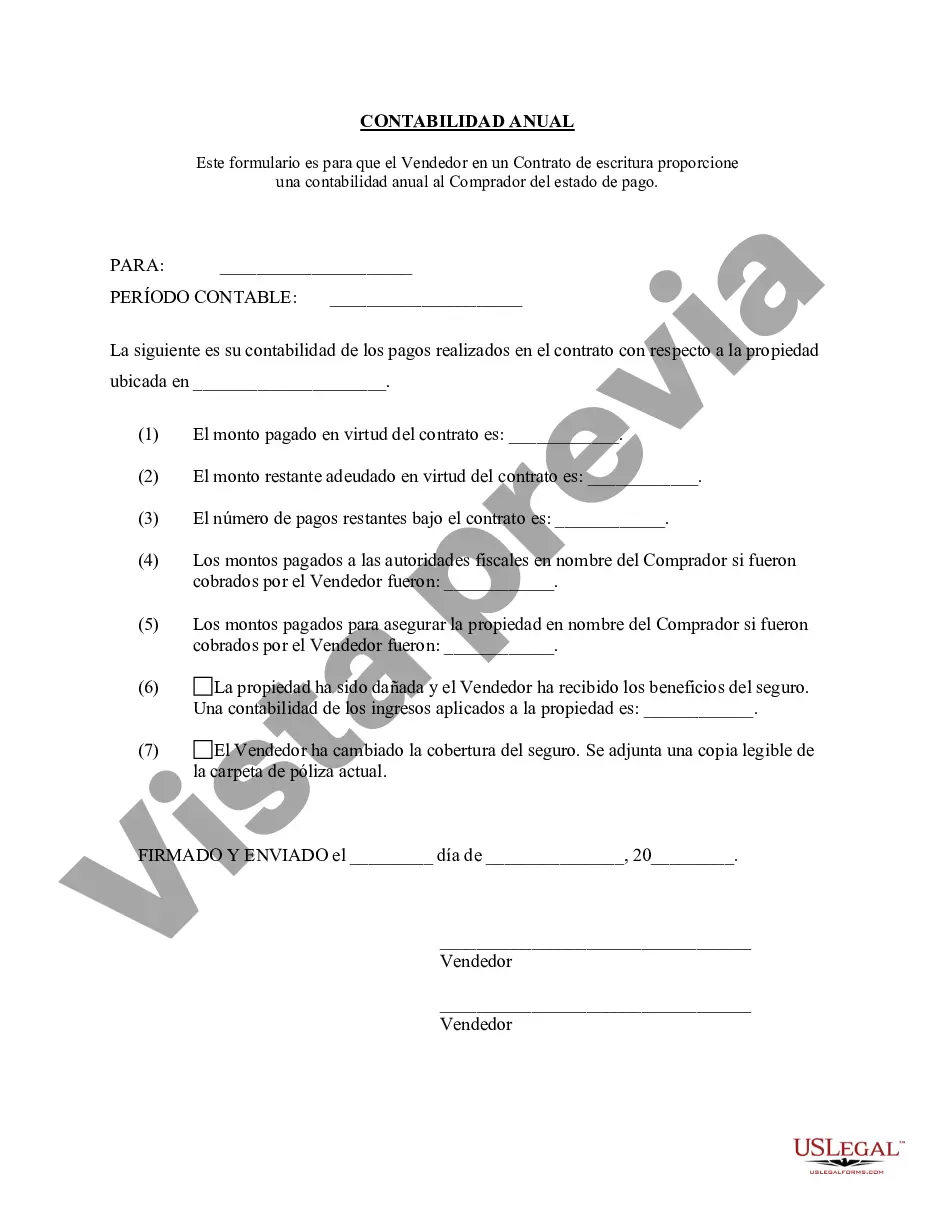

A Springfield, Missouri Contract for Deed Seller's Annual Accounting Statement is a document that sellers of properties utilizing a contract for deed in Springfield, Missouri, must provide to the buyer on an annual basis. This accounting statement serves as a detailed record of the financial transactions and obligations related to the contract for deed agreement. Keywords: Springfield, Missouri, Contract for Deed, Seller's Annual Accounting Statement, properties, buyer, financial transactions, obligations. There are various types of Springfield, Missouri Contract for Deed Seller's Annual Accounting Statements, including: 1. Standard Seller's Annual Accounting Statement: This is the most common type of accounting statement provided by sellers to buyers. It includes a comprehensive breakdown of all financial transactions and obligations for the year, such as principal and interest payments, property taxes, insurance premiums, and any additional charges. 2. Detailed Transaction Statement: This type of accounting statement provides a more in-depth breakdown of each individual financial transaction throughout the year. It includes specific dates, amounts, and descriptions of all payments made and received, allowing for a thorough understanding of the financial history of the contract for deed. 3. Tax Summary Statement: This accounting statement focuses primarily on the tax-related aspects of the contract for deed. It includes details about property tax payments made by the seller, any tax credits or deductions applied, and the buyer's responsibilities regarding tax obligations. 4. Insurance Statement: In cases where the seller is responsible for maintaining the property's insurance coverage, an Insurance Statement is provided as part of the Seller's Annual Accounting Statement. This document outlines the insurance premiums paid, coverage details, and any claims filed throughout the year. 5. Escrow Account Statement: If an escrow account is established for the contract for deed, the seller must provide an Escrow Account Statement along with the annual accounting statement. This statement includes details of all funds held in escrow, including any interest earned or disbursements made. By providing a detailed and accurate Seller's Annual Accounting Statement, sellers ensure transparency and maintain a clear record of all financial transactions pertaining to the contract for deed agreement. It allows buyers to review and verify the financial aspects of their investment, supporting a mutually beneficial and trustworthy relationship between the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Springfield Missouri Contrato de Escrituración Estado Contable Anual del Vendedor - Missouri Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Springfield Missouri Contrato De Escrituración Estado Contable Anual Del Vendedor?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, usually, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Springfield Missouri Contract for Deed Seller's Annual Accounting Statement or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Springfield Missouri Contract for Deed Seller's Annual Accounting Statement adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Springfield Missouri Contract for Deed Seller's Annual Accounting Statement is proper for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!