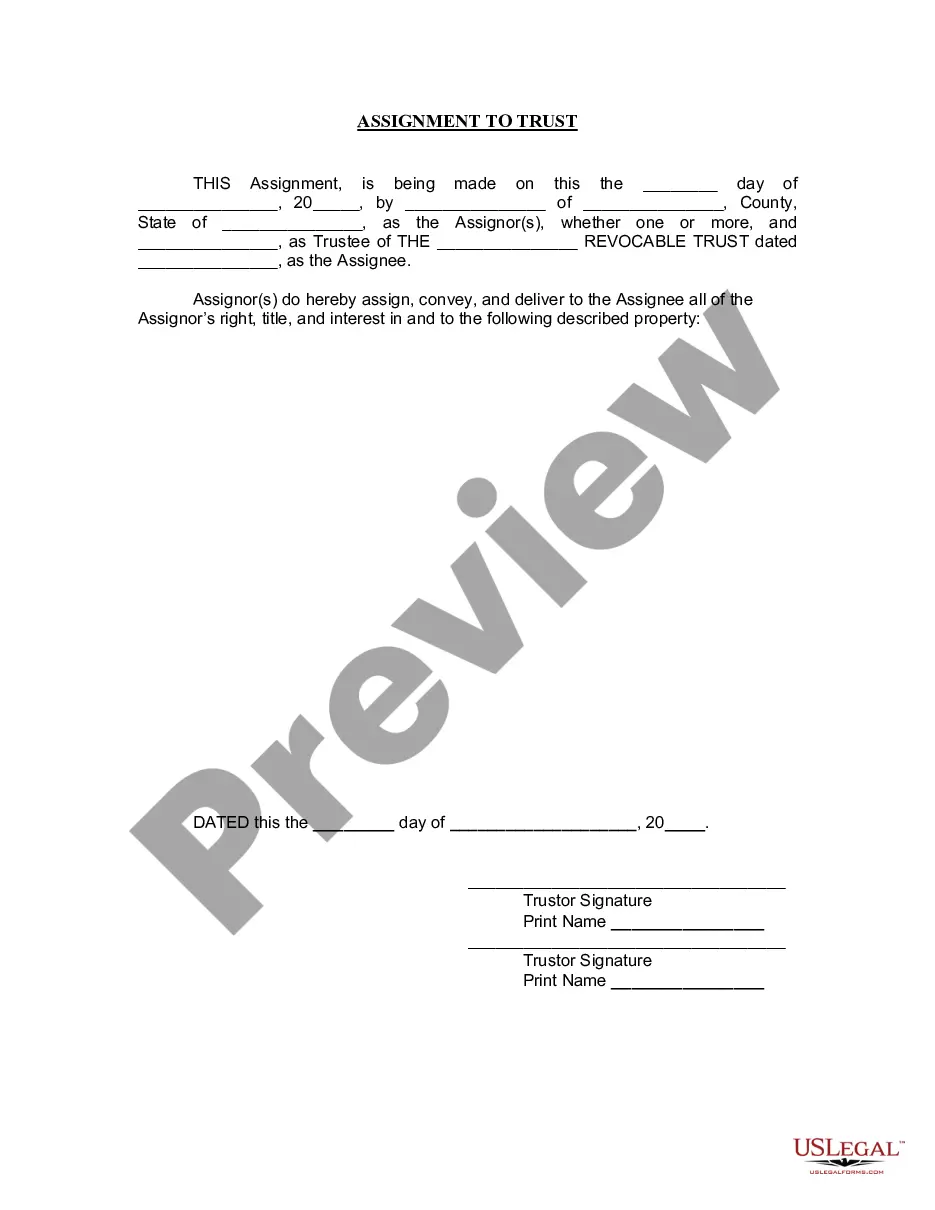

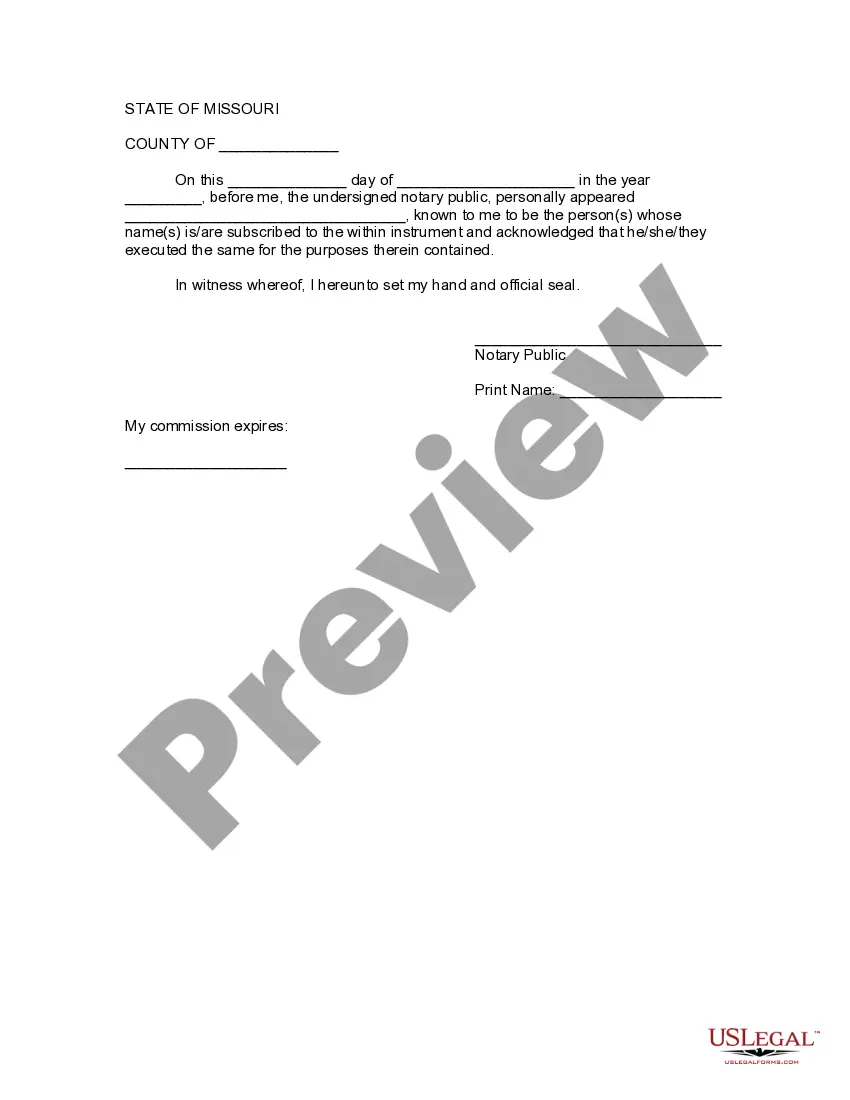

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Kansas City Missouri Assignment to Living Trust

Description

How to fill out Missouri Assignment To Living Trust?

Are you searching for a reliable and budget-friendly provider of legal forms to obtain the Kansas City Missouri Assignment to Living Trust? US Legal Forms is your ideal option.

Whether you require a straightforward agreement to establish rules for living together with your partner or a bundle of documents to facilitate your separation or divorce through the court, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business purposes. All templates we offer are not generic and tailored in accordance with the stipulations of specific state and county requirements.

To download the form, you need to Log In to your account, find the necessary form, and click the Download button beside it. Please remember that you can retrieve your previously acquired document templates at any time in the My documents section.

Is this your first experience with our platform? No problem. You can create an account with ease, but first, ensure to do the following.

Now you can establish your account. Then select a subscription option and proceed to payment. Once the payment is finalized, download the Kansas City Missouri Assignment to Living Trust in any of the available file formats. You can revisit the website whenever you wish and redownload the form at no additional cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and put an end to wasting your valuable time searching for legal paperwork online once and for all.

- Verify that the Kansas City Missouri Assignment to Living Trust adheres to the laws of your state and local area.

- Read the description of the form (if available) to ascertain who and what the form is appropriate for.

- Restart your search if the form is not suitable for your particular situation.

Form popularity

FAQ

