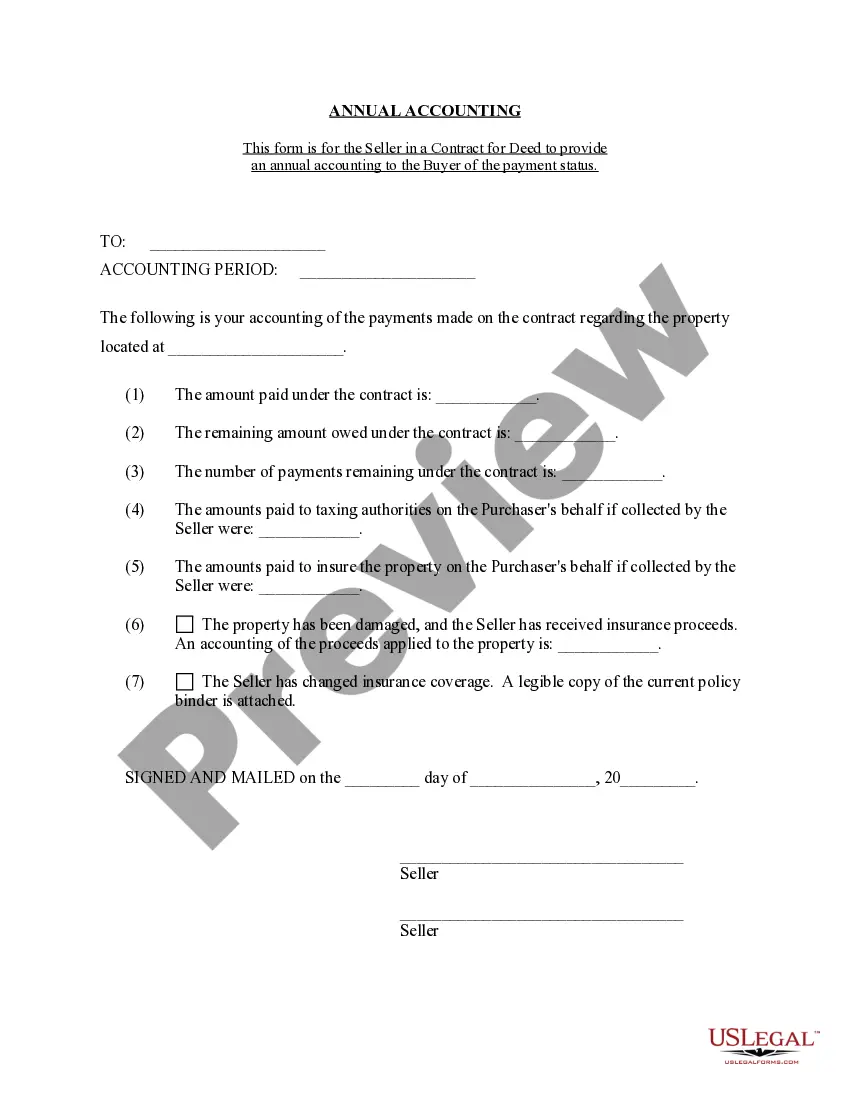

Cary North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out North Carolina Contract For Deed Seller's Annual Accounting Statement?

Are you in search of a reliable and cost-effective provider for legal documents to purchase the Cary North Carolina Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of papers to facilitate your divorce process in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes. Each template we provide is specific and tailored to meet the standards of different states and counties.

To obtain the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Please be aware that you can download your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can easily create an account, but before doing so, please ensure to follow these steps.

Now you can proceed to create your account. Then choose a subscription plan and move forward with the payment. Once the payment is processed, download the Cary North Carolina Contract for Deed Seller's Annual Accounting Statement in any available file format. You can revisit the website whenever needed and redownload the document at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending hours studying legal paperwork online once and for all.

- Check if the Cary North Carolina Contract for Deed Seller's Annual Accounting Statement adheres to the laws of your state and locality.

- Review the form’s description (if available) to determine the intended audience and purpose of the document.

- Restart your search if the form is not suitable for your legal situation.

