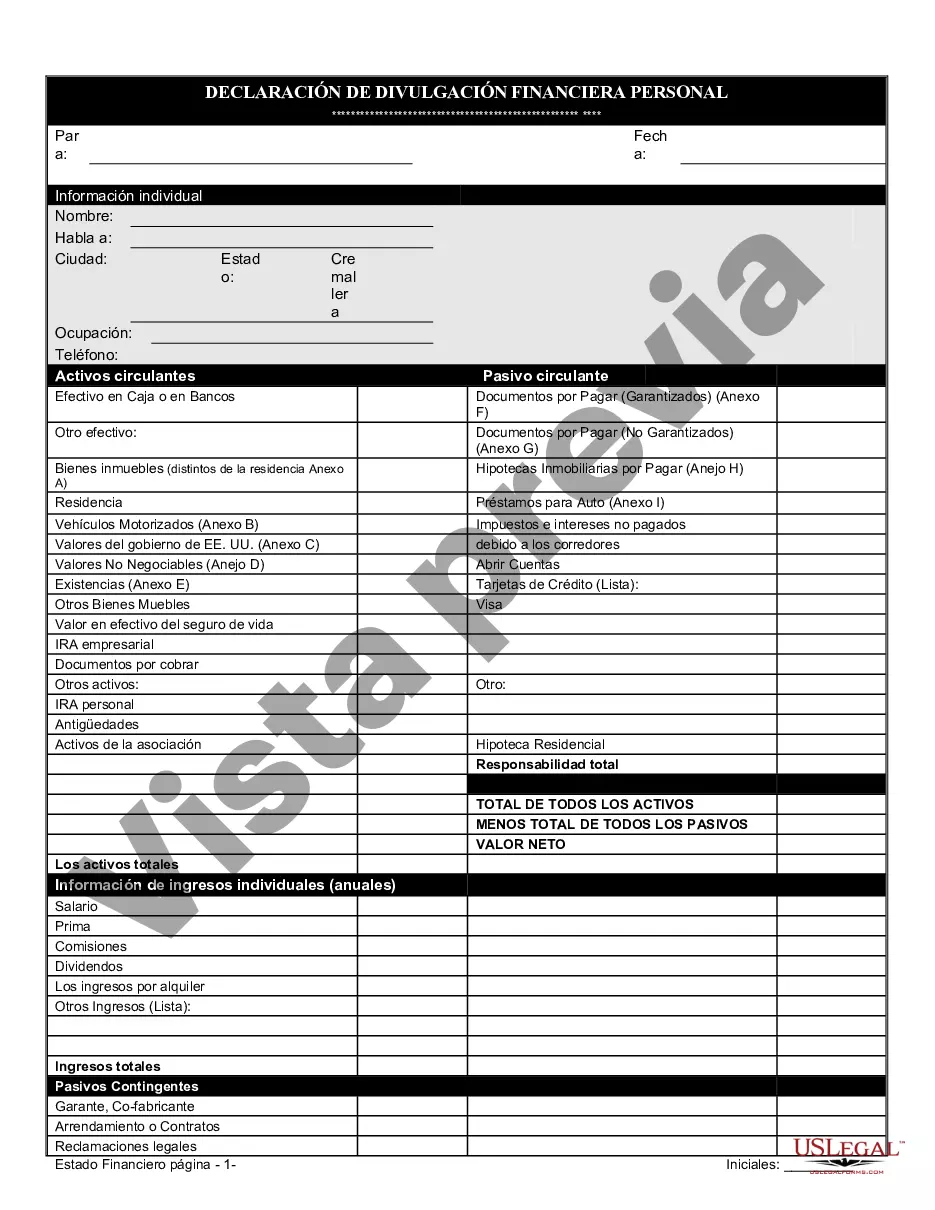

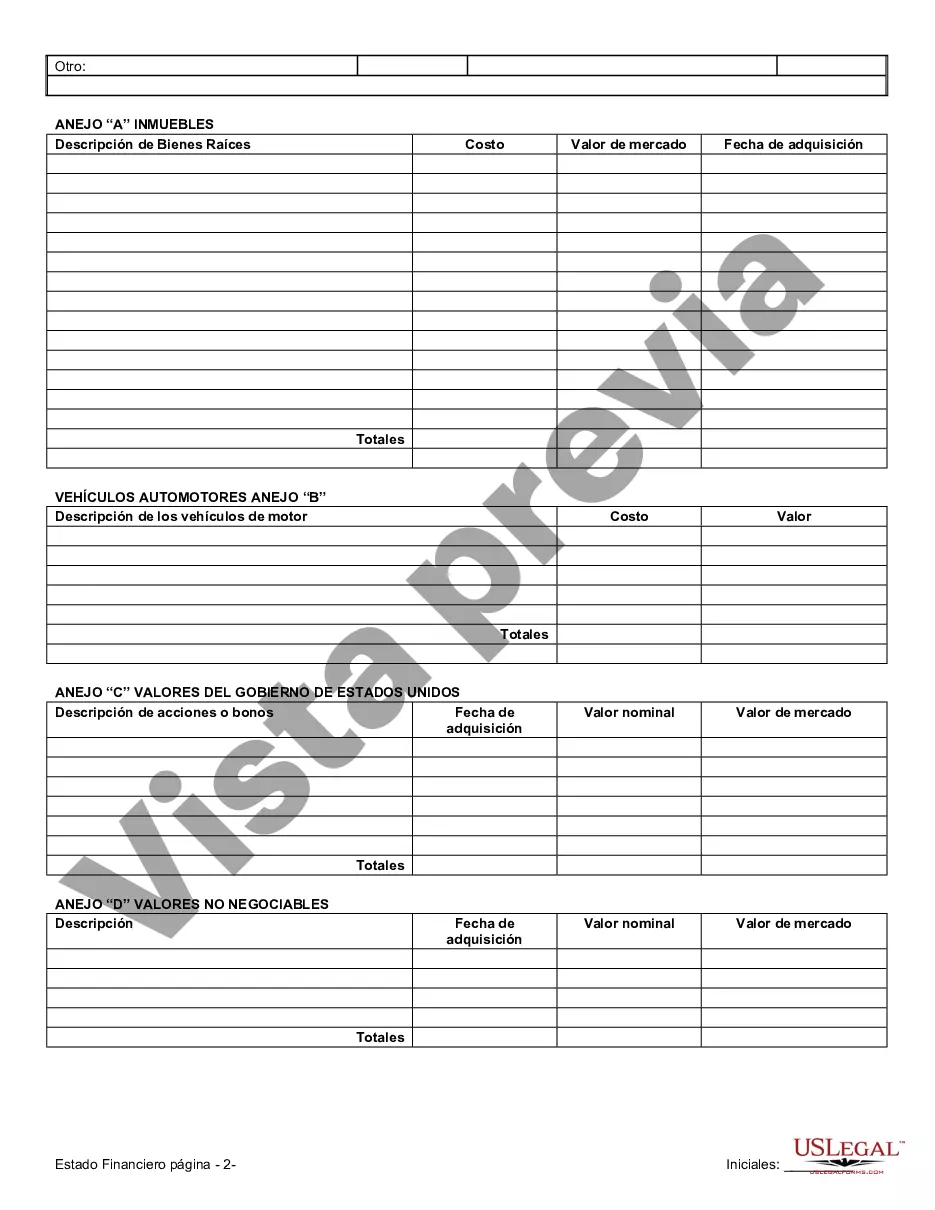

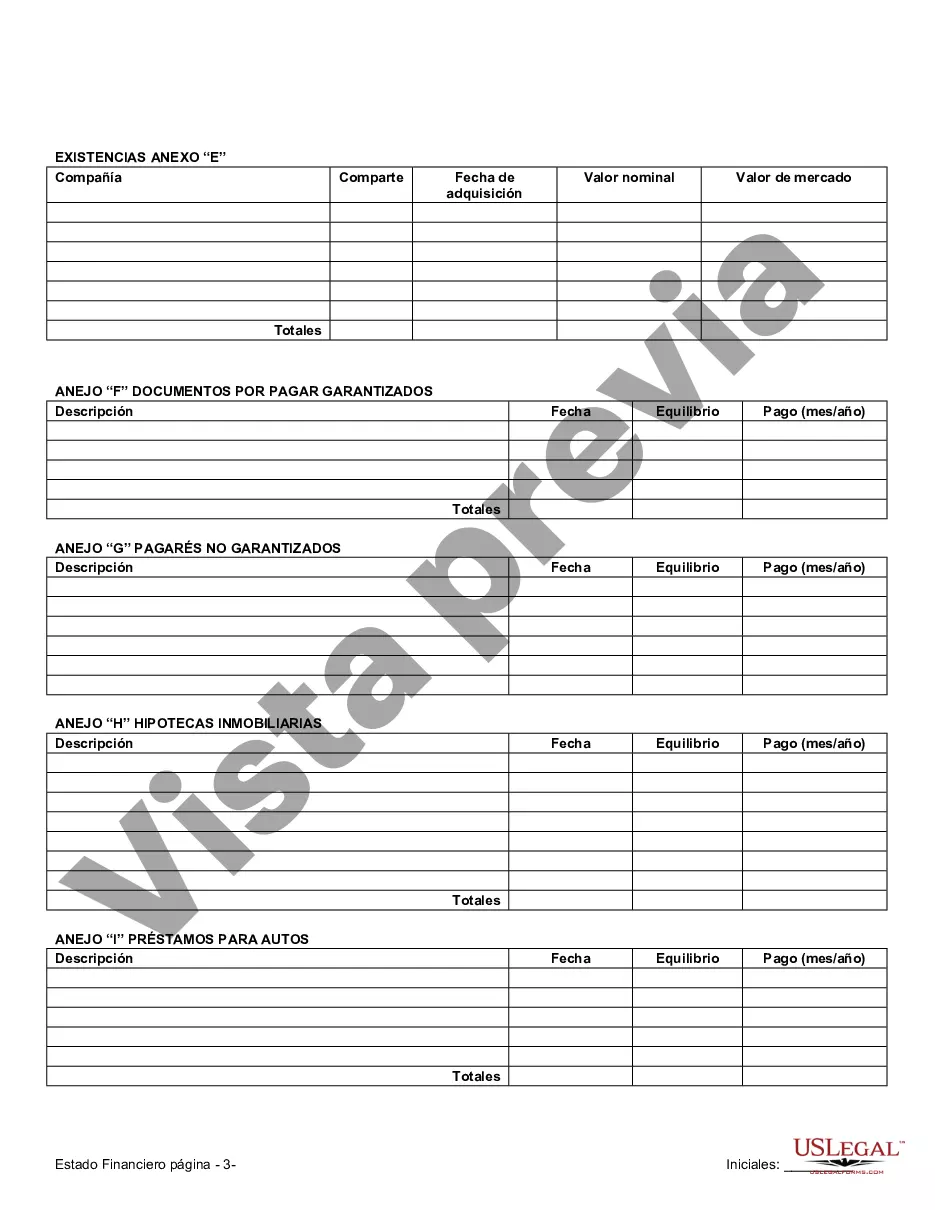

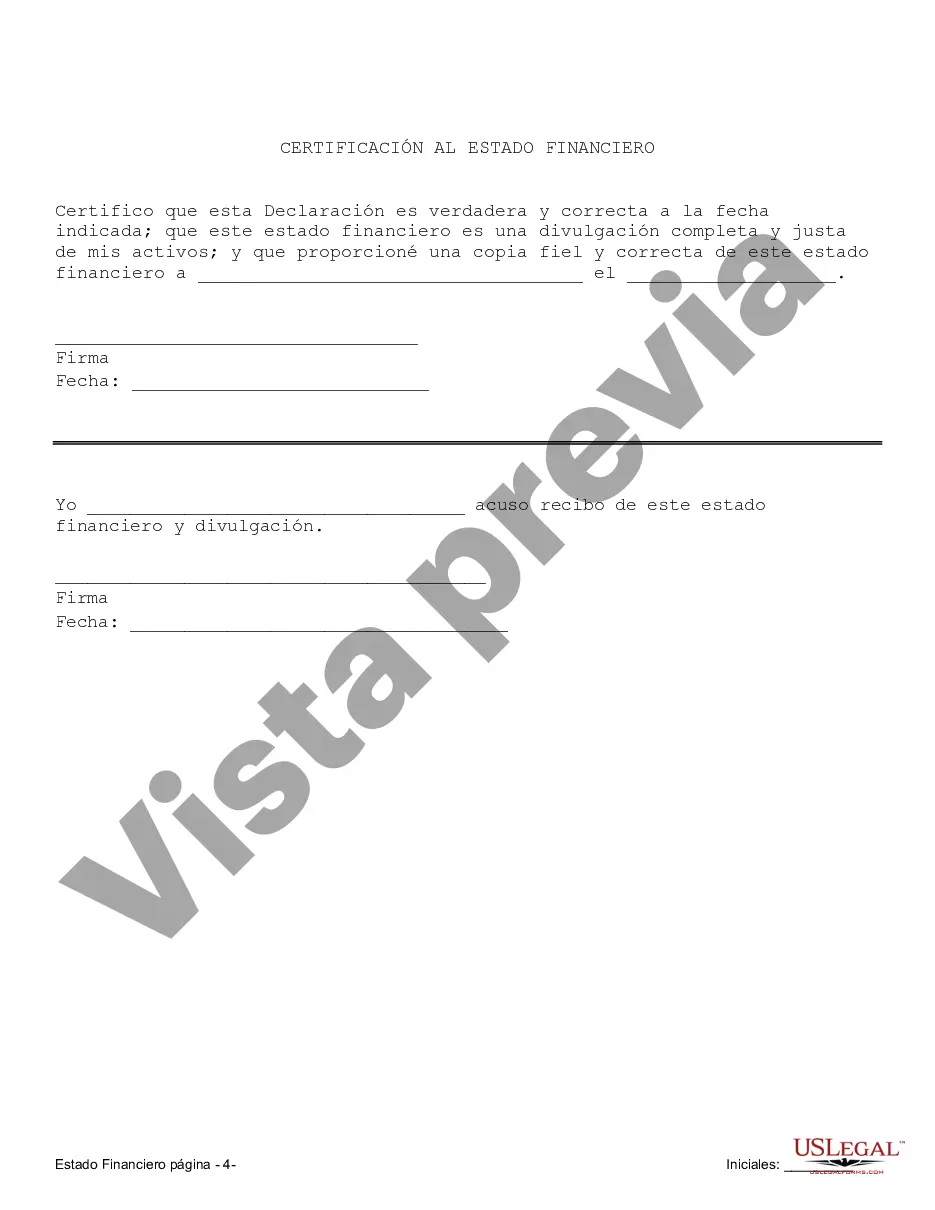

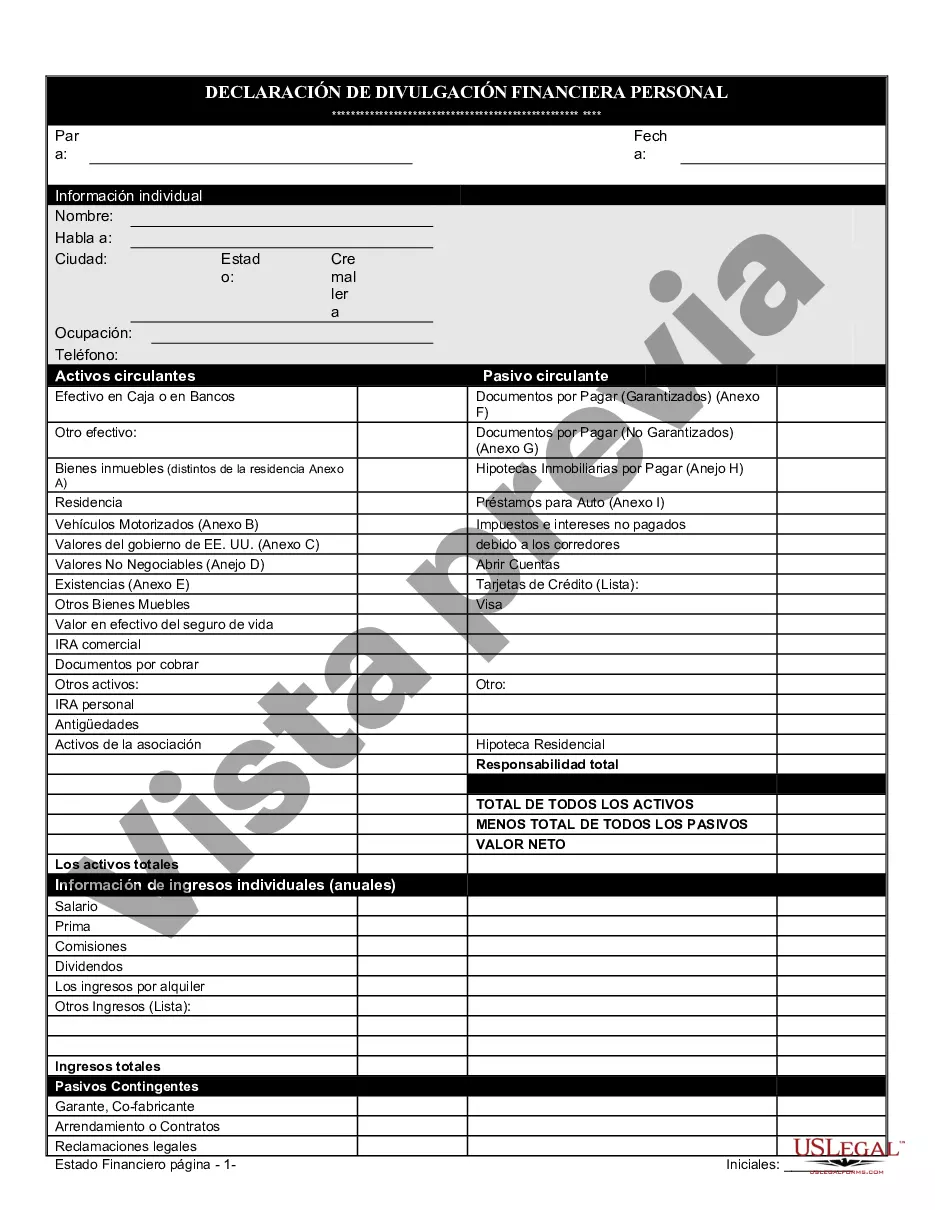

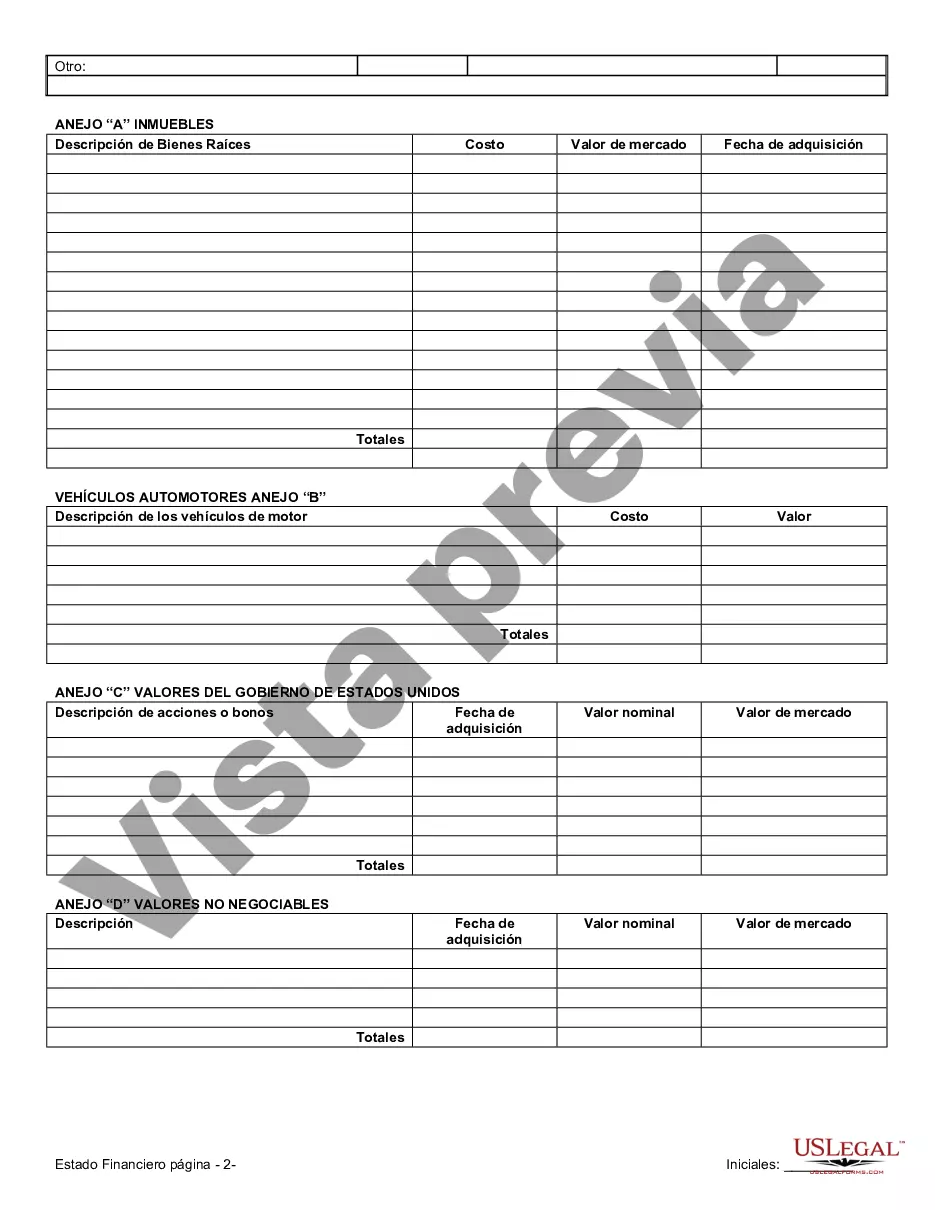

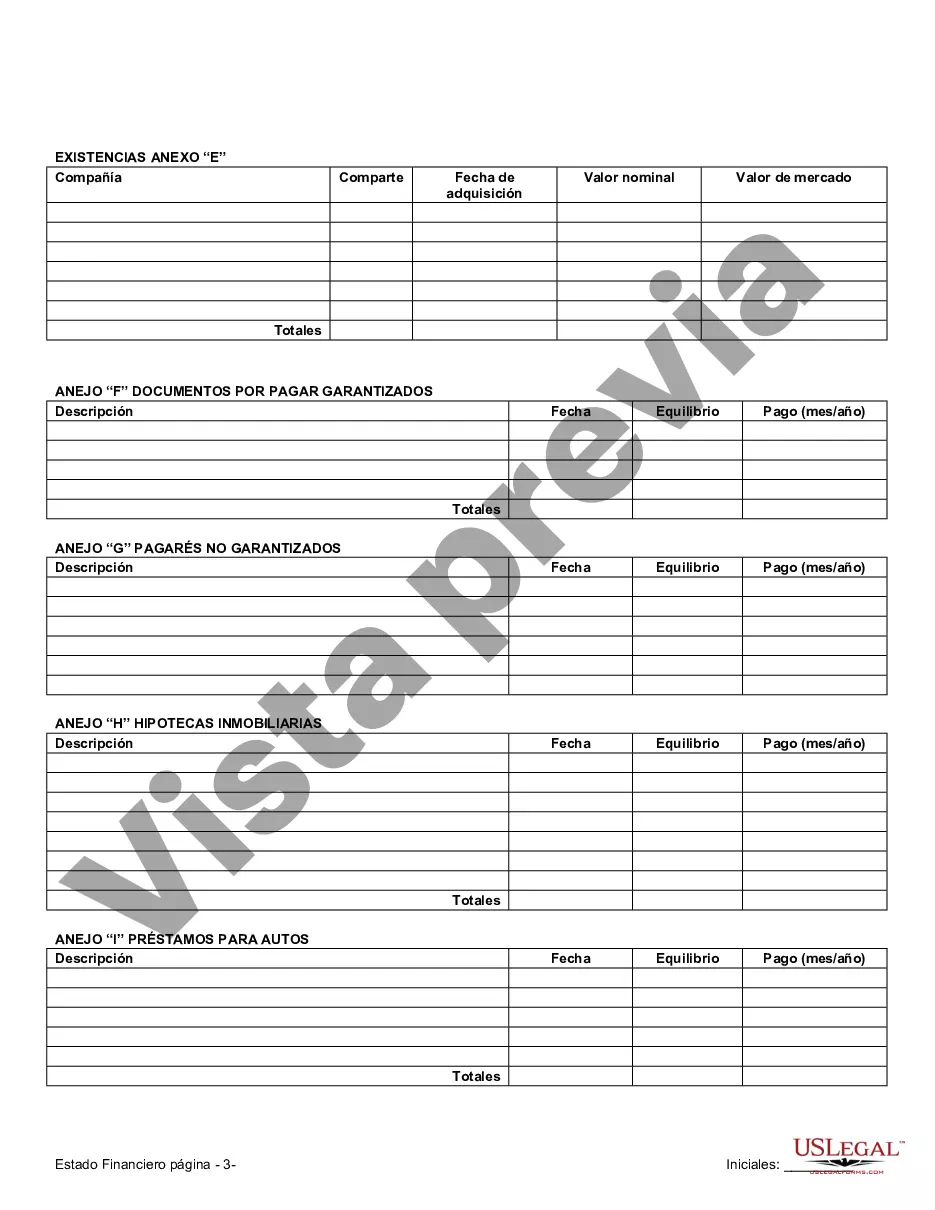

Mecklenburg North Carolina Financial Statements in Connection with Prenuptial Premarital Agreement are legal forms used in the state of North Carolina to disclose the financial resources, assets, and liabilities of each party involved in a prenuptial agreement. These statements play a crucial role in defining the financial obligations and rights of both individuals in the event of a divorce or separation. Here are some relevant details and key terms associated with these financial