Kansas City Missouri Financial Account Transfer to Living Trust A financial account transfer to a living trust in Kansas City, Missouri allows individuals to transfer ownership of their financial accounts into a trust that they have established during their lifetime. This process offers several benefits, including the ability to avoid probate, maintain privacy, and potentially reduce estate taxes. There are various types of financial account transfers to living trusts depending on the nature of the account. They include: 1. Bank Account Transfers: This involves transferring ownership of checking, savings, and money market accounts to a living trust. By doing so, the account funds will be managed by the trustee designated in the trust document. 2. Investment Account Transfers: Individuals can transfer ownership of stocks, bonds, mutual funds, certificates of deposit (CDs), and other investment accounts into a living trust. This allows for seamless management of investments and potentially ensures a smoother transition of assets to beneficiaries. 3. Retirement Account Transfers: It is possible to transfer ownership of retirement accounts such as 401(k)s, IRAs, and pensions into a living trust. However, special considerations should be made, and consulting with a financial advisor or attorney is highly recommended ensuring compliance with tax regulations and maximize beneficiary benefits. 4. Life Insurance Policies: By transferring life insurance policies into a living trust, policyholders can effectively manage these assets and dictate how the proceeds should be distributed to beneficiaries upon their passing. 5. Real Estate Transfers: In addition to financial accounts, individuals can also transfer ownership of their real estate assets, such as residential or commercial properties, into a living trust. This ensures that these properties are managed and distributed according to the trust's terms upon the owner's passing. It is crucial to consult with a qualified estate planning attorney or financial advisor in Kansas City, Missouri, to ensure that the financial account transfer to a living trust is conducted correctly and in compliance with state laws. They can provide guidance on the specific requirements and procedures involved in each type of account transfer, ensuring a smooth transition and effective management of assets.

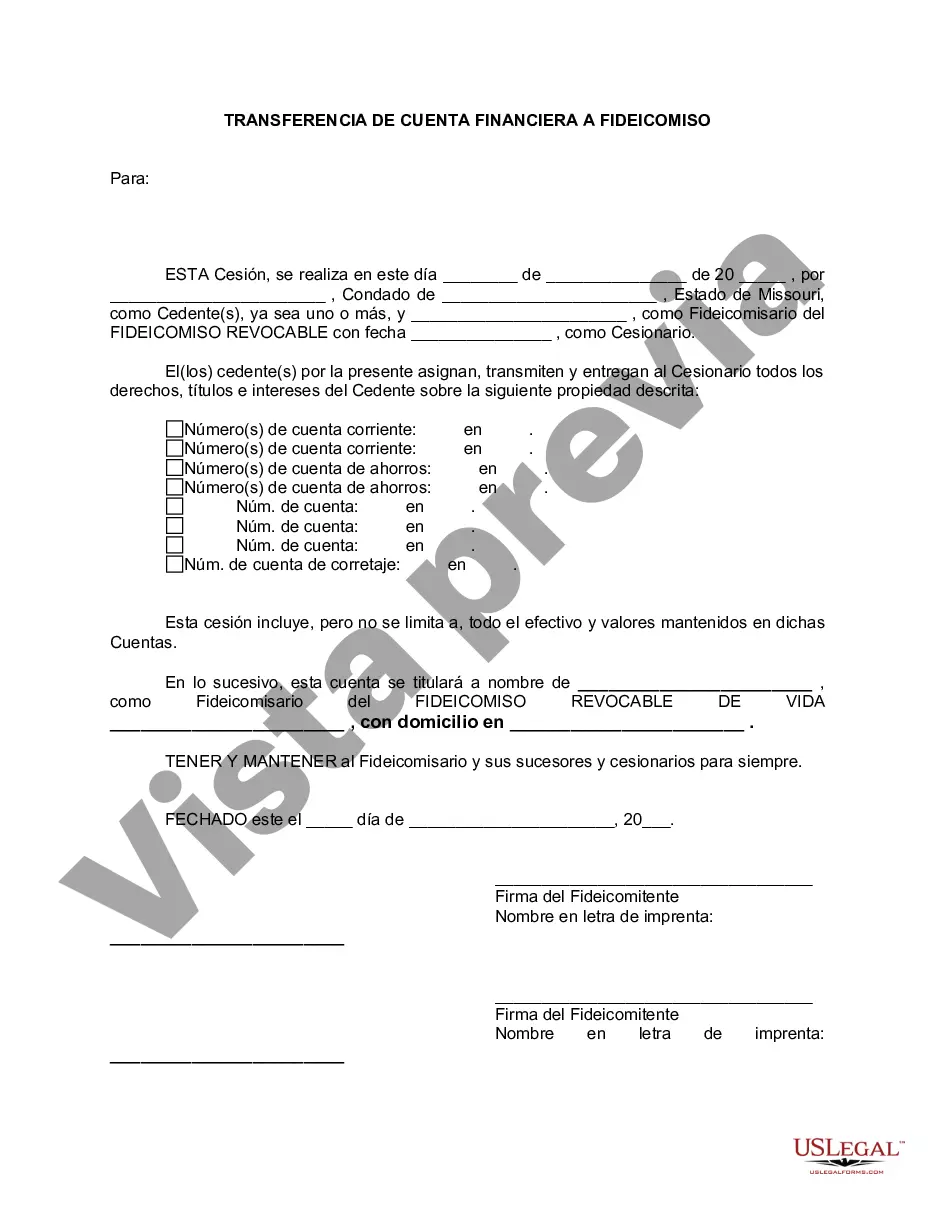

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas City Missouri Transferencia de cuenta financiera a fideicomiso en vida - Missouri Financial Account Transfer to Living Trust

Description

How to fill out Kansas City Missouri Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone with no legal background to create this sort of paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our service offers a huge library with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Kansas City Missouri Financial Account Transfer to Living Trust or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Kansas City Missouri Financial Account Transfer to Living Trust quickly employing our reliable service. In case you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps before downloading the Kansas City Missouri Financial Account Transfer to Living Trust:

- Ensure the form you have found is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Preview the document and go through a brief description (if available) of cases the paper can be used for.

- In case the one you picked doesn’t suit your needs, you can start again and search for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Kansas City Missouri Financial Account Transfer to Living Trust once the payment is through.

You’re all set! Now you can go ahead and print the document or fill it out online. In case you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.