Acuerdo o Contrato de Escritura de Venta y Compra de Bienes Raíces a/k/a Terreno o Contrato de Ejecución

Missouri Case Law

TITLE XXIX OWNERSHIP AND CONVEYANCE OF PROPERTY

Chapter 442 TITLES AND CONVEYANCE OF REAL ESTATE GENERALLY

442.010. Definitions.

When used in this chapter unless otherwise apparent from the context:

(1) The term "adult" shall be construed as meaning any person who is eighteen years of age or older;

(2) The term "minor" shall be construed as meaning any person who is less than eighteen years of age;

(3) The term "real estate" shall be construed as coextensive in meaning with lands, tenements and hereditaments, and as embracing all chattels real and as including a manufactured home as defined in section 700.010, which is real estate as defined in subsection 7 of section 442.015.

(RSMo 1939 § 3439, A.L. 1974 2d Ex. Sess. S.B. 2, A.L. 2010 S.B. 630) Prior revisions: 1929 § 3052; 1919 § 2211; 1909 § 2822 Effective 3-01-11

TITLE XXIX OWNERSHIP AND CONVEYANCE OF PROPERTY

Chapter 442 TITLES AND CONVEYANCE OF REAL ESTATE GENERALLY

442.020. Conveyances of lands.

Conveyances of lands, or of any estate or interest therein, may be made by deed executed by any person having authority to convey the same, or by his agent or attorney, and acknowledged and recorded as herein directed, without any other act or ceremony whatever.

(RSMo 1939 § 3401) Prior revisions: 1929 § 3014; 1919 § 2174; 1909 § 2787 CROSS REFERENCE: Statute of frauds--conveyances to be in writing, 432.010

TITLE XXIX OWNERSHIP AND CONVEYANCE OF PROPERTY

Chapter 442 TITLES AND CONVEYANCE OF REAL ESTATE GENERALLY

442.025. Conveyance to self and others to create joint estate.

1. Any person or persons owning real estate, or any interest therein, which he or they have power to convey, may effectively convey such real estate by a conveyance naming himself or themselves and another person or persons, or one or more of themselves and another person or persons, as grantees, and the conveyance has the same effect as to whether it creates a joint tenancy, or tenancy by the entireties, or tenancy in common, or tenancy in partnership, as if it were a conveyance from a stranger who owned the real estate to the persons named as grantees in the conveyance.

2. Any two or more persons owning real estate, or any interest therein, which they have power to convey, may effectively convey such real estate by a conveyance naming one, or more than one, or all such persons as grantees, and the conveyance has the same effect, as to whether it creates a separate ownership, or a joint tenancy, or tenancy by the entireties, or tenancy in common, or tenancy in partnership, as if it were a conveyance from a stranger who owned the real estate, to the persons named as grantees in the conveyance.

3. Any "person" mentioned in this section may be a married person, and any "persons" so mentioned may be persons married to each other.

(L. 1953 p. 615 § 442.024) CROSS REFERENCE: Homestead, conveyance requirements, 513.475

TITLE XXIX OWNERSHIP AND CONVEYANCE OF PROPERTY

Chapter 442 TITLES AND CONVEYANCE OF REAL ESTATE GENERALLY

442.130. Execution of deeds and other conveyances.

All deeds or other conveyances of lands, or of any estate or interest therein, shall be subscribed by the party granting the same, or by his lawful agent, and shall be acknowledged or proved and certified in the manner herein prescribed.

(RSMo 1939 § 3406) Prior revisions: 1929 § 3019; 1919 § 2179; 1909 § 2792 (2002) Section only requires the grantor actually conveying the interest in real property to subscribe a deed. Beck v. Beck, 90 S.W.3d 509 (Mo.App.E.D.).

TITLE XXIX OWNERSHIP AND CONVEYANCE OF PROPERTY

Chapter 442 TITLES AND CONVEYANCE OF REAL ESTATE GENERALLY

442.150. Proof or acknowledgment, by whom taken.

The proof or acknowledgment of every conveyance or instrument in writing affecting real estate in law or equity, including deeds of married women, shall be taken by some one of the following courts or officers:

(1) If acknowledged or proved within this state, by some court having a seal, or some judge, justice or clerk thereof, or a notary public; or

(2) If acknowledged or proved without this state and within the United States, by any notary public or by any court of the United States, or of any state or territory, having a seal, or the clerk of any such court or any commissioner appointed by the governor of this state to take the acknowledgment of deeds;

(3) If acknowledged or proved without the United States, by any court of any state, kingdom or empire having a seal or the mayor or chief officer of any city or town having an official seal or by any minister or consular officer of the United States or notary public having a seal.