statements: 1. Mecklenburg County: Mecklenburg County is located in the state of North Carolina and is known for its largest city, Charlotte. It is essential to understand that the financial statements mentioned here specifically cater to Mecklenburg County's jurisdiction. 2. Prenuptial Agreement: A prenuptial/premarital agreement is a legal contract created by couples before marriage or civil union. It outlines the rights and responsibilities of each party concerning their finances, property division, spousal support, and other related matters, with the aim to protect assets and clarify financial expectations in the event of a divorce or death. 3. Financial Statements: In the context of a prenuptial agreement, financial statements refer to detailed documents that provide an accurate snapshot of an individual's financial situation, including assets, income, debts, and financial obligations. These statements aid in determining the division of property and financial support if the marriage ends. 4. Assets: Assets include any property, accounts, investments, real estate, businesses, vehicles, or any other valuable items owned individually or jointly by the parties involved. Such assets are disclosed in the financial statements to establish their existence and value. 5. Liabilities: Liabilities involve any outstanding debts, mortgages, loans, credit card balances, or any other financial obligations that a party may have. These liabilities are considered in the financial statements to understand any potential financial burdens that may impact the division of assets. 6. Income: Income refers to the money earned by an individual through various sources such as employment, investments, royalties, rental properties, or any other means. Disclosing income details in the financial statements aids in determining potential spousal support or financial assistance in the event of divorce. 7. Separate Property: Separate property includes assets or income that are individually owned before the marriage and are intended to remain the sole ownership of an individual after the marriage ends. Clearly stating separate property in the financial statements helps protect such assets during the property division process. 