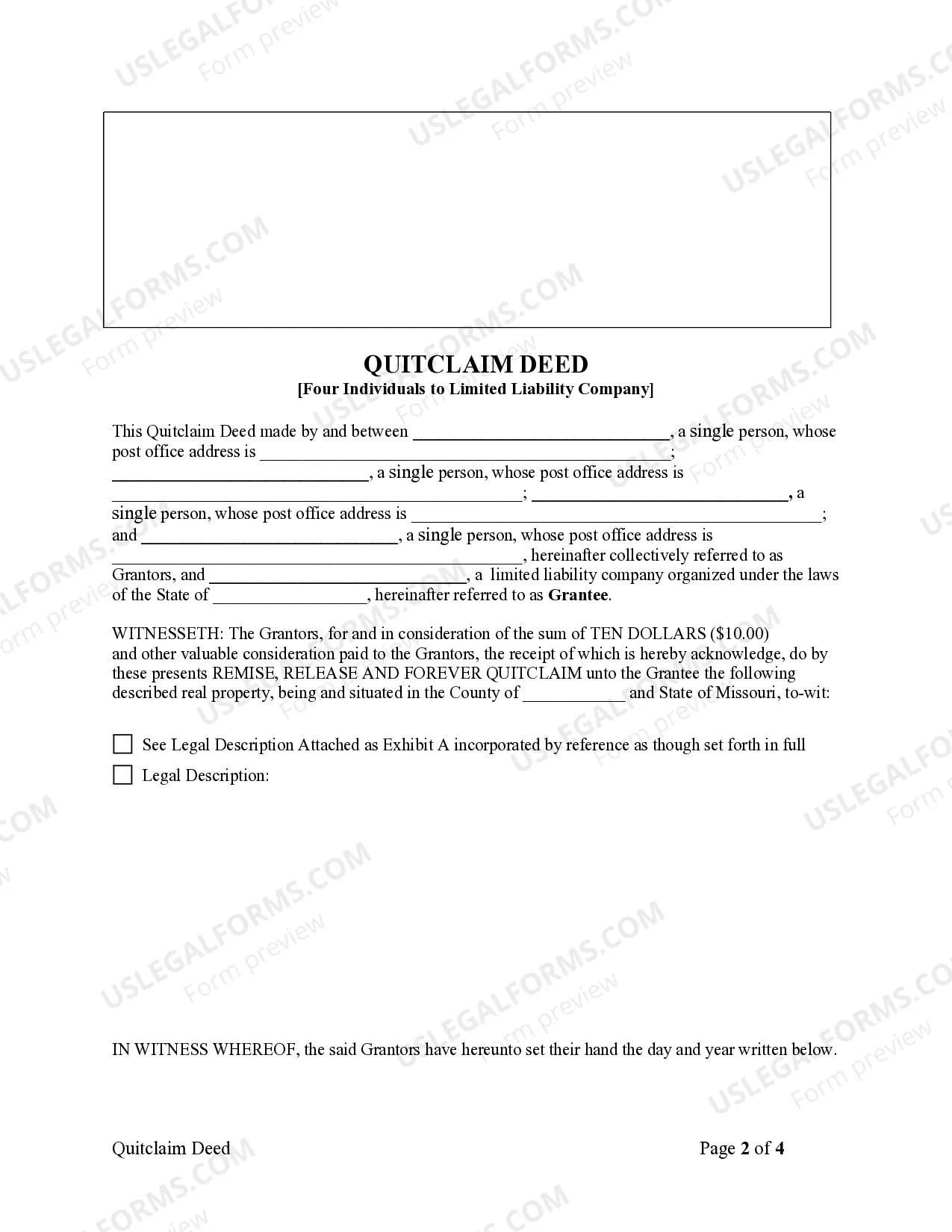

This form is a Quitclaim Deed where the grantors are four individuals and the grantee is a limited liability company. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used to transfer property ownership from one party to another. In the context of Lee's Summit, Missouri, the Lee's Summit Missouri Quitclaim Deed — Four Individuals to a Limited Liability Company refers to a specific type of property transfer involving four individuals as granters and a limited liability company (LLC) as the grantee. This type of deed is commonly used when a group of individuals wishes to convey their property interests to an LLC, often for business or investment purposes. The Lee's Summit Missouri Quitclaim Deed — Four Individuals to a Limited Liability Company is a straightforward and efficient method of transferring property ownership. Unlike other types of deeds, a quitclaim deed does not guarantee that the granter holds clear and marketable title to the property. Instead, it simply transfers the granter's present interest, if any, to the grantee. This means that the LLC acquiring the property through this deed assumes any potential risks or encumbrances associated with the property. This specific deed type may vary depending on the individual circumstances of the property transfer. Some examples of variations could include: 1. Lee's Summit Missouri Quitclaim Deed — Joint Tenants to a Limited Liability Company: This type of quitclaim deed involves joint tenants transferring their shared property interests to an LLC. Joint tenants hold equal ownership rights to a property and have the right of survivorship, meaning that if one tenant passes away, their share automatically transfers to the surviving tenants. Transferring ownership through a quitclaim deed in this scenario allows the LLC to obtain the joint tenants' interests. 2. Lee's Summit Missouri Quitclaim Deed — Tenants in Common to a Limited Liability Company: With this type of quitclaim deed, tenants in common transfer their respective fractional interests in a property to an LLC. Unlike joint tenants, tenants in common do not have the right of survivorship. Each tenant owns a specific percentage of the property, which they can freely transfer or inherit. By using a quitclaim deed, tenants in common can convey their individual interests to an LLC collectively. 3. Lee's Summit Missouri Quitclaim Deed — Trust Beneficiaries to a Limited Liability Company: In certain cases, property owners may hold their property in a trust. When trust beneficiaries decide to convey their interests to an LLC, they can use a quitclaim deed specifically designed for this purpose. The trust beneficiary would be the granter, and the LLC would be the grantee, allowing the LLC to assume ownership of the property held within the trust. Overall, the Lee's Summit Missouri Quitclaim Deed — Four Individuals to a Limited Liability Company is an important legal document utilized in property transfers involving multiple individuals and an LLC. It is crucial to consult with a qualified real estate attorney or legal professional to ensure the proper preparation and execution of this deed