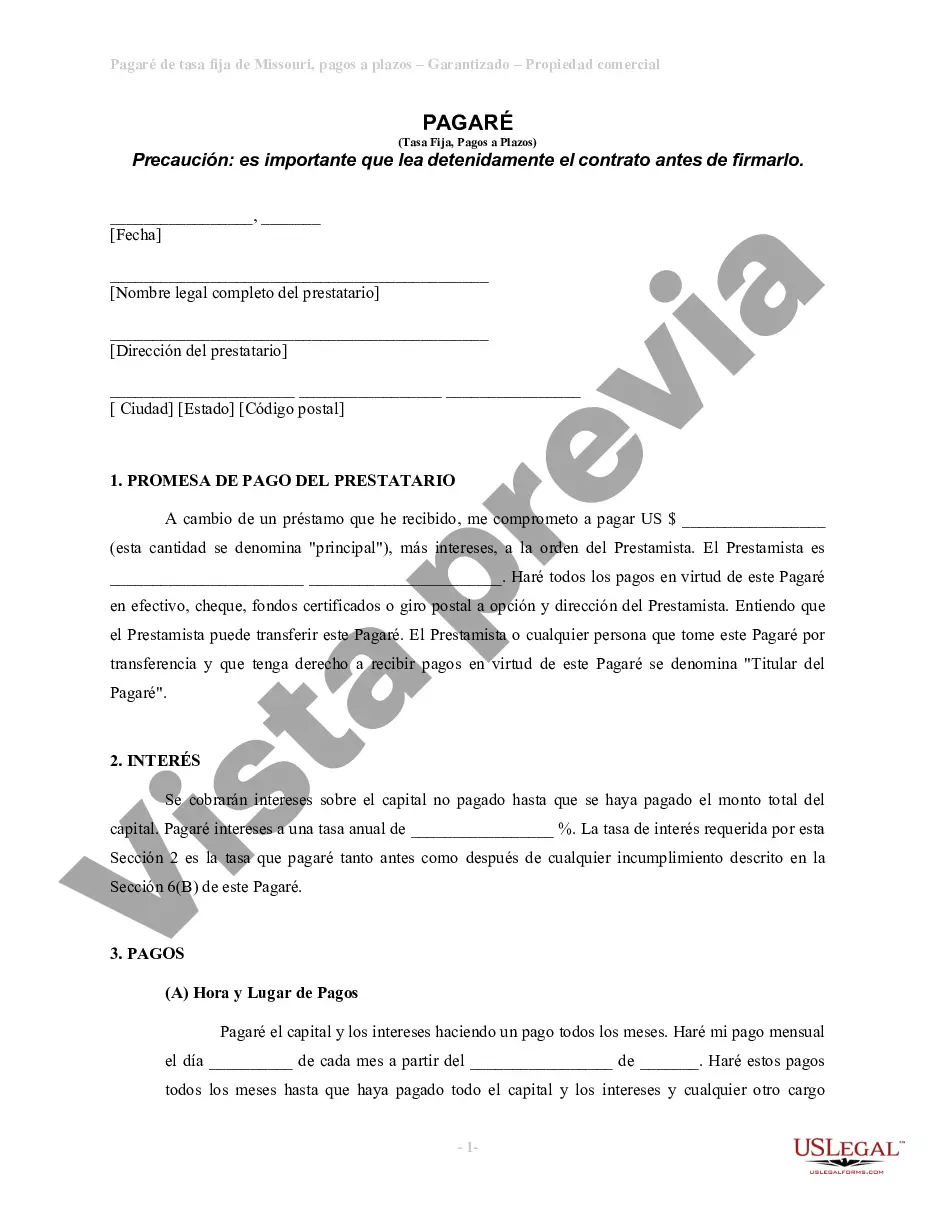

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

A Springfield Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legally binding document that outlines the terms and conditions of a loan agreement. This particular type of promissory note is unique to Springfield, Missouri, and is specifically secured by commercial real estate. The promissory note serves as evidence of the borrower's promise to repay the loan amount to the lender according to a predetermined schedule of installments. This fixed-rate promissory note provides clarity and certainty for both parties involved by establishing a set interest rate that remains unchanged throughout the repayment period. Key terms that are typically included in a Springfield Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate may encompass: 1. Loan Amount: This refers to the principal amount that the borrower receives from the lender, specific to the transaction involving commercial real estate in Springfield, Missouri. 2. Interest Rate: This is the annual percentage rate applied to the loan amount to calculate the interest charges. In a fixed-rate promissory note, the interest rate is predetermined and remains constant throughout the loan term, leading to consistent monthly installments. 3. Loan Term: The promissory note will specify the duration or term within which the borrower agrees to repay the loan in full. This period may range from a few years to several decades, contingent on the agreement between the parties involved. 4. Installment Schedule: The note will delineate a detailed repayment plan, outlining the precise dates and amounts of each installment. Installment payments typically include both principal and interest, allowing for gradual loan repayment over time. 5. Collateral Description: Since this promissory note is secured by commercial real estate, it will comprehensively describe the property being used as collateral. This description typically includes the property's address, legal description, and any other relevant details. Springfield Missouri Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate can come in various types, specifically tailored to meet different financial needs and circumstances. These types may include: 1. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Retail Real Estate: This type of promissory note is specifically secured by commercial real estate of retail establishments such as shopping malls or storefronts. 2. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Office Real Estate: This type of promissory note is specifically secured by commercial real estate that is utilized for office spaces or corporate buildings. 3. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Industrial Real Estate: This type of promissory note is specifically secured by commercial real estate used for industrial purposes, such as warehouses or manufacturing facilities. 4. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Mixed-use Real Estate: This type of promissory note is specifically secured by commercial real estate that encompasses a combination of different property types, such as residential and retail or office and retail spaces. In conclusion, a Springfield Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a detailed legal document that defines the terms of a loan secured by commercial property in the Springfield area. These notes can be tailored to different types of commercial real estate, including retail, office, industrial, and mixed-use