Form popularity

FAQ

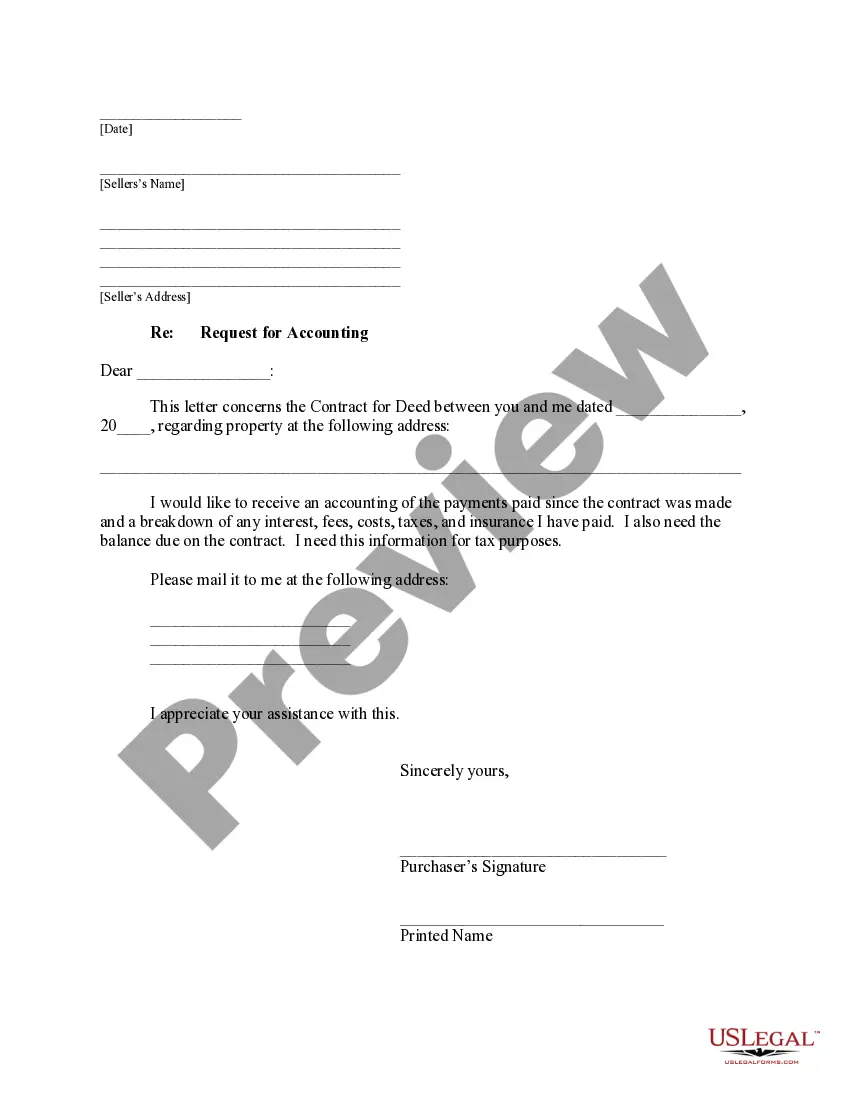

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

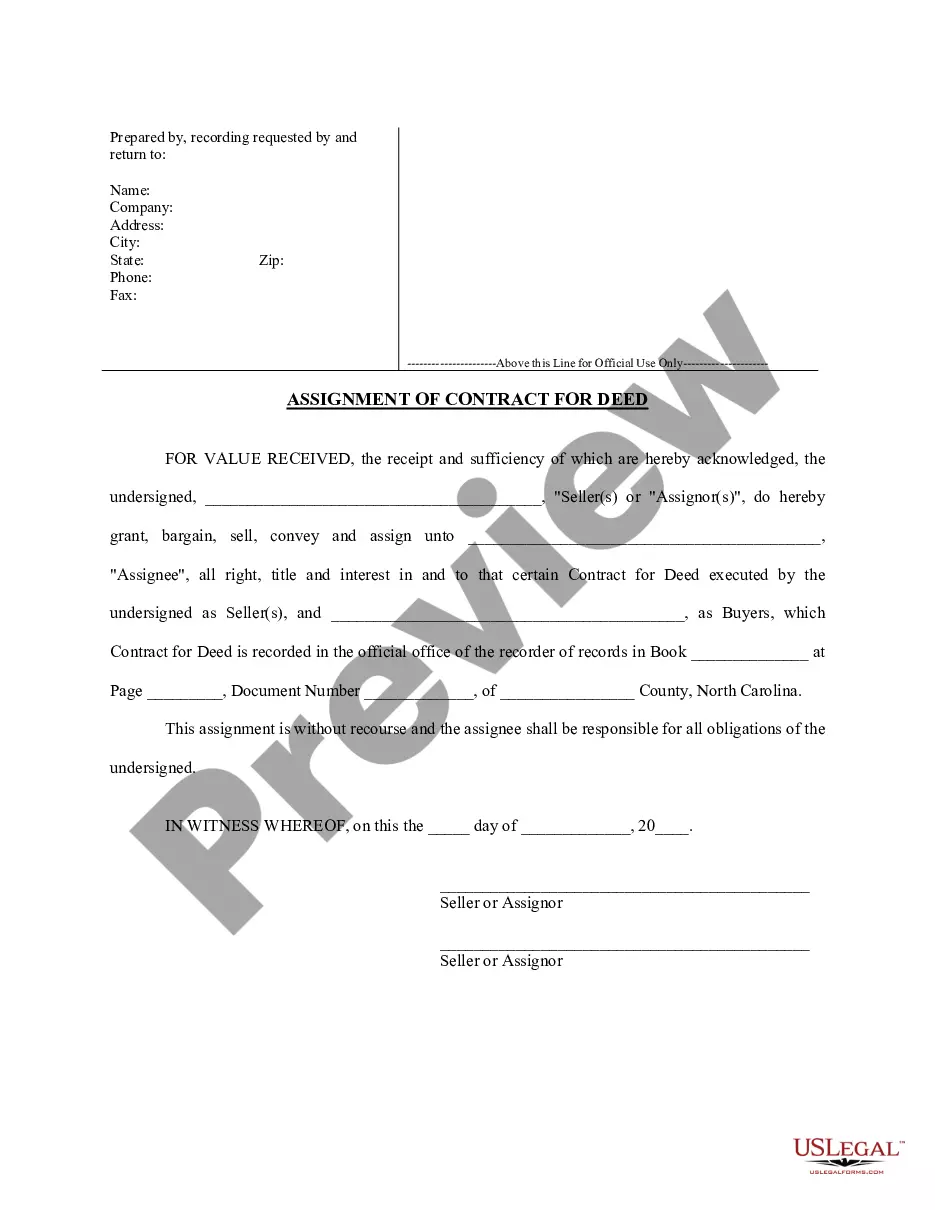

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

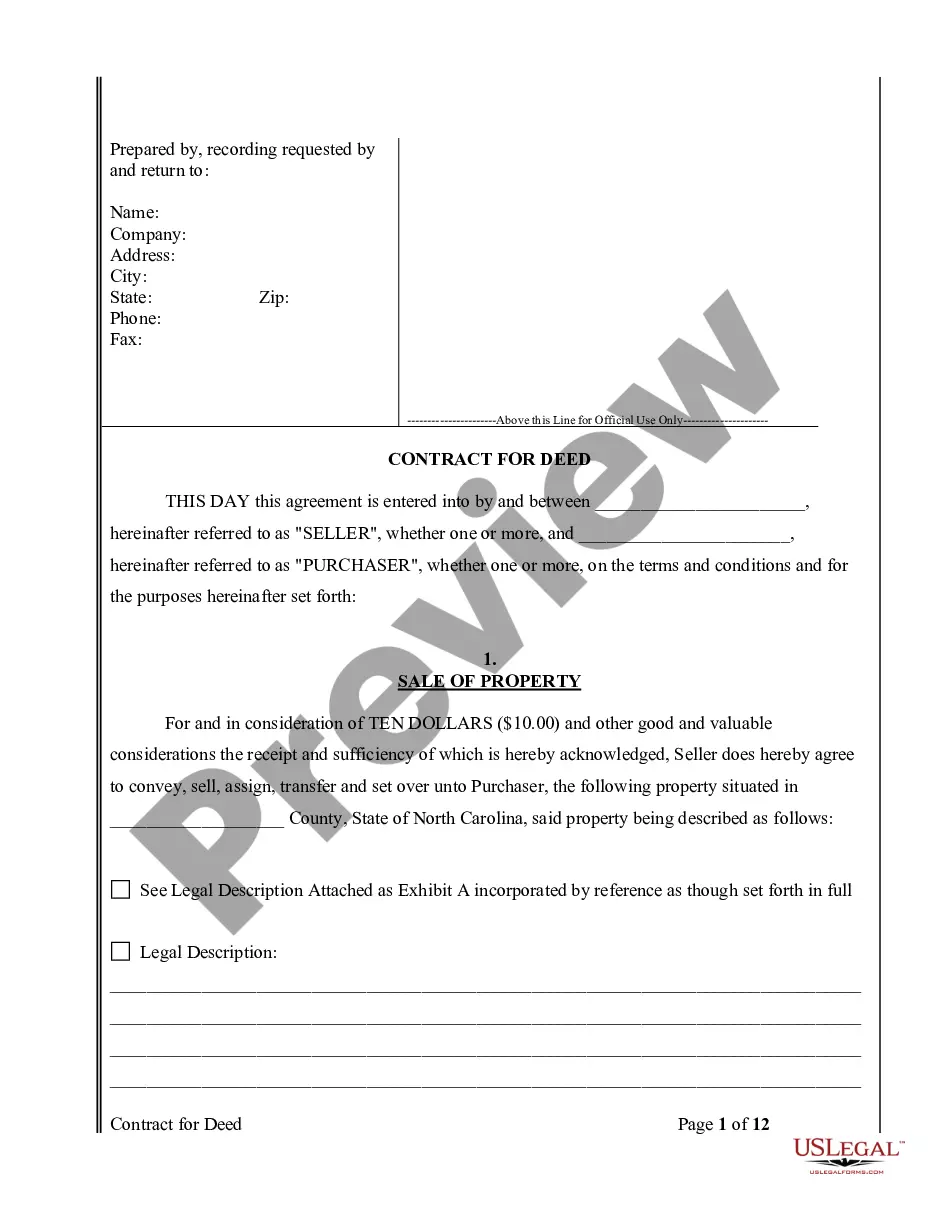

A contract for deed (sometimes called an installment purchase contract