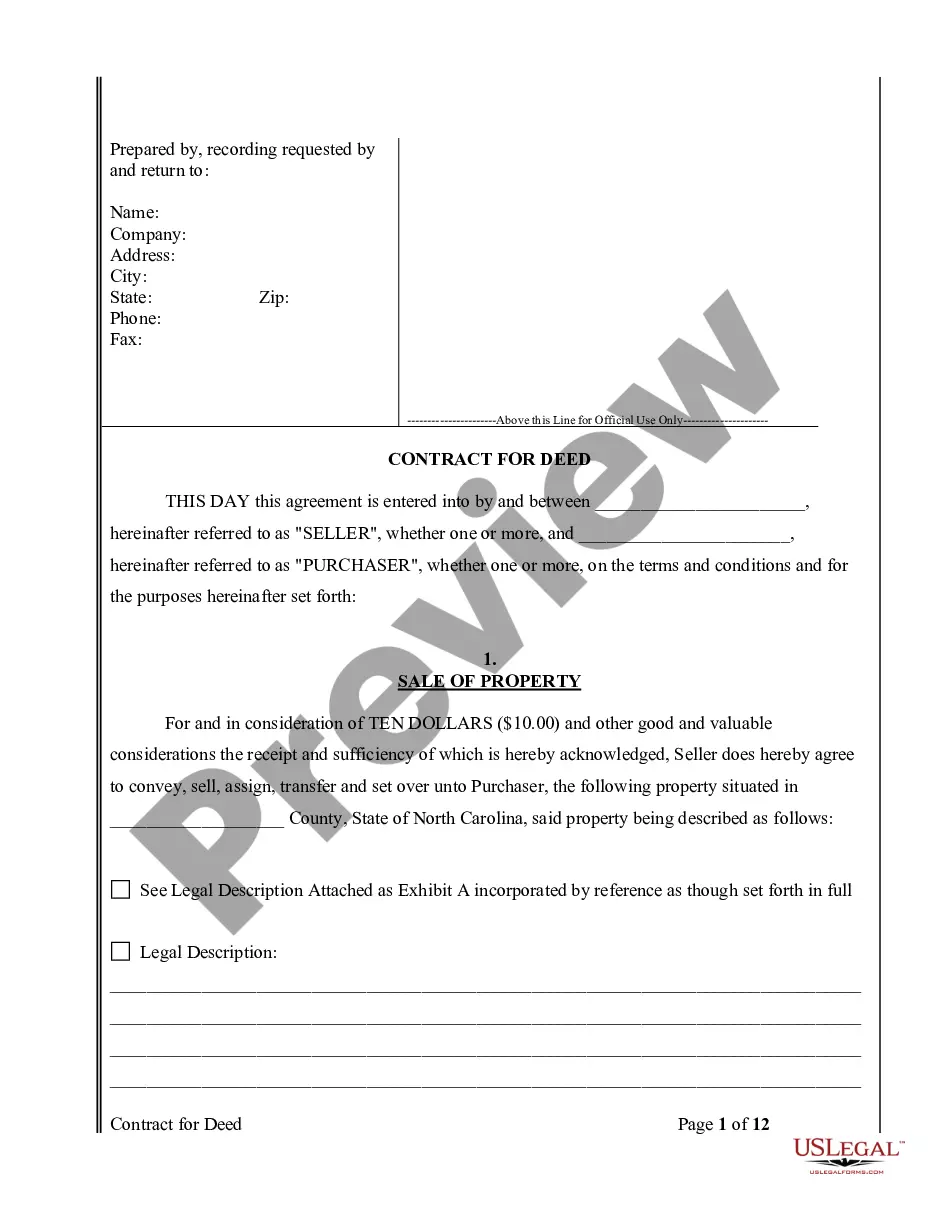

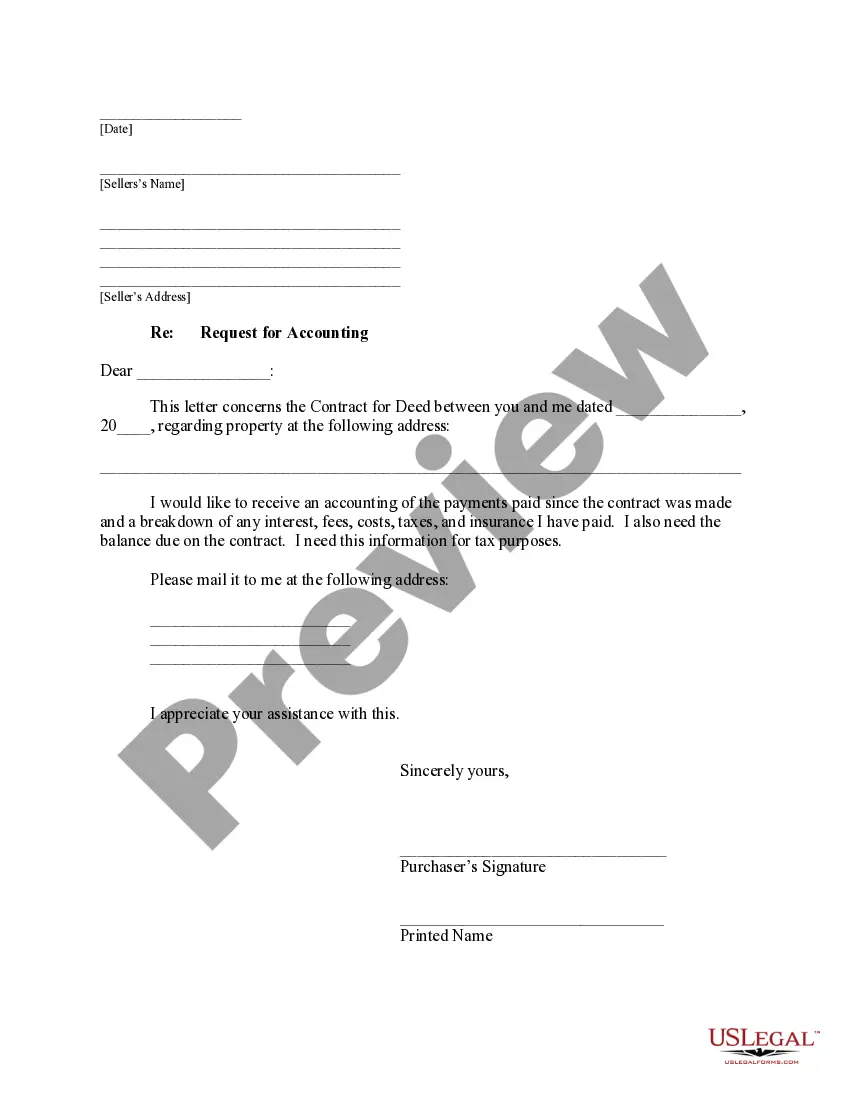

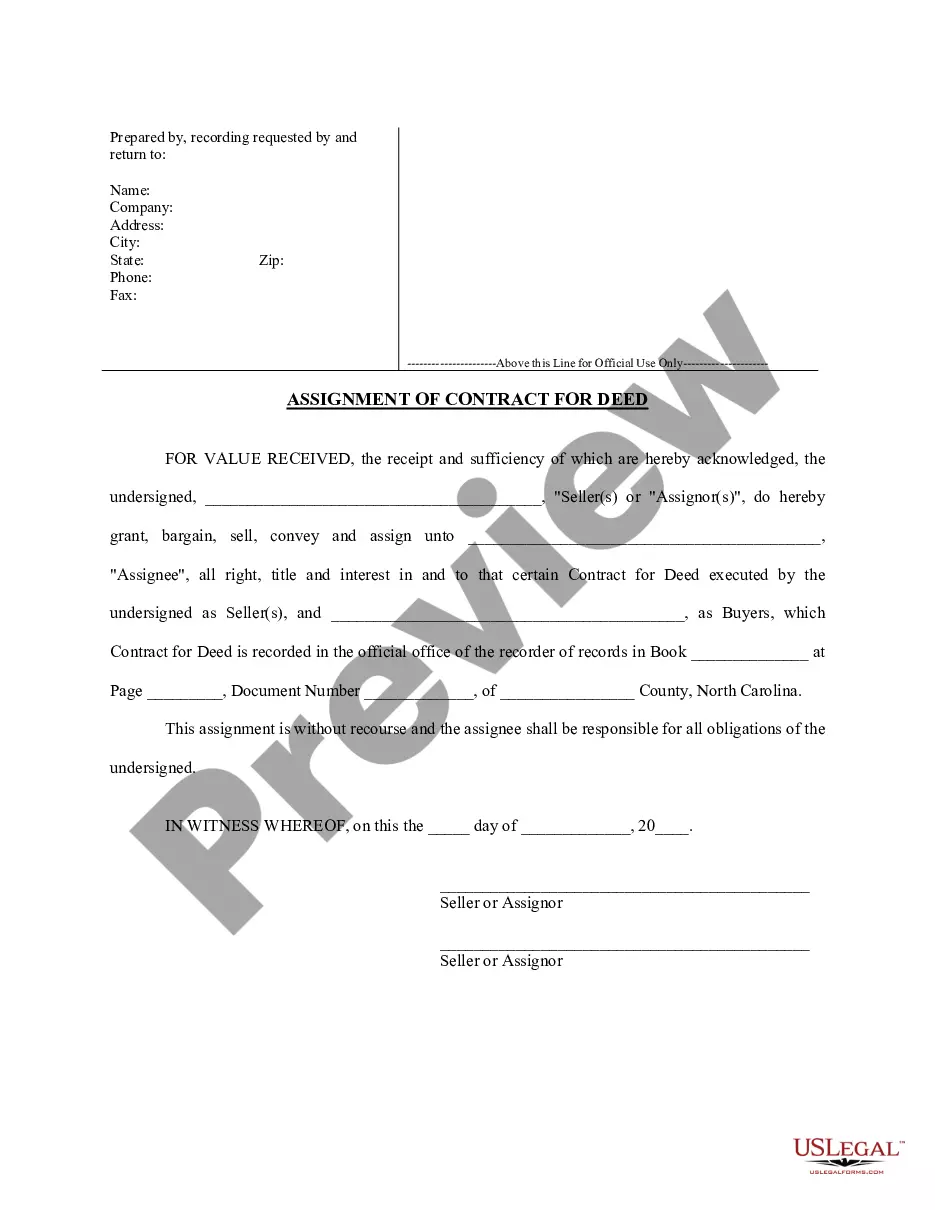

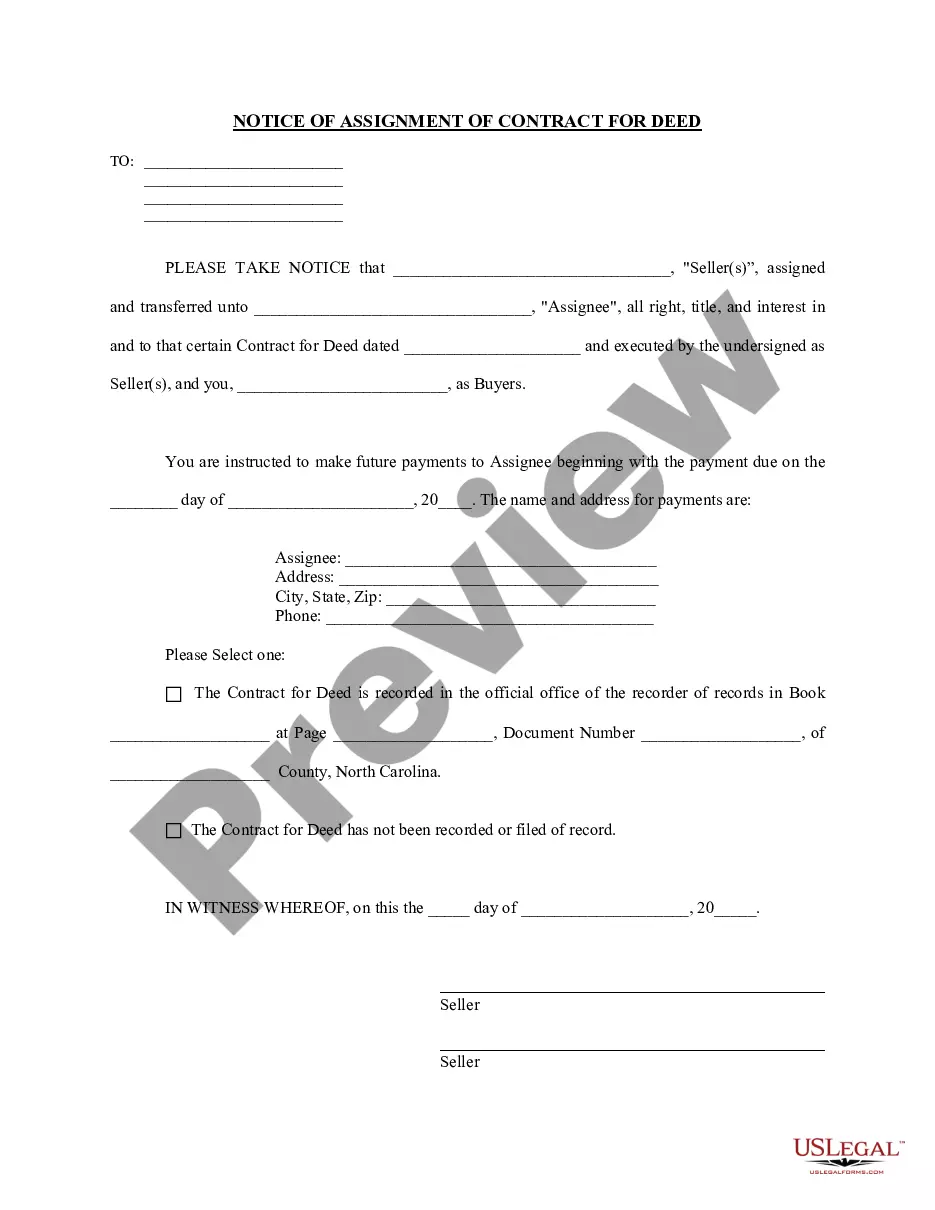

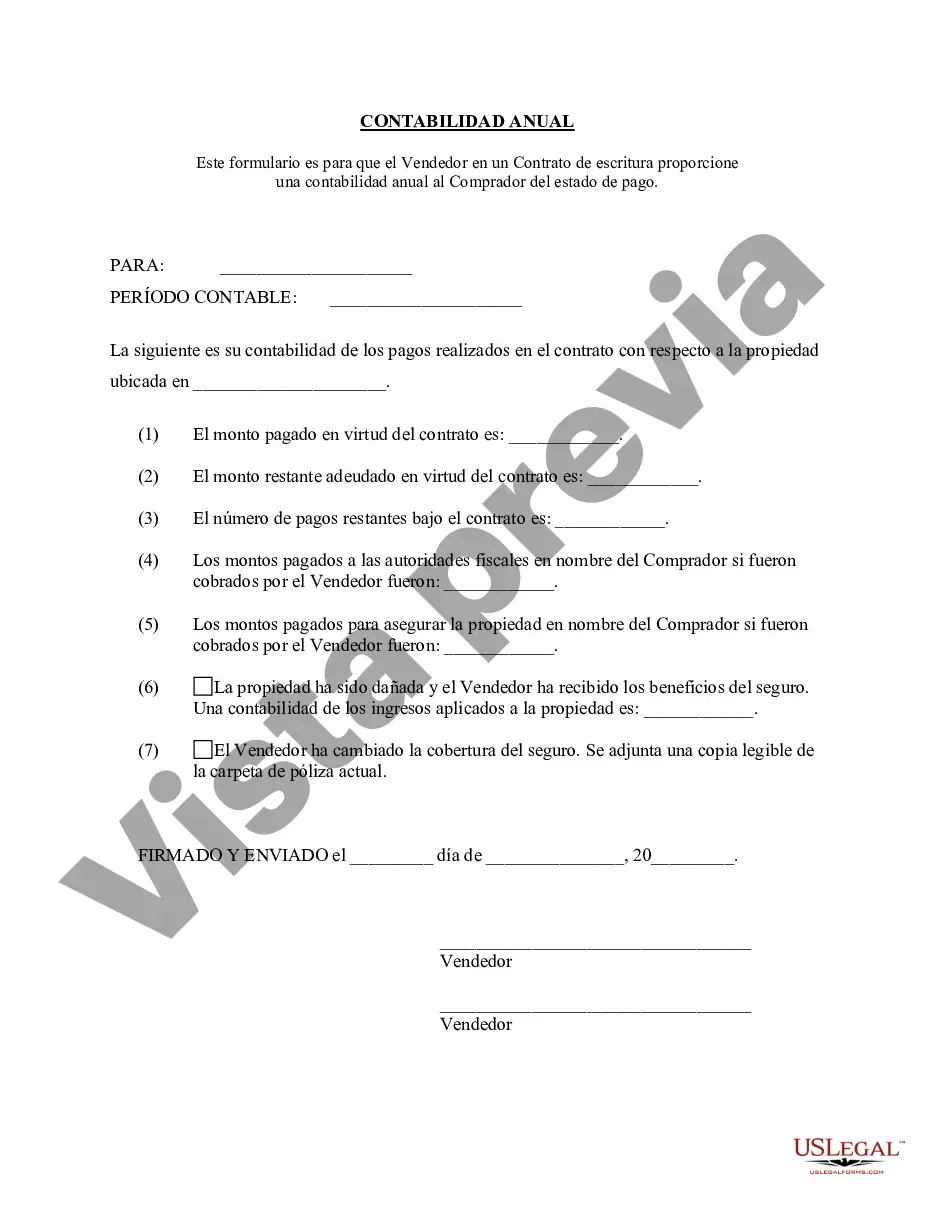

The Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of the financial transactions and obligations of the seller in a contract for deed agreement in Wilmington, North Carolina. This statement outlines the financial status of the seller and ensures transparency between the parties involved in the contract. The annual accounting statement highlights various key aspects, including the seller's income, expenses, profits, and losses derived from the contract for deed agreement. It presents a clear breakdown of the financial activities related to the sale of the property under the contract. Keywords: Wilmington North Carolina, contract for deed, seller's annual accounting statement, financial transactions, obligations, comprehensive overview, financial