type, considering the specific circumstances and requirements of the property transfer.A Quitclaim Deed is a legal document used to transfer property ownership from one party to another. In the context of Lee's Summit, Missouri, the Lee's Summit Missouri Quitclaim Deed — Four Individuals to a Limited Liability Company refers to a specific type of property transfer involving four individuals as granters and a limited liability company (LLC) as the grantee. This type of deed is commonly used when a group of individuals wishes to convey their property interests to an LLC, often for business or investment purposes. The Lee's Summit Missouri Quitclaim Deed — Four Individuals to a Limited Liability Company is a straightforward and efficient method of transferring property ownership. Unlike other types of deeds, a quitclaim deed does not guarantee that the granter holds clear and marketable title to the property. Instead, it simply transfers the granter's present interest, if any, to the grantee. This means that the LLC acquiring the property through this deed assumes any potential risks or encumbrances associated with the property. This specific deed type may vary depending on the individual circumstances of the property transfer. Some examples of variations could include: 1. Lee's Summit Missouri Quitclaim Deed — Joint Tenants to a Limited Liability Company: This type of quitclaim deed involves joint tenants transferring their shared property interests to an LLC. Joint tenants hold equal ownership rights to a property and have the right of survivorship, meaning that if one tenant passes away, their share automatically transfers to the surviving tenants. Transferring ownership through a quitclaim deed in this scenario allows the LLC to obtain the joint tenants' interests. 2. Lee's Summit Missouri Quitclaim Deed — Tenants in Common to a Limited Liability Company: With this type of quitclaim deed, tenants in common transfer their respective fractional interests in a property to an LLC. Unlike joint tenants, tenants in common do not have the right of survivorship. Each tenant owns a specific percentage of the property, which they can freely transfer or inherit. By using a quitclaim deed, tenants in common can convey their individual interests to an LLC collectively. 3. Lee's Summit Missouri Quitclaim Deed — Trust Beneficiaries to a Limited Liability Company: In certain cases, property owners may hold their property in a trust. When trust beneficiaries decide to convey their interests to an LLC, they can use a quitclaim deed specifically designed for this purpose. The trust beneficiary would be the granter, and the LLC would be the grantee, allowing the LLC to assume ownership of the property held within the trust. Overall, the Lee's Summit Missouri Quitclaim Deed — Four Individuals to a Limited Liability Company is an important legal document utilized in property transfers involving multiple individuals and an LLC. It is crucial to consult with a qualified real estate attorney or legal professional to ensure the proper preparation and execution of this deed type, considering the specific circumstances and requirements of the property transfer.