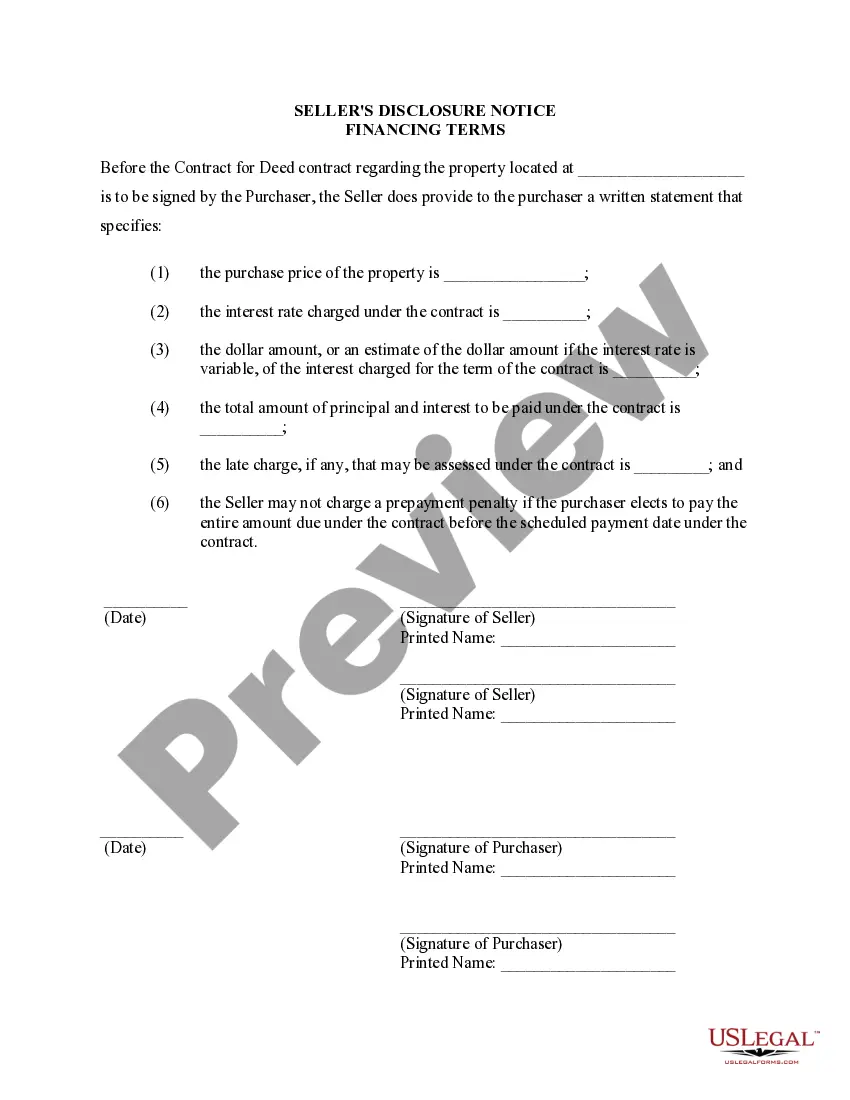

The Greensboro North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the terms and conditions of the financing arrangement between the seller and the buyer. This disclosure is crucial in providing transparency and clarity regarding the financial aspects of the property transaction. Let's explore the key points to be included in such a document: 1. Definition and Purpose: The Seller's Disclosure of Financing Terms describes the type of financing agreement being utilized, specifically the Contract or Agreement for Deed. It explains that this arrangement allows the buyer to make installment payments directly to the seller, who retains legal ownership until the agreed-upon payments are complete. 2. Parties involved: The document identifies the seller (property owner) and the buyer to establish their roles and responsibilities in the financing agreement. 3. Property details: A detailed description of the residential property being sold should be included, providing information such as the address, title information, and legal description. 4. Purchase price: The disclosure outlines the agreed-upon purchase price for the property and any conditions related to it, such as down payment requirements or adjustments. 5. Financing terms: This section covers the specific terms of the financing arrangement, including the duration and frequency of payments, interest rate (if applicable), and any late payment penalties. It may also include information regarding possible prepayment options. 6. Title and ownership: The disclosure highlights that, under the Agreement for Deed or Land Contract, legal title to the property remains with the seller until all agreed payments have been made. Once the full payment is received, the seller will transfer the title to the buyer. 7. Insurance and taxes: Information regarding property insurance and tax payments should be provided, such as who is responsible for these costs during the contract period. 8. Conditions and contingencies: Any conditions or contingencies associated with the financing terms should be clearly stated, such as default and foreclosure procedures, remedies for breach of contract, or potential conflicts that might arise. Different variations of the Greensboro North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may exist depending on specific circumstances or additional legal requirements. It is crucial for both buyers and sellers to consult with professional real estate attorneys or title companies to ensure compliance with local regulations and to address any unique situations that may arise during the financing process.

Greensboro North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Greensboro North Carolina Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you are looking for a valid form template, it’s extremely hard to choose a more convenient place than the US Legal Forms site – probably the most comprehensive libraries on the internet. With this library, you can get a huge number of form samples for business and personal purposes by types and states, or keywords. With our advanced search function, discovering the latest Greensboro North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is as easy as 1-2-3. In addition, the relevance of every file is verified by a group of expert lawyers that regularly review the templates on our website and revise them based on the newest state and county laws.

If you already know about our platform and have an account, all you need to receive the Greensboro North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the form you want. Look at its information and utilize the Preview function (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the appropriate document.

- Confirm your choice. Select the Buy now button. Next, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the form. Indicate the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained Greensboro North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Each and every form you save in your profile has no expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to have an additional duplicate for editing or creating a hard copy, you may come back and download it once again at any time.

Take advantage of the US Legal Forms extensive library to gain access to the Greensboro North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract you were seeking and a huge number of other professional and state-specific samples in one place!