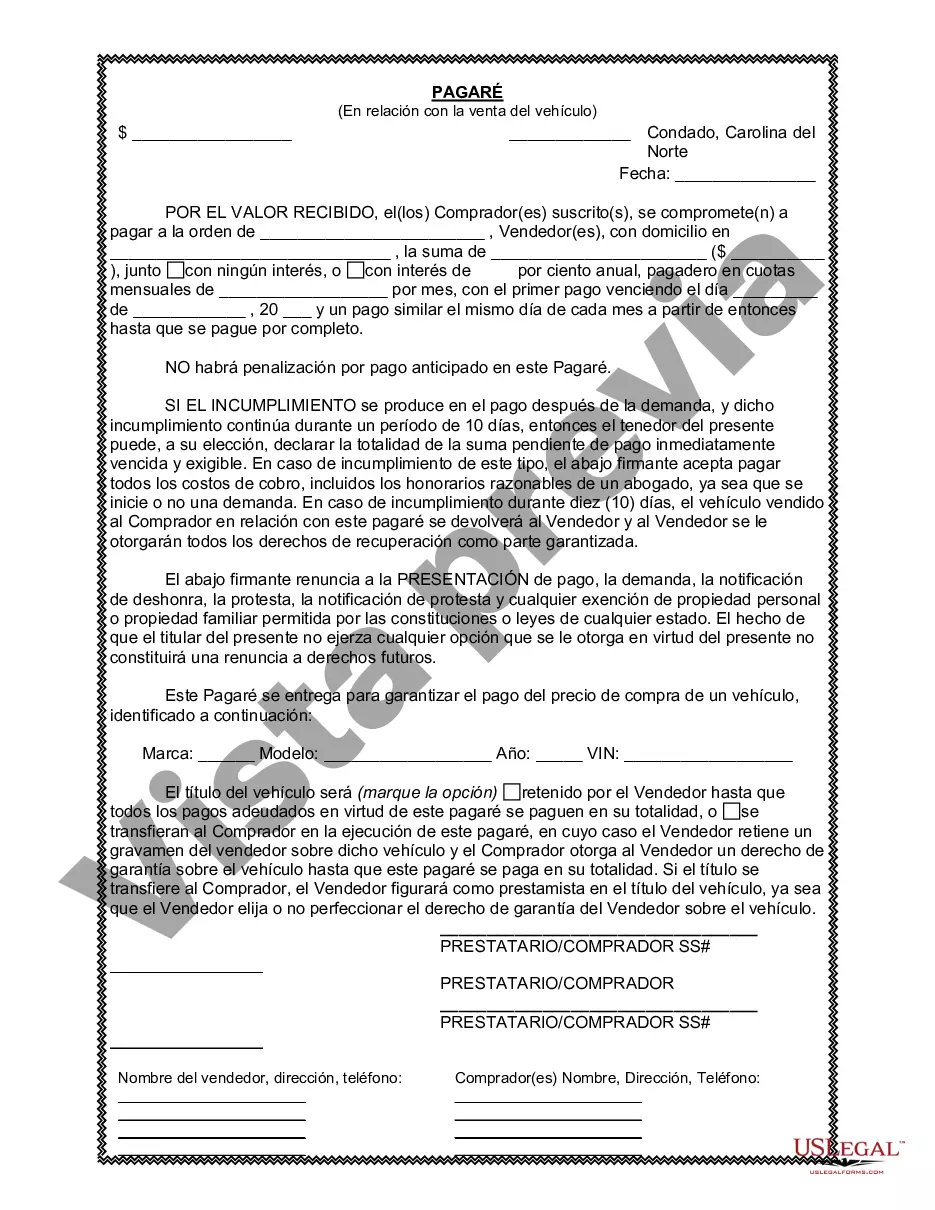

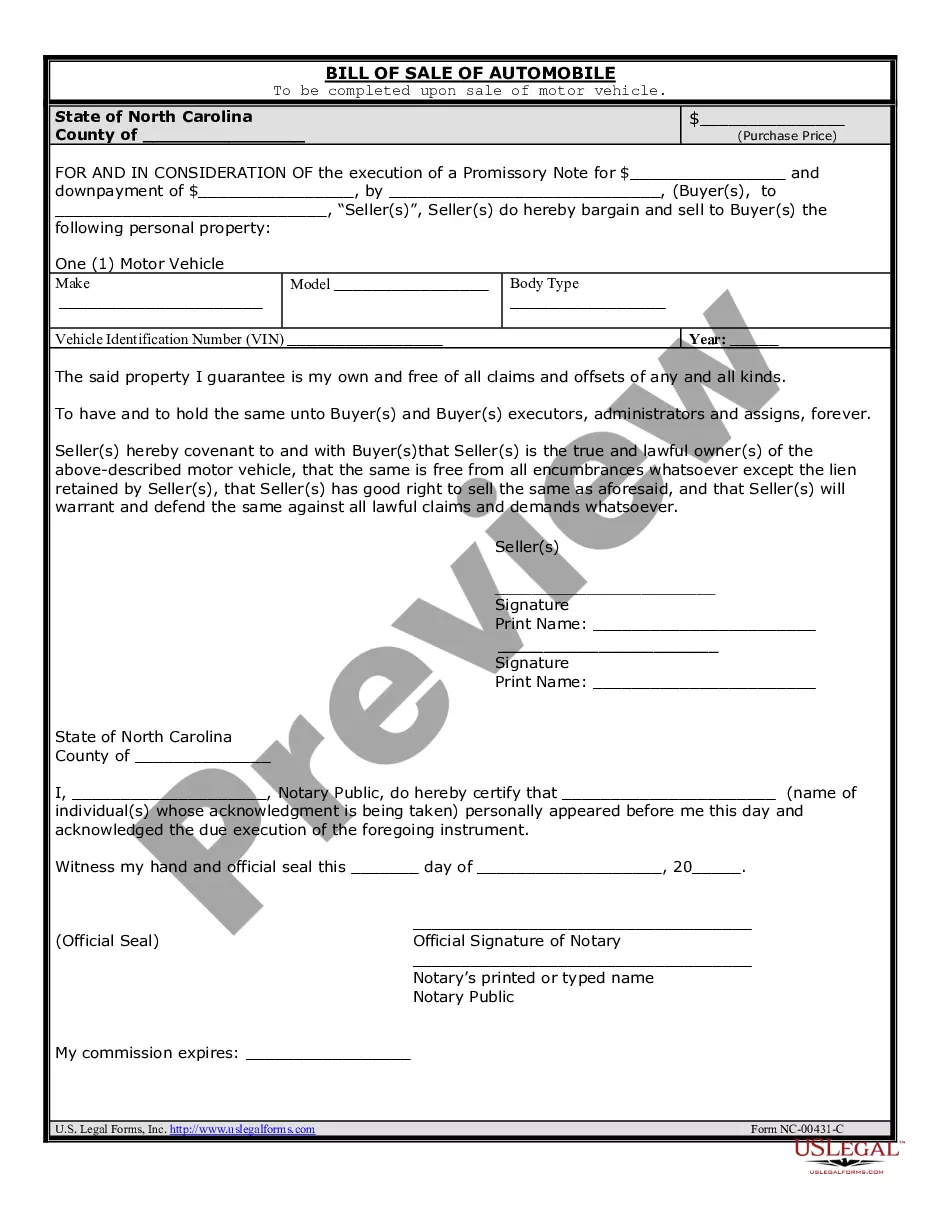

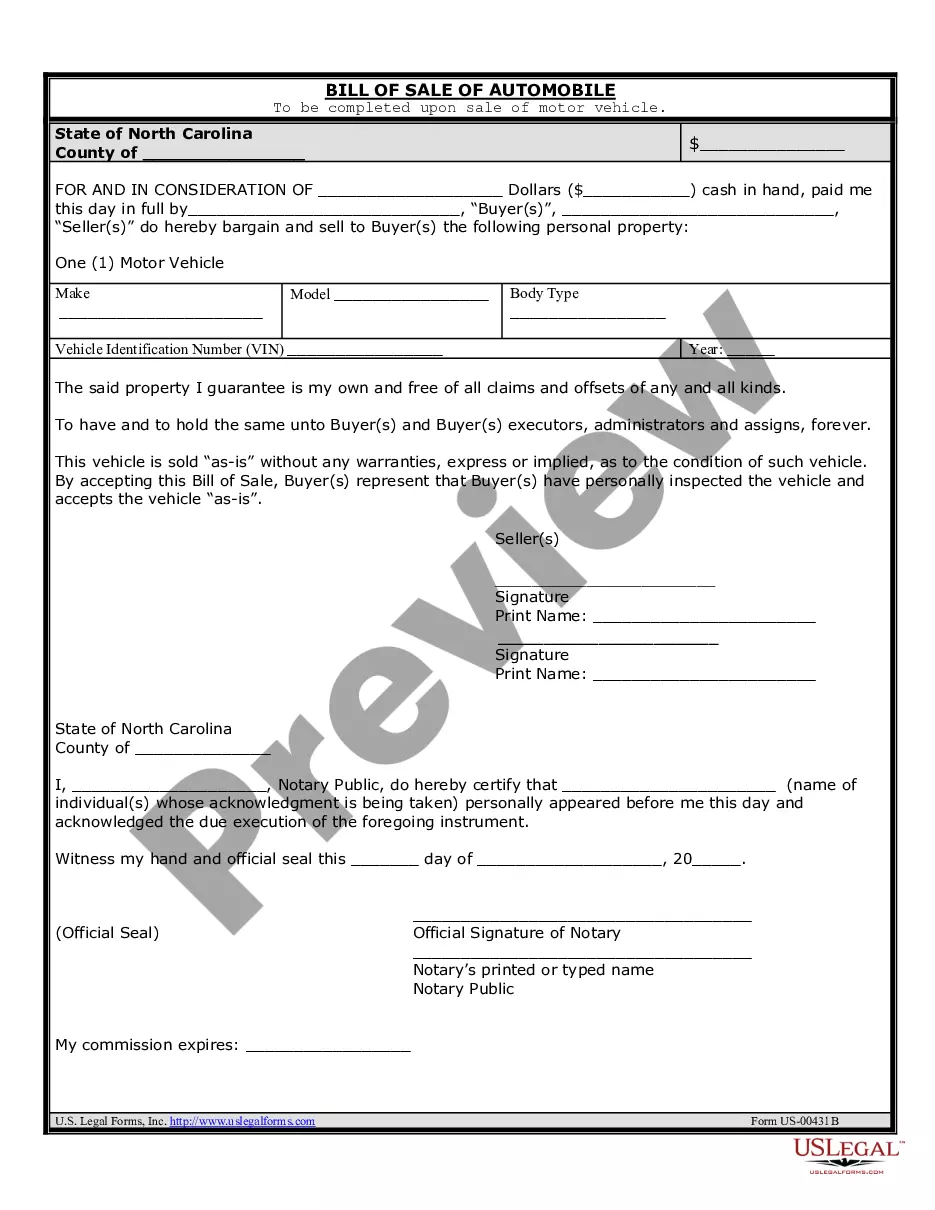

A Mecklenburg North Carolina Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller. This agreement acts as evidence of the debt owed by the buyer to the seller for the purchase of the vehicle. It specifies the repayment terms, interest rate (if any), and consequences for defaulting on the loan. The Mecklenburg North Carolina Promissory Note in connection with the sale of a vehicle or automobile can have various types depending on the specific details agreed upon by the parties involved. Some common types include: 1. Installment Promissory Note: An installment promissory note establishes a fixed repayment schedule, usually through equal monthly installments, until the loan is fully repaid. This type of note is suitable for buyers who cannot make a lump sum payment and prefer spreading the cost over a set period. 2. Balloon Promissory Note: A balloon promissory note contains lower monthly payments throughout the loan term, with a large final payment called the "balloon payment" due at the end of the loan. It allows the buyer to make smaller payments initially and settle the remaining balance in one lump sum. 3. Secured Promissory Note: A secured promissory note pledges collateral, such as the vehicle itself, to secure the loan. In case