Lee's Summit Missouri Notice of Dishonored Check — Criminal is an official document issued by the Lee's Summit law enforcement authorities in the state of Missouri, indicating that a check provided by an individual or business has been deemed invalid due to insufficient funds in the account to cover the stated amount. This legal notice notifies the check issuer that their action in writing the check is considered a criminal offense. A "bad check" or "bounced check" is a term commonly used to describe a check that has been returned unpaid by the bank due to insufficient funds. The Lee's Summit Missouri Notice of Dishonored Check — Criminal serves as a warning to individuals and businesses in Lee's Summit that issuing bad checks is a serious offense under Missouri law and may lead to criminal charges. Types of Lee's Summit Missouri Notice of Dishonored Check — Criminal: 1. Misdemeanor Bad Check: This classification pertains to checks with a value below a specific amount, typically set by Missouri state law. If the check's value falls below this threshold, it will be considered a misdemeanor offense, resulting in lesser penalties and fines. 2. Felony Bad Check: If the amount written on the bounced check exceeds the threshold set for misdemeanor charges, the act of issuing such a check becomes a felony offense. Felony bad checks involve larger sums of money, and conviction can result in more severe consequences, including lengthier prison sentences and higher fines. It is crucial for individuals and businesses in Lee's Summit, Missouri, to be aware of the potential consequences of issuing bad checks. The Lee's Summit Missouri Notice of Dishonored Check — Criminal serves as a reminder that the act of writing a check without sufficient funds is unlawful and punishable under Missouri law. It is always advisable to maintain a sufficient balance in bank accounts to prevent checks from being dishonored. Additionally, in case of financial difficulties, it is recommended to communicate with the payee and seek alternative payment methods to avoid legal trouble associated with bounced checks. If someone receives a Lee's Summit Missouri Notice of Dishonored Check — Criminal, they should take the matter seriously, consult legal counsel, and ensure timely resolution to avoid potential criminal charges and their associated consequences.