properties.A Springfield Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legally binding document that outlines the terms and conditions of a loan agreement. This particular type of promissory note is unique to Springfield, Missouri, and is specifically secured by commercial real estate. The promissory note serves as evidence of the borrower's promise to repay the loan amount to the lender according to a predetermined schedule of installments. This fixed-rate promissory note provides clarity and certainty for both parties involved by establishing a set interest rate that remains unchanged throughout the repayment period. Key terms that are typically included in a Springfield Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate may encompass: 1. Loan Amount: This refers to the principal amount that the borrower receives from the lender, specific to the transaction involving commercial real estate in Springfield, Missouri. 2. Interest Rate: This is the annual percentage rate applied to the loan amount to calculate the interest charges. In a fixed-rate promissory note, the interest rate is predetermined and remains constant throughout the loan term, leading to consistent monthly installments. 3. Loan Term: The promissory note will specify the duration or term within which the borrower agrees to repay the loan in full. This period may range from a few years to several decades, contingent on the agreement between the parties involved. 4. Installment Schedule: The note will delineate a detailed repayment plan, outlining the precise dates and amounts of each installment. Installment payments typically include both principal and interest, allowing for gradual loan repayment over time. 5. Collateral Description: Since this promissory note is secured by commercial real estate, it will comprehensively describe the property being used as collateral. This description typically includes the property's address, legal description, and any other relevant details. Springfield Missouri Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate can come in various types, specifically tailored to meet different financial needs and circumstances. These types may include: 1. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Retail Real Estate: This type of promissory note is specifically secured by commercial real estate of retail establishments such as shopping malls or storefronts. 2. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Office Real Estate: This type of promissory note is specifically secured by commercial real estate that is utilized for office spaces or corporate buildings. 3. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Industrial Real Estate: This type of promissory note is specifically secured by commercial real estate used for industrial purposes, such as warehouses or manufacturing facilities. 4. Springfield Missouri Installments Fixed Rate Promissory Note Secured by Mixed-use Real Estate: This type of promissory note is specifically secured by commercial real estate that encompasses a combination of different property types, such as residential and retail or office and retail spaces. In conclusion, a Springfield Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a detailed legal document that defines the terms of a loan secured by commercial property in the Springfield area. These notes can be tailored to different types of commercial real estate, including retail, office, industrial, and mixed-use properties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.