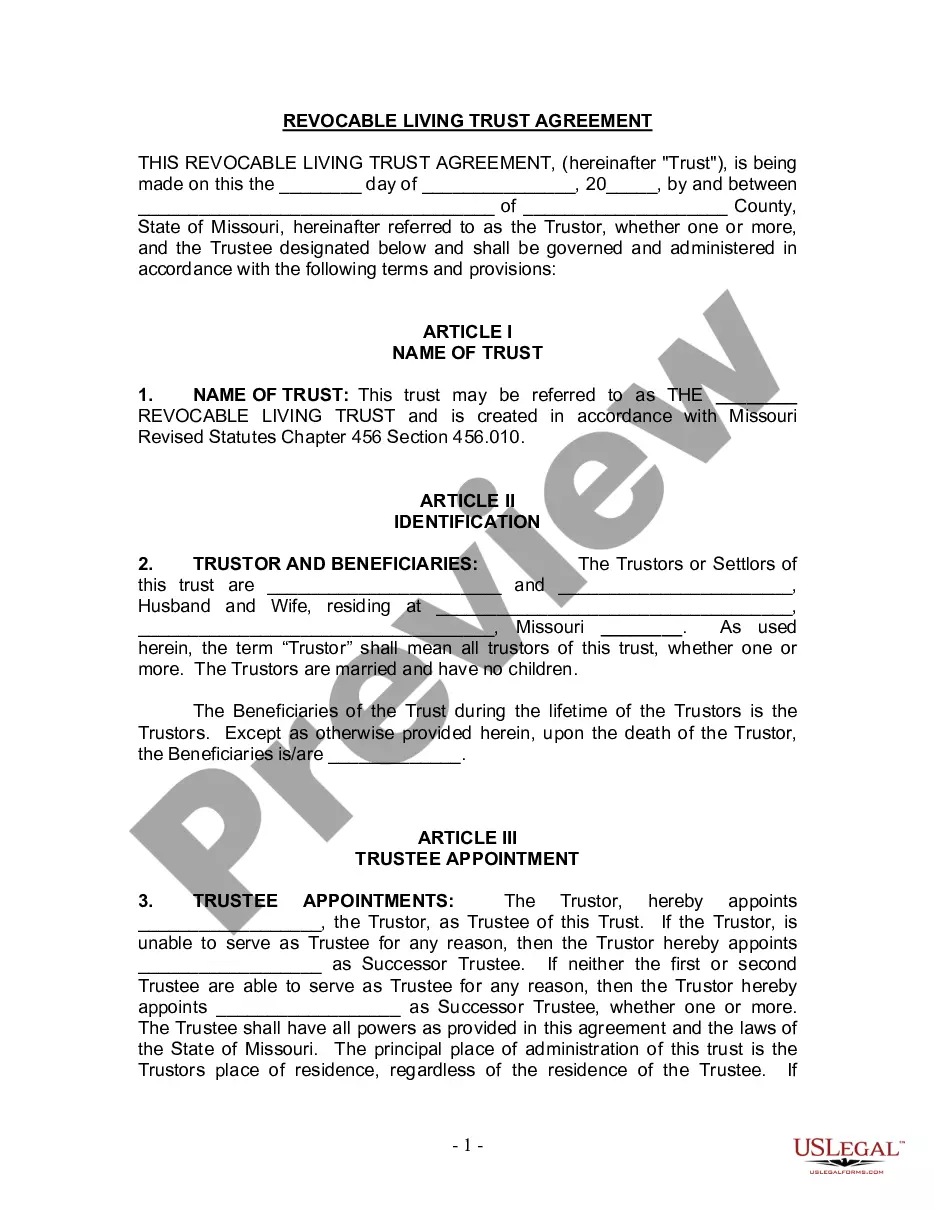

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Kansas City Missouri Living Trust for Husband and Wife with No Children

Description

How to fill out Missouri Living Trust For Husband And Wife With No Children?

Regardless of social or professional rank, finishing legal documents is a regrettable requirement in today’s society.

Too frequently, it’s nearly impossible for someone without legal training to craft this type of paperwork from the ground up, primarily due to the intricate language and legal nuances involved.

This is where US Legal Forms proves to be beneficial.

Ensure the form you select is tailored to your locality since the regulations of one state or county do not apply to another.

Review the document and read a brief description (if available) of the situations the document can be utilized for.

- Our service provides an extensive collection of over 85,000 ready-to-use, state-specific documents applicable to nearly any legal situation.

- US Legal Forms also serves as an excellent resource for associates or legal advisors who aim to enhance their efficiency through our DYI templates.

- Regardless of whether you need the Kansas City Missouri Living Trust for Husband and Wife without Children or any other document appropriate for your state or county, US Legal Forms has everything readily available.

- Here’s how you can quickly acquire the Kansas City Missouri Living Trust for Husband and Wife without Children utilizing our dependable service.

- If you’re already a returning customer, you can directly Log In to your account to obtain the required form.

- However, if you are new to our library, please make sure to follow these steps before securing the Kansas City Missouri Living Trust for Husband and Wife without Children.

Form popularity

FAQ

Avoiding Probate Court Although there are many differences between wills and trusts, the biggest difference is that wills do not avoid probate, while the purpose of a revocable living trust is to avoid probate. Probate is what happens when someone passes away with assets still titled in their own name.

In Missouri, if you are married and you die without a will, what your spouse gets depends on whether or not you have living descendants -- children, grandchildren, or great-grandchildren. If you don't, then your spouse inherits all of your intestate property.

No family trust company shall conduct business in this state without paying a filing fee and registering with the Secretary of State.

To create a living trust in Missouri, you put the terms of the trust into a trust agreement which you then sign in front of a notary public. The final step is to fund the trust, transfer ownership of assets into the name of the trust. A revocable living trust can offer you flexibility, control, and privacy.

Flat fees for complete estate plans which include a living trust, wills, durable financial powers of attorney, durable healthcare powers of attorney and livings wills should usually be a flat fee of between $1,250.00 and $2,000.00, at least in the St.

To create a living trust in Missouri, you put the terms of the trust into a trust agreement which you then sign in front of a notary public. The final step is to fund the trust, transfer ownership of assets into the name of the trust. A revocable living trust can offer you flexibility, control, and privacy.

As mentioned, if there is a surviving spouse, he or she gets the first $20,000 of the estate's value, plus 50% of the remainder.

There are other instances in which your siblings could take control of your assets. In very rare cases, if you have no close living descendants, your possessions may be passed off to distant relatives. And if Missouri can't find any relatives at all, then the state inherits the estate.

The cost of creating a living trust in Missouri can vary widely, depending on several factors. Some people do it with a few hundred dollars using online programs. Others seek the assistance of a lawyer and easily drop more than $1,000.