(RSMo 1939 § 3408, A. 1949 S.B. 1124) Prior revisions: 1929 § 3021; 1919 § 2181; 1909 § 2794 CROSS REFERENCES: Acknowledgment of deed of trust taken before trustee in said deed deemed valid, when, 443.030 Commissioners of deeds in sister states, appointment, oath, powers, 486.100 to 486.140

TITLE XXIX OWNERSHIP AND CONVEYANCE OF PROPERTY

Chapter 442 TITLES AND CONVEYANCE OF REAL ESTATE GENERALLY

442.380. Instruments to be recorded.

Every instrument in writing that conveys any real estate, or whereby any real estate may be affected, in law or equity, proved or acknowledged and certified in the manner herein prescribed, shall be recorded in the office of the recorder of the county in which such real estate is situated.

(RSMo 1939 § 3426) Prior revisions: 1929 § 3039; 1919 § 2198; 1909 § 2809 CROSS REFERENCES: Deed acknowledged and recorded under former law or copy, admissible in evidence, when, 490.290, 490.300, 490.310 Deed recorded before proof or acknowledgment, admissible in evidence, when, 490.320, 490.330 Idem sonans in names in instruments affecting real estate, rule as to admissibility, 490.450 Index of recorded instruments to be kept, 59.470 Instruments affecting real estate or copy read in evidence, when, 490.410, 490.420 Judgment or decree quieting or passing title to be recorded, 511.320 Recording of instruments in class one counties where recorder is required to maintain offices both at the county seat and another place in the county, 59.163 (2004) Special tax bill and resulting lien authorized by section 88.812 are not subject to recording requirement of section or to "first in time, first in right" rule of perfecting a security interest. Golden Delta Enterprises v. City of Arnold, 151 S.W.3d 119 (Mo.App.E.D.). (2012) Application of recording statutes and the "first spade rule"for mechanic's liens in section 429.060 provide that a purchase-money deed of trust recorded after the commencement of work on a project is inferior to any mechanic's liens arising on the land from that work. Bob DeGeorge Associates v. Hawthorn Bank, 377 S.W.3d 592 (Mo.banc).

TITLE XXXI TRUSTS AND ESTATES OF DECEDENTS AND PERSONS UNDER DISABILITY

Chapter 461 NONPROBATE TRANSFERS LAW

461.025. Deeds effective on death of owner - recording, effect. -

1. A deed that conveys an interest in real property to a grantee designated by the owner, that expressly states that the deed is not to take effect until the death of the owner, transfers the interest provided to the designated grantee beneficiary, effective on death of the owner, if the deed is executed and filed of record with the recorder of deeds in the city or county or counties in which the real property is situated prior to the death of the owner. A beneficiary deed need not be supported by consideration or be delivered to the grantee beneficiary. A beneficiary deed may be used to transfer an interest in real property to a trust estate, regardless of such trust’s revocability.<br />

<br />

2. This section does not preclude other methods of conveyancing that are permitted by law and that have the effect of postponing enjoyment of an interest in real property until the death of the owner. This section does not invalidate any deed, otherwise effective by law to convey title to the interest and estates therein provided, that is not recorded until after the death of the owner.<br />

<br />

(L. 1989 H.B. 145 § 25, A.L. 1994 S.B. 701, A.L. 1995 S.B. 116)<br />

<br />

461.026. Procedure to transfer tangible personal property to take effect on death of owner. —<br />

<br />

1. A deed of gift, bill of sale or other writing intended to transfer an interest in tangible personal property, that expressly states that the transfer is not to take effect until the death of the owner, transfers ownership to the designated transferee beneficiary, effective on death of the owner, if the instrument is in other respects sufficient to transfer the type of property involved and is executed by the owner and acknowledged before a notary public or other person authorized to administer oaths. A beneficiary transfer instrument need not be supported by consideration or be delivered to any transferee beneficiary.<br />

<br />

2. This section does not preclude other methods of transferring ownership of tangible personal property that are permitted by law and that have the effect of postponing enjoyment of property until the death of the owner.<br />