of default, the seller has the right to repossess the vehicle to recoup their losses. This provides extra security for the seller in case the buyer fails to repay the loan. 4. Unsecured Promissory Note: An unsecured promissory note does not involve collateral, which means the buyer isn't required to pledge any asset to secure the loan. However, this type of note may have higher interest rates to compensate for the increased risk taken by the seller. It is essential for both parties involved in a vehicle sale to meticulously draft and review the terms of the Mecklenburg North Carolina Promissory Note. Consulting a legal professional specializing in contract law can ensure that the note remains compliant with relevant state regulations and protects the rights of both the buyer and the seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Pagaré en relación con la venta de vehículos o automóviles - North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Mecklenburg North Carolina Pagaré En Relación Con La Venta De Vehículos O Automóviles?

If you are looking for a valid form template, it’s impossible to find a better platform than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can find a huge number of templates for company and individual purposes by types and states, or key phrases. With our high-quality search feature, discovering the most up-to-date Mecklenburg North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile is as easy as 1-2-3. In addition, the relevance of each record is proved by a group of expert attorneys that on a regular basis check the templates on our website and revise them according to the latest state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Mecklenburg North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the form you require. Check its information and use the Preview option (if available) to see its content. If it doesn’t meet your needs, use the Search field at the top of the screen to get the appropriate document.

- Confirm your selection. Choose the Buy now option. After that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the form. Choose the file format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Mecklenburg North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile.

Each form you save in your account does not have an expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you need to receive an extra copy for editing or creating a hard copy, you can return and export it once again at any moment.

Make use of the US Legal Forms professional collection to gain access to the Mecklenburg North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile you were seeking and a huge number of other professional and state-specific templates on one platform!