8. Joint Property: Joint property refers to assets or income that are acquired during the marriage and are shared equally by both parties. These joint property assets need to be identified and included in the financial statements to ensure equitable division if the couple decides to end their marriage. While the specific types of Mecklenburg North Carolina Financial Statements in Connection with Prenuptial Premarital Agreement might not vary significantly, they can be tailored to address individual circumstances. Examples may include Individual Financial Statements, Business Financial Statements, or Real Estate Financial Statements, depending on the nature of the assets involved. It is crucial to consult with a qualified family law attorney in Mecklenburg County, North Carolina, to ensure the accuracy and legality of these financial statements within the context of a prenuptial agreement. As laws and regulations may change, contacting a legal professional will provide access to the most up-to-date information and guidance regarding financial statements in connection with prenuptial agreements in Mecklenburg County, North Carolina.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Mecklenburg North Carolina Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Mecklenburg North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Mecklenburg North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Mecklenburg North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

Un acuerdo prematrimonial (o prenupcial) es un acuerdo escrito hecho por una pareja con intenciones de contraer matrimonio, en el que se especifica el convenio regulador que esta pareja desea que se contemple en el caso de que se divorcie.

Acuerdos prematrimoniales. Un acuerdo prematrimonial, tambien llamado acuerdo prenupcial, es un contrato celebrado entre dos personas antes del matrimonio, en el que se especifican los activos de cada una de ellas y como se repartiran en caso de que el matrimonio se termine por causas no naturales.

Los acuerdos entre futuros conyuges, antes de contraer matrimonio, son habitualmente conocidos como acuerdos prematrimoniales, prenupcial agreements o prenups....Estos requisitos a controlar son: La capacidad de las partes.El consentimiento.La forma.

Para llevar a cabo la realizacion de estos acuerdos, las personas interesadas deben tener sus cedulas. Asi mismo, deben detallar los muebles e inmuebles que cada uno aporta a la sociedad conyugal, y cuales no hacen parte de la misma, especificando su valor y una relacion de las deudas de cada uno, explica el portal.

Acuerdos prematrimoniales. Un acuerdo prematrimonial, tambien llamado acuerdo prenupcial, es un contrato celebrado entre dos personas antes del matrimonio, en el que se especifican los activos de cada una de ellas y como se repartiran en caso de que el matrimonio se termine por causas no naturales.

Al margen de las circunstancias de cada pareja, Isabel Winkels aconseja redactar «si o si» un acuerdo prematrimonial el precio suele rondar los 500 euros de media en las siguientes situaciones.

-Tecnicamente un 'contrato prenupcial' es un acuerdo celebrado entre futuros conyuges de forma previa a contraer matrimonio.