status, transparency, parties involved, income, expenses, profits, losses, breakdown, property sale. Different types of Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement include: 1. Income Statement: This type of statement focuses on the seller's income derived from the contract for deed. It provides details about the revenue generated through the property's monthly or annual payments made by the buyer. 2. Expense Statement: This statement outlines the various expenses incurred by the seller during the contract period. It includes costs related to property maintenance, repairs, insurance, property taxes, and any other relevant expenditures associated with the property. 3. Profit and Loss Statement: This statement provides an overview of the overall profitability or loss incurred by the seller under the contract for deed. It considers both the income generated and the expenses incurred, allowing the seller to assess the financial outcome of the agreement. 4. Payment Schedule Statement: This statement provides a detailed schedule of the buyer's payment plan and outlines the payments made by the buyer to the seller throughout the contract period. It helps track the payment history and ensures the seller can maintain accurate accounting records. 5. Tax Statement: This statement focuses specifically on the tax obligations and implications associated with the contract for deed. It includes details about property taxes paid by the seller, any tax deductions or benefits, and ensures compliance with local tax regulations. Keywords: Income statement, expense statement, profit and loss statement, payment schedule statement, tax statement, financial outcome, payment history, accounting records, tax obligations, tax deductions, compliance, local tax regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wilmington North Carolina Contrato de Escrituración Estado Contable Anual del Vendedor - North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Wilmington North Carolina Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you are searching for a relevant form template, it’s impossible to choose a more convenient service than the US Legal Forms website – one of the most considerable libraries on the internet. Here you can get a large number of form samples for organization and individual purposes by categories and states, or key phrases. With our advanced search feature, getting the most recent Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement is as easy as 1-2-3. In addition, the relevance of each and every record is confirmed by a group of professional attorneys that regularly check the templates on our platform and revise them according to the newest state and county demands.

If you already know about our system and have a registered account, all you should do to get the Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the sample you require. Check its information and make use of the Preview function to see its content. If it doesn’t meet your needs, use the Search option near the top of the screen to find the appropriate file.

- Confirm your decision. Select the Buy now button. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the format and save it to your system.

- Make adjustments. Fill out, modify, print, and sign the obtained Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement.

Each and every template you add to your user profile does not have an expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to receive an additional copy for enhancing or printing, you can return and export it once more anytime.

Take advantage of the US Legal Forms extensive collection to gain access to the Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement you were seeking and a large number of other professional and state-specific samples in a single place!