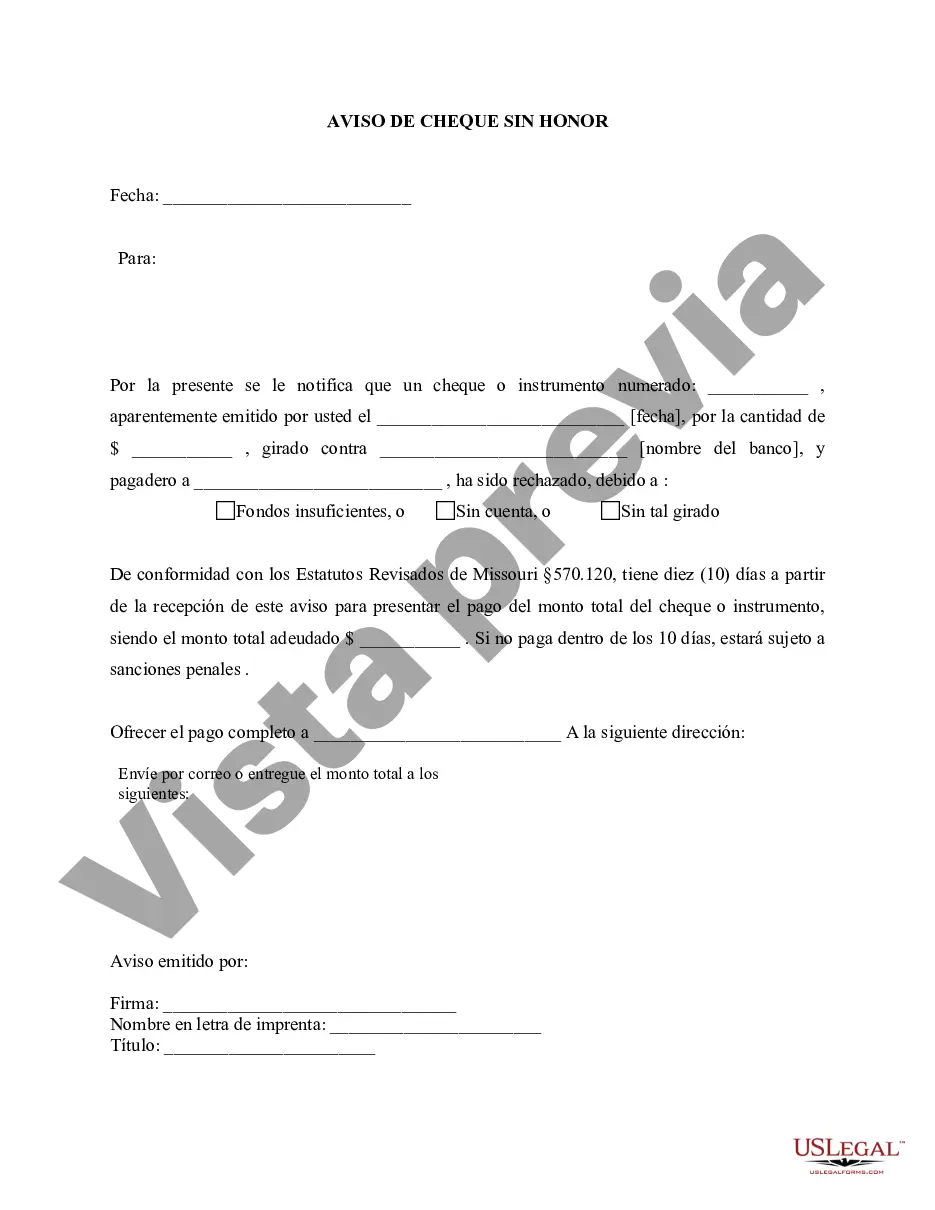

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Lee's Summit Missouri Aviso de cheque sin fondos - Penal - Palabras clave: cheque sin fondos, cheque sin fondos - Missouri Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

State:

Missouri

City:

Lee's Summit

Control #:

MO-402N

Format:

Word

Instant download

Description

Formulario de aviso de cheque sin fondos.

Lee's Summit Missouri Notice of Dishonored Check — Criminal is an official document issued by the Lee's Summit law enforcement authorities in the state of Missouri, indicating that a check provided by an individual or business has been deemed invalid due to insufficient funds in the account to cover the stated amount. This legal notice notifies the check issuer that their action in writing the check is considered a criminal offense. A "bad check" or "bounced check" is a term commonly used to describe a check that has been returned unpaid by the bank due to insufficient funds. The Lee's Summit Missouri Notice of Dishonored Check — Criminal serves as a warning to individuals and businesses in Lee's Summit that issuing bad checks is a serious offense under Missouri law and may lead to criminal charges. Types of Lee's Summit Missouri Notice of Dishonored Check — Criminal: 1. Misdemeanor Bad Check: This classification pertains to checks with a value below a specific amount, typically set by Missouri state law. If the check's value falls below this threshold, it will be considered a misdemeanor offense, resulting in lesser penalties and fines. 2. Felony Bad Check: If the amount written on the bounced check exceeds the threshold set for misdemeanor charges, the act of issuing such a check becomes a felony offense. Felony bad checks involve larger sums of money, and conviction can result in more severe consequences, including lengthier prison sentences and higher fines. It is crucial for individuals and businesses in Lee's Summit, Missouri, to be aware of the potential consequences of issuing bad checks. The Lee's Summit Missouri Notice of Dishonored Check — Criminal serves as a reminder that the act of writing a check without sufficient funds is unlawful and punishable under Missouri law. It is always advisable to maintain a sufficient balance in bank accounts to prevent checks from being dishonored. Additionally, in case of financial difficulties, it is recommended to communicate with the payee and seek alternative payment methods to avoid legal trouble associated with bounced checks. If someone receives a Lee's Summit Missouri Notice of Dishonored Check — Criminal, they should take the matter seriously, consult legal counsel, and ensure timely resolution to avoid potential criminal charges and their associated consequences.

Free preview

How to fill out Lee's Summit Missouri Aviso De Cheque Sin Fondos - Penal - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you’ve already used our service before, log in to your account and save the Lee's Summit Missouri Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Lee's Summit Missouri Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!