Title: Understanding the Kansas City Missouri Notice of Dishonored Check — Civil Proceedings Introduction: In Kansas City, Missouri, issuing a bad or bounced check is a serious offense with potential legal consequences. When a check you've written is returned unpaid by the bank due to insufficient funds or any other reason, the recipient may initiate civil proceedings against you. This article will provide a detailed description of the Kansas City Missouri Notice of Dishonored Check — Civil process, highlighting key points related to bad checks and bounced checks. Types of Kansas City Missouri Notice of Dishonored Check — Civil: 1. Bad Check: A bad check refers to a check that is dishonored by the bank due to insufficient funds in the account or other discrepancies. If you issue a check knowing that you do not have sufficient funds to cover it, you may face civil proceedings as a consequence. 2. Bounced Check: A bounced check is another term used interchangeably with a bad check. When a check bounces, it means the bank refuses to honor the payment due to various reasons like insufficient funds, account closure, or irregularities in the check itself. Key Points of the Kansas City Missouri Notice of Dishonored Check — Civil Process: 1. Initiating Civil Proceedings: When a recipient receives a bad or bounced check, they can initiate legal proceedings against the check issuer. The recipient should first send a written notice to the issuer informing them of the dishonored check and demanding payment within a specified time frame, usually 10 days. 2. Statutory Damages and Penalties: In Kansas City, Missouri, the recipient of a dishonored check may seek to recover the value of the check, plus statutory damages, as provided under state law. These statutory damages can be three times the amount of the check, with a minimum of $100 and a maximum of $500. 3. Filing a Civil Lawsuit: If the issuer fails to make the required payment within the specified timeframe, the recipient may file a civil lawsuit. This lawsuit seeks to recover the owed amount, statutory damages, court costs, and possibly attorney fees. 4. Legal Consequences: If found guilty by the court, the check issuer may be liable for the owed amount, statutory damages, and associated costs. Additionally, the issuer's credit rating may be adversely affected, and they may face challenges in obtaining credit or opening bank accounts in the future. Conclusion: Knowing the implications of issuing a bad or bounced check in Kansas City, Missouri, is crucial to avoid the legal consequences and protect your financial reputation. By understanding the Kansas City Missouri Notice of Dishonored Check — Civil process, individuals can take necessary precautions to ensure they have sufficient funds before issuing any checks, preventing such incidents from occurring in the first place. Be responsible and ensure that your checks are backed by enough funds to honor them, preventing any potential civil proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas City Missouri Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Missouri Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

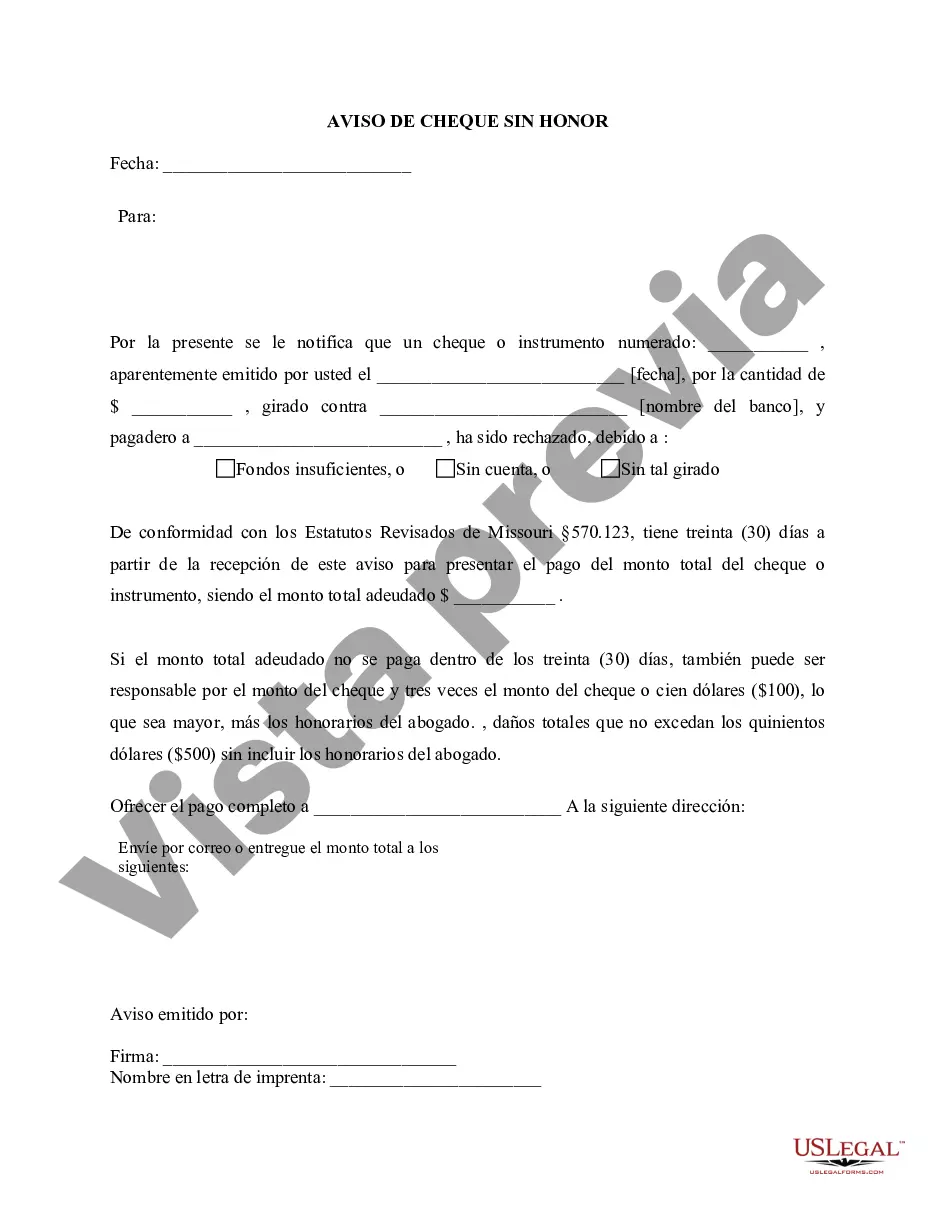

Description

How to fill out Kansas City Missouri Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you are looking for a relevant form, it’s extremely hard to find a better platform than the US Legal Forms website – one of the most extensive libraries on the web. Here you can find thousands of templates for company and personal purposes by categories and regions, or keywords. With our advanced search function, discovering the most up-to-date Kansas City Missouri Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is as elementary as 1-2-3. Moreover, the relevance of each file is verified by a team of skilled lawyers that on a regular basis check the templates on our website and update them based on the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to receive the Kansas City Missouri Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you need. Read its description and utilize the Preview option (if available) to explore its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to find the needed record.

- Affirm your selection. Choose the Buy now button. Next, select the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the template. Pick the file format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the received Kansas City Missouri Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Each and every template you add to your account does not have an expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you need to have an additional copy for editing or printing, you can come back and export it once again at any moment.

Take advantage of the US Legal Forms professional catalogue to get access to the Kansas City Missouri Notice of Dishonored Check - Civil - Keywords: bad check, bounced check you were looking for and thousands of other professional and state-specific templates on a single platform!