<br />

(L. 1995 S.B. 116)<br />

<br />

Missouri Case Law<br />

<br />

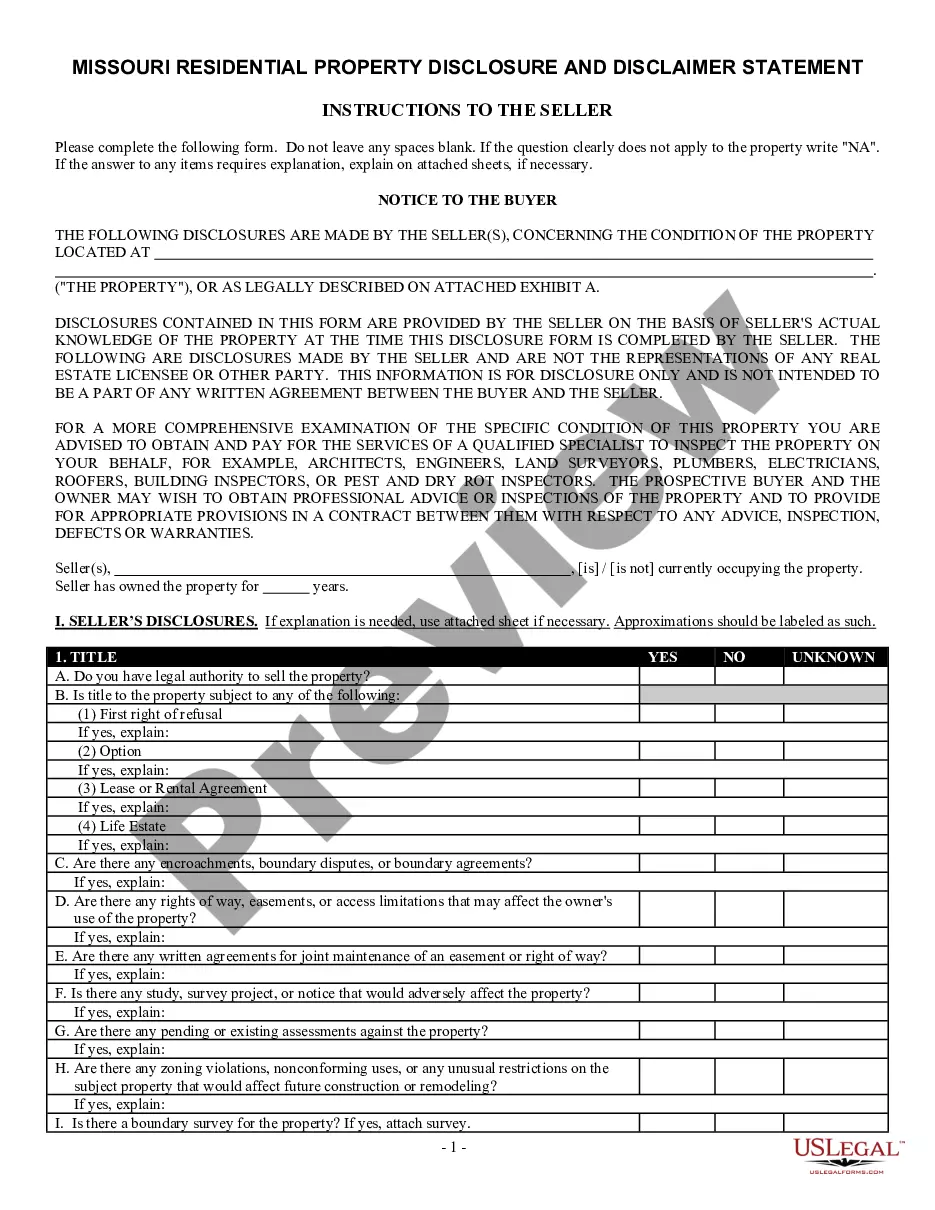

Generally, a contract for deed, also referred to as an installment land sale contract, is used as a substitute or alternative to a mortgage or deed of trust. Under a contract for deed, the buyer of real estate makes a down payment and agrees to make remaining payments at a specified rate of interest in installments to the seller. The buyer normally takes possession of the property at the time the contract for deed is made. The seller agrees to convey the property to the buyer by delivering a warranty deed upon completion of the installment payments. The seller remains the record owner and the buyer under such contract does not receive legal title to the property until the installment payments are completed. Prior to the end of the installment payments, the buyer has an equitable ownership interest. Ryan v. Speigelhalter, 64 S.W.3d 302 (2002).<br />

<br />

The contract for deed is a form of owner financing. The seller remains the record owner and the buyer under such contract does not receive legal title to the property until the installment payments are completed. Long v. Smith, 776 S.W.2d 409 (Mo. App. 1989).<br />

<br />

Although a contract for deed and a mortgage serve similar economic functions, the purchaser under a contract for deed is not a mortgagor. Id.<br />

<br />

Contracts for deed typically contain forfeiture clauses which provide that time is of the essence and that when a buyer defaults, the seller has the option to declare the contract terminated, retake possession of the premises, and retain all previous payments as liquidated damages. Contracts for deed have traditionally been governed by general principles of contract law and courts have enforced forfeiture clauses on the assumption that they are carrying out the intent of the parties to the contract. Id.