The cost of creating a living trust in Missouri can vary widely, depending on several factors. Some people do it with a few hundred dollars using online programs. Others seek the assistance of a lawyer and easily drop more than $1,000.

Flat fees for complete estate plans which include a living trust, wills, durable financial powers of attorney, durable healthcare powers of attorney and livings wills should usually be a flat fee of between $1,250.00 and $2,000.00, at least in the St.

A living trust in Missouri, also called an inter vivos trust, is set up by the settlor, the person who owns the assets going into trust. When you create a living trust, you need to choose a trustee who will manage the assets in the trust for your benefit while you are alive.

Under Section 456.10-1005.3, RSMo there is generally five (5) years to file suit after the first of the following: (1) the removal, resignation or death of the trustee, (2) the termination of the beneficiary's interest in the trust, or (3) the termination of the trust.

No family trust company shall conduct business in this state without paying a filing fee and registering with the Secretary of State.

The income of an estate or trust is taxed to the fiduciary or beneficiary. The tax is paid by the fiduciary responsible for administering the estate or trust, except that beneficiaries pay the tax on distributions of estate or trust income received during the taxable year.

To create a living trust in Missouri, you put the terms of the trust into a trust agreement which you then sign in front of a notary public. The final step is to fund the trust, transfer ownership of assets into the name of the trust. A revocable living trust can offer you flexibility, control, and privacy.

Avoiding Probate Court Although there are many differences between wills and trusts, the biggest difference is that wills do not avoid probate, while the purpose of a revocable living trust is to avoid probate. Probate is what happens when someone passes away with assets still titled in their own name.

In Missouri, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).