or installment sale agreement) is a real estate transaction in which the purchase of the property is financed by the seller rather than a third party such as a bank, credit union or other mortgage lender.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

A Contract for Deed is a way to buy a house that doesn't involve a bank. The seller finances the property for the buyer. The buyer moves in when the contract is signed. The buyer pays the seller monthly payments that go towards payment for the home.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

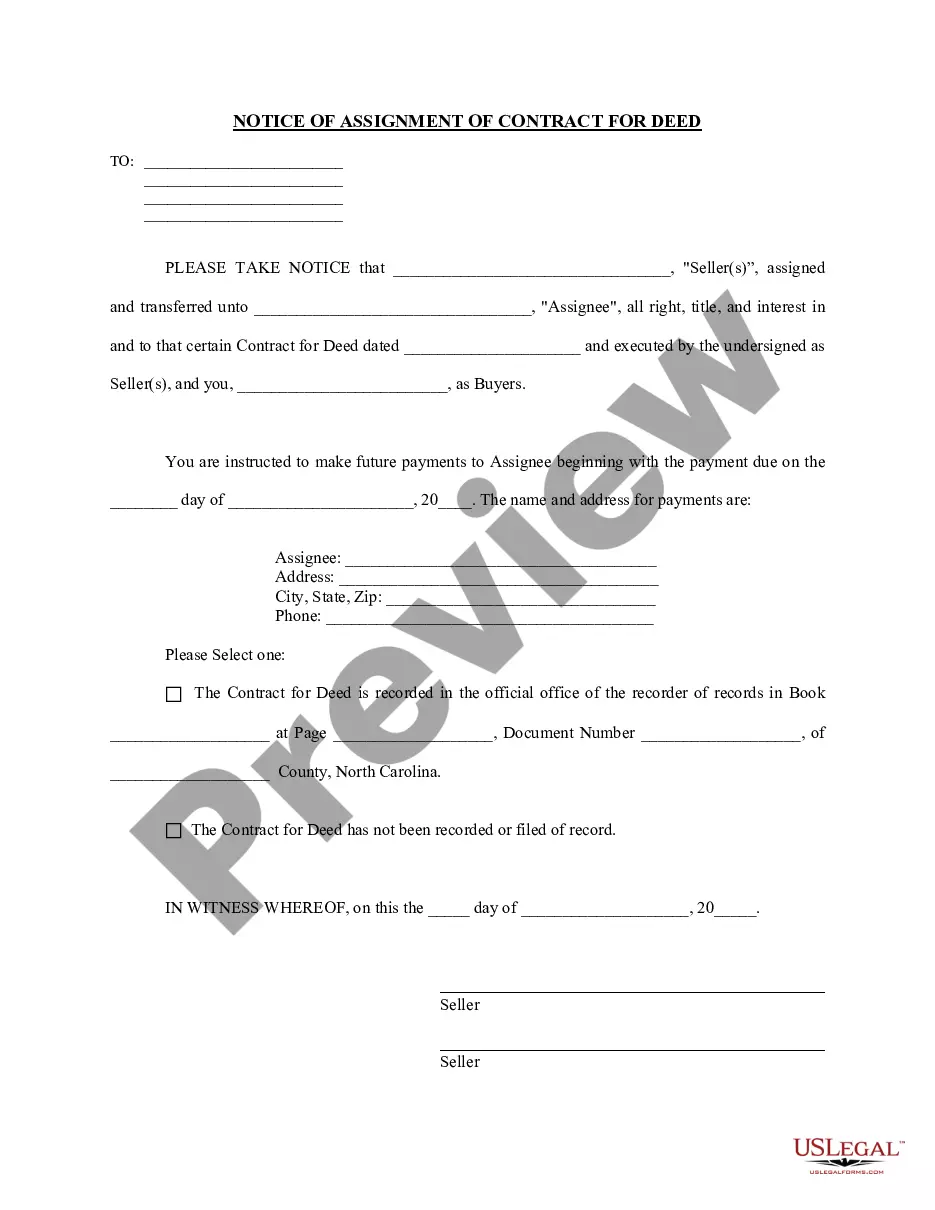

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in