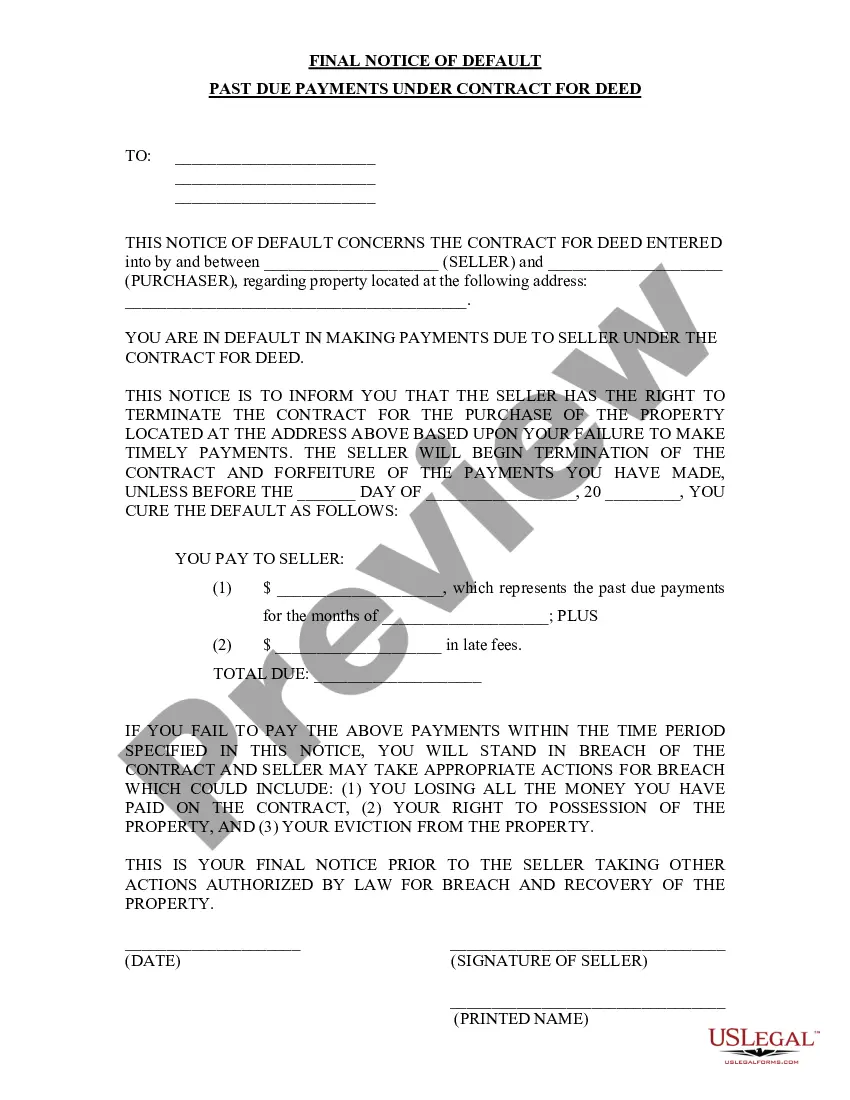

Raleigh North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out North Carolina Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you are looking for an appropriate document, it’s exceedingly difficult to select a superior service than the US Legal Forms site – likely the most comprehensive collections on the internet.

With this collection, you can obtain thousands of document examples for business and personal objectives by categories and areas, or keywords.

With our top-notch search capability, locating the latest Raleigh North Carolina Final Notice of Default for Past Due Payments related to Contract for Deed is as simple as 1-2-3.

Finalize the payment. Use your credit card or PayPal account to complete the registration process.

Obtain the document. Specify the file format and save it to your device.

- Furthermore, the relevance of each record is validated by a team of expert attorneys who regularly assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our service and possess a registered account, all you need to do to obtain the Raleigh North Carolina Final Notice of Default for Past Due Payments related to Contract for Deed is to Log In to your user account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the following guidelines.

- Ensure you have located the document you need. Review its description and utilize the Preview option to examine its content. If it doesn’t meet your requirements, use the Search feature at the top of the page to locate the suitable record.

- Validate your choice. Click the Buy now button. Afterwards, select your desired subscription plan and enter credentials to register an account.

Form popularity

FAQ

Though, North Carolina nonjudicial foreclosures usually involve one court hearing (see below). After completing the required steps, the lender can sell the home at a foreclosure sale. Most lenders opt to use the nonjudicial process because it's quicker and cheaper than litigating the matter in court.

Physical Records All real estate records are public records and are available for inspection between the hours of 8 a.m. and 5 p.m. Monday through Friday. The Register of Deeds Office is located in the County and Courts Office Building, 720 East Fourth Street, Charlotte, NC 28202.

How much does an appeal cost? It usually costs $150 to file an appeal in court. You may not have to pay these court costs if you receive food stamps, Supplemental Security Income (SSI) or cannot afford this fee.

Service by sheriff or other authorized person. If the respondent is served in North Carolina, the petition and notice of hearing must be served by the sheriff of the county in which the respondent is served or by some other person duly authorized by law to serve the petition and notice.

A certificate of relief is a court order. It reflects the court's determination?after notice to the prosecutor and victim and, if requested by the court, investigation by a probation officer?that the petitioner should be granted relief. See G.S. 15A-173.4 (describing procedure for issuance of a certificate of relief).

For each lawsuit, the plaintiff must pay a $96 filing fee to the clerk of court. You pay an additional $30 fee for each defendant to cover the cost of the sheriff getting the proper legal forms to the defendant.

How Long Does the Typical Foreclosure Process Take in North Carolina? It takes approximately three months to complete a non judicial foreclosure in North Carolina if everything goes smoothly. It may take longer than three months if the borrower fights the foreclosure or if the lender seeks a judicial foreclosure.

Where to File the Form: You must file the petition with the Office of the Clerk of Superior Court in the North Carolina county in which you were convicted. If you now reside in a different county, you still must file the petition in the county of conviction.

North Carolina is a power of sale foreclosure jurisdiction. This means that unlike many other states in which a lender seeking to foreclose must go through a lengthy judicial process in order to regain collateral (your house), North Carolina lenders may foreclose through a private sale process.

Redeeming the House While many states say that sales are final, you are given a short period in which you can redeem your home under North Carolina law. This period lasts for just ten days after the home is sold.