Title: High Point, North Carolina Notice of Default for Past Due Payments under Contract for Deed Introduction: In High Point, North Carolina, the Notice of Default for Past Due Payments in connection with a Contract for Deed signifies a crucial legal document that highlights the failure to meet financial obligations under such agreements. This comprehensive description aims to outline the intricacies of these notices and their ramifications on individuals involved in satisfying the terms of a Contract for Deed. 1. Understanding the Notice of Default for Past Due Payments: The Notice of Default serves as a formal notification issued by the seller to the buyer, indicating that the latter has failed to make timely payments according to the agreed-upon terms outlined in the Contract for Deed. It is a significant step towards initiating legal actions to address the delinquency. 2. Types of High Point, North Carolina Notice of Default for Past Due Payments: a. Initial Notice of Default: This notice is typically served when the buyer initially fails to make the necessary payments within the agreed timeframe. It serves as a warning alerting the buyer about their delinquent payments and the potential consequences for non-compliance. b. Final Notice of Default: The Final Notice of Default comes into effect when the buyer has persistently failed to rectify their past-due payments even after receiving the initial notice. This notice signals a more advanced stage of delinquency, highlighting the imminent consequences if payment is not made promptly. c. Notice of Right to Cure: In certain cases, High Point, North Carolina may require the seller to issue a Notice of Right to Cure, allowing the buyer a specific time frame to bring their payments up to date before further legal actions can be pursued. This notice emphasizes the possibility of rectifying the delinquency within a designated period. 3. Ramifications and Potential Consequences: a. Foreclosure Proceedings: In extreme cases, where the buyer fails to respond to the Final Notice of Default or to rectify the past-due payments within the stipulated time frame, the seller may initiate foreclosure proceedings. This legal action allows the seller to reclaim the property, effectively terminating the buyer's rights under the Contract for Deed. b. Additional penalties and fees: Depending on the terms of the Contract for Deed, the buyer may be subject to additional penalties, fees, or increased interest rates due to their failure to make timely payments. These financial consequences can further exacerbate the buyer's financial situation and complicate their ability to resolve the default. c. Credit Score Implications: One of the critical long-term effects of defaulting on Contract for Deed payments is the negative impact on the buyer's credit score. A default can lead to a significant decrease in the credit score, making it harder for the buyer to obtain favorable terms on future credit applications and financial transactions. Conclusion: The High Point, North Carolina Notice of Default for Past Due Payments under a Contract for Deed serves as an essential legal document, providing formal notice to delinquent buyers regarding their failure to meet their financial obligations. Buyers should take these notices seriously, promptly addressing the delinquent payments to avoid severe consequences such as foreclosure, additional penalties, and negative credit score implications. It is advisable for both buyers and sellers to consult legal professionals to understand their rights and obligations under a Contract for Deed to prevent default situations from arising.

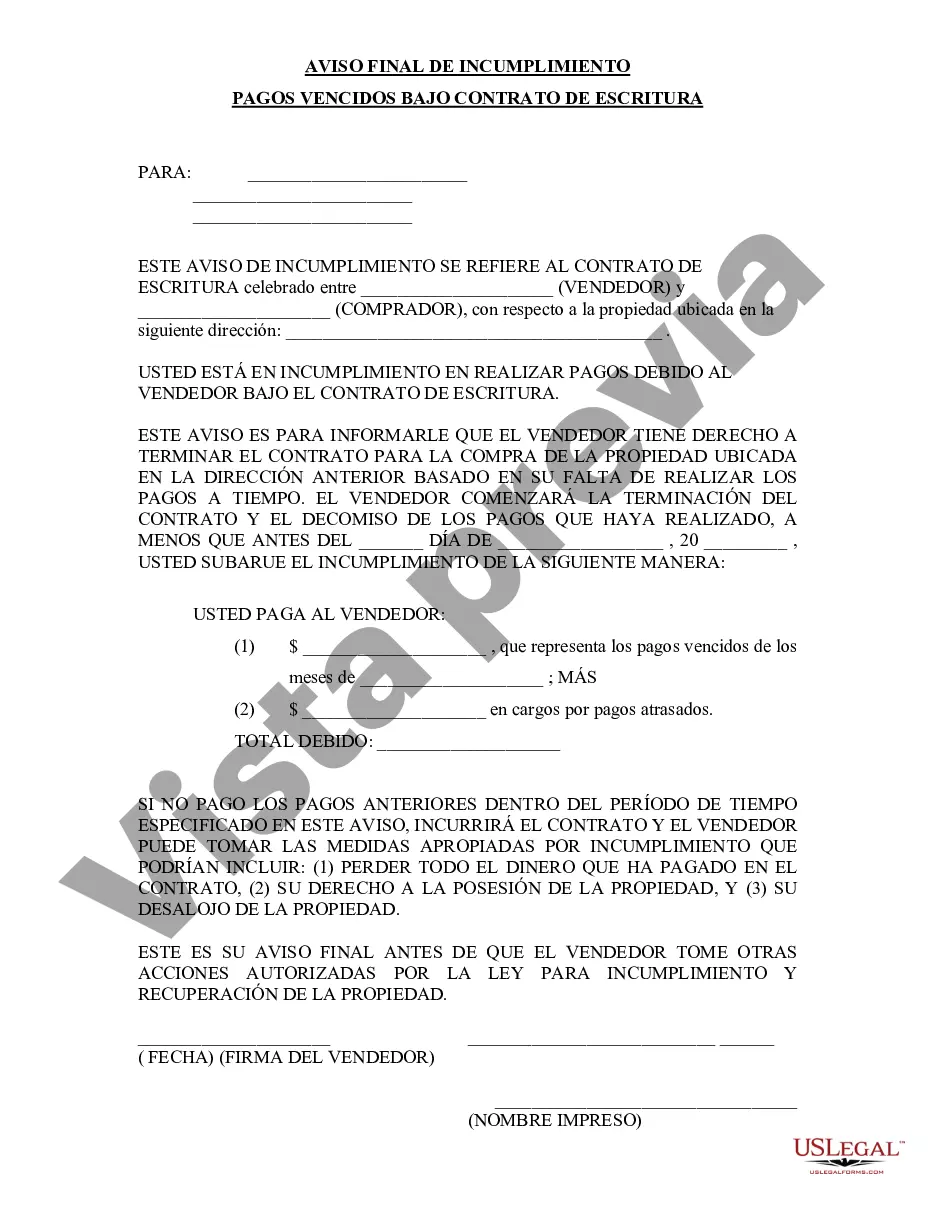

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.High Point North Carolina Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out High Point North Carolina Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any law education to draft such papers cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform provides a massive collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the High Point North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the High Point North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed in minutes employing our reliable platform. If you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are unfamiliar with our library, make sure to follow these steps prior to obtaining the High Point North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Be sure the template you have chosen is suitable for your location since the regulations of one state or county do not work for another state or county.

- Preview the document and go through a brief outline (if provided) of scenarios the paper can be used for.

- If the one you picked doesn’t meet your requirements, you can start again and search for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the High Point North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed as soon as the payment is through.

You’re all set! Now you can go ahead and print the document or complete it online. Should you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.